Here is an essay on ‘Exchange Rates’ for class 11 and 12. Find paragraphs, long and short essays on ‘Exchange Rates’ especially written for school and college students.

Essay # 1. Meaning of Exchange Rate:

The rate of exchange is the rate at which the currency of one country is exchanged for the currency of another country. It is the price paid for a unit of foreign currency in terms of the home currency.

The exchange rate existing between two currencies can be expressed in two alternative ways:

Firstly, it is a ratio of one unit of foreign currency to a certain number of units of the home currency.

ADVERTISEMENTS:

Secondly, it is a ratio of certain number of units of the foreign currency to one unit of the home currency.

For instance, if one U.S. dollar can be exchanged with Rs. 60, then the rate of exchange between these two currencies can be expressed as:

(i) 1 U.S. dollar = Rs. 60 or

(ii) 1 Re. = 1.67 Cents

ADVERTISEMENTS:

At a particular point of time, there does not exist in the foreign exchange market a single or unique rate of exchange between two currencies. There is rather a large spectrum of exchange rates as per the credit instruments employed for the transfer function. There is a sight rate in case of foreign bills of exchange, a T.T. or cable rate in case of telegraphic transfers. It is also called as a spot rate. There may be a usance rate or long rate.

It may be applicable to foreign exchange transactions over one month to 3 months period. There is also forward exchange rate which applies to future exchange contracts. It is, therefore, clear that there is the existence of a large structure of exchange rates in a foreign exchange market at a specified point of time.

Suppose the rate of exchange between rupee and dollar is – 1 U.S. dollar = Rs. 60. This rate of exchange may not hold itself. There are possibilities of variations in it. In case the exchange rate becomes 1 U.S. dollar = Rs. 58, it signifies that dollar has depreciated relative to rupee.

Previously 1 U.S. dollar could buy Rs. 60. Now it can have in exchange only Rs. 58. At the same time, it means the rupee has appreciated against dollar. On the opposite, if the exchange rate becomes- 1 U.S. dollar = Rs. 62, it means dollar has appreciated relative to rupee and one dollar can now buy Rs. 62. The rupee, on the other hand, has undergone depreciation.

ADVERTISEMENTS:

The rate of exchange between dollar and rupee can be maintained at the level -1 U.S. dollar = Rs. 60 through arbitrage. Arbitrage means the purchase of foreign currency in the market where its price is low and its sale in a market where its price is relatively high. Suppose in Mumbai, the exchange rate is – 1 U.S. dollar = Rs. 60 and it is – 1 U.S. dollar = Rs. 56 in New York.

The speculators or arbitrageurs will start buying dollars in New York and sell it in Mumbai, thereby making a profit of Rs. 4 per dollar. Such transactions will result in a fall in the price of dollar in Mumbai and a rise in New York. Ultimately, the price of dollar in terms of rupees will become equal in both the markets and arbitrage will come to an end.

Essay # 2. Determination of Equilibrium Exchange Rate:

Since the rate of exchange is the price of one currency expressed in terms of another, it is determined, like every other price by the forces of demand and supply. The demand for and supply of foreign exchange together determine the equilibrium rate of exchange. The equilibrium rate of exchange is defined as the rate at which the demand for foreign exchange equals the supply of foreign exchange.

It can be viewed also as a rate at which the par value of the home currency with foreign currency is exactly maintained. The rate of exchange not only has no tendency to change, there is also neither under-valuation nor over-valuation of the home currency (or foreign currency).

In the words of Scammel, an equilibrium rate is “that rate at which over a standard period during which full employment is maintained and there is no change in the amount of restriction on trade or on currency transfer, causes no net change in the holding of gold and currency reserves of the country concerned.”

R. Nurkse has defined the equilibrium rate of exchange from a different viewpoint. According to him, the equilibrium rate of exchange is the “rate which over a certain period of time, keeps the balance of payments in equilibrium.”

It is mentioned that the equilibrium rate of exchange is determined by equality between the demand for and supply of foreign exchange. The relevant question is whether the demand and supply forces pertain to the home currency or foreign currency. In this connection, it must be pointed out that the rate of exchange can be determined either by the demand for and supply of foreign currency or the home currency.

In either of the two cases, the equilibrium rate of exchange will be exactly the same. In the present analysis, the demand for and supply of foreign currency (the U.S. dollars) will be considered for determining the equilibrium rate of exchange between dollar and rupee.

Demand for Foreign Exchange:

ADVERTISEMENTS:

The demand for foreign exchange is the derived demand. The demand for U.S. dollars in India arises because of the demand for American goods and services from India. If exchange rate of dollar with rupee is relatively lower, the Indian importers will have a strong inducement to import goods and services from the U.S.A.

It will signify a larger demand for dollars. On the opposite, the relatively higher exchange rate of dollar with rupee will act as a disincentive and lesser quantities of goods and services will be imported from the U.S.A.

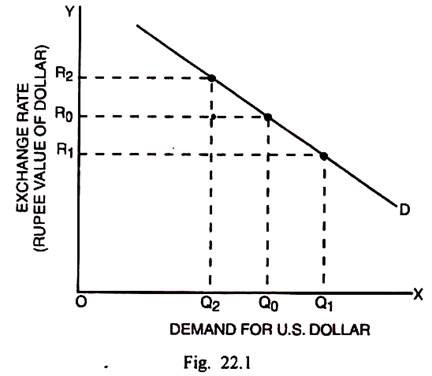

As a consequence, there will be a less demand for dollars by this country at a higher exchange rate of dollar. This inverse relation between the exchange rate and demand for foreign exchange (dollars), the demand function for dollars slopes negatively. It may be shown through Fig. 22.1.

ADVERTISEMENTS:

In Fig. 22.1, the demand for the U.S. dollars is measured along the horizontal scale and the exchange rate is measured along the vertical scale. D is the demand curve of foreign exchange (dollars). It slopes downwards from left to right. At the exchange rate R0, the demand for dollars is Q0. At a lower exchange rate R1 (rupee value of dollar), the demand for dollars is larger at Q1. On the opposite, if the exchange rate is higher at R2, the demand for dollars is Q2.

The extent to which a given change in the rate of exchange causes a change in the demand for foreign exchange depends upon the elasticity of the demand function of foreign exchange.

The greater or lesser elasticity of demand function of foreign exchange is determined by the nature of commodities imported, presence or absence of import-competing industries and the time period necessary for bringing about change in the production pattern subsequent upon price changes and variations in demand.

Supply of Foreign Exchange:

ADVERTISEMENTS:

The supply of foreign exchange (dollars) is dependent upon the supply of goods and services by the home country (India) to the foreign country (the U.S.A.). An expansion or contraction in exports to the United States by India will signify greater or lesser availability of foreign exchange with the latter.

The supply of foreign exchange refers to different quantities of foreign currency which are available to the home country at different rates of exchange. If exchange value of dollar with rupee is relatively lower, that will discourage exports to the United States and the consequent lesser quantity of dollars available at the lower rate of exchange.

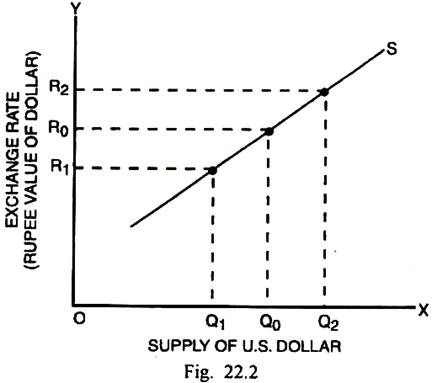

On the opposite, if the exchange value of dollar with rupee is relatively higher, the Indian exporters will be induced to make larger exports to that country. As a result, there can be a larger supply of dollars at the higher exchange rate. So there is a direct relation between the rate of exchange and supply of foreign exchange. From this, it follows that the supply function of foreign exchange slopes upwards from left to right. It is shown through Fig. 22.2.

In Fig. 22.2, S is the supply function of exports. It slopes positively. At R0 rate of exchange, the supply of dollars is Q0. At a lower rate of exchange R1, the supply of dollars is Q1. When the rate of exchange is higher at R2, the supply of foreign exchange (dollar) is also higher at Q2.

Whether supply of foreign exchange varies by a greater or lesser measure due to a given change in the rate of exchange, is determined by a greater or lesser elasticity of the supply function of exports. It is interesting that the elasticity of supply of foreign exchange is conditioned by the same set of factors as influence the elasticity of demand.

ADVERTISEMENTS:

In this regards, Sodersten comments, “Basically the same factors that are of importance for determining elasticity of demand curve for foreign exchange also determine the elasticity of supply curve.”

Given the demand and supply functions of foreign exchange, the equilibrium rate of exchange is determined by the equality between the demand for and supply of foreign exchange. If the demand for foreign currency is more than its supply, the excess demand conditions will push up the exchange rate. An increase or appreciation in the exchange value of foreign currency denotes depreciation in the exchange value of the home currency.

On the opposite, if the supply of foreign currency is more than its demand, the excess supply conditions will cause a fall or depreciation in the exchange value of foreign currency. This signifies an appreciation of exchange value of the home currency. Thus excess demand raises the exchange rate whereas the excess supply lowers it.

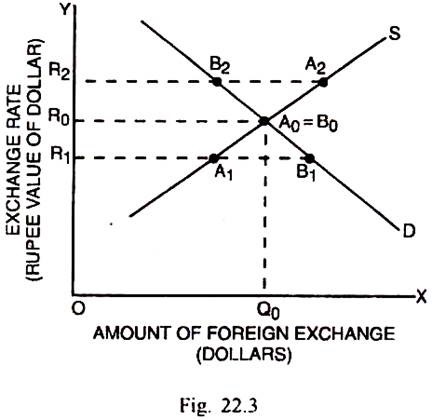

The exchange rate is in equilibrium and has no tendency to change, when there is equality between demand for and supply of foreign exchange. The determination of equilibrium rate of exchange is shown through Fig. 22.3.

In Fig. 22.3, the amount of foreign exchange in dollars is measured along the horizontal scale and the exchange rate or rupee value of dollar is measured along the vertical scale. D is the negatively sloping demand function of foreign exchange and S is the supply function of foreign exchange. Initially the rate of exchange is R1 and the demand for foreign exchange B1R1 exceeds the supply of foreign exchange A1R1 by A1B1, This excess demand gap will push up the value of dollar relative to rupee and the rate of exchange tends to rise.

ADVERTISEMENTS:

On the opposite, when the exchange rate is R2, the supply of foreign exchange A2R2 is more than the demand for and foreign exchange B2R2 by A2B2. The excess supply of dollar will lower the exchange value of dollar relative to rupee. In this case the rate of exchange has a tendency to fall. When the rate of exchange is R0, the demand for supply of foreign exchange are exactly equal (A0R0 = B0R0).

Since there is neither excess demand nor excess supply pressures, the rate of exchange has no tendency to change. Therefore, R0 is equilibrium rate of exchange which is determined by the intersection between the demand and supply functions of foreign exchange.

If there is an increase in the demand for dollars from the Indian importers, the demand function will shift to the right. This will result in a rise in the exchange rate. There will be appreciation of dollar and accompanying depreciation of rupee.

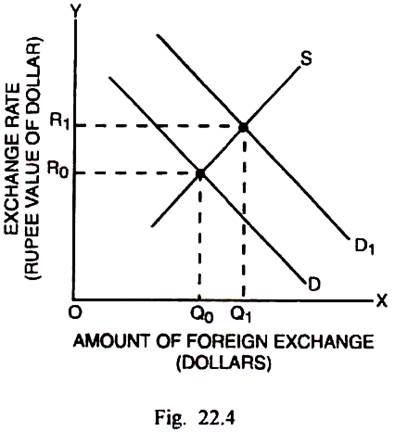

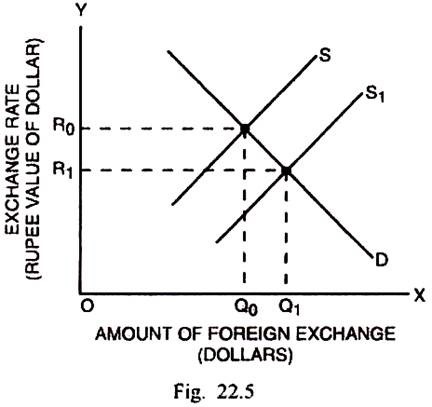

On the opposite, if there is an increase in the supply of dollars, the supply function of dollars will shift to the right. It will result in a fall in the rate of exchange. While dollar will depreciate, rupee will experience an appreciation. This is shown through Fig. 22.4 and 22.5.

In Figs. 22.4 and 22.5, the amount of foreign exchange is measured along the horizontal scale and rate of exchange is measured along the vertical scale. D and S are the demand and supply functions of foreign exchange. In Fig. 22.4, the rate of exchange is originally R0 and the foreign exchange demanded and supplied is Q0. If demand for foreign exchange (dollars) increases the demand function shifts to D1.

ADVERTISEMENTS:

At the exchange rate R0, there is an excess demand for the dollars resulting in a rise in exchange rate of dollars to R1. It implies the depreciation of rupee. In the new equilibrium situation, the amount of foreign exchange is Q1.

In Fig. 22.5, the original equilibrium rate of exchange is R0 and the quantity of foreign exchange is Q0. If there is an increase in the supply of foreign exchange (dollars), the supply function of foreign exchange shifts to the right to S1. At R0 rate of exchange, there is an excess supply of foreign exchange. It causes the rate of exchange of dollar for rupee to depreciate. In other words, there is an appreciation of rupee. The new equilibrium rate of exchange gets determined at a lower level R1 and the amount of foreign exchange is Q1.

Essay # 3. Spot and Forward Rates of Exchange:

There can be two variants of equilibrium rate of exchange—spot rate of exchange and the forward rate of exchange.

The spot rate of exchange exists in the spot exchange market. In such a market, the spot transactions of foreign exchange take place. The seller of foreign exchange is required to deliver the foreign exchange he has sold on the spot (i.e., within two days). The buyer on the other hand will receive immediately (within two days) the foreign exchange he has bought.

The rate of exchange applicable to spot transactions of foreign exchange is called as the spot rate. The equilibrium spot rate of exchange is determined by the demand for and supply of foreign exchange in the spot market.

ADVERTISEMENTS:

The forward rate of exchange exists in the forward exchange market. The forward exchange market is concerned with such transactions of foreign exchange in case of which the contract to buy or sell foreign exchange is signed in the current period but the delivery of foreign exchange takes place at a future date at a price agreed upon in advance. The period for settlement of contract between the buyers and sellers of foreign exchange is usually three months.

There can even be a shorter or longer time perspective than three months in some cases. The equilibrium rate of exchange existing in the forward market is called as the forward rate of exchange. The demand and supply conditions governing these contracts, actually determine the forward rate of exchange.

The spot and forward markets or the exchange rates existing in these markets are closely linked together in different ways such as:

(i) Interest arbitrage,

(ii) Hedging,

(iii) Speculation, and

(iv) Swap operations.

(i) Interest Arbitrage:

The relation between spot and forward rates can be explained through interest arbitrage with the help of an illustration. It is assumed that the spot exchange rate is Rs. 60 for 1 dollar. This rate must be the same in New York and Mumbai exchange markets.

In case the rate of exchange is 60: 1 in New York but 64: 1 in Mumbai, it would pay to take dollars from New York to Mumbai and sell them there. Such sales would continue to take place until there is equalisation of exchange rates in the two markets.

Assuming that the spot rate is Rs. 60 for 1 dollar and forward rate is Rs. 62 for 1 dollar, there is a premium on dollar. The premium on dollar exists when forward rate (Rf) exceeds the spot rate (Rs), i.e., Rf > Rs. The premium on dollar = Rf-Rs. On the opposite if Rf < Rs there is a discount on dollar. The discount on dollar = Rs-Rf.

In case the interest rates in the two countries differ, an interest arbitrage will arise and differences will appear in the spot and forward rates. It is assumed that the interest rates in New York and Mumbai are 2 and 5 percent respectively. We continue to assume that spot rate is 60: 1. Now Rs. 60 will yield interest of Rs. 3. 00 per year in Mumbai or 0.75 Re. per 3 months.

In New York Rs. 60 will yield an interest of Rs. 1.20 per year or 0.30 Re. per 3 months. Since the interest yield is higher in Mumbai than in New York, the U.S. arbitrageurs would place their funds in Mumbai in case the spot rate and forward rates were the same in Mumbai. It would result in excess supply of forward dollars in Mumbai and cause the forward rate to fall until the yield on Rs. 60 in Mumbai equaled that of 1 dollar in New York.

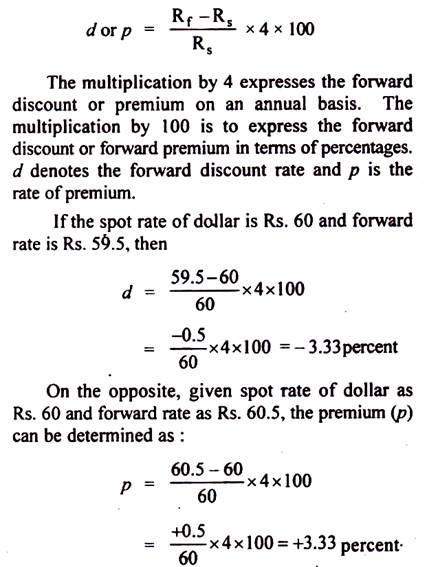

The forward discounts or premiums are usually expressed as percentages per year from the corresponding spot rate and can be calculated as below:

If there is a difference in the short term interest rates of two countries, the country with the higher interest rate would have its forward rate of exchange at a discount. Suppose India has a higher interest rate, an arbitrageur in the U.S.A. can then receive a higher interest return on his funds if placed in India. If the interest rate differential were 3.33 percent, the discount on forward rate would also be 3.33 percent in equilibrium.

If it is less, his gain on the interest rate differential will be larger than the loss on the discount. In this situation, it is favourable for an arbitrageur to place his funds in India than in the U.S.A. The inflow of funds into India is likely to have a depressing effect upon the forward rate in that country until the interest-rate differential becomes equal to the rate of discount.

If, on the opposite, the short term interest rate in India is lower than the rate in the U.S.A., the forward rate of exchange will be at a premium. If the interest rate differential were 3.33 percent, the premium in equilibrium position, would also be of that magnitude. If the premium on forward rate were higher, it would be more advantageous to place funds in India than in the U.S.A.

On the contrary, if the premium were lower than the interest rate differential, the arbitrageurs would like to place funds in the U.S.A. than in India.

In the above analysis, a simplifying assumption had been taken concerning the equality between interest rate differential and discount or premium. In reality, however, the differences exist between the interest rate differentials on the one hand and premium or discount on the other.

Mentioning the reasons for it, B. Sodersten remarked, “Depending upon his subjective risk and liquidity considerations, an arbitrageur might not find it optional to equalise objective return on his investment in two countries.”

(ii) Hedging:

Another factor to connect spot and forward rates is hedging. The signing of a contract and delivery of good often involves some interval of time. A depreciation of exchange rate during this period can cause exchange risk to the exporter. Hedging can enable him to offset such a risk. He will sell an equivalent amount of foreign exchange in the forward market at the prevailing forward rate.

He neither receives money nor delivers the foreign currency in the current period when the contract is made. After three months, if exchange rate has depreciated, he will receive an amount equivalent to difference in exchange rate.

Any loss in the spot market can thus be offset through hedging. Similarly an importer can offset the exchange risk caused by rise in exchange rate through buying equivalent amount of foreign exchange at the forward rate. Hedging brings about an increase in the supply of and demand for foreign exchange. By averting risk of loss due to exchange rate fluctuations through hedging, the exporters and importers can fully concentrate on their pure trading functions and ensure an expansion in the volume of trade.

The extent to which hedging can raise the demand for and supply of foreign exchange is determined by several factors including the volume of trade, attitude towards risk aversion and liquidity conditions. The hedging contracts are generally for a period of 3 months. No doubt, in some cases the period of forward contracts happens to be longer than three months. In such situations, however, hedging does not function in an efficient manner and risk arising from exchange variations can be hardly averted.

(iii) Speculation:

The speculation in foreign exchange tends to make the spot and forward rates to move together. The speculators, who expect the spot rates to rise in the future, buy currency in the forward market so that it could be sold out in the spot market when they get the delivery of the currency.

On the opposite, the speculators, who expect the spot rates to decline in the future, sell currency in the forward market so that they should be able to buy in the spot market when they need currency for the delivery. As a result of these activities of the speculators, the spot and forward rates have a tendency to move together.

(iv) Swap Operations:

The swap operations mean the sale of spot currency by commercial banks in order to make the forward purchase of the same currency or alternatively the purchase of the spot currency for the forward sale of the same currency. Thus, there is swap of the forward for the spot or vice-versa. These operations are conducted by the commercial banks in order to adjust their fund position.

Through such operations, it becomes possible for the banks to carry out the simultaneous sale or purchase of spot and forward currencies. The swap operations are also known as double deals as the spot currency is swapped against the foreign currency.

Essay # 4. Factors Causing Variations in Exchange Rates:

If the two countries have inconvertible paper currencies, the fundamental factors responsible for variation in the rates of exchange between them are the demand for and supply of the domestic and foreign currencies.

The factors behind these two broad catch-all categories of demand and supply, that are responsible for the variations in the market rate of exchange, are as follows:

(i) Changes in Exports and Imports:

The change in the volume of international trading transactions is the principal cause of exchange rate fluctuations. If the imports from abroad are in excess of exports, the demand for foreign currency is stronger than foreigner’s demand for home currency. Such a situation will cause an appreciation of the foreign currency and the corresponding depreciation in the home currency.

On the contrary, the excess of exports over imports reflects a state of excess supply of foreign currency. That results in a depreciation of foreign currency and an accompanying appreciation of home currency.

(ii) Capital Movements:

If there is unrestricted short term or long term capital flows from one country to another, the exchange rate between two currencies is likely to be affected. The inflow of capital from abroad, by increasing the supply of foreign currency, causes a depreciation of foreign currency relative to the home currency.

The outflow of capital from the latter, on the opposite, creates excess supply of its currency abroad that results in the depreciation of its external value.

(iii) Changes in Price Level:

A rise in price level in the home country relative to a foreign country makes the exports more costly and imports cheaper. Such a situation discourages exports and encourages imports resulting in BOP deficit and consequent depreciation in the exchange value of home currency. The deflationary trends in the home currency make exports more competitive and imports rather costly. In such a case, the demand for home currency rises relative to its supply and the exchange value of home currency appreciates while that of the foreign currency depreciates.

(iv) Banking Operation:

The banking operations such as sale and purchase of bank drafts, letters of credit, arbitrage and dealing in bills of exchange do have effect upon the exchange rate through their impact upon the demand for and supply of foreign exchange.

A large issue of bank drafts or letters of credit on foreign banks causes a rise in the demand for foreign currency and consequent appreciation of the foreign currency. In the opposite case, similar banking operations by foreign banks can result in the appreciation of the currency of the home country.

(v) Changes in Interest Rates:

A higher structure of interest rates in the home country than in the foreign countries will lead to a large inflow of short term and long term capital from other countries. As a consequence, the foreign currency will depreciate relative to the home currency. On the opposite, a lower structure of interest rates in the home country than abroad will cause capital outflow and consequent depreciation in the exchange value of home currency.

(vi) Stock Exchange Activities:

The stock exchange activities such as sale and purchase of foreign securities, debentures, stocks, shares etc. too have influence upon the rate of exchange. If there is a large scale sale of securities, debentures, shares etc. to foreigners, the demand for home currency by the foreigners increases. It causes a rise in the exchange value of home currency relative to the foreign currency.

The purchase of foreign securities, debentures etc. on opposite, by the people of home country raises the demand for foreign currency. As a consequence, the exchange value of foreign currency relative to home currency rises.

(vii) Speculation:

If the speculators expect an appreciation of foreign currency relative to home currency, they will start purchasing the foreign currency in exchange of home currency with the object of selling it in future. The immediate pressure of demand upon foreign currency will cause it to appreciate relative to home country.

Subsequently, when the holding of foreign currencies will be offloaded, the exchange value of foreign currency relative to home currency will fall. Thus activities of speculators can bring about fluctuations in the exchange rates.

(viii) Economic Development:

A higher rate of development is often associated with the higher rate of growth of imports of goods, services and capital, while exports grow at a slower rate. Consequently, the developing countries have to contend with a deteriorating BOP situation. The increasing BOP deficit tends to cause the depreciation of these currencies relative to other currencies.

(ix) Structural Changes:

The structural changes include demand pattern, institutional set up, technological changes etc. These changes influence the demand structure of foreign and home produced goods. The technological changes at home and abroad have impact upon the relative costs. Given such effects of structural changes, the volume and pattern of trade and BOP situation cannot get affected. Thus the rate of exchange between two currencies may undergo changes on account of structural changes at home and abroad.

(x) Monetary Policy:

The variations in the rate of exchange can take place also on account of the monetary policy measures such as changes in money supply and variations in bank rate. An increase in bank rate, by pushing up the whole structure of interest rate in the given country, can attract a larger inflow of capital, resulting in depreciation of foreign currency and appreciation of home currency and vice-versa. The expansionary money policy can lead to a fall in the exchange value of home currency due to outflow of capital and rise in internal prices and vice-versa.

(xi) Exchange Controls:

The imposition of exchange control restricts the outflow of capital and depresses imports. The liberalisation of exchange controls ensure increased inflow of capital and goods from abroad. They have effect on the demand for and supply of foreign exchange and bring about variations in the rate of exchange.

(xii) Political Conditions:

If there is political stability, peace and security and efficient and honest administration in a country, there can be a large inflow of capital from foreign countries. It will have the effect of raising the exchange value of home currency relative to foreign currency. If there is political instability, disturbed conditions, lack of security and inefficient and corrupt administration, there is a danger of flight of capital and consequent fall in the external value of home currency.