Before J. Viner developed the theory of customs union, there was a general belief that customs union raises the level of welfare as customs union is a movement towards freer trade at least within a specific area. Viner pointed out that the conclusion concerning increase in welfare due to customs union is not necessarily true.

He analysed the production effects of customs union through the concepts of trade creation and trade diversion. The works of the writers like Meade, Lipsey, Lancaster and many others analysed the consumption effects. H.G. Johnson followed a partial equilibrium approach to investigate fully the effects of a customs union by incorporating both the production and consumption effects.

Partial Equilibrium Analysis of Customs Union:

A custom union is an organisation that includes two or more countries. They abolish tariff and other trade restrictions among themselves and adopt a common external tariff against the non-member countries.

ADVERTISEMENTS:

The static effects of a customs union in a partial equilibrium system, on the lines suggested by Viner, Meade, Lipsey and Johnson, can be studied on the basis of the assumptions given below:

(i) The customs union includes two countries—the home country A and the partner country B.

(ii) The rest of the world is denoted by a third country, say country C.

(iii) The customs union imposes a common external tariff.

ADVERTISEMENTS:

(iv) There is an absence of any other type of trade restriction.

(v) The customs union imposes only a specific tariff.

(vi) The three countries produce only one commodity says, X.

(vii) The home country A was the highest cost country and the country C was the least cost country before the formation of the customs union.

ADVERTISEMENTS:

(viii) The supply curves are perfectly elastic in countries A and C.

(ix) The production is governed by constant returns to scale.

(x) There is perfect competition in both product and factor markets.

(xi) The supply of productive inputs is fixed.

(xii) There is a state of full employment of resources.

(xiii) The techniques of production are given and constant.

(xiv) The transport costs are absent.

(xv) The home country is originally having balance of trade equilibrium, i.e., exports equal imports.

The effects of customs union on production, consumption and trade, given the above assumptions, can be explained in terms of trade creation and trade diversion due to customs union.

ADVERTISEMENTS:

(a) Trade Creation:

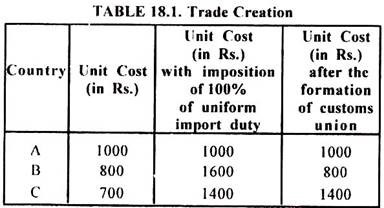

The formation of customs union involves the abolition of tariff among the member countries and imposition of common tariff against the rest of the world. It is supposed that the home country A is the least efficient country and its unit cost of producing a watch is Rs. 1000.

In the partner country B, which is more efficient, the unit cost of production of that watch is Rs. 800. The rest-of-the world is represented by non-member country C, which is the most efficient and the average cost of producing the same watch is Rs. 700 in that country.

If, before the formation of custom union, the home country A imposes 100 percent tariff on all imports, the unit costs in B and C become Rs. 1600 and Rs. 1400 respectively. In these circumstances, it is desirable for the home country A to produce the commodity domestically. If the customs union is formed and duty is removed on imports from B but it remains in the case of country C, the partner country B becomes the least cost country. Now the home country will prefer to import watches from B rather than produce it domestically. So the formation of customs union has resulted in the creation of trade.

ADVERTISEMENTS:

(b) Trade Diversion:

It is possible that before the formation of the customs union, a given commodity (watches) was being imported from the most efficient and the least cost country C. After the formation of the customs union, as duty is removed from import from the partner country B, while it remains enforced on imports from C, the former becomes the least cost country.

In such a situation, the home country A will start importing watches from the partner country B rather than non-member country C. Thus there is diversion of trade from outside country C to the partner country B after the formation of the customs union. It may be explained through the Table 18.2.

ADVERTISEMENTS:

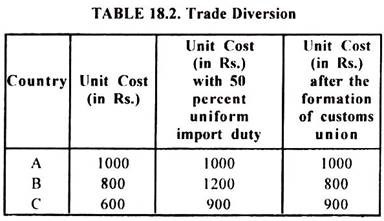

Table 18.2 shows that the unit costs of watch in the home country (A), partner country (B) and non-member country (C) before the formation of the customs union were Rs. 1000, Rs. 800 and Rs. 600 respectively. Thus country C was the least cost or the most efficient country and the home country A was the highest cost country.

As the home country imposes 50 percent duty on all imports, the unit costs in A, B and C become Rs. 1000, Rs. 1200 and Rs. 900 respectively. Since C is the least cost country, watches will be imported by A from this country.

After the formation of the customs union, the import duty is abolished on imports from B, while it remains in case of non-member country C. The unit costs, in this situation, are Rs. 1000, Rs. 800 and Rs. 900 in case of A, B and C respectively. As a consequence, country A will prefer to import watches from country B (partner country) rather than the outside country C. Thus the formation of customs union results in the diversion of trade from an outside country to the partner country. This is called as the trade diversion.

The partial equilibrium effects of the formation of the customs union can be analysed with the help of Fig. 18.1.

ADVERTISEMENTS:

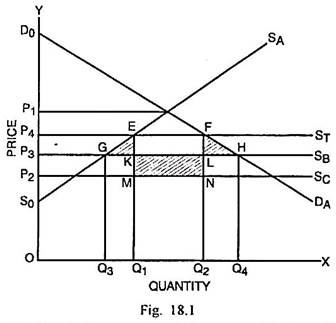

In Fig. 18.1., quantity of the commodity (watches) is measured along the horizontal scale and price along the vertical scale. DA and SA are the demand and supply curves respectively of the home country A. SB and SC are the perfectly elastic supply curves of countries B and C respectively. The selling price of country A is OP1 whereas the selling prices of countries B and C are respectively OP3 and OP2. Thus country C is the most efficient and the home country A is the least efficient.

Before the formation of the customs union, country A imposes P2P4 per unit tariff on all imports. Now the tariff-ridden price for country C is OP2 + P2P4 = OP4. It is still lower than A’s selling price OP1. Country B is out of picture because its selling price inclusive of tariff is even higher than A’s selling price. Country A will enter into trade with country C.

At the tariff-ridden price OP4, the domestic production by country A is OQ1 and the demand is OQ2 so that the quantity imported from country C is Q1Q2. The consumer’s surplus in this trade equilibrium is D0FP4 and producer’s surplus is S0EP4. The revenue receipts of the government in country A are EFLK. The measure of welfare before the formation of the customs union is D0FP4 + S0EP4 + EFLK = D0FLKE S0.

If customs union is formed and the tariffs are removed in case of partner country B, while these continue to exist in case of the non-member country C. As the selling price OP3 of country B is lower than that of country C, the home country will import watches from the partner country B and country C gets eliminated from trade.

The main effects after the formation of customs union are as follows:

a. Price Effect:

ADVERTISEMENTS:

As compared to the tariff-ridden price OP4, there is a fall in the selling price to OP3 after the customs union is formed.

b. Production Effect:

Before the formation of the custom union, the domestic production in country A was OQ1. After the customs union is formed, the domestic production falls from OQ1 to OQ3. This fall in output is met through imports. The overall import is Q3Q4 which is more than the earlier imports Q1Q2. The increase in imports Q1Q3 that offsets the fall in domestic production is termed as Trade Creation Effect I.

c. Consumption Effect:

Before the formation of customs union, the quantity demanded was OQ2 and afterwards it is OQ4. Thus the demand for watches rises by Q2Q4. This additional demand is met through imports from the partner country B. Thus the increase in consumption Q2Q4 is the consumption effect. It is referred as Trade Creation Effect II. Jacob Viner had over-looked it but the writers like Meade, Gehrels, Lipsey and Johnson have recognised it.

d. Revenue Effect:

ADVERTISEMENTS:

Before the formation of the customs union, the government in country A was obtaining revenues from tariff to the tune of EFLK. After the formation of customs union, since imports are being made from the partner country B, the government does not receive any revenues. Thus there is loss in government revenues to the extent of EFLK.

Given the trade creation effects I and II the total trade creation effect is (Q1Q3 + Q2O4).

e. Welfare Effect:

The welfare effect due to trade creation can be assessed as below:

Gain in Consumer’s Surplus = P4FHP3

Loss in Producer’s Surplus = P4EGP3

ADVERTISEMENTS:

Loss in Government Revenues = EFLK

Welfare Effect = P4FHP3 – P4EGP3 – EFLK = ΔEKG + ΔFLH

Trade Diversion and Reduction in Welfare:

While the trade creation results in a gain in welfare, the diversion of trade from a non-member country (C) to the member country (B) after the formation of customs union, involves some loss in welfare. The reason for it is that the trade gets diverted from a more efficient or low cost country C to the less efficient or high cost country B.

Before the formation of customs union, the home country A was importing Q1Q2 quantity of the commodity from the non-member country C. After the formation of customs union, the quantity imported is Q3Q4 out of which Q3Q1 and Q2Q4 can be identified as trade creation effect and the remaining quantity imported Q1Q2 is the trade diversion effect.

Before the formation of the customs union, the payment for importing Q1Q2 quantity was Q1EFQ2. Out of it the revenue receipts to the government of the home country amounted to (P2P4 × Q1Q2 = EMNF). So the actual payment to country C for the import of Q1Q2 quantity of watches was Q1MNQ2.

After the formation of the customs union, the same quantity Q1Q2 is being imported from the partner country B on account of trade diversion. Since no tariff is applicable to B, the total payment to it due to import amounts to OP3 × Q1Q2 = KQ1 × Q1Q2 = Q1KLQ2.

Thus there is a larger external payment for importing the same quantity after the formation of the customs union to the extent of Q1KLQ2 – Q1MNQ2 = KMNL which is shown through shaded area in Fig. 18.1.

This represents a loss or reduction in welfare. From this, it follows that trade diversion causes a reduction in welfare. The simple reason for the decline in welfare is that the imports are made from less efficient (high cost) partner country B rather than more efficient (low cost) non-member country C.

f. Net Welfare Effect of Custom Union:

The trade creation results in an increase in welfare. It is depicted by areas ΔEKG and ΔFLH in Fig. 18.1. The trade diversion, on the contrary, causes a reduction in welfare. In Fig. 18.1, it has been shown by the area KMNL. Therefore the formation of customs union may either cause a net increase or reduction in welfare.

(i) If KMNL = (ΔEKG + ΔFLH), there is neither an increase nor a decrease in net welfare.

(ii) If KMNL < (ΔEKG + ΔFLH), the formation of customs union results in a net increase in welfare of the home country A.

(iii) If KMNL > (ΔEKG + ΔFLH), the formation of customs union leads to a net loss in welfare in country A.