Here is a compilation of essays on ‘Balance of Payments (BOP)’ for class 11 and 12. Find paragraphs, long and short essays on ‘Balance of Payments (BOP)’ especially written for school and college students.

Essay on BOP

Essay Contents:

- Essay on the Introduction to Balance of Payments (BOP)

- Essay on the Balance of Payments on Current Account in India

- Essay on the Scenario of BOP Position in India

- Essay on the Methods of Correcting Deficit in Balance of Payment in India

- Essay on the Measures Taken by the Indian Government for Improving Balance of Payments

Essay # 1. Introduction to Balance of Payments (BOP):

ADVERTISEMENTS:

Balance of payment is a systematic record of all economic transactions in a period between one country and rest of the world. It also shows the relationship between one country’s total payment to all other countries and its total receipts from them. It is, thus, a statement of payment and receipts on international transactions.

“A systematic record of all economic transactions between the residents of the reporting country and of foreign countries during a given period of time.” — Kindle Berger

It may also be important to note that Balance of payment is different from Balance of trade because BOT includes only the difference between the value of visible export and import. Visible items are only material goods exported and imported. It is also known as merchandise account of exports and imports.

On the other hand BOP is a more comprehensive concept because it covers both visible as well as invisible items. Invisible items are not recorded in customs returns e.g. services, banking, and transportation.

ADVERTISEMENTS:

Thus, BOP is a broader term than BOT. If exports are greater than imports the country’s BOP will be favourable and if exports are lesser than imports BOP will be adverse and if exports are equal to imports BOP will be in equilibrium.

A Balance of payment statement consists of two parts:

(a) Current account

(b) Capital account

ADVERTISEMENTS:

(a) Current Account:

Current account of BOP statement relates to real and short term transactions. It contains receipts and payments on account of exports of visible and invisible items. These are income generating transfers and are not merely financial transactions.

Items of current account include:

Investment Income, Insurance, Transportation, Travel, Expenditure incurred on services like commissions, patent fees, royalties etc., Donation and Gifts.

The capital account of the balance of payment of a country deals with the financial transactions. It includes all types of short and long term international movements of capital. If a country invests or lends abroad it is a payment and will be included in debit side. On the other hand capital inflows in the form of borrowings from abroad or the foreign investment in the home country are entered on the credit side of BOP account.

Essay # 2. Balance of Payments on Current Account in India:

When India became independent in 1947, it had a sterling balance of Rs. 1733 crore. This was the result of a sizeable surplus on balance of trade with the U.K. during the Second World War Period when U.K. had made large scale purchasing from India to meet its war requirements. The foreign exchange position of the country was, thus, quite satisfactory. However, in the post-independence period, the imports which had remained suppressed during the war period rose significantly. The import bill rose substantially while exports remained stagnant. The deficit had to be made good from the sterling balance.

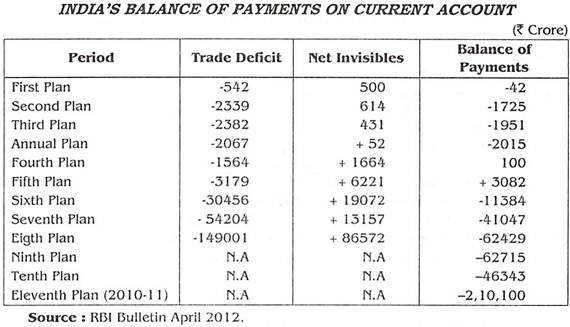

With the introduction of planning in India, the balance of payments position of the country has been recording considerable changes with corresponding with the continuous changes in its imports and exports. The following table shows the balance of payments position during the plan periods.

The balance of payments position during the various plan periods is analysed as follows:

ADVERTISEMENTS:

1. The First Plan Period (1951-56):

During the First Plan Period, the balance of payments was affected by the Korean War Boom, American recession of 1953 and favourable monsoon at home which helped to boost agricultural and industrial production. Though during this plan period trade deficit was Rs. 542 crore, but there was surplus in net invisibles to the extent of Rs. 500 crore. Accordingly, adverse balance of payment during the First Plan was only Rs. 42 crore.

2. The Second Plan Period (1956-61):

ADVERTISEMENTS:

During the second plan, the deficit in the balance of trade was to the tune of Rs. 2339 crore and the surplus of invisibles and donations from friendly countries totaled Rs. 614 crores. Ultimately the unfavourable balance of payment position during this period was to the order of Rs. 1725 crore.

The highly unfavourable balance of payment was the result of:

(i) Heavy imports of capital goods to develop heavy and basic industries.

(ii) Huge imports of food-grains and raw materials resulting from growing population and expanding industry.

ADVERTISEMENTS:

(iii) The inability of the economy to increase exports.

(iv) The necessity of making minimum ‘maintenance imports’ for a developing economy.

3. The Third Plan Period (1961-65):

During the Third Plan the country experienced a current account deficit in its balance of payments to the extent of Rs. 1951 crores which was financed by loans from foreign countries under various schemes.

This adverse balance was mainly because:

(i) Imports were expanding faster under the impact of defence and development and to overcome domestic shortages.

ADVERTISEMENTS:

(ii) Exports were extremely sluggish and failed to match imports.

Annual Plans (1966-69):

During the period of annual plans, the deficit of balance of payments on current account rose to Rs. 2015 crore. This was because of the heavy imports of food grains to overcome famine conditions and internal shortage of food grains on the one side and inadequate exports due to economic recession on the other. Besides devaluation of the rupee was a failure and instead of reducing the trade balance deficit, it further aggravated it.

4. The Fourth Plan Period (1969-74):

During the Fourth Plan Period, the balance of payments position became favourable for the first time since independence. In this plan, the Government introduced both export promotion and import substitution measures to wipe out deficits in the balance of payments. The trade deficit during the Fourth Plan was Rs. 1564 crore and the surplus in net invisibles amounted to Rs. 1664 crores. The plan ended with a surplus of Rs. 100 crore in the balance of payments.

The Fifth Plan Period (1974-78):

ADVERTISEMENTS:

During the fifth plan, trade balance was affected by two factors:

(i) The value of imports was rapidly rising due to hike in oil prices.

(ii) The value of exports was also raising under the impact of export promotion measures.

Although a surplus in trade was achieved in 1976-77, but the plan experienced an increasing trend in trade deficit to the extent of Rs. 3179 crore. Another distinguishing feature of this plan was the sharp increase in invisibles in the last two years of the plan. The surplus balance in invisibles during this plan period stood at Rs. 6261 crore.

The reasons for this substantial increase were:

(i) Stringent measures taken against smuggling and illegal payment transactions.

ADVERTISEMENTS:

(ii) The relative stability in the external value of the rupee at a time when major international currencies were experiencing sizeable fluctuations.

(iii) Increased in earnings from tourists.

(iv) The growth of earnings from technical, consultancy and contracting services and

(v) Increase in the number of Indian nationals going abroad for employment and larger remittances sent by them to India.

During this plan period, India was able to have huge surplus balance of payments of Rs. 3082 crore. For the first time since planning started, India was in a comfortable position in its external account.

The Sixth Plan Period (1980-85):

ADVERTISEMENTS:

There has been a sea change in the balance of payments position since 1979-80. As against the surplus balance of payments experienced by the country during the whole of Fifth Plan, India started experiencing adverse balance of payments from 1979-80 onwards. The deficit during the sixth plan period amounted to Rs. 11384 crore despite positive invisibles of Rs. 19072 crore because the trade deficit during this period was Rs. 30456 crore.

During the Sixth Plan, apart from external assistance, India had to meet this huge deficit in the current account through withdrawals of SDRs and borrowing from IMF under the extended credit arrangements. Besides India used part of its accumulated foreign exchange reserves to meet its deficit in the balance of payments.

The Seventh Plan Period (1985-90):

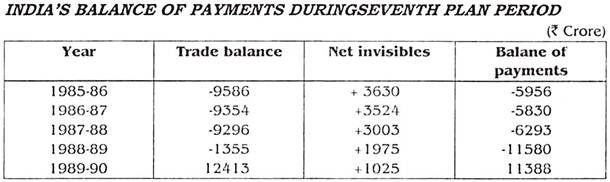

During 1985-1990 the total trade deficit amounted to Rs. 54204 crore for the seventh plan. Making an adjustment for the positive balance on invisible account (i.e. Rs. 13157 crore), the deficit in balance of payment on current account was Rs. 41047 crore. The highly adverse balance of payment position was the cause for serious concern.

Year-wise balance of payments during Seventh Plan is as shown in the table:

1990-91 to 1991-92 Periods:

For the first time during the last 40 years, net invisibles became negative to the tune of Rs. 435 crore in 1990-91. Thus, the cushion available through net invisibles to partly neutralise the trade deficit was removed. In 1990-91, the trade account deficit was Rs. 17369 crore. In 1991-92, the deficit on current account declined to Rs. 2237 crore.

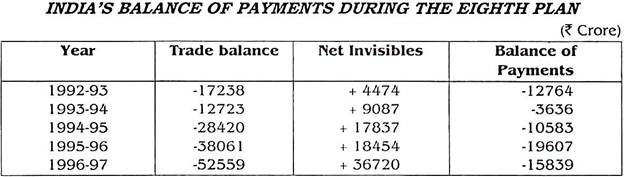

The Eighth Plan Period (1992-1997):

During the Eighth Plan, the trade deficit had been mounting and by 1996-97 it has reached a record level of Rs. 62429 crore from that of Rs. 12764 crore in 1992-93. For the Eighth Plan Period, the invisibles neutralised the trade deficit to the extent of about 58% a really commendable achievement.

Despite this the balance of payments has shown continuously a defect in all the years as shown in the following table:

There were several reasons for this rise in deficit:

(i) Imports of capital goods increased by 34%.

(ii) There was 22% increase in the imports of essential raw materials required for the production of capital goods.

(iii) There was 27% increase in the import of petrol.

(iv) There was much increase in imports due to the expectation of a decline in the exchange rate of the rupee.

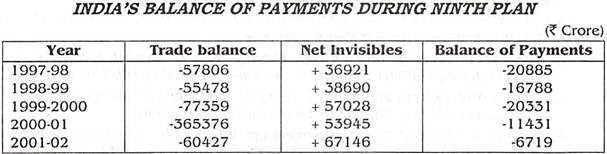

The Ninth Plan Period (1997-2000):

During 1997-98, the current account deficit reached a record level of Rs. 20885 crores and during 1998-99, it declined to Rs. 16788 crore. In 1999-2000, it again increased to Rs. 20331 crores. This was largely due to a much greater trade deficit to the order of Rs. 77359 crore which could not be neutralized though net invisibles earned a surplus of Rs. 57028 crore. The situation improved in 2000-01 and the current account deficit declined to Rs. 11431 crores. In 2001-02, the situation reversed. Surplus in net invisibles exceeded the trade deficit and the balance of payments showed a surplus to the tune of Rs. 6719 crore.

This information is shown in the following table:

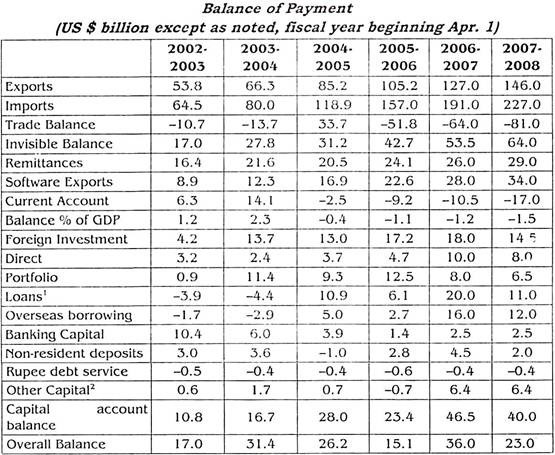

Tenth Plan (2002-07):

Balance of payments on current account was in surplus at Rs. 19,987 crore in first year of Tenth Plan. In 2003-04 it was again surplus at Rs. 46,952 crore. But it was in deficit at Rs. 46,343 crore in 2006-07.

Eleventh Plan (2007-12):

Balance of Payment on current account was in deficit at Rs. 68,914 crores in the first year of eleventh five year plan. During 2009-10 the balance was again negative at Rs. 1,80,626 crore because growth rate of exports had drastically came down due to global slowdown. It was again negative by 2010-11 at Rs. 2,10,100 crore.

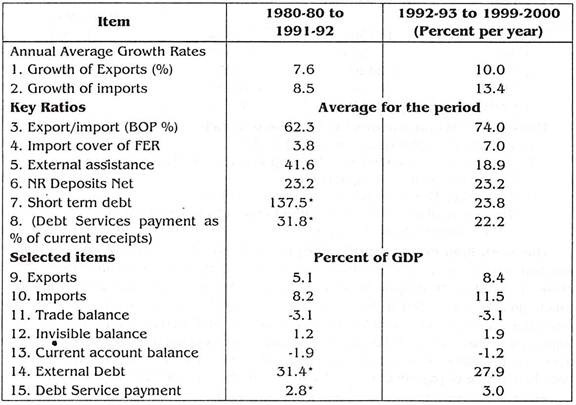

There have been significant improvements in the structure of India’s Balance of payment and the strength of the external sector since the economic crisis of June 1991:

Following conclusions can be drawn from the above table:

(a) The reforms of 1990s facilitate India to move away from a closed economy towards a more open and liberal economy.

(b) The export cover of imports rose sharply from an annual average of 62 percent during 1980-81 to 1991-92 to 74 percent during 1992-2000.

(c) The ratio of exports and imports to G.D.P. rose from an annual average of 13.2 percent during 1980-92 to 19.9% during 1992-2000.

(d) The current account deficit as percentage of G.D.P. declined from as annual average of 1.9 percent during 1980-92 to a well manageable level of 1.2 percent during 1992-2000.

(e) The capital account of BOP has also undergone a major structural change in favour of non-debt creating foreign investment flows.

(f) Foreign exchange reserves were built to a very comfortable level of about 8 months of imports from a critical level of about two months of imports in June 1991.

(g) External debt and debt service indicators marked sustained improvements over 1990s. External debt as a percent of GDP declined gradually from 38.7 percent at the end of March 2000.

(h) Similarly debt service payments on external debt as percent of current receipts declined gradually from 35.3 percent in 1990-91 to 16.0 percent in 2000.

The strength of the external sector has enabled India to withstand fairly well the Asian financial crisis contagion and the related adverse spill overs.

Reasons for satisfactory Balance of payment situation in 1990’s:

(i) High Earnings from Invisibles:

The impressive role played by invisibles in covering trade deficit is due to a sharp rise in invisible receipts payment since 1992-93. From $17319 million in 1993-94, invisible receipts raised $30,312 million in 1999-2000 and further to $34,447 million in 2000-2001.

(ii) Rise in External Commercial Borrowings:

In this period External Commercial Borrowings accounted for more than 25 percent of total capital inflows into the economy. Over the period 1993-94 to 2000-2001 ECB accounted for more than 27 percent of total capital inflows in the economy.

(iii) Non-Resident Deposits:

There has been a considerable increase in nonresident deposits also. In fact Government has been offering various incentives to MRI to boost foreign exchange reserves of the country.

(iv) Role of Foreign Investment:

Since 1991, the Government has been offering various concessions, facilities and incentives to the foreign investors with a view to encouraging foreign investment into the country. Over the period from 1991 to 2002 Foreign Investment accounted for 54.5 percent of total capital inflows into the country.

Although BOP problem is not as severe as it was earlier but still it is not totally eliminated. Still our import bill is always higher as compared to export payments.

(1) 2005-06 affected by redemption of US$5 billion 5 year India imports million deposits.

(2) Includes delayed export reserve and advance payment against imports.

Tracking the shifts in India’s balance of payments:

(i) Current account deficit showing only gradual deterioration whereas capital account surplus is surging.

(ii) Policy measures have exacerbated the increase in capital inflows, complicating monetary management.

(iii) Overseas borrowing limit should be cut and reforms stepped up to allow capital inflows to be digested.

India’s BOP shows a record increase in capital inflows that has substantially offset a gradual widening of the current account (CA) deficit. The magnitude of inflows has overwhelmed the central bank and complicated monetary policy. Moreover, policy makers made their task more difficult last year by increasing the ceiling on overseas borrowing by Indian corporate cutting back this ceiling would ease-but admittedly not reverse the appreciation pressure on INR and also make monetary management easier.

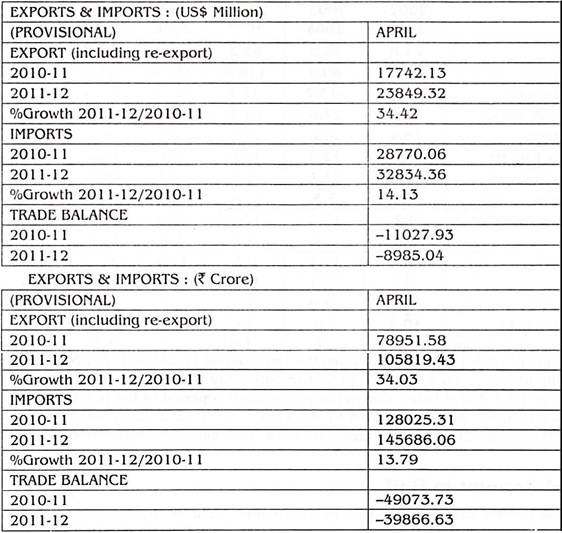

Trade Balance:

The trade deficit for April 2011 was estimated at US $ 8985.0 million which was lower than the deficit of US $ 11027.9 million during April 2010.

It we compare the exports and imports of the year 2010-11 and 2011-12 we can see that the growth of exports is almost the same in both years and growth of imports also being the same, the trade balance is negative but same in both the years in the month of April in (US$ Billion) same is the case of growth if we measure in crores.

Essay # 3. Scenario of BOP Position in India:

The Indian economy has been progressively globalising ever since the initiation of economic reforms in 1991. The increase in capital inflows in 2009-10 is an indicator of the growing influence of global developments on the Indian economy.

The highlights of BOP developments during 2010-11 were higher exports, imports, invisibles, trade, CAD and capital flows in absolute terms as compared to fiscal 2009-10. Both exports and imports showed substantial growth of 37.3 per cent and 26.8 per cent respectively in 2010-11 over the previous year. The trade deficit is increased by 10.5 per cent in 2010-11 over 2009-10. However, as a proportion of gross domestic product (GDP), it improved to 7.8 per cent in 2010-11 (8.7 per cent in 2009-10).

Net invisible balances showed improvement, registering a 5.8 per cent increase in 2010-11. The CAD widened to US $45.9 billion in 2010-11 from US $ 38.2 billion in 2009-10, but improved marginally as a ratio of GDP to 2.7 per cent in 2010- 11 vis-a-vis 2.8 per cent in 2009-10. Net capital flows at US $62.0 billion in 2010-11 were higher by 20.1 per cent as against US $51.6 billion in 2009-10, mainly due to higher inflows under ECBs, external assistance, short-term trade credit, NRI deposits and bank capital. In 2010-11, the CAD of US $45.9 billion was financed by the capital account surplus of US $ 62.0 billion and it resulted in accretion to foreign exchange reserves to the tune of US $13.1 billion (US $13.4 billion in 2009-10).

Current Account Deficit:

The CAD increased to US $ 45.9 billion in 2010-11 from US $ 38.2 billion in 2009- 10, despite improvement in net invisibles, mainly on account of higher trade deficit. However, as a proportion of GDP, CAD marginally improved to 2.7 per cent in 2010- 11 as compared to 2.8 per cent in 2009-10.

The CAD increased to US $32.8 billion in H1 of 2011-12, as compared to US $ 29.6 billion during the corresponding period of 2010-11, mainly on account of higher trade deficit. As a proportion of GDP, it was marginally lower at 3.6 per cent during HI of 2012-11 vis-a-vis 3.8 per cent in H1 of preceding year.

As per the latest data available from the Ministry of Commerce, at US $242.8 billion during April 2011-January 2012, exports registered a growth 23.5 per cent over exports of US $196.6 billion during the same period in 2010-11. At US $391.5 billion, imports recorded 29.4 per cent growth during April 2011 – January 2012 over the figure of US $302.6 billion during the corresponding period of the previous year. Consequently, trade deficit increased by 40.3 per cent to US $148.7 billion during April 2001-January 2012 as compared to US $106 billion in April 2010-January 2011.

Capital Account in BOP:

Capital inflows can be classified by instrument (debt or equity) and maturity (short-term or long term). The main components of capital account include foreign investment, loans, and banking capital. Foreign investment comprising FDI and portfolio investment represents non-debt liabilities, while loans (external assistance, ECBs and trade credit) and banking capital including NRI deposits are debt liabilities. In India, FDI is preferred over portfolio flows as the FDI flows tend to be more stable than portfolio and other forms of capital flows. Rupee-denominated debt is preferred over foreign currency debt and medium and long-term debt is preferred over short-term.

The capital account surplus is improved by 20.1 per cent to US $62.0 billion during 2010-11 from US $51.6 billion in 2009-10. However, as a proportion of GDP, it declined marginally to 3.7 per cent in 2010-11, from 3.8 per cent in 2009-10.

Net accretion to reserves (on BOP basis) in 2010-11, at US $13.1 billion, remained at more or less the same level as in 2009-10 (US $13.4 billion).

Essay # 4.

Methods of Correcting Deficit in Balance of Payment in India:

Persistent disequilibrium in the Balance of payment particularly the deficit balance is undesirable because it –

(a) Weakens the country’s economic position at the international level and

(b) Affects the progress of economy adversely.

It must be cured by taking appropriate measures.

Important methods of correcting Balance of payment are as follows:

1. Deflation:

It is the classical medicine for correcting deficit in Balance of payment. Deflation refers to the policy of reducing the quantity of money in order to reduce price and money income of the people.

The Central Bank by raising the bank rate, by selling the securities in the open market and by other methods can reduce the volume of credit in the economy which will lead to fall in prices and money income of people. Fall in prices will stimulate exports and reduction in income checks imports.

Thus deflationary policy restores equilibrium to the Balance of payment:

(a) By encouraging exports through reduction in their prices

(b) By discouraging imports through the reduction in incomes at home.

Moreover higher interest rates in domestic market will attract foreign funds which can be used for correcting disequilibrium.

But it is also pointed out that deflation is not considered as a suitable method to correct adverse Balance of payment because of following reasons:

(a) It means reduction in income or wages which is strongly opposed by trade unions.

(b) It causes unemployment and sufferings of the working class.

(c) In a developing country expansionary monetary policy rather than deflationary monetary policy is required to meet the development needs.

2. Depreciation:

It means a fall in the rate of exchange of one currency in terms of another. A currency will depreciate when its supply in the foreign exchange market is large in relation to its demand.

In other words, a currency is said to depreciate if its value falls in terms of foreign currency, i.e. if more domestic currency is required to buy a unit of foreign currency. The effect of depreciation of a currency is to make imports dearer and exports cheaper. Thus depreciation helps a country to achieve a favourable balance of payment by checking imports and stimulating exports.

3. Devaluation:

Devaluation refers to the official reduction of the external values of a currency. Thus devaluation serves only as an alternative method of depreciation.

The success of devaluation depends upon following condition:

(a) The elasticity of demand for the country’s export should be greater than unity.

(b) The elasticity of demand for the country’s import should be less than unity.

(c) The exports of the country should be non-traditional and are increasingly demanded by other countries.

(d) The domestic price should not rise and should remain stable after devaluation.

(e) Other countries should not retaliate by restoring to corresponding devaluation. Such a measure will affect each other’s gain.

(f) Devaluation also suffers from certain defects:

(i) Devaluation is a clear reflection of the country’s economic weakness.

(ii) It reduces the confidence of the people in country’s currency and this may lead to speculative outflow of capital.

(iii) It encourages inflationary pressures in the home country.

(iv) It increases the burden of foreign debt.

(v) It involves large time lag to produce effects.

(vi) It is temporary device and does not provide permanent remedy to correct adverse Balance of payment (BOP).

4. Exchange Control:

Exchange control is the most widely used method for correcting disequilibrium in the Balance of payment. It refers to the control over the use of foreign exchange by Central Bank. Under this method, all the exporters are directed by the Central Bank to surrender their foreign exchange earnings. Foreign exchange is rationed among the licenced importers. Only essential imports are permitted.

Exchange control is the most direct method of restricting a country’s imports. The major draw-back of this method is that it deals with the deficit only and not its causes. Rather it may aggravate these causes and thus may create a more basic disequilibrium. It does not provide a permanent solution for a chronic disequilibrium.

5. Capital Movement:

Inflow of capital or capital imports can be used to correct a deficit in balance of payment. If the capital is perfectly mobile between the countries, an increase in the domestic rate of interest above the world rate will result in the inflow of capital. This will reduce the deficit in the balance of payment.

6. Encouraging Exports:

In order to correct an adverse Balance of payment, all efforts should be made to encourage exports. The Government should adopt various export promotion programmes such as reduction of export duties, provision of export subsidies, quality control incentive for exports etc. Exporters should be given all types of help by the Government.

7. Discouraging Imports:

Attempt should also be made to reduce import by adopting various measures.

(a) Import Duties:

Import duty or tariff is a tax on imports. The Government imposes tax on some or all imports. This raises the price of imports which in turn discourage import and thus help in correcting adverse Balance of payment.

(b) Import Quotas:

Fixing import quotas is another method for correcting adverse Balance of payment by reducing imports. Under this system, the Government fixes the maximum quantity of a value of the commodity to be imported. Thus by restricting imports through import quota is a direct method of correcting disequilibrium in the Balance of payment and is considered better than import duty. Instead of taxing imports, the import quota directly limits the quantity that can be brought into the country.

(c) Import Substitution:

Yet another method of correcting disequilibrium in the balance of payment through reducing imports is to encourage industries producing import substitutes. It helps the national economy to become more self- sufficient and reduce its dependence on imports.

Therefore it becomes clear that India should go for globalisation and open up its economy considerably by liberalising the import export regime. In fact, the policy package offered by the World Bank and IMF to the developing countries facing balance of payment problems specifically included import liberalisation and a more ‘open’ trade and industrial policy as a condition for grant of assistance. But it is seen that liberalisation of imports pushed up import bill immediately and the export sector failed to respond at such a fast pace. Therefore the deficits actually increased. It is thus obvious that such a programme can be undertaken only if adequate financing for a sufficiently long period is available.

Much more positive action is needed on the export front. According to Bimal Jalan, a feasible goal is to raise India’s share of trade to at least 1.5 percent in the world trade in next ten years i.e. by about 0.1 percent per annum.

Therefore to solve the problem of Balance of payment careful mixture of inward and outward strategy is required. The Government should import only those commodities which need high capital and export those Goods and commodities in which it has relative advantage.

Essay # 5. Measures Taken by the Indian Government for Improving Balance of Payments:

Full Convertibility of Rupee in the Current Account:

In budget proposals of 1992-93, a new system named LERMS (Liberalised Exchange Rate Management System) was introduced and since March 1, 1992 double exchange rates system was adopted. Under new system, the exporters could sell 60% of their foreign exchange earnings to authorized foreign exchange dealers on open market exchange rate, while 40% sale was made compulsorily on exchange rates decided by the RBI.

Besides, authorized exchange rate became applicable for providing foreign exchange by the Government for the most essential imports, while importers of other items had to manage themselves foreign exchange in the open market. This step was taken to discourage imports. LERMS showed good results and encouraged by it, the Government introduced in 1993-94, full convertibility of rupee in trade account.

By adopting this step the Government abolished double exchange rate system for export and import and implemented LERMS based on open market exchange. In budget proposals of 1994-95, then Union Finance Minister, Dr. Manmohan Singh, declared the full convertibility of rupee in the current account. This full convertibility, however, did not meet the norms prescribed by the IMF under Article-VIII of the Agreement. Article-VIII does not lay any restrictions on current account transactions among the nations.

The high officials of IMF declared in New Delhi on August 5, 1994 that IMF expected the Government of India to implement three important steps before getting its affiliation in clause VIII—

1. Abolition of foreign currency (ordinary) non-repatriable deposit scheme.

2. Abolition of the ceiling for providing foreign exchange for foreign tours of foreign education.

3. To provide facility of interest repatriation on non-resident none deposits.

On 19th August, 1994 the RBI declared certain relaxations while declaring full convertibility of Indian rupee in current account.

There relaxations are:

1. The repatriation of income earned from investments by NRIs and their overseas corporate bodies will be allowed in a phased manner over a three years period.

2. The existing uppermost ceilings for providing foreign exchange for foreign tours, education, medical treatment, gift and services was converted into indicative ceilings beyond which foreign exchange could be obtained for bonafide current payments after making a reference to the RBI.

3. Interest repatriation facility was provided on deposits of non-resident non-repatriable (NRNR) accounts from October 1, 1994, but the principal amount remained non-repatriable. Both principal and interest amounts were non-repatriable earlier.

4. No new deposits under foreign currency (ordinary) non-repatriable deposit scheme were to be accepted after August 20, 1994, but deposits accepted before October 1, 1994 under FCONR Scheme will get the facility of interest repatriation.

The process of easing the restrictions was formalized in August 1994 with India accepting Article VIII Status of IMF.

Causes of Disequilibrium:

Various causes of disequilibrium in the balance of payment are as follows:

1. Development Schemes:

The main reason for adverse balance of payment in the developing countries is a huge investment in development schemes in these countries. Import increases whereas exports may not increase because these countries generally export primary goods. Moreover, the volume of exports may fall because newly created domestic industries may need them.

2. Price Cost Structure:

Increase is prices due to higher wages and higher cost of raw material etc. reduces exports and makes Balance of payment unfavourable.

3. Changes in Foreign Exchange Rate:

An increase in the external value of money makes imports cheaper and exports dearer. Thus, imports increase and exports fall and balance of payment become unfavourable. Similarly a reduction in the external value of money leads to a reduction in imports and an increase in exports.

4. Fall in Export Demand:

No doubt developing countries are trying their best to export not only primary but also industrial goods. In fact they are producing industrial goods at a much faster rate but still these goods are not highly demanded because of low quality and higher price.

5. Demonstration Effect:

According to Nurkse, the people of less developed countries always follow the consumption pattern of the Developed countries. As a result import increases and Balance of payment position becomes worse.

6. International Borrowings and Lending:

Lending countries have favourable Balance of payment whereas borrowing countries have adverse position less developed countries are capital lacking countries. These countries have to depend upon developed countries for their financial needs. Therefore if they finance first they charge higher rate of interest and second they impose lot of adverse conditions on developing countries. It becomes ultimately the cause of their Balance of payment.

7. Cyclical Fluctuations:

During depression, the incomes of the people in foreign countries fall. As a result the exports of these countries tend to decline which in turn produces disequilibrium in the home country’s balance of payment.

8. Newly Independent Countries:

The newly independent countries in order to develop international relations incur huge amounts of expenditure on the establishment of embassies, mission etc. in other countries. This adversely affects their Balance of payment position.

9. Population Explosion:

Rapid growth of population in countries like India increases imports and decreases the capacity to export. Moreover whatever is produced extra for export purposes, the same is consumed within the economy. The import remains same. This leads to adverse BOP position.

10. Natural Factors:

Natural factors like droughts, floods etc. adversely affect the production of the economy. As a result exports fall, the imports increase and the country experiences deficit in Balance of payment.

11. Political Factors:

Political factors also produce disequilibrium in the Balance of payment. Domestic production is adversely affected by the political instability, wars etc. The prices of goods increase and as a result, the exports fall causing disequilibrium in Balance of payment.