In this article we will discuss about:- 1. Government Borrowing or Debt-Financing of Budget Deficit 2. Government Borrowing or Debt-Financing of Government Expenditure-The Case of India.

Government borrowing is another fiscal method by which resources may be mobilised for economic development. In developing economies, the governments resort to borrowing in order to finance schemes of economic development. Government or what is also called public borrowing becomes necessary because taxation alone cannot provide sufficient funds for economic development. Besides, too heavy taxation has an adverse effect on private saving and investment.

It may be noted that when government increases its expenditure, it often results in budget deficit which is also fiscal deficit. This fiscal deficit can be financed in two ways. First, by borrowing by the government from the market and this borrowing leads to the increase in public debt. Borrowing as a means to finance the fiscal deficit is therefore called debt-financing of budget deficit. Second, budget or fiscal deficit can be financed by printing new money and therefore it is called money financing of fiscal deficit.

How much resources should be mobilised through borrowing and creation of money by the government depends on whether or not the funds so obtained are used for productive purposes which generates higher growth in GDP. In our view, in a developing economy such as ours, a fine balance needs to be struck between how much resources have to be raised through taxation, borrowing (i.e., debt financing) and newly created money.

Government Borrowing or Debt-Financing of Budget Deficit:

ADVERTISEMENTS:

A popular method of financing budget deficit is borrowing by the government which issues bonds and sells them to the public. Generally, sale of interest-bearing bonds to the public is indirect through financial intermediaries such as banks. Banks buy the bonds floated by the government with the currency deposits of the public. Therefore, borrowing by the government for financing of budget deficit is also known as bond-financing of budget deficit.

With the borrowed money in this way the government is able to expand its expenditure but at the same time it adds to public debt which has both short-run and long-run consequences. It may also be noted that budget deficit also comes about when taxes are reduced, keeping government expenditure constant. This type of budget deficit can also be financed through borrowing by selling bonds to the banks or public. The government has not only to pay annually interest on borrowed funds but has to pay back also the principal sum borrowed for which it may levy higher taxes in future.

The Keynesians have emphasised the expansionary effect of debt financing of government expenditure. In the Keynesian model with a fixed price level, the increase in government

expenditure through use of borrowed money causes an upward shift in aggregate expenditure (C + I + G) curve. If the economy is working at less than full-employment level of national income so that output gap exists in the economy, the increase in debt-financed government expenditure will bring about expansion in output or income.

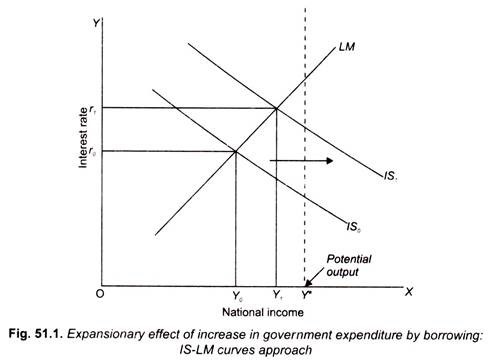

With the increase in income at the given tax rate, tax revenue collected will rise which will over time reduce the budget deficit or even ultimately eliminate it so that budget becomes balanced. This can also be illustrated through IS-LM model in Fig. 51.1 where IS and LM curves are drawn, given the money supply in the economy. Y* is the full-employment level of output. Initially, the equilibrium is at income level Y0. Now, with increase in government expenditure through borrowing IS curves shifts to the right from IS0 to IS1 with LM curve remaining the same.

ADVERTISEMENTS:

As a result, as will be seen from Fig. 51.1, national income increases to Y1. This will bring about increase in tax revenue collected by the government and over time budget deficit will be reduced or even eliminated. It will be seen from Fig. 51.1 that though interest rate also rises but it does not fully offset the expansionary effect of increase in government expenditure so that there is net expansionary effect of debt-financed increase in government expenditure.

However, critics have pointed out that debt-financed government expenditure is largely offset by the crowding-out effect of debt financing on private investment. The crowding-out effect on private investment takes place in a variety of ways. First, it has been pointed out that government’s borrowing funds to finance budget deficit will lead to the increase in demand for lendable funds which will cause the rate of interest to rise. The rise in interest rate will cause private investment to decline. Thus debt-financed increase in government expenditure crowds out private investment. According to this view, due to crowding-out effect on private investment net expansionary effect of increase in government expenditure is negligible.

On the other hand, the society will have to bear the burden of increase in public debt as a result of debt-financed expansion in government expenditure. If budget deficit arises due to reduction in taxes, keeping government expenditure constant, this will also lead to rise in interest rate and will therefore cause crowding-out effect on private investment. This happens because reduction in taxes stimulates consumption expenditure of the people which reduces savings. The decline in savings causes interest rate to rise resulting in fall in private investment.

ADVERTISEMENTS:

Wealth Effect of Government Borrowing (i.e., Debt-Financing):

In our above analysis, we have not taken into account the wealth effect of debt financing. When the government issues bonds to finance its budget deficit, it creates private wealth. This is because bonds are considered as wealth by the people. Patinkin and Friedman in their models include wealth in their money demand function. That is, according to them, demand from money depends on the real value of wealth, apart from other factors.

If this wealth effect of bond-financing of budget deficit is recognised, then it exercises an important influence on the dynamic behaviour of the economy. When through borrowing for financing budget deficit more bonds are issued and sold by the government, the wealth of the people increases which will raise the demand for money. The increase in demand for money, money supply remaining the same, causes a leftward shift in the LM curve, for instance, from LM0 to LM1 in Fig. 51.2. (Note that, on the contrary, financing of government expenditure through creation of printed money, LM curve will shift to the right.)

Thus, while with the increase in government expenditure IS curve shifts to the right to the new position IS1, which tends to raise aggregate income, the wealth effect of bonds issued to finance the deficit causes leftward shift in the LM curve which tends to raise rate of interest and thereby crowds out private investment. According to Friedman, the wealth effect is quite substantial so that it completely offsets the expansionary effect of increase in government expenditure.

In Fig. 51.2, initially the equilibrium is at Y0 level of income. With bond-financed increase in government expenditure IS curve shifts from IS0 to IS1 and due to wealth effect LM curve shifts leftward to LM1. It will be seen that interest rate rises from r0 to r1 with no net effect on the level of income which remains unchanged at Y0. Due to rise in interest, private investment declines so much that it completely offsets the expansionary effect of debt-financed budget deficit. As a result, budget deficit persists and debt goes on accumulating and becomes unsustainable.

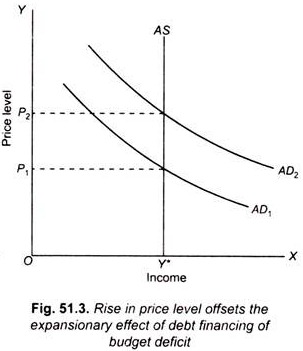

In the above analysis of crowding-out effect of debt-financing, it is assumed that price level remains fixed. However, when the aggregate supply function is vertical as is the case when the economy is working at full capacity output (i.e., full-employment level), increase in aggregate demand (AD) brought about by increase in government expenditure through borrowing will result in rise in price level, equilibrium level of income remains unchanged as shown through AS-AD model in Fig. 51.3. Since income remains unchanged, tax-revenue will not increase and therefore budget deficit persists and debt will go on accumulating and over time become unsustainable.

Conclusion:

ADVERTISEMENTS:

Expansionary effect of borrowing to finance budget deficit has been challenged on the ground of its crowding-out effect. However, in our view, the crowding- out effect of debt financing has been blown out of all proportions. As a matter of fact, crowding-out effect of debt financing of budget deficit is negligible, especially when the economy is working at less than full-employment level of income.

Generally, budget deficit and its financing through floating of bonds are recommended to overcome depression when there is underemployment equilibrium and therefore output gap exists. Empirical evidence also shows that wealth effect of sale of bonds is not significant. Besides, even in developing countries where there is gross underutilisation of resources or when they work at less than full-production capacity, policy of budget deficits and financing it through debt is a useful instrument to stimulate economic growth and raise income.

Government Borrowing or Debt-Financing of Government Expenditure-The Case of India:

In India there has been a problem of persistent budget deficits which has been largely financed by borrowing from the banks and public and thus adding to the public debt. In 1991 as a measure of economic reforms IMF directed that fiscal deficit of the central government should be reduced to achieve economic stability. The economists associated with IMF and World Bank hold the view that large fiscal deficit raises inflation rate of the economy on the one hand and since it is financed largely by borrowing from the market, this raises rate of interest and therefore crowds out private investment and adversely affects economic growth. Besides, it has been pointed out that the persistent budget deficit year after year adds to public debt and as a result ratio of public debt to national income (Debt/ GDP ratio) will greatly increase which will land the country in debt trap.

In view of the above, it is appropriate to discuss the above issues relating to borrowing for financing budget deficit and thereby to increase its developmental expenditure in the light of the recent Indian experience. It is worth mentioning that from 1997 to 2002-03 the Indian economy experienced slowdown in economic growth due to lack of aggregate demand resulting mainly from the fall in public investment and poor performance in agriculture.

ADVERTISEMENTS:

In this situation, output gap in the Indian economy emerged as the existing production capacity was not fully utilised. Besides, there has been lack of infrastructure facilities which stands in the way of raising private investment. Again in 2008-09 there was slowdown in the Indian economy due to global financial crisis (2007-09) leading to a sharp fall in Indian export which is now an important component of aggregate demand.

With their focus on reducing fiscal deficit the government reduced its capital expenditure (i.e., investment expenditure) because it failed to curb its consumption expenditure and subsidies. Thus, Mihir Rakshit, a leading Indian macroeconomist, rightly states, “With their focus on fiscal deficit, policy makers seem to think that what matters primarily is curbing government expenditure irrespective of changes in their composition. The period 1995-2000 was marked by 9.6 per cent and 12.6 per cent growth in government consumption and subsidies respectively, but public accumulation grew at snail’s pace of 1.9 per cent and its two crucial constituents, namely, investment in agriculture and infrastructure, actually declined by 5.6 per cent and 0.2 per cent respectively”.

The consequences of borrowing to finance budget deficit in the case of India depends on whether or not output gap exists due to lack of demand and infrastructural facilities. If the output gap exists, then increase in government expenditure on consumption and subsidies will raise aggregate demand and help in utilising more fully the existing production capacity and over time will cause private investment to rise. But this will not raise public saving and public investment and therefore will not result in much higher growth of the economy.

This may also raise ratio of public debt to GDP since due to slow growth in GDP, tax collection will not appreciably rise. Mihir Rakshit aptly points out that, “The Indian economy since 1997 has also been characterised by output gap, high fiscal deficit and growing debt/GDP ratio. The mainstream view in India is that despite the output gap fiscal deficits crowd out private investment and is unsustainable.”

ADVERTISEMENTS:

The mainstream view of borrowing for financing fiscal deficit is not correct and has been rightly challenged by some prominent Indian economists such as Mihir Rakshit, V.N. Pandit and Prabhat Patnaik, among others. Under the circumstances when there exists output gap and underutilisation of production capacity, the increase in government expenditure, especially of investment nature, will crowd in private investment and speed up rate of economic growth.

To quote Mihir Rakshit, “Contrary to widespread perception among commentators budget deficits associated with closing the output gap in fact crowds in private investment crowding in will be much more pronounced in countries like India where government’s infrastructural investment favourably affects private investment even while projects are being executed- the fact that highways are being built in some areas or that it will soon have abundant supply of power, communication facilities is likely to induce private investors to start setting up new units and expanding existing ones even in the short run.”

When there is out gap in a developing economy such as India, even increase in government’s consumption expenditure will crowd in private investment through the former’s demand effect. But, as has been pointed out by Dr. Mihir Rakshit, crowding-in effect of government’s investment expenditure will be greater because it expands the infrastructural facilities (i.e., supply-side factors) badly needed for increase in private investment.

In our view, the expansionary effect of government’s investment expenditure and also its crowding-in effect on private investment in a developing country like India is not confined to the situation when output gap and underutilisation of capital stock exists due to demand deficiency but also when such an economy functions at its normal capacity. Besides, even in normal times, government borrowing to finance its investment expenditure which brings about rapid economic growth, budget deficits and debt/GDP ratio over time can be reduced.

An important rule of public finance, which is sometimes described as a golden rule, is that if borrowed money by the government is used for investment or developmental purposes, it leads to growth in GDP or national income. Given the tax rate, this increase in income will ensure collection of more tax revenue possible. As a result, fiscal deficit will be reduced and debt/GDP ratio will decline. This has actually happened in India.

As a matter of fact, long ago (in 1994) E.D. Domar had stated the condition for sustainability of persistent budget deficits and consequently of mounting public debt. According to Domar, debt- financed fiscal deficits are sustainable if growth rate exceeds the rate of interest. This is because economic growth means increase in income or GDP from which annual interest payments can be made and if growth in income exceeds the rate of interest, the part of increase in income may be used for retiring public debt.

ADVERTISEMENTS:

In this way with the growth of the economy fiscal deficit and debt/GDP ratio can be reduced. Elaborating Domar’s condition, Mihir Rakshit writes, “According to Domar, if the government finances part of its expenditure (amounting to a given fraction of full-employment output) through borrowing, in a growing economy public debt and the government interest outgo as proportion of GDP will be stable in the long run provided the growth rate exceeds the interest rate. The implication is that when this condition is satisfied, maintenance of full employment through debt financing of budget deficit does not erode fiscal viability or produce a debt trap.”

In case of India’s macrodynamics the viability and sustainability can be explained through the following equation –

Y = C (Yd) + Iν (Y1 –Y t-1) + Ig + G … (1)

where Y stands for national income (i.e., GDPFC), Yd for disposable income, C for consumption which depends on disposable income (Yd), Iν for private investment which depends on change in national income (Y), Ig for government’s investment expenditure, and G for government’s consumption expenditure

Now, Yd = Y-T where T stands for tax revenue. If t is the rate of income tax, then T = tY. Thus

Yd = Y-tY = (1-t) Y…. (2)

ADVERTISEMENTS:

Since budget deficit (BD) in our simple model is the difference between government total expenditure on consumption (G) and investment (Ig) and the tax revenue collected, we have

BD = (Ig + G) – tY …(3)

Now substituting (1 -t) Y for Yd in equation (1) above we have

Y = C [(1 – t) Y] + Iν (Y1 – Y t-1) + Ig + G…. (4)

The viability and sustainability of government borrowing for financing fiscal deficits in a growing economy must be based on the magnitude of government investment expenditure (Ig) in the total expenditure (Ig + G).

Suppose the economy is working at the full capacity output and government increases its investment expenditure, say, on infrastructure and finances the budget deficit through incurring debt. This increase in government investment expenditure will raise income through both demand effect and capacity effect and will therefore stimulate private investment which depends on change in income (i.e., Y1 – Y t-1). This increase in both government and private investment will over time cause rapid growth in income which in turn will result in more tax revenue. Thus, in this way budget deficit will be reduced with favourable effect on public debt/GDP ratio, if rate of growth in income (GDP) exceeds rate of interest.

ADVERTISEMENTS:

It is thus clear that sustainability of fiscal deficit and public debt depends on shifting the composition of government expenditure towards investment. To quote Mihir Rakshit, “Budgetary viability requires an improvement in revenue balances in the medium term and the long run public investment in agriculture aided by crowding-in effect raises agricultural productivity and acts as a stimulant to a rural economy, brings down poverty and enables the government to reduce over time expenditure on food or fertilizer subsidies and poverty alleviation measures. An increase in government investment in rural and urban infrastructural facilities through increased revenue receipts and decreased subsidies will strengthen budgetary position not only in the medium term and the long run but in the short run as well.”

It is interesting to note that when with effect from year 2003 the government investment expenditure in India has been raised, tax revenue collection has significantly risen and also fiscal deficit, revenue deficit and debt/GDP ratio also declined. Besides, private investment went up (i.e., crowded in) rather than crowding out by increase in debt-financed increase in government expenditure.

Thus, in the 1990s when the focus in our strategy was to reduce fiscal deficit, no matter reducing capital expenditure of the government for this purpose, the Indian economy experienced slowdown in growth and our fiscal situation worsened. On the other hand, when from March 2003 we shifted the focus toward increase in government investment expenditure on power, ports, highways, and rural roads in a big way, private investment also crowded in, generated higher economic growth which resulted in lower fiscal deficits and lower debt/GDP ratio.

Nowadays, the Central Government borrows mostly from the market through sale of its bonds of different maturities carrying different rates of interest by RBI.

Public Borrowing Generates Additional Productive Capacity:

The funds raised by public borrowing can be utilised for building up economic infrastructure for the economy through schemes for the development of irrigation, transport, power and communication. They can help also in building up of the agricultural and industrial base of the economy. All such investments facilitate further economic growth. There is no doubt, therefore, that the public borrowing plays a very useful and important role in accelerating economic growth of developing economies. Public debt promotes saving and investment, the two most crucial determinants of economic growth.

ADVERTISEMENTS:

But there are three problems concerning government borrowing. First, government borrowing leads to increase is public debt whose burden falls on future generations who have to pay higher taxes to the government for paying back the borrowed funds. Besides, every year the government has to pay interest on the borrowed funds and these annual interest payments which are very large due to accumulated large public debt generally cause large deficit in revenue account of the government budget.

As a result, a large chunk of new borrowings every year are used to make interest payments. Thirdly, borrowing by the government from the market leads to increase in demand for loanable funds and causes rise in interest rate. At a higher interest rate private investment falls. Thus it is often asserted that Government borrowing crowds out private investment. However, when the Central Bank through its accommodating monetary policy expands the money supply to ensure ample liquidity in the banking system, the banks can make adequate funds available for meeting the demand for funds for the corporate sector.

However, government borrowing has often been used to finance its current or consumption expenditure as there has been large revenue deficit year after year with the result that financing of capital expenditure through government borrowing has been very small. This does not promote growth of the economy. The golden rule of government borrowing is that it should be used for financing investment or productive projects so that it yields returns which can be used to pay interest on the borrowed funds as well as pay back the principal amount. In this way, government borrowing would not involve any burden on future generations and instead higher economic growth will occur which will benefit the future generations.

Another problem of government borrowing to finance large fiscal deficit is that it causes large increase in government expenditure which leads to excess demand conditions in the immediate future which cause inflation in the economy. Therefore, financial prudence requires that fiscal deficit should be of reasonable degree and the funds borrowed by the government should be used for investment and productive purposes so that inflationary pressures can be contained.

Obstacles:

But there exist a number of obstacles which hinder the success of borrowing policy in developing countries. The resources of the organised financial market may be too inadequate to fulfill the needs of both the private and public sectors. Further, in the financial market the competition for funds between the government and the private sector will raise rate of interest and this will have a highly disincentive effect on the expansion of investment in the private sector. More borrowing by the government leads to the rise in market rates of interest.

The higher interest rates tend to reduce private investment. Therefore, it is often asserted that the higher borrowing target by the government ‘crowds out ‘private investment. In India the rates of interest on loans (on bonds or securities) of government have been raised quite substantially. Since banks and others prefer to invest in government securities because they are safe (i.e., riskless), this has reduced funds for private investment. However, in our view, this can be avoided if RBI through its monetary measures ensures adequate availability of funds available with the banks so that rate of interest does not rise when investors borrow from the market.

For the success of government’s borrowing policy, it is necessary that financial institutions be developed and extended into the rural areas of the economy in order to inculcate the habit of thrift in the population and to mobilise for productive purposes the amount of savings originating in this sector. Besides, for the mobilisation of savings it will be necessary to check and regulate the diversion of savings into unproductive investment such as real estate, gold and jewellery and inventory accumulation.

Suitable techniques of borrowing must also be devised. For example, bonds issued by the government should be adjusted to the preferences of the general public; bonds of large denomination and long maturity may be offered to the institutional investors, whereas those of small denomination and short maturity may be reserved for the non-institutional public.

If properly devised and conducted small savings campaign can mobilise a sizable amount of resources. Further, the mobilisation of the hoardings of gold and jewellery through government borrowing programmes constitutes a highly desirable source of resource mobilisation. In this connection the announcement by the Finance Minister in his budget for 2015-16 to issue gold bonds is a welcome step in this direction.