In this article we will discuss about:- 1. Meaning of Cooperative Bank 2. History of Cooperative Banking in India 3. Structure 4. Evaluation 5. Weaknesses Reserve Bank and Cooperative Banking.

Meaning of Cooperative Bank:

Cooperative bank is an institution established on the cooperative basis and dealing in ordinary banking business. Like other banks, the cooperative banks are founded by collecting funds through shares, accept deposits and grant loans.

The cooperative banks, however, differ from joint stock banks in the following manner:

(i) Cooperative banks issue shares of unlimited liability, while the joint stock banks issue shares of limited liability.

ADVERTISEMENTS:

(ii) In a cooperative bank, one shareholder has one vote whatever the number of shares he may hold. In a joint stock bank, the voting right of a shareholder is determined by the number of shares he possesses.

(iii) Cooperative banks are generally concerned with the rural credit and provide financial assistance for agricultural and rural activities. Joint stock companies are primarily concerned with the credit requirements of trade and industry.

(iv) Cooperative banking in India is federal in structure. Primary credit societies are at the lowest rung. Then, there are central cooperative banks at the district level and state cooperative banks at the state level. Joint stock banks do not have such a federal structure.

(v) Cooperative credit societies are located in the villages spread over entire country. Joint stock banks and their branches mainly concentrate in the urban areas, particularly in the big cities

History of Cooperative Banking in India:

ADVERTISEMENTS:

Cooperative movement in India was started primarily for dealing with the problem of rural credit. The history of Indian cooperative banking started with the passing of Cooperative Societies Act in 1904. The objective of this Act was to establish cooperative credit societies “to encourage thrift, self-help and cooperation among agriculturists, artisans and persons of limited means.”

Many cooperative credit societies were set up under this Act. The Cooperative Societies Act, 1912 recognised the need for establishing new organisations for supervision, auditing and supply of cooperative credit. These organisations were- (a) A union, consisting of primary societies; (b) the central banks; and (c) provincial banks.

Although beginning has been made in the direction of establishing cooperative societies and extending cooperative credit, but the progress remained unsatisfactory in the pre-independence period. Even after being in operation for half a century, the cooperative credit formed only 3.1 per cent of the total rural credit in 1951-52.

Structure of Cooperative Banking:

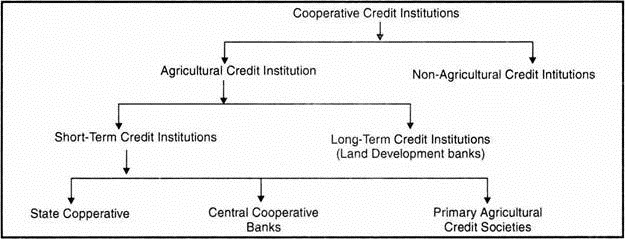

There are different types of cooperative credit institutions working in India. These institutions can be classified into two broad categories- agricultural and non-agricultural. Agricultural credit institutions dominate the entire cooperative credit structure.

ADVERTISEMENTS:

Agricultural credit institutions are further divided into short-term agricultural credit institutions and long-term agricultural credit institutions.

The short-term agricultural credit institutions which cater to the short-term financial needs of agriculturists have three-tier federal structure- (a) at the apex, there is the state cooperative bank in each state; (b) at the district level, there are central cooperative banks; (c) at the village level, there are primary agricultural credit societies.

Long-term agricultural credit is provided by the land development banks. The whole structure of cooperative credit institutions is shown in the chart given.

Short-Term Rural Cooperative Credit Structure:

In rural India, there exists a 3-tier short-term rural cooperative structure. Tier-I includes state cooperative banks (SCBs) at the state level; Tier-II includes central cooperative banks (CCBs) at the district level; and Tier- III includes primary agricultural credit societies (PACSs).

In 19 states, there exists a 3-tier short-term cooperative credit structure, comprising SCBs, CCBs and PACSs. And in 12 states, there exists a 2-tier short-term cooperative structure. In the north-eastern states, including Sikkim, the structure is 2-tier, comprising only SCBs and PACSs.

As on March 31, 2013, the number of SCBs was 31, of CCBs was 370 and of PACSs was 92432. As on March 31, 2012, the loans advanced by SCBs were Rs. 75600 crore, by CCBs were Rs. 14400 crore and by PACSs were Rs. 91200 crore.

ADVERTISEMENTS:

1. State Cooperative Banks (SCBs):

Functions and Organisation:

State cooperative banks are the apex institutions in the three-tier cooperative credit structure, operating at the state level. Every state has a state cooperative bank.

State cooperative banks occupy a unique position in the cooperative credit structure because of their three important functions:

ADVERTISEMENTS:

(a) They provide a link through which the Reserve Bank of India provides credit to the cooperatives and thus participates in the rural finance,

(b) They function as balancing centers for the central cooperative banks by making available the surplus funds of some central cooperative banks. The central cooperative banks are not permitted to borrow or lend among themselves,

(c) They finance, control and supervise the central cooperative banks, and, through them, the primary credit societies.

Capital:

ADVERTISEMENTS:

State cooperative banks obtain their working capital from own funds, deposits, borrowings and other sources:

(i) Own funds include share capital and various types of reserves. Major portion of the share capital is raised from member cooperative societies and the central cooperative banks, and the rest is contributed by the state government. Individual contribution to the share capital is very small;

(ii) The main source of deposits is also the cooperative societies and central cooperative banks. The remaining deposits come from individuals, local bodies and others.

(iii) Borrowings of the state cooperative banks are mainly from the Reserve Bank and the remaining from state governments and others.

Loans and Advances:

State cooperative banks are mainly interested in providing loans and advances to the cooperative societies. More than 98 per cent loans are granted to these societies of which about 75 per cent are for the short-period. Mostly the loans are given for agricultural purposes.

ADVERTISEMENTS:

The number of state cooperative banks rose from 15 in 1950-51 to 21 in 1960-61 and to 28 in 1991-92. The loans advanced by these banks increased from Rs. 42 crore in 1950-51 to Rs. 260 crore in 1960-61, and further to Rs. 7685 crore in 1991-92.

2. Central Cooperative Banks (CCBs):

Functions and Organisation:

Central cooperative banks are in the middle of the three-tier cooperative credit structure.

Central cooperative banks are of two types:

(a) There can be cooperative banking unions whose membership is open only to cooperative societies. Such cooperative banking unions exist in Haryana, Punjab, Rajasthan, Orissa and Kerala.

ADVERTISEMENTS:

(b) There can be mixed central cooperative banks whose membership is open to both individuals and cooperative societies. The central cooperative banks in the remaining states are of this type. The main function of the central cooperative banks is to provide loans to the primary cooperative societies. However, some loans are also given to individuals and others.

Capital:

The central cooperative banks raise their working capital from own funds, deposits, borrowings and other sources. In the own funds, the major portion consists of share capital contributed by cooperative societies and the state government, and the rest is made up of reserves.

Deposits largely come from individuals and cooperative societies. Some deposits are received from local bodies and others. Deposit mobilisation by the central cooperative banks varies from state to state.

For example, it is much higher in Gujarat, Punjab, Maharashtra, and Himachal Pradesh, but very low in Assam, Bihar, West Bengal and Orissa. Borrowings are mostly from the Reserve Bank and apex banks.

Loans and Advances:

ADVERTISEMENTS:

The number of central cooperative banks in 1991-92 was 361 and the total amount of loans advanced by them in 1991-92 stood at Rs. 14226 crore. About 98 per cent loans are received by the cooperative societies and about 75 per cent loans are short-term. Mostly the loans are given for agricultural purpose.

About 80 per cent loans given to the cooperative societies are unsecure and the remaining loans are given against the securities such as merchandise, agricultural produce, immovable property, government and other securities etc.

Problem of Overdues:

The most distressing feature of the functioning of the central cooperative banks is heavy and increasing overdue loans. In 1997-98, the percentage of overdues to demand at the central cooperative level was 34.

According to the Review of the Cooperative Movement in India, 1974-76, by the Reserve Bank of India, the main causes of these overdues are:

(a) Natural calamities such as floods, draughts, etc., affecting the repaying capacity of the borrowers;

ADVERTISEMENTS:

(b) Inadequate and inefficient supervision exercised by the banks;

(c) The poor quality and management of societies and banks;

(d) Absence of linking of credit with marketing;

(e) Reluctance to coercive measures; and

(f) Where coercive measures were taken, the inability of the machinery to promptly execute the decrees.

For the rehabilitation of the weak Central cooperative banks, the Central Sector Plan Scheme has been formulated under which semi financial help is given to write off the bad debts, losses and irrecoverable overdues against small and marginal farmers.

3. Primary Agricultural Credit Societies (PACSs):

Functions and Organisation:

Primary agricultural credit society forms the base in the three-tier cooperative credit structure. It is a village-level institution which directly deals with the rural people. It encourages savings among the agriculturists, accepts deposits from them, gives loans to the needy borrowers and collects repayments.

It serves as the last link between the ultimate borrowers, i.e., the rural people, on the one hand, and the higher agencies, i.e., Central cooperative bank, state cooperative bank, and the Reserve Bank of India, on the other hand.

A primary agricultural credit society may be started with 10 or more persons of a village. The membership fee is nominal so that even the poorest agriculturist can become a member.

The members of the society have unlimited liability which means that each member undertakes full responsibility of the entire loss of the society in case of its failure. The management of the society is under the control of an elected body.

Capital:

The working capital of the primary credit societies comes from their own funds, deposits, borrowings and other sources. Own funds comprise of share capital, membership fee and reserve funds. Deposits are received from both members and non- members. Borrowings are mainly from central cooperative banks.

In fact, the borrowings form the chief source of working capital of the societies. Normally, people do not deposit their savings with the cooperative societies because of poverty, low saving habits, and non-availability of better assets to the savers in term of rate of return and riskiness from these societies.

Coverage:

In 1999-2000 there were 88 thousand primary agricultural societies covering more than 96 per cent rural areas. The membership of these societies was 8.68 crore. During the past few decades, the Reserve Bank in collaboration with State governments, has been taking various measures to reorganise the viable primary credit societies and to amalgamate non-viable societies with large-sized multipurpose societies.

This work of reorganisation of primary societies into strong and viable units has been completed in almost all the states except Gujrat, Maharashtra, and Jammu and Kashmir. It is because of reorganisation that the number of primary societies which increased from 105 thousand in 1950-51 to 212 thousand in 1960- 61, declined to 92 thousand in 1999-2000.

Loans Advanced:

The loans advanced by the primary credit societies have been Showing 3 Continuously increasing trend. They rose from Rs. 23 crore in 1950-51 to Rs. 202 crore in 1960-61 and further to Rs. 13600 crore in 1999-2000.

Only the members of the societies are entitled to get loans from them. Most of the loans are short-term loans and are for agricultural purposes. Low interest rates are charged on the loans.

The societies are expected to increase amounts of loans to the weaker sections of the rural community, particularly the small and marginal farmers. There, however, exists a serious problem of overdue loans of the societies which have increased from Rs. 6 crores in 1950-51 to Rs. 44 crore in 1960-61 and to Rs. 2875 crore in 1991-92.

Land Development Banks (LDBs) or Cooperative Agricultural and Rural Development Banks (CARDBs):

Besides short-term credit, the agriculturists also need long-term credit for making permanent improvements in land, for repaying old debts, for purchasing agricultural machinery and other implements. Traditionally, the long-term requirements of agriculturists were mainly met by money lenders and some other agencies. But this source of credit was found defective and has been responsible for the exploitation of farmers.

Cooperative banks and commercial banks by their very nature are not in a position to provide long-term loans because their deposits are mainly demand (short-term) deposits. Thus, there was a great need for a specialised institution for supplying long-term credit to agriculturists. The establishment of land development banks now known as cooperative and rural development banks (CARDBs) is an effort in this direction.

Structure:

The land development banks are registered as cooperative societies, but with limited liability.

These banks have two-tier structure:

(a) At the state level, there are state or central land development banks, now known as state cooperative agricultural and rural development banks (SCARDBs) generally one for each state. They were previously known as central land mortgage banks,

(b) At the local level, there are branches of the state land development banks or SCARDBs and primary land development banks now known as primary cooperative agricultural and rural development banks (PCARDBs).

In some states, there are no primary land development banks, but the branches of the state land development bank. In Madhya Pradesh, the state cooperative bank itself functions as the state land development bank. In other states like Andhra Pradesh, Kerala and Maharashtra, there are more than one state land development banks.

Similarly, the primary land development banks also vary organisationally in different states. At the national level, the land development banks have also formed a union, called All-India Land Development Banks’ Union.

Capital:

Land development banks raise their funds from share capital, reserves, deposits, loans and advances, and debentures. Debentures form the biggest source of finance. The debentures are issued by the state land development banks.

They carry fixed interest, have maturity varying from 20 to 25 years, and are guaranteed by the state government. These debentures are subscribed by the co-operative banks, commercial banks, the State Bank of India and the Reserve Bank of India.

Besides the ordinary debentures, the land development banks also float rural debentures for the period upto 7 years. These debentures are subscribed by farmers, panchayats, and the Reserve Bank. The Reserve Bank substantially contributes to the finance of land development banks by extending funds to the state governments for contributing to the share capital of these banks and by subscribing to ordinary and rural debentures.

Growth:

In India, the first cooperative land mortgage bank was organised in Jhang in Punjab in 1920.But the effective beginning was made in Madras with the establishment of a central land development bank in 1929. Later on other states also established such institutions.

The number of state cooperative agricultural and rural development banks (SCARDBs) which was 5 in 1950-51, rose to 20 in 2013. The number of primary cooperative agricultural and rural development banks (PCARDBs) was 697 in 2013.

Loans and Advances:

The land development banks or SCARDBs provide long-term loans to the agriculturists- (a) for redemption of old debt, (b) for improvement of land and methods of cultivation, (c) purchasing costly machinery, and (d) in special cases, for purchasing land. These banks grant loans against the mortgage of land and the period of loan varies from 15 to 30 years.

In 1999-2000, the loans sanctioned by these banks were Rs.2520 crore and the amount of loans outstanding was Rs. 11670 crore. The amount of loans outstanding at the end-March 2012 was Rs. 19400 crore by SCARDBs and Rs.12000 crore by PCARDBs.

Defects of Land Development Banks:

Although numerically the land development banks have grown over the years, they have not been able to make much progress in providing long-term finance to the farmer.

The following are the factors responsible for the unsatisfactory performance of land development banks:

i. Uneven Growth:

There has been uneven growth of land development banks. These have shown some progress in the states like Andhra Pradesh, Tamil Nadu, Karnataka, Maharashtra, Gujrat. Other states have made very little progress. About half of the states have no land development bank.

ii. Problem of Overdues:

The major problem faced by the land development banks is the existence of heavy overdues. Moreover, the overdues are continuously rising over the years. In 1991-92, the percentage of the overdues 6f the land development banks has been put between 42 to 44 per cent.

Faulty loaning policies, inadequate supervision, over-utilisation of loans, ineffective measures for recovery, willful defaulters, etc. are the main causes of unsatisfactory level of overdues. In view of the seriousness of the problem, the state governments have been advised to draw up and implement time-bound programmes for special recovery drives.

iii. Lack of Trained Staff:

In spite of quantitative growth of the land development banks, they have not shown much qualitative improvements in the field of granting loans largely due to inadequate technical and supervisory staff. Necessary changes in the legislation of cooperative institutions are also required if the lending activities are to be diversified for non-traditional developmental purposes and on the basis of non-landed security.

iv. Other Defects:

Other defects of the land development banks can be summarised below:

(a) These banks charge very high interest rates on the loans provided by them.

(b) There is much delay and red-tapism in the granting of loans,

(c) Second loan is not advanced unless the first is not repaid.

(d) Installments and the period of loans are not fixed on the basis of the repaying capacity of the borrowers.

(e) The procedure of receiving a loan from these banks is so complicated that the agriculturist is forced to seek help from the money lender,

(f) Weaker sections of the rural society such as landless labourers, village artisans and marginal farmers, are generally unable to secure loans from these banks for their productive activities simply because they do not have land or adequate security to offer against loans.

(g) Mostly loans are given for the repayment of old loans and for development purposes.

v. Report of Rural Credit Survey:

The Report of the Committee of Direction of All-India Rural Credit Survey has pointed out the unsatisfactory performance of the land mortgage banks (now called the land development banks) in the following manner:

(a) These banks raise inadequate funds in a manner ill-rated to demand and usually lend them in a manner uncoordinated with development;

(b) They act as if prior debts and not production had claim on its attention; and

(c) They reach only the large cultivator and reach him late.

Evaluation of Cooperative Banking:

Progress of Cooperative Credit:

As a result of effective steps taken by the government and the Reserve Bank of India, the cooperative banking system in India made tremendous progress after independence. The cooperative credit which was only 3.1 per cent of the total rural credit in 1951-52, rose to 15.5% in 1961-62 and to 22.7 per cent in 1970-71.

The total amount of short-term credit granted by the cooperatives increased from Rs. 23 crore in 1951 -52 to Rs. 203 crore in 1961-62 and further to Rs. 1425 crore in 1979-80. Thus, during the period of about two decades (i.e., 1960-61 to 1979- 80), the short-term and medium-term loans increased by more than seven times.

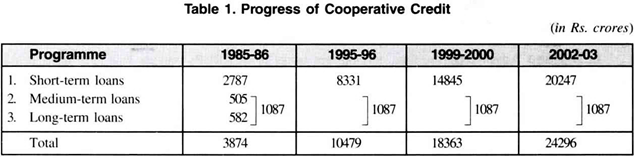

Table 1 shows that cooperative credit increased significantly from Rs. 3874 crore in 1985-86 to Rs. 10479 crore in 1995-96, and further to Rs. 24296 crore in 2002-03. Short-term cooperative credit increased from Rs. 2787 crore in 1985-86 to Rs. 8331 crore in 1995-96 and to Rs. 20247 crore in 2002-03. Medium-term and long-term cooperative loans increased from Rs. 1087 crore in 1985-86 to Rs. 2148 crore in 1995-96 and to Rs. 4049 crore in 2002-03.

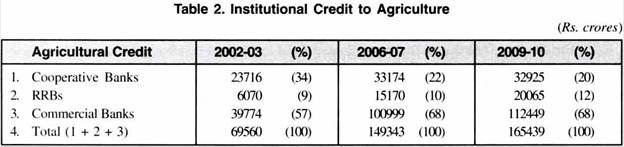

Table-2 shows that during 10th Five Year Plan (2002-03 to 2006-07), agricultural credit from cooperative banks increased from Rs. 23716 crore (34%) to Rs. 33174 crore (22%). In 2009-10, it was Rs. 32925 crore (20%).

Importance of Cooperative Banks:

The cooperative banking system has to play a critical role in promoting rural finance and is specially suited to Indian conditions.

Various advantages of cooperative credit institutions are given below:

I. Alternative Credit Source:

The main objective of cooperative credit movement is to provide an effective alternative to the traditional defective credit system of the village money lender. The cooperative banks tend to protect the rural population from the clutches of money lenders. The money lenders have so far dominated the rural areas and have been exploiting the poor people by charging very high rates of interest and manipulating accounts.

II. Cheap Rural Credit:

Cooperative credit system has cheapened the rural credit both directly as well as indirectly:

(a) Directly, because the cooperative societies charge comparatively low interest rates, and

(b) Indirectly, because the presence of cooperative societies as an alternative agency has broken money lender’s monopoly, thereby enforcing him to reduce the rate of interest.

III. Productive Borrowing:

An important benefit of cooperative credit system is to bring a change in the nature of loans. Previously the cultivators used to borrow for consumption and other unproductive purposes. But, now, they mostly borrow for productive purposes. Cooperative societies discourage unproductive borrowing.

IV. Encouragement to Saving and Investment:

Cooperative credit movement has encouraged saving and investment by developing the habits of thrift among the agriculturists. Instead of hoarding money the rural people tend to deposit their savings in the cooperative or other banking institutions.

V. Improvement in Farming Methods:

Cooperative societies have also greatly helped in the introduction of better agricultural methods. Cooperative credit is available for purchasing improved seeds, chemical fertilizers, modern implements, etc. The marketing and processing societies have helped the members to purchase their inputs cheaply and sell their produce at good prices.

VI. Role of Cooperative Banks before 1969:

Till the nationalisation of major commercial banks in 1969, cooperative societies were practically the only institutional sources of rural credit. Commercial banks and other financial institutions hardly provided any credit for agricultural and other rural activities. Cooperative credit to the agriculturists as a percentage of total agricultural credit increased from 3.1 per cent in 1951-52 to 15.5 per cent in 1961-62 and further to 22.7 per cent in 1970-71.

On the other hand, the agricultural credit provided by the commercial banks as a percentage of total agricultural credit remained almost negligible and fell from 0.9 percent in 1951-52 to 0.6 percent in 1961-62 and then rose to 4 per cent in 1970-71.

VII. Role of Cooperative Banks after 1969:

After the nationalisation of commercial banks in 1969, the government has adopted a multi-agency approach. Under this approach, both cooperative banks and commercial banks (including regional rural banks) are being developed to finance the rural sector.

But, this new approach also recognised the prime role to be played by the cooperative credit institutions in financing rural areas because of the following reasons:

(a) Co-operative credit societies are best suited to the socio-economic conditions of the Indian villages.

(b) A vast network of the cooperative credit societies has been built over the years throughout the length and breadth of the country. This network can neither be duplicated nor be surpassed easily.

(c) The cooperative institutions have developed intimate knowledge of the local conditions and problems of rural areas.

VIII. Suitable Federal Structure of Cooperative Banking System:

Cooperative banking system has a federal structure with- (a) primary agricultural credit societies at the village level, (b) higher financing agencies in the form of central cooperative and state cooperative banks, (c) land development banks for providing long- term credit for agriculture. Such a banking structure is essential and particularly suited for effectively meeting the financial requirements of the vast rural areas of the country.

Considering the great importance of cooperative banks, particularly in the rural areas, it is not surprising that every committee or commission, that has examined the working of the cooperative banking system in India, has expressed the common view that “cooperation remains the best hope of rural India.”

Weaknesses of Cooperative Banking:

Various committees, commissions and individual studies that have reviewed the working of the cooperative banking system in India have pointed out a number of weaknesses of the system and have made suggestions to improve the system.

Major weaknesses are given below:

I. General Weaknesses of Primary Credit Societies:

Organisational and financial limitations of the primary credit societies considerably reduce their ability to provide adequate credit to the rural population.

The All India Rural Credit Review Committee pointed out the following weaknesses of the primary credit societies:

(a) Cooperative credit still constitutes a small proportion of the total borrowings of the farmers,

(b) Needs of tenants and small farmers are not fully met.

(c) More primary credit societies are financially weak and are unable to meet the production-oriented credit needs,

(d) Overdues are increasing alarmingly at all levels,

(e) Primary credit societies have not been able to provide adequate and timely credit to the borrowing farmers.

II. Inadequate Coverage:

Despite the fact that the cooperatives have now covered almost all the rural areas of the country, its rural household membership is only about 45 per cent. Thus, 55 per cent of rural households are still not covered under the cooperative credit system.

In fact, the borrowing membership of the primary credit societies is significantly low and is restricted to a few states like Maharashtra, Gujrat, Punjab, Haryana, Tamil Nadu and to relatively rich land owners.

Criteria of determining borrowing membership include:

(a) Borrowing members as a proportion of rural households,

(b) The average amount of loan issued per borrowing member, and

(c) The proportion of loans going to weaker sections.

The banking Commission 1972 has brought out the following reasons for the low borrowing membership cooperative societies:

(a) Inability of the people to provide the prescribed security;

(b) Lack of up-to-date land records;

(c) Ineligibility of certain purposes for loans;

(d) Inadequacy of prescribed credit limits;

(e) Onerous conditions prescribed for loans such as share capital contribution at 10 or 20 per cent of loans outstanding and compulsory saving deposits; and

(f) Default of members to repay loans.

III. Inefficient Societies:

In spite of the fact that the primary agricultural credit societies in most of the states have been reorganised into viable units, their loaning business has not improved. As the Seventh Plan has observed that out of 94089 primary agricultural credit societies in the country in 1982-83, only 66000 societies had full time paid secretaries. About 34000 societies were running at loss.

IV. Problem of Overdues:

A serious problem of the cooperative credit is the overdue loans of the cooperative institutions which have been continuously increasing over the years. In 1991-92, percentage of overdues to demand at the level of land development banks was 57, at the level of central cooperative banks was 41 and at the level of primary agricultural credit societies was 39.

The overdues in the short-term credit structure are most alarming in North-Eastern States. In the long-term loaning sector, the problem of overdues has almost crippled the land development banks in 9 states, viz., Maharashtra, Gujarat, Madhya Pradesh, Bihar, Karnataka, Assam, West Bengal, Orissa and Tamil Nadu.

Large amounts of overdues restrict the recycling of the funds and adversely affect the lending and borrowing capacity of the cooperative societies.

The Banking Commission 1972 pointed out the following reasons for the overdue loans:

(a) Indifferent management or mismanagement of primary societies;

(b) Unsound lending policies resulting in over-lending or lending unrelated to actual needs, diversions of loans for other purposes;

(c) Vested interests and group politics in societies and willful defaulters;

(d) Inadequate supervision over the use of loans and poor recovery efforts;

(e) Lack of adequate control of central cooperative banks over primary societies;

(f) Lack of proper links between credit and marketing institutions;

(g) Failure to take quick action against willful defaulters; and

(h) Uncertain agricultural prices.

V. Regional Disparities:

There have been large regional disparities in the distribution of cooperative credit. According to the Seventh Plan, the eight states of Andhra Pradesh, Gujarat, Haryana, Kerala, Madhya Pradesh, Maharashtra, Punjab and Rajasthan account for about 80 per cent of the total credit disbursed. The per hectare short-term credit disbursed varied from Rs. 4 in Assam to Rs. 718 in Kerala.

VI. Benefits to Big Land Owners:

Most of the benefits from the cooperatives have been covered by the big land owners because of their strong socio-economic position. For instance, in 1984-85 the farmers having holdings less than two hectares got only 38.8 per cent of the total loans granted by the primary agricultural credit societies, whereas the land owners with holdings of more than 2 hectare received 55 per cent. The share of the poorest rural population (i.e. tenants, share croppers and landless labours) was only 6.2 per cent.

VII. Lack of Other Facilities:

Besides the provision of adequate and timely credit, the small and marginal farmers also need other facilities in the form of supply of inputs (i.e., better seeds, fertilisers, pesticides, etc), extension and marketing services.

These facilities will enable them to utilise the borrowed credit in a proper way. Therefore, the credit societies should be reorganised into multi-purposes cooperatives.

Reserve Bank and Cooperative Banking:

Strengthening the cooperative credit movement has been the Reserve Bank of India’s special responsibility ever since its establishment in 1935.

The following are the various measures undertaken by the Reserve Bank to develop cooperative banking system and to promote cooperative finance in the country:

1. Agricultural Credit Department:

The Reserve Bank has a separate Agricultural Credit Department whose functions are:

(i) To maintain an expert staff to study all questions of agricultural credit and be available for consolation by the central and state governments, state cooperative banks and other banking organisations; and

(ii) To coordinate the operations of the Reserve Bank in connection with agricultural credit and relations with the state cooperative banks and other institutions engaged in the business of agricultural credit.

2. All-India Rural Credit Survey:

The Reserve Bank’s real role in the cooperative credit movement started with the appointment of All-India Rural Credit Survey Committee in 1951. The objective of this Committee was to study the problems of rural credit and explore possibilities of expanding agricultural credit through cooperative credit system.

The committee submitted its report in December 1954 which highlighted the vital importance of cooperative rural credit.

The Committee found that while private credit agencies, i.e., money lenders and traders supply 70 per cent of the rural credit, the cooperative societies provided only 3 per cent of the total borrowed amount.

The Committee observed that the rural credit in India fell short of the right quantity, was not of right type, did not serve the right purpose, and often fail to go to the right people. Regarding the future of cooperative credit movement the committee said, “cooperation had failed, but cooperation must succeed.”

3. Integrated Scheme of Rural Credit:

For the success of cooperative credit movement, the Survey Committee suggested an integrated scheme of rural credit based on the following fundamental principles- (a) state partnership in cooperative credit institutions; (b) full coordination between credit and other agricultural activities, particularly, marketing and processing; and (c) administration through adequately trained and efficient personnel, responsive to the needs of the rural population.

4. Provision of Finance:

In pursuance of the recommendations of the Survey Committee and the later committees like the Committee on Cooperative Credit (1960), the Reserve Bank has activity helped the cooperative system to expand rural credit. The Reserve Bank does not provide finance directly to the agriculturists, but only through cooperative sector.

The Reserve Bank provides financial assistance for meeting short-term, medium-term and long-term rural needs.

The needs are explained as under:

(i) Short-Term Finance:

The Reserve Bank provides short-term finance to the state cooperative banks in two ways- (a) through loans and advances; (b) through rediscounting facility. The financial assistance is given for seasonal agricultural operations and for marketing of crops.

In 1950-51, the Reserve Bank sanctioned short- term credit of Rs. 7.6 crore. This amount increased to Rs. 147 crore in 1960-61 and to Rs. 1090 crore in 1981-82.

(ii) Medium-Term Finance:

The Reserve Bank provides medium-term loans to state cooperative banks generally for 3 to 5 years. These loans are provided for- (a) land improvements like bunding, digging of wells and water channels; (b) repair of wells and other irrigational schemes; (c) purchase of livestock, implements and machinery; (d) construction of farm houses and cattle sheds.

The Reserve Bank also provides medium-term loans in scarcity affected areas. Over the years, the amount of medium- term loans sanctioned by the Reserve Bank has considerably increased from Rs. 27 lakh in 1954-55 to Rs. 24 crore in 1970-71 and to Rs. 110 crore in 1981-82.

(iii) Long-Term Finance:

The Reserve Bank provides long-term financial assistance for a maximum period of 20 years for agriculture in there ways- (a) It subscribes a portion of debentures issued by the land development banks. (b) It grants long term loans to such banks, (c) It grants loans to state governments for subscribing to the share capital of cooperative credit institutions. The total long- term loans sanctioned by the Reserve Bank were Rs. 212 crore in 1981-82.

5. Setting Up of Funds:

To meet its financial obligations, the Reserve Bank set up two national funds in 1956, i.e., the National Agricultural Credit (Long-Term Operations) Funds, and the National Agricultural Credit (Stabilisation) Fund.

The Purpose of the Long-Term Operations Funds was- (a) to make long- term loans available to state governments to enable them to subscribe the share capital of cooperative credit institutions; (b) to make medium-term loans to state cooperative banks for agricultural purposes; (c) to make long-term loans to the central land mortgage banks against the guarantee of the state government; and (d) to purchase debentures of central land mortgage banks against the guarantee of state government. The Stabilisation Fund helps the state cooperative banks to convert their short-term loans into medium-term loans in cases of draught, famine or other calamities.

6. Strengthening of Cooperative Banking Structure:

With a view to strengthen cooperative banking structure and promote cooperative credit, the Reserve Bank undertakes the following measures:

(i) It pays special attention towards rehabilitating and revitalising the weaker cooperative units.

(ii) It makes arrangements for maintaining the flow of cooperative credit by involving commercial banks to finance the primary agricultural societies.

(iii) It makes efforts in improving the lending policies and operational efficiency of cooperative credit institutions.

(iv) It provides financial accommodation to cooperative credit institutions.

(v) It conducts special training courses at the Cooperative Bankers’ Training Colleges for the personnel of state, central and urban banks.