In this article we will discuss about the costs and the theory of comparative costs.

Transport Costs and the Theory of Comparative Costs:

The Ricardian comparative costs theory rests upon the assumption that there is an absence of transport costs. This assumption is not at all valid in actual life. The transport costs not only exist but these can also significantly affect the profitability and pattern of international trade. In this connection quite useful contributions have been made by such writers as W. Isard, C.P. Kindelberger and W. Beckerman. The trade between two countries will take place if the difference of costs of producing a commodity exceeds the transport costs, otherwise no exports or imports will occur despite comparative advantages.

This can be illustrated by assuming that there are two countries X and Y and two commodities A and B. It is further supposed that x and y are the real cost per unit measured in labour-hours in two countries.

Country X will enjoy comparative advantage, if the following condition is satisfied:

ADVERTISEMENTS:

x/y < w2/w1R

Where w1 is the average money wage in country X, w2 is the average money wage in country Y and R is the rate of exchange of the units of currency of country Y for one unit of the currency of country X. If Tx1 is the money cost of transporting commodity A from country X to country Y, the comparative advantage of country X in respect of commodity A can now be determined, if the following condition is satisfied.

The commodity A will be imported by country X from country Y, if:

Tx2 is the money cost of transporting commodity A from country Y to country X.

By combining (i) and (ii), we get:

When condition (iii) holds valid, there can be neither export nor import of commodity A. Hence the international trade will take place, if the difference in real cost of producing commodity exceeds the transport costs.

ADVERTISEMENTS:

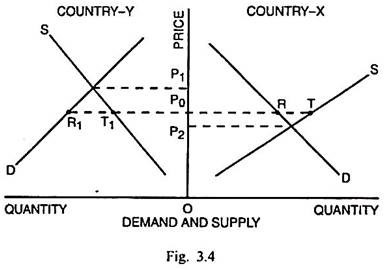

The international trade between the home country (X) and foreign country (Y) in the absence of transport costs can be shown through Fig. 3.4. It is supposed that home country (X) enjoys the comparative cost advantage over the country Y in the production and export of commodity A.

In Fig. 3.4, given the respective demand and supply curves D and S related to commodity A for the two countries, the pre-trade equilibrium prices are P2 in home country X and P1 in the foreign country Y. This price differential indicates that X has comparative advantage in the production of commodity A. If they enter into exchange at the price P0 when transport costs are zero, the home country X has an exportable surplus of RT which can be absorbed by county Y, which has an excess demand equal to R1T1.

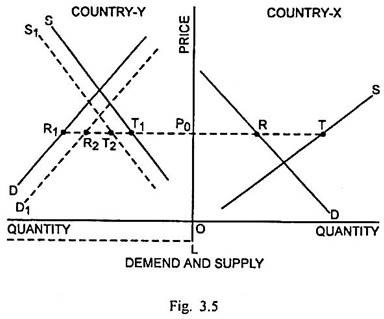

If transport costs are introduced, it will cause an increase in the price of imported goods from the point of view of country Y. If the per unit transport cost is OL, it is shown through sliding down the horizontal scale for country Y. It will also involve a downward shift in the demand and supply curves of country Y from D and S to D1 and S1. These shifts are again equivalent to the amount of transport costs. Fig. 3.5 shows that there will be shrinkage in the volume of trade due to the presence of transport costs.

In Fig. 3.5, originally in the absence of international trade, the export surplus RT of country X is absorbed by the import demand R1T1 in country Y. If there is transport cost OL per unit, the price in country Y for commodity A is in effect OP0 + OL = P0L. It is indicated through slide in the horizontal scale of country Y.

The impact of inclusion of transport cost is that the demand and supply curves related to country Y shift to D1 and S1 respectively. Now the country X has the exportable surplus RT but the demand for import for the commodity A is reduced to R2T2 only. It signifies that transport costs act as a barrier to international trade.

The transport costs tend to hinder geographical specialisation and offset the comparative cost advantage that a country may have over the other. If the heavy transport costs restrict the international division of labour, to that extent the world becomes poorer, though it does not invalidate the doctrine of comparative advantage. Any attempt to lower the transport costs between two countries will expand the volume of trade; enlarge the gains from trade and; bring about a significant change in the pattern of international trade.

Decreasing Costs and the Theory of Comparative Costs:

The classical comparative costs theory was based upon the assumption of constant returns or the constant costs. In actual reality, the production is governed by either increasing or decreasing costs. Whether the conditions of varying returns or costs are consistent with the theory of comparative costs or not, became a matter of controversy between economists like G. Haberler and F. Graham.

ADVERTISEMENTS:

Haberler, though his opportunity costs theory, explained that the principle of comparative costs could be valid under increasing opportunity costs or diminishing returns even though specialisation would be incomplete. As regards the trade under decreasing costs conditions, Graham expressed the fear that the volume of production would diminish in the trading countries after trade.

F. Graham disagreed with the classical contention that the specialisation based on the principle of comparative costs would cause expansion in the volume of production was subject to the law of increasing returns of diminishing costs. Graham attempted to demonstrate that specialisation in such a situation would cause considerable loss to one of the two countries and it may serve as a deterrent to trade.

Graham gave an arithmetical example to illustrate his argument. Two countries America and England produce two goods—wheat (subject to decreasing costs). Pre-trade situation is that 40 units of wheat are exchanged for 40 units of watches in England and 40 units of wheat are exchanged for 37 units of watches in America. The latter has comparative advantage in wheat, while the former has the comparative advantage in watches.

Now let them enter into exchange at the ratio of 40 units of wheat for 40 units of watches. The wheat production would be expanded and that of watches would be reduced in America and the reverse would happen in England. It is supposed that a reduction in output by say, 3700 watches in America would release resources to be diverted to the production of wheat, and raise its production by, say, 37500 units, which is less than 40,000 units on account of the operation of increasing costs there. These 37500 units of wheat would enable America to import 37500 units of watches.

ADVERTISEMENTS:

Again the same amount of factors is withdrawn from the production of watches. Now, it is supposed that reduction in the output of watches is, say 36000, which is less than 37000 and the resource diversion causes an increase in output of wheat by say 36200 units, and not 37500 units as in the previous case. These 36200 units of wheat can again be exchanged with 36200 units of watches.

Thus America, which could originally have 37000 + 37000 = 74000 watches, can have after trade 37500 + 36200 = 73700 watches. Thus a loss of 74000 – 73700 = 300 watches has been inflicted on America, due to free trade on account of specialisation based on the principle of comparative costs.

Thus Graham reached the conclusion that specialisation on the basis of comparative costs principle under the conditions of decreasing costs, will cause a reduction in real income or output. Since the free trade makes the country producing under decreasing costs worse off, there is a valid ground for imposing tariff to protect the domestic product from foreign competition.

Criticisms:

ADVERTISEMENTS:

Graham’s analysis related to specialisation under decreasing costs came to be criticised by Haberler on the following grounds:

(i) Perfect Competition:

Graham’s analysis rests upon the assumption of perfect competition. Haberler argued that prefect competition is inconsistent with a long run competitive equilibrium under the conditions of decreasing costs. As expansion in output lowers costs, the firm will have a continuous tendency to expand its output.

Ultimately the size of firm will expand to such an extent that the single firm will become able to meet the entire market demand. It implies the emergence of monopoly and break-down of perfect competition. This indicates the incompatibility between decreasing costs and perfectly competitive equilibrium.

(ii) Varying Reactions of Monopolists:

If the decreasing costs lead to emergence of monopoly, it is not definite what the producer’s reaction will be the concerning output. The decreasing costs are also likely to cause a fall in price and hence in profits. In order to secure maximum revenues, the monopolist may start reducing output continuously.

ADVERTISEMENTS:

The opposite reaction can also be possible. He may increase output to lower the marginal costs and expand his sales both in the home and foreign markets. It is, therefore, not certain that a given country, operating under decreasing costs, must become worse off due to trade.

(iii) Confusion Related to Average-Marginal Relationship:

The main determinant of price and output is the marginal cost rather than the average cost. Graham’s analysis has confused the average- marginal relationship. Jacob Viner pointed out that Graham’s analysis was in terms of average cost. The transfer of resources from one industry to another must be governed by the relative increments or decrements in output.

There is not likely to be a transfer of resources, if there is a net loss in the marginal product. In this connection J. Viner commented, “Had Graham dealt with this problem in terms of marginal costs and marginal returns for both industries, he could not have obtained results unfavourable to trade.”

(iv) External Economies:

The conditions of decreasing costs are often attributed to the external economies. Graham’s argument can be valid, if the economies external to the firm are supposed to be internal to the industry. Knight, however, pointed out that the economies external to one firm may be internal to another firm. It implies that the latter firm is large enough to enjoy monopoly position in the market. The presence of some degree of monopoly contradicts Graham’s analysis based on the assumption of perfect competition.

ADVERTISEMENTS:

(v) Limited Practical Application:

Haberler opined that the concept of external economies is vague and indeterminate. In the face of foreign competition, an industry enjoying external economies may not expand but contract its output, resulting in a rise in the costs of the firm. Such a situation necessitates the imposition of tariffs to provide protection to the home industry. But protection should be temporary in such an event.

Graham seems to suggest tariffs over a long period. Moreover, the exact quantification of external economies is difficult. In view of this situation, Haberler remarked, “It is really not practicable to base a policy of protection upon phenomena so vague and difficult to estimate as external economies.” It signifies that the field for practical application of Graham’s analysis is quite limited.

(vi) Incomplete Analysis:

Graham’s analysis assumes that the production in one country (England) in both the industries is governed by the law of constant costs, while it is governed by the law of decreasing costs in the second country (United States). He should have analyzed trade by assuming decreasing cost conditions in both the countries. Hence his analysis is faulty and incomplete.

(vii) Over-Emphasis on Decreasing Costs:

ADVERTISEMENTS:

In this analysis, Graham laid excessive emphasis upon deceasing costs. It led to a wrong impression that the decreasing costs are the basis of international trade. He seemed to overlook the fact that the basis of trade was not the decreasing costs but rather the comparative differences in costs. So long as one country has low relative costs than the other, international exchange can take place.

The above analysis does not mean that Graham’s approach has absolutely no validity. It has been recognised even by the modern economists including Tinbergen that free trade among countries can, in certain circumstances, create harmful effects for some of the trading countries and there does exist some justification for protecting the home industries through tariffs.