In this article we will discuss about:- 1. Meaning of Money Market 2. Features and Objectives of Money Market 3. Structure 4. Constituents 5. Sub-Markets 6. Participants 7. Defects 8. Measures to Improve.

Meaning of Money Market:

Money market is a market for short-term funds. We define the short-term as a period of 364 days or less. In other words, the borrowing and repayment take place in 364 days or less. The manufacturers need two types of finance: finance to meet daily expenses like purchase of raw material, payment of wages, excise duty, electricity charges etc., and finance to meet capital expenditure like purchase of machinery, installation of pollution control equipment etc.

The first category of finance is invested in the production process for a short-period of time. The market where such short-time finance is borrowed and lent is called ‘money market’. Almost every concern in the financial system, be it a financial institution, business firm, a corporation or a government body, has a recurring problem of liquidity management, mainly because the timing of the expenditures rarely synchronize with that of the receipts.

The most important function of the money market is to bridge this liquidity gap. Thus, business and finance firms can tide over the mismatches of cash receipts and cash expenditures by purchasing (or selling) the shortfall (or surplus) of funds in the money market.

ADVERTISEMENTS:

In simple words, the money market is an avenue for borrowing and lending for the short-term. While on one hand the money market helps in shifting vast sums of money between banks, on the other hand, it provides a means by which the surplus of funds of the cash rich corporations and other institutions can be used (at a cost) by banks, corporations and other institutions which need short-term money.

A supplier of funds to the money market can be virtually anyone with a temporary excess of funds. The government bonds, corporate bonds and bonds issued by banks are examples of money market instruments, where the instrument has a ready market like the equity shares of a listed company. The money markets refer to the market for short-term securities (one year or less in original maturity) such as treasury bills, certificates of deposits, commercial paper etc. Money market instruments are more liquid in nature.

The money market is a market where money and highly liquid marketable securities are bought and sold. It is not a place like the stock market but an activity and all the trading is done through telephones. One of the important features of the money market is honor of commitment and creditworthiness.

The money market form an important part of the financial system by providing an avenue for bringing equilibrium of the surplus funds of lenders and the requirements of borrowers for short periods ranging from overnight up to a year. Money market provides a non-inflationary way to finance government deficits and allow governments to implement monetary policy through open market operations and provide a market based reference point for setting interest rate.

Features and Objectives of Money Market:

ADVERTISEMENTS:

Following are the features of money market:

1. Money market has no geographical constraints as that of a stock exchange. The financial institutions dealing in monetary assets may be spread over a wide geographical area.

2. Even though there are various centers of money market such as Mumbai, Calcutta, Chennai, etc., they are not separate independent markets but are inter-linked and interrelated.

ADVERTISEMENTS:

3. It relates to all dealings in money or monetary assets.

4. It is a market purely for short-term funds.

5. It is not a single homogeneous market. There are various sub-markets such as Call money market, Bill market, etc.

6. Money market establishes a link between RBI and banks and provides information of monetary policy and management.

7. Transactions can be conducted without the help of brokers.

8. Variety of instruments are traded in money market.

Following are the objectives of money market:

1. To cater to the requirements of borrowers for short term funds, and provide liquidity to the lenders of these funds.

ADVERTISEMENTS:

2. To provide parking place for temporary employment of surplus fund.

3. To provide facility to overcome short term deficits.

4. To enable the central bank to influence and regulate liquidity in the economy.

5. To help the government to implement its monetary policy through open market operation.

Structure of Indian Money Market:

ADVERTISEMENTS:

(i) Broadly speaking, the money market in India comprises two sectors- (a) Organised sector, and (b) Unorganised sector.

(ii) The organised sector consists of the Reserve Bank of India, the State Bank of India with its seven associates, twenty nationalised commercial banks, other scheduled and non-scheduled commercial banks, foreign banks, and Regional Rural Banks. It is called organised because its part is systematically coordinated by the RBI.

(iii) Non-bank financial institutions such as the LIC, the GIC and subsidiaries, the UTI also operate in this market, but only indirectly through banks, and not directly.

(iv) Quasi-government bodies and large companies also make their short-term surplus funds available to the organised market through banks.

ADVERTISEMENTS:

(v) Cooperative credit institutions occupy the intermediary position between organised and unorganised parts of the Indian money market. These institutions have a three-tier structure. At the top, there are state cooperative banks. At the local level, there are primary credit societies and urban cooperative banks. Considering the size, methods of operations, and dealings with the RBI and commercial banks, only state and central, cooperative banks should be included in the organised sector. The cooperative societies at the local level are loosely linked with it.

(vi) The unorganised sector consists of indigenous banks and money lenders. It is unorganised because activities of its parts are not systematically coordinated by the RBI.

(vii) The money lenders operate throughout the country, but without any link among themselves.

(viii) Indigenous banks are somewhat better organised because they enjoy rediscount facilities from the commercial banks which, in turn, have link with the RBI. But this type of organisation represents only a loose link with the RBI.

Constituents of Indian Money Market:

Money market is a centre where short-term funds are supplied and demanded. Thus, the main constituents of money market are the lenders who supply and the borrowers who demand short-term credit.

I. Supply of Funds:

ADVERTISEMENTS:

There are two main sources of supply of short-term funds in the Indian money market:

(a) Unorganised indigenous sector, and

(b) Organised modern sector.

(i) Unorganized Sector:

The unorganised sector comprises numerous indigenous bankers and village money lenders. It is unorganized because its activities are not controlled and coordinated by the Reserve Bank of India.

(ii) Organized Sector:

ADVERTISEMENTS:

The organized modern sector of Indian money market comprises:

(a) The Reserve Bank of India;

(b) The State Bank of India and its associate banks;

(c) The Indian joint stock commercial banks (scheduled and non-scheduled) of which 20 scheduled banks have been nationalised;

(d) The exchange banks which mainly finance Indian foreign trade;

(e) Cooperative banks;

ADVERTISEMENTS:

(f) Other special institutions, such as, Industrial Development Bank of India, State Finance Corporations, National Bank for Agriculture and Rural Development, Export-Import Bank, etc., which operate in the money market indirectly through banks; and

(g) Quasi-government bodies and large companies also make their funds available to the money market through banks.

II. Demand for Funds:

In the Indian money market, the main borrowers of short-term funds are: (a) Central Government, (b) State Governments, (c) Local bodies, such as, municipalities, village panchayats, etc., (d) traders, industrialists, farmers, exporters and importers, and (e) general public.

Sub-Markets of Organised Money Market:

The organised sector of Indian money market can be further classified into the following sub-markets:

A. Call Money Market:

ADVERTISEMENTS:

The most important component of organised money market is the call money market. It deals in call loans or call money granted for one day. Since the participants in the call money market are mostly banks, it is also called interbank call money market.

The banks with temporary deficit of funds form the demand side and the banks with temporary excess of funds form the supply side of the call money market.

The main features of Indian call money market are as follows:

(i) Call money market provides the institutional arrangement for making the temporary surplus of some banks available to other banks which are temporary in short of funds.

(ii) Mainly the banks participate in the call money market. The State Bank of India is always on the lenders’ side of the market.

(iii) The call money market operates through brokers who always keep in touch with banks and establish a link between the borrowing and lending banks.

(iv) The call money market is highly sensitive and competitive market. As such, it acts as the best indicator of the liquidity position of the organised money market.

(v) The rate of interest in the call money market is highly unstable. It quickly rises under the pressures of excess demand for funds and quickly falls under the pressures of excess supply of funds.

(vi) The call money market plays a vital role in removing the day-to-day fluctuations in the reserve position of the individual banks and improving the functioning of the banking system in the country.

B. Treasury Bill Market:

The treasury bill market deals in treasury bills which are the short-term (i.e., 91, 182 and 364 days) liability of the Government of India. Theoretically these bills are issued to meet the short-term financial requirements of the government.

But, in reality, they have become a permanent source of funds to the government. Every year, a portion of treasury bills are converted into long-term bonds. Treasury bills are of two types: ad hoc and regular.

Ad hoc treasury bills are issued to the state governments, semi- government departments and foreign central banks. They are not sold to the banks and the general public, and are not marketable.

The regular treasury bills are sold to the banks and public and are freely marketable. Both types of ad hoc and regular treasury bills are sold by Reserve Bank of India on behalf of the Central Government.

The treasury bill market in India is underdeveloped as compared to the treasury bill markets in the U.S.A. and the U.K.

In the U.S.A. and the U.K., the treasury bills are the most important money market instrument:

(a) Treasury bills provide a risk-free, profitable and highly liquid investment outlet for short-term, surpluses of various financial institutions;

(b) Treasury bills from an important source of raising fund for the government; and

(c) For the central bank the treasury bills are the main instrument of open market operations.

On the contrary, the Indian Treasury bill market has no dealers expect the Reserve Bank of India. Besides the Reserve Bank, some treasury bills are held by commercial banks, state government and semi-government bodies. But, these treasury bills are not popular with the non-bank financial institutions, corporations, and individuals mainly because of absence of a developed treasury bill market.

C. Commercial Bill Market:

Commercial bill market deals in commercial bills issued by the firms engaged in business. These bills are generally of three months maturity. A commercial bill is a promise to pay a specified amount in a specified period by the buyer of goods to the seller of the goods. The seller, who has sold his goods on credit draws the bill and sends it to the buyer for acceptance. After the buyer or his bank writes the word ‘accepted’ on the bill, it becomes a marketable instrument and is sent to the seller.

The seller can now sell the bill (i.e., get it discounted) to his bank for cash. In times of financial crisis, the bank can sell the bills to other banks or get them rediscounted from the Reserved Bank. In India, the bill market is undeveloped as compared to the same in advanced countries like the U.K. There is absence of specialised institutions like acceptance houses and discount houses, particularly dealing in acceptance and discounting business.

D. Collateral Loan Market:

Collateral loan market deals with collateral loans i.e., loans backed by security. In the Indian collateral loan market, the commercial banks provide short- term loans against government securities, shares and debentures of the government, etc.

E. Certificate of Deposit and Commercial Paper Markets:

Certificate of Deposit (CD) and Commercial Paper (CP) markets deal with certificates of deposit and commercial papers. These two instruments (CD and CP) were introduced by Reserve Bank of India in March 1989 in order to widen the range of money market instruments and give investors greater flexibility in the deployment of their short-term surplus funds.

Participants in Money Market:

A large number of borrowers and lenders make up the money market.

Some of the important players are listed below:

1. Central Government:

Central Government is a borrower in the money market through the issue of Treasury Bills (T-Bills). The T-Bills are issued through the RBI. The T-Bills represent zero risk instruments. They are issued with tenure of 91 days (3 months), 182 days (6 months) and 364 days (1 year). Due to its risk free nature, banks, corporates and many such institutions buy the T-Bills and lend to the government as a part of it short- term borrowing programme.

2. Public Sector Undertakings:

Many government companies have their shares listed on stock exchanges. As listed companies, they can issue commercial paper in order to obtain its working capital finance. The PSUs are only borrowers in the money market. They seldom lend their surplus due to the bureaucratic mindset. The treasury operations of the PSUs are very inefficient with huge cash surplus remaining idle for a long period of time.

3. Insurance Companies:

Both general and life insurance companies are usual lenders in the money market. Being cash surplus entities, they do not borrow in the money market. With the introduction of CBLO (Collateralized Borrowing and Lending Obligations), they have become big investors. In between capital market instruments and money market instruments, insurance companies invest more in capital market instruments. As their lending programmes are for very long periods, their role in the money market is a little less.

4. Mutual Funds:

Mutual funds offer varieties of schemes for the different investment objectives of the public. There are many schemes known as Money Market Mutual Fund Schemes or Liquid Schemes. These schemes have the investment objective of investing in money market instruments.

They ensure highest liquidity to the investors by offering withdrawal by way of a day’s notice or encashment of units through Bank ATMs. Naturally, mutual funds invest the corpus of such schemes only in money market. They do not borrow, but only lend or invest in the money market.

5. Banks:

Scheduled commercial banks are very big borrowers and lenders in the money market. They borrow and lend in call money market, short-notice market, repo and reverse repo market. They borrow in rediscounting market from the RBI and IDBI. They lend in commercial paper market by way of buying the commercial papers issued by corporates and listed public sector units. They also borrow through issue of Certificate of Deposits to the corporates.

6. Corporates:

Corporates borrow by issuing commercial papers which are nothing but short-term promissory notes. They are issued by listed companies after obtaining the necessary credit rating for the CP. They also lend in the CBLO market their temporary surplus, when the interest rate rules very high in the market. They are the lender to the banks when they buy the Certificate of Deposit issued by the banks. In addition, they are the lenders through purchase of Treasury bills.

There are many other small players like non-banking finance companies, primary dealers, provident funds and pension funds. They mainly invest and borrow in the CBLO market in a small way.

Defects of Indian Money Market:

A well-developed money market is a necessary pre-condition for the effective implementation of monetary policy. The central bank controls and -regulates the money supply in the country through the money market. But, unfortunately, the Indian money market is inadequately developed, loosely organised and suffers from many weaknesses.

Major defects are discussed below:

I. Dichotomy between Organised and Unorganised Sectors:

The most important defect of the Indian money market is its division into two sectors- (a) the organised sector and (b) the unorganised sector. There is little contact, coordination and cooperation between the two sectors. In such conditions it is difficult for the Reserve Bank to ensure uniform and effective implementations of its monetary policy in both the sectors.

II. Predominance of Unorganised Sector:

Another important defect of the Indian money market is its predominance of unorganised sector. The indigenous bankers occupy a significant position in the money- lending business in the rural areas. In this unorganised sector, no clear-cut distinction is made between short- term and long-term and between the purposes of loans.

These indigenous bankers, which constitute a large portion of the money market, remain outside the organised sector. Therefore, they seriously restrict the Reserve Bank’s control over the money market.

III. Wasteful Competition:

Wasteful competition exists not only between the organised and unorganised sectors, but also among the members of the two sectors. The relation between various segments of the money market is not cordial; they are loosely connected with each other and generally follow separatist tendencies.

For example, even today, the State Bank of Indian and other commercial banks look down upon each other as rivals. Similarly, competition exists between the Indian commercial banks and foreign banks.

IV. Absence of All-India Money Market:

Indian money market has not been organised into a single integrated all-Indian market. It is divided into small segments mostly catering to the local financial needs. For example, there is little contact between the money markets in the bigger cities, like, Bombay, Madras, and Calcutta and those in smaller towns.

V. Inadequate Banking Facilities:

Indian money market is inadequate to meet the financial need of the economy. Although there has been rapid expansion of bank branches in recent years particularly after the nationalisation of banks, yet vast rural areas still exist without banking facilities. As compared to the size and population of the country, the banking institutions are not enough.

VI. Shortage of Capital:

Indian money market generally suffers from the shortage of capital funds. The availability of capital in the money market is insufficient to meet the needs of industry and trade in the country. The main reasons for the shortage of capital are- (a) low saving capacity of the people; (b) inadequate banking facilities, particularly in the rural areas; and (c) undeveloped banking habits among the people.

VII. Seasonal Shortage of Funds:

A Major drawback of the Indian money market is the seasonal stringency of credit and higher interest rates during a part of the year. Such a shortage invariably appears during the busy months from November to June when there is excess demand for credit for carrying on the harvesting and marketing operations in agriculture. As a result, the interest rates rise in this period. On the contrary, during the slack season, from July to October, the demand for credit and the rate of interest decline sharply.

VIII. Diversity of Interest Rates:

Another defect of Indian money market is the multiplicity and disparity of interest rates. In 1931, the Central Banking Enquiry Committee wrote- “The fact that a call rate of 3/4 per cent, a hundi rate of 3 per cent, a bank rate of 4 per cent, a bazar rate of small traders of 6.25 per cent and a Calcutta bazar rate for bills of small trader of 10 per cent can exist simultaneously indicates an extraordinary sluggishness of the movement of credit between various markets.”

The interest rates also differ in various centres like Bombay, Calcutta, etc. Variations in the interest rate structure are largely due to the credit immobility because of inadequate, costly and time-consuming means of transferring money. Disparities in the interest rates adversely affect the smooth and effective functioning of the money market.

IX. Absence of Bill Market:

The existence of a well-organised bill market is essential for the proper and efficient working of money market. Unfortunately, in spite of the serious efforts made by the Reserve Bank of India, the bill market in India has not yet been fully developed.

The short-term bills form a much smaller proportion of the bank finance in India as compared to that in the advanced countries.

Many factors are responsible for the underdeveloped bill market in India:

(i) Most of the commercial transactions are made in terms of cash.

(ii) Cash credit is the main form of borrowing from the banks. Cash credit is given by the banks against the security of commodities. No bills are involved in this type of credit,

(iii) The practice of advancing loans by the sellers also limits the use of bills,

(iv) There is lack of uniformity in drawing bills (hundies) in different parts of the country,

(v) Heavy stamp duty discourages the use of exchange bills.

(vi) Absence of acceptance houses is another factor responsible for the underdevelopment of bill market in India.

(vii) In their desire to ensure greater liquidity and public confidence, the Indian banks prefer to invest their funds in first class government securities than in exchange bills,

(viii) The Reserve Bank of India also prefers to extend rediscounting facility to the commercial banks against approved securities.

Undeveloped Nature of Indian Money Market:

An insight into the various defects and inadequacies of the Indian money market reveals that as compared to the advanced international money markets like the London Money Market, the New York Money Market, etc., Indian money market is still an undeveloped money market. It is “a money market of a sort where banks and other financial institutions lend or borrow funds for short periods.”

The following characteristics of Indian money market highlight its undeveloped nature:

(i) The Indian money market does not possess highly developed and adequately developed banking system.

(ii) It lacks sufficient and regular supply of short-term assets such as bills of exchange, treasury bills, short-term government bonds, etc.

(iii) There is no uniformity in the interest rates which vary considerably among different financial institutions as well as centres,

(iv) In the Indian money market, there are no dealers in short-term assets who can function as intermediaries between the government and the banking system,

(v) No doubt, a well-developed call money market exists in India, there is absence of other necessary sub-markets such as the acceptance market, commercial bill market, etc.

(vi) There is no proper coordination between the different sectors of the money market,

(vii) The Indian money market does not attract foreign funds and thus lacks international status.

Measures to Improve Indian Money Market:

Suggestions to Remove Defects:

In a view of the various defects in the Indian money market, the following suggestions have been made for its proper development:

(i) The activities of the indigenous banks should be brought under the effective control of the Reserve Bank of India.

(ii) Hundies used in the money market should be standardised and written in the uniform manner in order to develop an all-India money market,

(iii) Banking facilities should be expanded especially in the unbanked and neglected areas,

(iv) Discounting and rediscounting facilities should be expanded in a big way to develop the bill market in the country.

(v) For raising the efficiency of the money market, the number of the clearing houses in the country should be increased and their working improved.

(vi) Adequate and less costly remittance facilities should be provided to the businessmen to increase the mobility of capital.

(vii) Variations in the interest rates should be reduced.

Reserve Bank and Indian Money Market:

The Reserve Bank of Indian has taken various measures to improve the existing defects and to develop a sound money market in the country.

Important among them are:

(i) Through the introduction of two schemes, one in 1952 and the other in 1970, the Reserve Bank has been making efforts to develop a sound bill market and to encourage the use of bills in the banking system. The variety of bills eligible for use has also been enlarged.

(ii) A number of measures have been taken to improve the functioning of the indigenous banks. These measures include- (a) their registration; (b) keeping and auditing of accounts; (e) providing financial accommodation through banks; etc.

(iii) The reserve bank is fully effective in the organised sector of the money market and has evolved procedures and conventions to integrate and coordinate the different components of money market.

Due to the efforts of the Reserve Bank, there is now much more coordination in the organised sector than that in the unorganised sector or that between organised and unorganised sectors.

(iv) The difference between various sections of the money market has been considerably reduced. With the enactment of the Banking Regulation Act, 1949, all banks in the country have been given equal treatment by the Reserve Bank as regards licensing, opening of branches, share capital, the type of loans to be given, etc.

(v) In order to develop a sound money market, the Reserve Bank of Indian has taken measures to amalgamate and merge banks into a few strong banks and given encouragement to the expansion of banking facilities in the country,

(vi) The Reserve Bank of India has been able to reduce considerably the differences in the interest rates between different sections as well as different centres of the money market.

Now the interest rate structure of the country is much more sensitive to changes in the bank rate. Thus, the Reserve Bank of India has succeeded to a great extent in improving the Indian money market and removing some of its serious defects.

But, there are certain difficulties faced by the Reserve Bank in controlling the money market:

(i) The absence of bill market restricts the Reserve Bank’s ability to withdraw surplus funds from the money market by disposing of bills.

(ii) The existence of indigenous bankers is the major hurdle in the way of integrating the money market.

(iii) Inadequate development of call money market is another difficulty in controlling the money market. The banks do not maintain fixed ratios between their cash reserves and deposits and the Reserve Bank has to undertake large open market operations to influence the policy of the banks.

Working Group on Money Market:

In, 1986, the Reserve Bank of India set up a Working Group under the chairmanship of Mr. N. Vaghul to examine the possibilities of enlarging the scope of money market and to recommend specific measures for evolving other suitable money market instruments.

The Working Group submitted its Report in January, 1987. It has made a number of recommendations for activating and developing the Indian money market.

Some Important recommendations are as follows:

(i) Measures should be taken to improve the operation of the call money market,

(ii) Rediscounting market should be developed with a view to facilitating the emergence of genuine bill culture in the country.

(iii) A short-term commercial paper should be introduced.

(iv) An active secondary market for Government paper, especially a ‘182 days Treasury Bill’ Refinance facility, should be developed.

(v) A Finance House should be set up to deal in short-term money market instruments.

(vi) Banks and private non-bank financial institutions should be encouraged to provide factoring services.

(vii) There should be continuing development and refinement of money market instruments, and every new instrument must be approved by the Reserve Bank.

Recent Measures Taken by RBI:

The Reserve Bank of India has taken the following measures to implement the recommendation of the Working Group since 1987:

(i) With a view to make bill financing attractive to the borrowers, from April 1987, the effective interest rate on bill discounting for categories subject to the maximum lending rate has been fixed at a rate one percentage point lower than the maximum lending rate.

(ii) In order to attract additional funds into rediscount market, the ceiling on the bill rediscounting rate has been raised from 11.5% to 12:5%

(iii) Access to bill rediscounting market has been increased by selectively increasing the number of participants in the market.

(iv) 182 Day Treasury Bills have been introduced in 1987. In 1992-93, 364 Day Treasury Bills were introduced and the auction of 182 Day Bill has been discontinued. Like 182-Day Treasury bills, 364 Day Bills can be held by commercial banks for meeting Statutory Ratio.

(v) In August 1989, the government remitted the duty on usance bills. This step removed a major administrative constraint in the use of bill system.

(vi) Total deregulation of money market interest rates with effect from May 1, 1989 is a significant step taken by RBI towards the activation of money market. Removing the interest ceiling on money rates would make them flexible and lend transparency to transactions in the money market.

(vii) Certificates of Deposits (CDs) were introduced in June 1989 to give investors greater flexibility in employment of their short-term funds.

(viii) Another money market instrument, Commercial Paper (CP), was introduced in 1990-91 to provide flexibility to the borrowers rather than additionally of funds over and above the eligible credit limit.

(ix) Since July 1987, the Credit Authorisation Scheme (CAS) has been liberalised to allow for greater access to credit to meet genuine demand in production sectors without the prior sanction of the Reserve Bank.

(x) In April, the Discount and Finance House of Indian Limited (DFHI) was established with a view to increasing the liquidity of money market instruments.

(xi) In 1991, the scheduled commercial banks and their subsidiaries were permitted to set up Money Market Mutual Fund (MMMF) which would provide additional short-term avenue to investors and bring money market instruments within the reach of individuals and small bodies.

As a result of various measures taken by the RBI, the Indian money market has shown signs of notable development in many ways:

(i) It is becoming more and more organised and diversified.

(ii) The government trading in various instruments, like 364 Day treasury Bills, commercial bills and commercial paper, has increased considerably.

(iii) The volume of inter-bank call money, short notice money and term money transactions have grown significantly.

(iv) At present, scheduled commercial banks, cooperative banks, Discount and Finance House of India (DFHI) are participating in the money market both as lenders and borrowers of short-term funds, while Life Insurance Corporation of India (LIC), Unit Trust of India (UTI), General Insurance Corporation of India (GIC), Industrial Development Bank of India (IDBI) and National Bank for Agriculture and Rural Development (NABARD) are participating as lenders.

Discount and Finance House of India (PFHI):

The Working Group of Money Market, in its Report submitted in 1987, recommended, among other things, that a Finance House should be set up to deal in short-term money market instruments.

As a follow- up on the recommendations of the Working Group, the Reserve Bank in India, in collaboration with the public sector banks and financial institutions, set up the Discount and Finance House of India Limited (DFHI) in April 1988.

DFHI is the apex body in the Indian money market and its establishment is a major step towards developing a secondary market for money instruments. DFHI, which commend its operations from April 25, 1988 deals in short-term money market instruments.

As a matter of policy, the aim of the DFHI is to increase the volume of turnover rather than to becomes the repository of money market instruments. The initial paid up capital of DFHI is Rs. 150 crores. Apart from this, it has lines of refinance from RBI and a line of credit from the consortium of public sector banks.

As the apex agency in the Indian money market, the DFHI has been playing an important role ever since its inception. It has been promoting the active participation of the scheduled commercial banks and their subsidiaries, state and urban cooperative banks and all-Indian financial institutions in the money market.

The objective is to ensure that short-term surplus and deficits of these institutions are equilibrated at market-related rates through inter-bank transactions and various money market instruments. In 1990-91 the DFHI opened its branches at Delhi, Calcutta, Madras, Ahmedabad and Bangalore in order to decentralise its operations and provide money market facilities at the major money market centres in the country.

DFHI has been providing secondary market for money instruments and Government of India Treasury Bills.

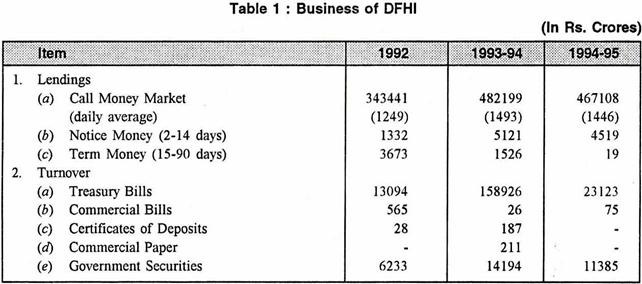

Details of turnover of DFHI in various instruments in 1992 (upto Dec.), 1993-94 and 1994-95 are given in Table 1:

Certificate of Deposit (CD) and Commercial Paper (CP):

In March 1989, Reserve Bank of India decided to introduced Certificates of Deposit (CD) and Commercial Paper (CP) in order to widen the range of money market instruments and give investors greater flexibility in the deployment of their short-term surplus funds.

I. Certificates of Deposit (CD):

The Certificates of Deposit (CD) can be issued only by the scheduled commercial banks in multiple of Rs. 25 lakhs subject to the minimum size of an issue being Rs. 1 crore. Their maturity will vary between three months and one year. CDs will be issued at discount to face value and the discount rate will be freely determined. They will be further freely transferable by endorsement and delivery. CDs will, however, be subject to reserve requirements. Banks will neither be allowed to grant loans against CDs, nor can they buy their own CDs.

II. Commercial Paper (CP):

Commercial Paper (CP) can be issued by a listed company which has a net worth of at least Rs. 10 crores and a working capital limit of not less than Rs. 25 crore. CPs will be issued in multiples of Rs. 25 lakhs subject to the minimum size of an issue being Rs. 1 crore. Their maturity ranges from three months to six months. They will be freely transferable by endorsement and delivery.

The company issuing CP will have to obtain every six months a specified rating from an agency approved by the Reserve Bank. The company can raise money through CP upto a maximum amount equivalent to 20% of its working capital limits. Banks will not be permitted to either underwrite or co- accept the issue of CP.

On January 3, 1990, the Reserve Bank issued guidelines, for issue of CP, according to which a company will have to obtain P1 + rating from Credit Rating Information Service of India Ltd. and also classification under Health Code Number from its financing banks and it has also to maintain the current ratio of 1.33 : 1 to be eligible to issue CP.