In this essay we will discuss about the vicious circle of poverty.

Most widely propagated explanation why poor underdeveloped countries have failed to grow economically is that they are trapped in vicious circles of poverty. These vicious circles of poverty operate both on the supply and demand sides of capital formation. Supply side of capital formation refers to saving required to accelerate capital formation in order to raise productivity and per capita income.

On the other hand, demand side of capital formation refers to inducement to invest (that is, investment demand) which depends on the size of market (i.e.; level of demand) which is small in the underdeveloped countries. Ragnar Nurkse in his now well-known work’ on underdeveloped countries attributed the persistence of poverty in them to these vicious circles of poverty and suggested policies to break these vicious circles. Both these vicious circles take poverty as their starting point.

Following are the types of vicious circles of poverty:

ADVERTISEMENTS:

1. Vicious Circle of Poverty (Supply-Side):

In the underdeveloped countries the rate of savings has been very low. In other words, these countries save a very small proportion of their current national income. In India the level of gross domestic savings has increased to about 30% of the national income in recent years only because of the stimulus provided by the planned development under the Five Year Plans. The level of savings in underdeveloped countries is very small mainly because their level of national income and per capita income is very low. As a result, much of the income is consumed and little is left for investment purposes.

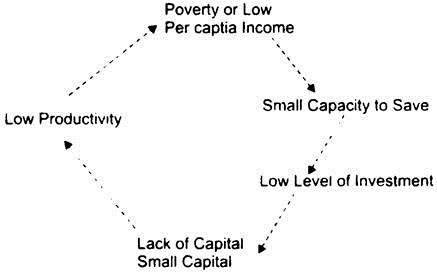

Thus underdeveloped countries are caught in the vicious circle of poverty. Because of the low level of income the capacity to save is very small. Since the capacity to save is small, rate of saving and investment must be low. Investment being low leads to a lack of capital per head. Because there is small amount of capital per head, the productivity of the people or real income per head will be low. Thus, the vicious circle is complete. Vicious circle of poverty on the supply-side of capital formation is illustrated in Fig. 5.1.

Fig. 5.1. Vicious circle of poverty on the supply-side of capital formation

ADVERTISEMENTS:

In a slightly different way Professor Hicks describes the working of vicious circle in an under developed country as thus, “Productive power can be used either for the production of consumption goods or of investment goods. Now when the average productivity of a community is low, it will have the greatest difficulty in producing enough consumption goods to satisfy the basic necessities of life; so it will have little productive power to spare for the production of investment goods. Countries which are in this position are involved in a vicious circle. A large supply of capital equipment would enable them to escape from the toils of overpopulation but they are too deeply caught in those toils to be able to produce that equipment for themselves. Thus, they cannot escape without assistance from outside.”

Apart from the low level of per capita income, the low relative level of real income in underdeveloped countries as compared with the advanced and rich countries also makes their capacity to save very small. The great and growing inequalities between the income levels and, therefore, living standards of different countries, combined with increasing awareness of these inequalities have pushed up the general propensity to consume of people in the underdeveloped countries and, have, therefore, reduced their capacity to save. The tendency of the people of underdeveloped countries to copy the higher levels of consumption standards prevailing in the advanced countries has been called “International demonstration effect” by Nurkse. This also explains why the rate of saving and capital formation in developing countries has been low which the main cause of their underdevelopment is.

It may be noted that Nurkse used the idea of vicious circle of poverty to advocate that with adequate foreign aid or foreign direct investment the underdeveloped countries could succeed in breaking the vicious circle of poverty. He argued that with injection of foreign capital, productivity of labour would rise which would lead to higher incomes and eventually will generate higher savings. With higher savings made possible by injection of foreign capital, rate of capital formation will be raised which will help to break the vicious circle of poverty. Furthermore, higher incomes generated by greater investment with foreign capital would also increase aggregate demand in the economy which will stimulate capital formation by creating profitable investment opportunities.

ADVERTISEMENTS:

A Critique:

However, the above thesis of Nurkse is questionable. If this thesis were valid, then it would be difficult to explain the development and capital formation in the present-day developing countries like China (until 1980s) and India which also started with low per capita income and many of them grew economically without much foreign aid. Of course, foreign aid and foreign investment can make an important contribution to economic development of the underdeveloped countries. What is being stressed here is that higher rate of capital formation and economic growth can be achieved without much inflow of foreign capital.

Though the majority of the people in poor developing countries is poor and is not in a position to save much but due to glaring inequalities in the distribution of income, there is minority of the people which is quite rich and wealthy and are in a position to save. Savings, it is said, do not depend on per capita income but how income and wealth are distributed in a society.

For example, a poor Indian peasant may be unable to save because he has to spend all of whatever small income he earns to survive but there are many rich people in India who can save a lot. It is worth mentioning that some poor countries have managed to achieve a high rate of saving and investment.

Even Japan when it began developing at the end of 19th century had an average per capita income only slightly more than India in the 1950s and still it was able raise its rate of saving and investment. Despite its poverty and low rate of economic growth (on average 3.5% per annum till the end of 1970s), even India was able to raise its rate of saving to 17 per cent in 1978-79 which far exceeded Arthur Lewis prescription of raising rate of saving to 12 to 15% of national income to achieve self-sustained high growth rate.

But it is worth mentioning that in a country like India the people who get large incomes generally use much of their incomes for conspicuous consumption, investment in land and real estate, speculative transactions, inventory accumulation and hoarding of gold and jewellery rather than using them for productive investment. Low use of savings for productive investment is one of the important factors responsible for low rate of economic growth in the developing countries. For raising of productive investment, tendency for spending a good part of their income on conspicuous consumption and making unproductive investment be discouraged.

2. Vicious Circle of Poverty (Demand Side):

An important reason why investment or capital formation is low has been advanced by Nurkse. He argues that just as division of labour is limited by the size of the market, inducement to invest is also limited by the size of the market. The size of the market in underdeveloped countries is very small due to the low per capita income of the people, and the income per capita is low because there is a use of meagre amount of capital in the production processes in underdeveloped countries. The use of capital equipment in the production of goods and services for the domestic market is discouraged by the small size of the market.

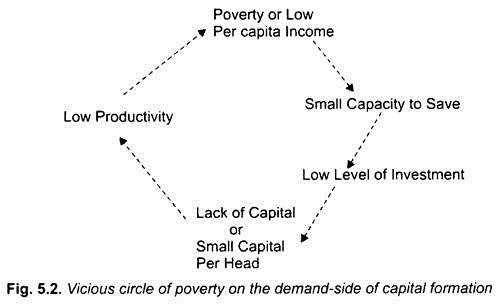

Thus, a vicious circle operates on the demand-side of capital formation. To quote Nurkse, “The inducement to invest may be low because of the small buying power of the people, which is due to their small real income, which again is due to low productivity. The low level of productivity, however, is a result of the small amount of capital used in production, which its turn may be caused at least partly by the small inducement to invest.” The vicious circle of poverty operating on the demand side is illustrated in Fig. 5.2.

From above it is concluded that underdeveloped countries have remained poor and economically backward because of low rate of capital accumulation as compared with the growth of population. As a result, capital per worker is very small and therefore his productivity is low. This, as seen above, gives rise to the vicious circle of poverty which is an important cause of persistent underdevelopment.

If the underdeveloped countries want to accelerate the rate of capital accumulation so as to achieve rapid economic growth, then the vicious circles of poverty operating on the supply and demand sides of capital formation have to be broken. Once the vicious circles are broken and a country starts developing, economic growth becomes cumulative and these circles become beneficent.

A Critique:

However, there are also flaws in the argument for the operation of vicious circle of poverty on the demand-side of capital formation. In this regard, the argument of Nurkse that limited size of the market is responsible for low rate of investment in poor underdeveloped countries is not entirely correct. The relationship between the limited size of the market and lower investment is based on the argument that economies of scale in industries are a key feature of their growth and for big industrial enterprises to produce on a large scale and to be economically profitable, the size of market, that is level of demand for a product must be large.

ADVERTISEMENTS:

However, Nurkse and others ignore the fact that economies of scale are important only for a few industries such as basic heavy industries of machine making steel, chemicals, fertilizers etc. but it is often feasible to produce quite efficiently in small enterprises in sectors such as textiles, shoes and leather products, food processing industries, jute manufactures’ etc.

Besides, while per capita income in developing countries is small but due to inequalities in income distribution prevailing in the poor developing countries, there are quite a large number of people whose incomes are high enough to demand or buy the products of large-scale industrial enterprises which make them quite profitable to be set up in developing countries.

In view of the above it is possible to argue that limited size of the market is a problem for some industries but only in rare cases, it is a major cause of persistence of underdevelopment of the poor backward countries.

Suggestions for Breaking the Vicious Circle of Poverty:

ADVERTISEMENTS:

In order to break the vicious circle of poverty and bring about economic growth, an important thing to be noted is that in underdeveloped countries rate of saving and investment can be increased without the reduction in consumption. As is well known, rate of saving in underdeveloped countries is low. With a given rate of saving and investment, some rate of economic growth and as a result some increment in income must be occurring in these underdeveloped countries. If out of this increment in income a proportionately greater part is saved, the rate of saving of the economy will rise.

For instance, suppose as a result of 15% rate of saving and investment, an increment in income equal to Rs 100 crore takes place. If out of these Rs 100 crore, a greater part is saved, say 25%, and 75% is consumed, then the rate of saving will rise above 15%. It should be noted that in this process consumption will not decline, in fact it will increase by Rs 75 crore, and along with this the rate of saving will also increase. If the increment in income of Rs 100 crore is wholly consumed away, the rate of saving will decline.

The saving of Rs 25 crore out of the increment of Rs 100 crore, means that the marginal rate of saving is 25%, which is higher than the previous average rate of saving i.e., 15% which means average rate of saving will go up. The sum and substance of the argument is that in underdeveloped countries, the rate of investment and capital formation can be stepped up even without reduction in the consumption of the people, provided the marginal rate of saving is kept higher than the average rate of saving even though the current average rate of saving is low.

In this way, the rate of investment can be stepped up and standards of living of the people can be raised in future without the reduction in present consumption. This is how the vicious circle of poverty operating on the supply side of the capital formation can be broken.

As explained before, according to Nurkse, vicious circle of poverty also operates on the demand side of capital formation. To break the vicious circle on the demand side, Nurkse suggested ‘the strategy of balanced growth’. According to this, if investment is made in an individual industry, it is likely to fail owing to low income and limited size of the market. This is because investment in an individual industry does not raise the incomes of the people outside that industry.

If the incomes of the people outside that industry do not rise, the demand for the product of that industry will not increase adequately to buy the larger production of the industry made possible by larger investment in it. Thus more investment in one individual industry makes possible large increase in production.

ADVERTISEMENTS:

But since the incomes of the people are low, the demand for the product of the firms in which more investment has been made, will not rise and therefore productive capacity of the firms will not be fully utilised. As a result of this, larger investment in them may not be profitable. This would have an adverse effect on the inducement to invest in the industry.

But, according to Nurkse, if investment is made in several industries simultaneously, then the workers employed in various industries will become consumers of each other’s products, and will thus create demand for one another. The simultaneous investment in a large number of industries has been called balanced growth. The balanced growth, i.e., simultaneous investment in a large number of industries creates its own demand. Thus, according to Nurkse, through the strategy of balanced growth vicious circle of poverty operating on the demand side of capital formation can be broken.

Comments:

In our view, Nurkse has exaggerated the vicious circle on the demand side of capital formation. Actually, there is enough demand for several products in underdeveloped countries like India and investment in the industries producing them is quite profitable. The reason for this is that in underdeveloped countries, owing to the large inequalities of income there are several people who have enough purchasing power to buy certain goods, despite the low per capita income.

For instance, who can deny that in India investment in agriculture, sugar industry, refined oil, vanaspati ghee, etc., cannot be increased because of lack of demand for them. It is thus clear that production and capital formation in these countries are low not due to the lack of demand. There are other factors which are responsible for low production and capital formation in these countries.

Another important thing to note in this connection is that several commodities are imported in large quantities by developing countries, which shows that demand for them exists in these countries. Substitution of these imports by producing them at home will not face any problem of lack of demand. Therefore, for the imported products, there is generally no problem of lack of demand or inadequate size of the market. Therefore, in many Latin American countries, strategy of import substitution of consumer goods was followed under which industrial goods which were previously imported started being produced in their own countries.

ADVERTISEMENTS:

Thus no problem of small size of the market was faced. We thus see that vicious circle of poverty can-be broken in underdeveloped countries by making larger investment in a large number of import-substituting industries. Besides, investment and industrial production can be substantially increased by producing for exports. East Asian Countries of South Korea, Taiwan, Singapore, and Hong Kong accelerated their rate of capital formation and economic growth during the seventies and eighties through this route. In this way economic growth can be accelerated to raise the standards of living of the people.