Standard cost has also been referred to as cost plan for a single unit. This cost plan will give an element-wise outline of what the product cost should be according to management’s thinking. This thinking is not merely an estimate or guess work. It is based on certain assumed conditions of efficiency, economic and other factors.

The term ‘standard cost’ has been defined as a predetermined cost which is calculated from the management’s standards of efficient operation and the relevant necessary expenditure.

Thus, standard cost is the normal cost under the ideal circumstances. It may be used as a base for the purpose of price fixation and submission of quotations. Moreover, the standards when compared with the actual cost may also be used as tools for cost control and as a yardstick for measuring efficiency of performance, which is possible with standard costing system.

Contents

- An Overview of Standard and Standard Cost

- Introduction to Standard Cost and Standard Costing

- Meaning and Definitions of Standard Costing

- Need for Standard Cost

- Features of Standard Costing

- Characteristics of Standard Costing

- Objectives of Standard Costing

- Purposes of Standard Cost

- Components of Standard Costing

- Conditions to be Satisfied for the Application of of Standard Costing

- Classification of Standards

- Methods of Accounting of Standard Costs

- Standard Hour or Minute

- Uses of Standard Costing

- Standard Cost Card

- Standard Cost Sheet

- Revision of Standards

- Estimated Costs

- Difference between Standard Cost and Budgetary Control

- Difference between Standard Cost and Estimated Cost

- Setting up of Standards

- Stages of Standard Costing

- Steps of Standard Costing

- Difference between Basic Standard and Current Standard

- Physical Standards

- Variance Analysis

- Distinction between Ideal Standard and Normal Standard

- Advantages of Standard Costing

- Limitations of Standard Costing

- Advantages of Standard Costs

What is Standard Costing? – Meaning, Definitions, Features, Characteristics, Setting Up Standards, Standard Cost Card, Variance Analysis, Advantages, Limitations, Difference, Formula, Examples

An Overview of Standard and Standard Cost

From Management’s point of view, “What a product should have costed” is more important than “What it did cost”. Managers are constantly comparing their product cost with “What it should have costed”. Reasons for deviations are rigorously analysed and responsibilities are promptly fixed.

ADVERTISEMENTS:

Thus, “what a product should have costed” is a question of great concern to management for improvement of cost performance. A scientific answer to this problem, i.e., an answer based on reasons and consequences, is developed by use of standard costing. Standard costing is a managerial device to determine efficiency and effectiveness of cost performance.

Standard:

It is a predetermined measurable quantity set in defined conditions.

ADVERTISEMENTS:

Standard Cost:

Standard cost is a scientifically pre-determined cost, which is arrived at assuming a particular level of efficiency in utilization of material, labour and indirect services.

CIMA defines standard cost as “a standard expressed in money. It is built up from an assessment of the value of cost elements. Its main uses are providing bases for performance measurement, control by exception reporting, valuing stock and establishing selling prices.”

Standard cost is like a model, which provides basis of comparison for actual cost. This comparison of actual cost with standard cost reveals a very useful information for cost control.

ADVERTISEMENTS:

Standard cost has also been referred to as cost plan for a single unit. This cost plan will give element-wise outline of what the product cost should be according to management’s thinking. This thinking is not merely an estimate or guess work. It is based on certain assumed conditions of efficiency, economic and other factors.

Standard cost is primarily used for following purposes:

1. Establishing budgets.

2. Controlling costs and motivating and measuring efficiencies.

3. Promoting possible cost reduction.

4. Simplifying cost procedures and expediting cost reports.

5. Assigning cost to materials, work-in-process and finished goods inventories.

6. Forms basis for establishing bids and contracts and for setting selling prices.

Introduction to Standard Cost and Standard Costing

Cost may be divided into two main categories, i.e Historical costs and Predetermined costs. Historical costs are the actual costs which can be determined only after they are incurred. It cannot be used for cost control purposes as it does not help management to take corrective action when needed.

ADVERTISEMENTS:

It does not provide any yardstick against which efficiency can be measured. It is unsuitable for price quotations, production planning and involves too much of paper work.

Such limitations encouraged the development of a new costing approach, i.e., predetermined costs. It helps management to know costs before production starts and control inefficiency and waste at the source. Predetermined costs — when ascertained on a scientific basis — result in standard costs.

It is used in standard costing which is a special technique to control costs and can be used in conjunction with any other system.

Standard Cost:

ADVERTISEMENTS:

The word ‘Standard’ means a norm or a criterion. Hence, a standard figure is one against which one can measure an actual figure to ascertain how much actual figures differ from standard.

CIMA has defined standard cost as – “a predetermined calculation of how much costs should be under specified working conditions. It is built up from an assessment of the value of cost elements and correlated technical specifications, and qualification of materials, labour and other costs to the prices and/or wage rates expected to apply during the period in which the standard cost is intended to be used. Its main purpose is to provide bases for control through variance accounting, for the valuation of stock and work-in-progress and in some cases, for fixing selling prices.”

Thus, standard cost is a predetermined cost calculated well in advance of production on the basis of a specification of all the factors affecting costs and used in standard costing.

It is a predetermined cost which should be attained under a given set of operating conditions.The prime object of standard cost is to look forward and assess what the cost ‘should be’ as distinct from what the cost has been in the past.

ADVERTISEMENTS:

Standard Costing:

Standard costing is a system of cost accounting which uses predetermined standard costs relating to each element of cost, i.e., material, labour and overhead.

CIMA has defined standard costing as – “the preparation and the use of standard costs, their comparison with actual costs and analysis of variances to their causes and points of incidence”. It is the most effective technique for controlling performance and cost.

The technique of standard costing is summarised below:

1. Fixing of standard costs for various elements of costs, i.e., material, labour and overheads.

2. Determining actual costs.

ADVERTISEMENTS:

3. Comparing the actual costs with the standard costs to find the differences, i.e., variance.

4. Analysing variances for ascertaining reasons of variances.

5. Forwarding variance analysis reports to management for appropriate action, where needed.

Standard Costing – Meaning and Definitions

Realization of the deficiencies of Historical Costing (i.e., Historical Approach to Costing) led to the evolvement of Standard Costing which has a prospective approach to Costing. However, it should be noted at this stage that Standard Costing is only a control device and not a distinct method of Product Costing. That means, it is not a substitute for any method of Product Costing.

It only suggests establishing standards for each element of cost and ensuring that the activities are performed by incurring not more than the pre-determined or standard costs. Therefore, the prospective approach can be introduced into any of the methods of Product Costing. That means, it can be used with any method of Costing viz., Process Costing and Job Costing.

In this backward, few definitions of Standard Costing are presented below followed by the analysis:

ADVERTISEMENTS:

The Chartered Institute of Management Accountants (CIMA), London defines Standard Costing as the preparation and use of standard costs, their comparison with actual cost and the analysis of variances to their causes and points of incidence.

Brown and Howard have defined Standard Costing as … a technique of cost accounting which compares the standard cost of each product or service with actual cost to determine the efficiency of the operation, so that any remedial action may be taken immediately.

W. W. Big has opined that standard costing discloses the cost deviations from standard and classifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

This way, a number of institutions and individuals have defined Standard Costing meaning, more or less, the same as presented above. A careful analysis of the above definitions reveals some of the important steps involved in introducing Standard Costing System.

They are summarized below:

1. Determination of standards for each element of costs,

ADVERTISEMENTS:

2. Collection of information about actual performance pertaining to each element of cost on a continual basis,

3. Comparison of actual cost with standard cost to find out the deviations (known as variances),

4. Analysis of variances to find out the areas where the company has fared well and the areas in which it has failed to achieve the target result,

5. Identification of probable reasons for such variances, and

6. Suggesting and taking suitable measures.

Need for Standard Cost (With Reasons)

Standard costs are pre-determined costs computed before commencement of production. The need for standard costs arises owing to the limitations or weaknesses of historical costs. While historical costs are ascertained after the completion of an activity or operation and, as such, can tell us what the costs actually are, standard costs are computed in advance of production.

ADVERTISEMENTS:

They are planned costs which tell us what the costs should be. Accordingly, historical costs are of little use from the point of view of cost control and decision making.

The need for standard costs arises for the following reasons:

Reason # (a) Cost Control:

As pointed out above, historical costs are made available after the occurrence of an event and also, after the lapse of a particular period time. Consequently, nothing can be done to rectify something that has gone wrong, except conducting a post-mortem examination of the thing that has gone wrong in order to get an idea of what has gone wrong and why.

This procedure is only a sort of ‘post-control’ and not pre-control. Cost control and managerial decision-making demand costs even before production. This is possible only with standard costs.

Reason # (b) Measurement of Efficiency:

Historical costs do not serve the purpose of evaluating performance and measuring operational efficiency. There being nothing like yardstick of performance, management will not be able to know whether a particular operation is as efficient as it should be.

With standard costs, however, the actual performance may be compared with the predetermined standard of performance, and management may be apprised of the efficiency or otherwise of an activity or operation.

Reason # (c) Fixation of Selling Price:

Historical costs, which are accumulated after the completion of an activity, vary from period to period. As such, the unit costs computed on the basis of historical data vary, in turn, from day to day. Such fluctuating cost information is of little use in fixation of selling price.

Reason # (d) Economy in Cost of Costing:

Computation of historical costs involves much time and labour. If the number of products is more, the cost accounting system will also be complex. Consequently, historical costs are computed by reference to source documents such as material requisition, job cards, time cards, etc. only after much time and clerical labour. Hence, historical costs involve substantial expenditure.

Standard Costing – 8 Essential Features

1. Predetermination of technical data related to manufacturing operations, processes, products and their efficiencies, wastage, losses, machine utilisation, etc.

2. Predetermination of standard costs in full detail under each element of cost, i.e., Material, Labour, overheads.

3. Predetermination of standard selling prices.

4. Predetermination of standard profit margins.

5. Comparison of the actual performance and costs with standards.

6. Analysis of variances-cost, sales and profit along with the reasons for deviations of actuals from the standards.

7. Presentation of variances to management for taking appropriate action and remedial measures.

8. Revision of standards where necessary.

Main Characteristics of Standard Costing

The characteristics of standard costing are as follows:

(i) A careful determination of standards.

(ii) A comparison of actual performance with standards by preparing appropriate reports showing difference between actual and standard performance.

(iii) Identifying the reasons for the difference between actual performance and standards through variance analysis. Variances may be controllable and non- controllable.

(iv) Taking appropriate action on the basis of the nature of variances, i.e. controllable and non-controllable.

(v) If the variance is controllable, take corrective action to prevent its recurrence; if non-controllable, revise future standards.

Standard costing can be used by any industry irrespective of whether it has job costing, process costing or any other method of costing. However, it can be used more effectively in industries which have standardised repetitive nature of operations i.e. process industry.

But industries, which are engaged in non-repetitive nature of work (job industries) can also employ standard costing for better performance. In fact, standards can be determined for any activity and so standard costing can be applied to any industry.

Standard Costing – 6 Important Objectives

The important objectives of Standard Costing are as follows:

1. Exercising control over all the items of costs pertaining to production, administration, and selling and distribution,

2. Preparation and submission of the reports regularly to the managerial personnel about the progress and also how the costs to-date compares with the corresponding standards. This is done with the objective of enabling the management to take necessary and timely corrective measures,

3. Creation of cost-consciousness among the employees of the company,

4. Creation of team spirit among the human resource of the company,

5. To reap the benefit of management by exception so that the precious time and effort of the management are devoted only for the areas wherein the progress is not in accordance with the standards, and

6. To guide the management and the staff about the possible ways for improving the performance of the organization in future.

However, it must be noted here that the primary objective of Standard Costing is to exercise greater control over the costs by setting standards and requiring the personnel to achieve the targets set in the standards.

Purposes of Standard Costs

Standard costs are used for the following purposes:

Purpose # (a) Planning and Control –

Standards serve as a yardstick or benchmark showing direction to the concern’s activities, i.e., where to go (known as planning), and analysing whether the actual activities are in proper direction (known as control).

Purpose # (b) Pricing Decisions –

Standard costs facilitate pricing decisions. Besides helping price fixation, standard costs also enable management to make decisions with regard to submission of quotations, answering tenders, etc. Since pre-determination of costs is based on acceptable standards of efficiency, decision-making is likely to be more precise and simple.

Purpose # (c) Variance Analysis –

Standard costs facilitate identification and measurement of variances from the standards. Such a step improves performance and also leads to revision of standards wherever necessary.

Purpose # (d) Management by Exception –

Standard costs also facilitates management by exception. By analysing the variances, management may concentrate on significant deviations from the standards and take corrective action.

Standard Costing – Top 3 Components

Standard costing is a system that establishes a detailed cost plan in advance of operations.

It consists of three components:

(i) Quantity standard—for each unit of finished product, there is some expected amount of direct material and number of direct labour hours. It is expressed in terms of input measures such as pounds, board feet, yards, etc. These are generally based on information provided by the design department or the engineering department,

(ii) Price standard—for each unit of finished product, there is a price standard. It is expressed in terms such as rupees per gallon, dollars per pound, etc. The price is usually set by the purchasing department,

(iii) Also included in the price standard are any freight or shipping costs the company will have to pay to obtain the materials. Prices should reflect current market prices to be used throughout the forthcoming fiscal period.

Conditions to be Satisfied for the Application of Standard Costing

For application of Standard Costing the following conditions must be satisfied:

1. Adequate number of standard products or components should be manufactured.

2. Methods, processes and operations should be capable of being standardised.

3. Adequate number of costs should be capable of being controlled.

Standard costing is most suitable for industries producing standardised products which are repetitive in nature, i.e., industries using process costing method, e.g., cement, sugar, fertilisers, etc.

It is not suitable for jobbing industries as each job undertaken may be different from another. Setting standards for each job is difficult and expensive. In jobbing industries Standard Costing may be applied for certain standard components and for certain processes and operations which are repetitive in nature.

Classification of Standards – Based on Period of Operations and Based on Tightness and Looseness

Based upon tightness, looseness and period of operation, standards have been classified in the following categories:

1. Based on Period of Operations:

i. Current standards.

ii. Basic standards.

iii. Normal standards.

2. Based on Tightness and Looseness:

i. Ideal standards.

ii. Expected or attainable standards.

1. Based on Period of Operations:

i. Current Standards:

Current standards are established giving specific regard to current conditions, in which standards are used. These standards –

(a) outline what cost should be under current conditions;

(b) call for periodical review and frequent revisions;

(c) require to be changed with changes in method of production and price level; and

(d) hold good for related accounting period. These standards are easily understood and have proved most useful for managerial control.

There are two main advantages of the use of current standards:

(a) These standards provide definite goals for short periods, which employees can usually be expected to reach. They also appear to be fair bases with which the current performance is measured.

Current standards are set at a level which is high yet attainable with reasonably diligent efforts and attention to the correct method of doing the job. These standards may be effective for stimulating efficiency.

(b) Use of current standards which closely represent expected actual performance, is economical. Such attainable standards can be used in planning, budgeting and control processes. Where standards are not close to expected actual performance, they may be applicable for control purposes, but are not realistic for planning and budgeting use.

ii. Basic Standards:

These are referred to with different names, like bogey standards, static standard and fixed standard. These standards –

(a) are established for an unaltered use for a long period of time;

(b) allow consistent comparison with same base line;

(c) may not stand in harmony with current conditions;

(d) do not specify level of efficiency required;

(e) represent a special class of standards of a statistical nature;

(f) are used in the same way as the statisticians use commodity price indices;

(g) serve as a yardstick with which actual performance is compared; and

(h) are not revised unless the products or the manufacturing operations or processes are changed.

The main advantage of the basic standard is that it minimises the number of revisions which would be required due to change in cost of materials and labour.

When basic standard is used, no change is required other than a computation of the cost relationships between the basic period and the current period. This computation is used in adjusting the standard costs before making comparison with the actual costs.

To illustrate this point, the year 1984 is assumed to be the basis for comparison and calculation. The material used by the firm is copper sheet, which is Rs.40 per kg. This figure is used to represent 100 per cent as base figure.

In the year 1994, the average price of copper is Rs.80 per kg. The basic standards for the copper material to be used must first be adjusted by 200 per cent before a comparison with the actual costs can be made.

These standards can be used in industries, where routines and operations are well established and working conditions do not normally change for a long time. These standards may be good to spotlight trends, but they cannot form basis to gauge efficiency.

iii. Normal Standards:

These standards are based on past averages adjusted to anticipated future changes. These standards are prepared for relatively longer period covering a trade cycle.

In formation of these standards, allowance is given to normal waste and scrap, normal fatigue and breaks, normal machine breakdown and maintenance and normal mistakes in production. These standards represent the cost performance which should normally be attained.

While these standards are very likely attainable, they are difficult to compute, because of probable errors in predicting the extent and duration of cyclical effects. A good performance is more than an ordinary performance.

A standard should not be very high to cause frustration, but still it should be high enough to expect a reasonably diligent effort for its accomplishment. The normal standard may be good for long-term planning and decision making, but their utility in efficiency appraisal is limited.

2. Based on Tightness and Looseness:

i. Ideal Standards:

Under these standards, attention is focused on perfection. These standards aim at absolutely minimum cost, which is attainable only in perfect operating conditions. These standards provide no scrap, no idle time, no rest period and no breakdown.

In the long run, it is impossible to attain these standards. Ideal standards have also been referred to as theoretical standards. These standards are rarely attained in practice. Where ideal standards are used, the accounts reveal unfavourable variances as regular feature.

This results in a depressing feeling among the staff members. Ideal standards can also be used for a long time without change or adjustment. These standards can also be used as engineering standards in highly mechanised industry.

After these standards are once set, they are rarely changed, unless radical changes are made in the product or in the manufacturing processes. One Professor told his students “ideal standards are like dreams of Sophia Lorens— distant, desirable but rarely attainable”.

ii. Expected or Attainable Standards:

It is a compromise between extremes of ideal standard and normal standard. These standards –

(a) are set providing for operating inefficiencies, which are unavoidable;

(b) take into account prevailing conditions in the period for which standards are used;

(c) are very realistic in nature and provide best criterion for evaluation of performance;

(d) have got the maximum usage because they fulfil all the requirements of good standards, i.e. they are consistent, realistic, capable of attainment and provide incentive for improvement.

In these standards, level of performance expected is higher than level of performance expected in normal standard. But this level is higher enough to expect reasonably diligent effort for accomplishment. It is capable of fulfillment. These standards are very useful for cost control purposes.

Methods of Accounting of Standard Costs (With Features)

Following three methods of accounting of standard costs are commonly used:

1. Partial Plan or Output Plan

2. Single Plan

3. Dual Plan.

1. Partial Plan:

It is also called Output Method.

The features of partial plan are given below:

i. Work-in-progress account is debited with actual cost of material, actual cost of labour and actual overhead.

ii. Work-in-progress account is credited with standard cost of finished goods.

iii. At the end of accounting period work-in-progress account is credited with standard cost of unfinished goods.

iv. After entering at (iii) above is passed, debit and credit sides of work-in-progress account are compared and difference in transferred to cost variance, which is further analysed for reporting to management on the basis of additional information not recorded in accounts.

2. Single Plan:

The features of single plan are summarised below:

i. Work-in-progress account is debited with standard cost.

ii. Work-in-progress account is credited with standard cost.

iii. Inventory is valued at standard cost.

iv. All variances are computed at any stage before debiting work-in-progress account.

Some companies compute rate and expenditure variances at the inception. Quantity/efficiency variances are calculated at the time of crediting control accounts.

3. Dual Plan:

Under this method all cost ledgers are maintained at actual cost. Standard cost is used in subsidiary records to give statistical information to management for purpose of control.

Standard Hour or Minute (With Calculation)

Production is generally expressed in terms of physical units like tonnes, pounds, gallons, numbers, etc. When different type of products are being manufactured in the factory, it is difficult or rather impossible to express all the products in one common unit.

For example, in the coke oven factory, both coke and gas are produced. Coke is measured in tonnes, while gas is measured in cubic feet. Thus, difficulty arises in expressing heterogeneous products in one common measure—either in tonnes or in cubic feet.

Standard hour approach is very useful in expressing the output of an organisation, when it is producing a variety of products having different units of measurement.

CIMA defines Standard hour or minute as “the quantity of work achievable at standard performance in aft hour or minute.” It is the media of converting production into allowed hours or minutes. It states in detail the standard relationship between time and output.

Standard relationship implies that considerable amount of thought and energy is applied before specifying “time allowed” for a unit of output. In a manufacturing organisation work done, i.e., production is expressed in physical terms only, but with the aid of standard hours it can be converted or expressed in allowed hours or minutes also.

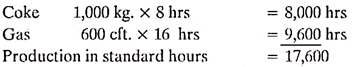

Suppose production in coke oven factory is – 1,000 kg of coke and 600 cft of gas and the standard time allowed per unit is 8 hours and 16 hours respectively.

The production in standard hours will be:

Standard Costing – Special Uses

The use of standard costing is fast growing as an effective technique of cost accountancy.

Its special uses are discussed under following headings:

Use # 1. Adds to Managerial Effectiveness and Efficiency:

It is hot enough for a manager to be effective. He has to be efficient as well. Performance of a manager should be both effective and efficient, i.e., desired objective should be accomplished with minimum input resources.

The use of standard costing provides media to specify these objectives of effectiveness and efficiency. It also provides framework to measure the degree or attainment of effectiveness and efficiency.

Use # 2. Aids Inventory Costing:

Valuation of inventory at standard cost simplifies the pricing of inventory? It enables the company to follow a consistent practice. All operating gains and losses are charged off to accounting period in which they arise. This enables executives to analyse the variances by type, causes and locations.

When standard costing is used, a unit standard cost is available for inventory valuation and pricing of store issues. It avoids the need to compute a new average unit price with each input entry, as is the case, when perpetual inventory records are kept at actual cost.

Use # 3. Help in Product Pricing:

The knowledge of standard cost of product can be useful as one of many factors to be taken into account for pricing. The standard cost of a product is a useful starling point in pricing. It provides a warning that unless this amount and something more for profit is recovered in the selling price, the product will not be really profitable.

The knowledge gained in setting standard cost provides the entire cost picture of the product ranging from its out-of-pocket cost to full costs.

With all this information, it becomes possible to ascertain the extent to which an available price will cover out-of-pocket costs and contribute to recovery of fixed costs. The standard cost provides one of the many factors that should be considered in pricing.

Use # 4. Reduces Clerical Record Keeping and Aids Cost Reduction:

Standard costs may result in reduction of clerical work. For example, under actual cost system, each item of each material requisition must be coasted separately, when LIFO of FIFO method is used. In a large company, this is an enormous task, since thousands of requisitions may be issued.

Under a standard costing system, all the issues of a particular type have to be multiplied once by the standard cost. Under standard costing, only quantities have to be maintained on stores records. This saving is, of course, partially offset by the added cost of establishing and revising standards.

Use # 5. Aids in Budgetary Planning and Control:

The use of standard costs and knowledge of relationship gained through establishment of standards are useful in budgetary planning and control.

The standard costs developed for each product can be used to convert the sales estimates into projections of material, labour and overhead. In situations where a large variety of products are involved, it is possible to select and use the standard costs on a few products representative of large groups.

Standard costs can also be used to develop representative proportion of material, labour and overhead by product group. Thus, the knowledge gained through studies for establishment of standard cost can be extremely effective and useful for planning and control.

Standard Cost Card

When all the standard costs have been determined, a Standard Cost Card is prepared for each product or service. The process of setting standards for materials, labour and overheads results in the establishment of the standard cost for the product.

Such a cost card shows for a specified unit of production, quantity, quality and price of each type of materials to be used, the time and the rate of pay of each type of labour, the various operations the product would pass through, the recovery of overhead and the total cost.

The build-up of the standard cost of each item is recorded in standard cost card. These details serve as a basis to measure the efficiency against which actual quantities and costs are compared. The type of standard cost card varies with the requirements of individual firm hence no uniform format can be prescribed.

Standard Cost Sheet

After the standards for various elements of cost have been set, these are recorded in a form, which is referred to as standard cost sheet. It contains quantity and price of each class of material used, grade of labour, labour rate and time and overhead rate for each product.

Standard cost sheet also shows total of each element of cost for each department. One cost sheet is prepared for each product manufactured.

The information is arranged in standard cost sheet in such a way that the cost of even a partly finished unit can also be quickly determined. These standard cost sheets arc of great use in making quotations and finding out variances. The number and complexity of standard cost sheets or cards depend upon the size and characteristics of the business.

A plant producing thousands of different articles naturally has been for many more cards than one producing a single article. In some firms, a large number of small parts must first be manufactured before the main product can be assembled.

In the production of sewing machines, vacuum cleaners, pianos, washing machines and various motors, a separate standard cost sheet or card must be used for each part manufactured.

Then, finally an assembly standard cost sheet for final product is prepared. Manufacturing process of pianos require more than four hundred different parts and for each part, there is standard cost sheet. In these situations, an assembly standard cost sheet for final product is prepared in the end.

Standard Costing – Revision of Standards (With Circumstances)

Standards are always set for a particular period. Decision to change or not to change the standards rests entirely on circumstances. The revision of standard is a costly exercise involving a lot of labour and expenditure.

At the same time obsolete standards lead to wrong conclusions and frustration. Minor changes can be taken care of by variance analysis, but major changes in method of production may necessitate prompt revision.

A review of standards should be made at a specific interval according to decision of management, but revision should be attempted only when compelling unusual conditions come to prevail.

A revision may be attempted in the following circumstances:

1. It has been proved that standards set were fundamentally wrong.

2. Changes in price level may compel to revise standards.

3. Only unforeseen, substantial and apparently permanent price rise makes a case for revision of standards.

4. There is change in material specification.

5. Basic wage rates have changed substantially and almost permanently.

The guiding factor for changing the standard is, whether or not conditions have so changed that standards as set no longer reflect what was in mind at the time of their determination.

The standards should be changed only when underlying conditions change, in many cases mania for revising the standards, when they ought not to be changed, has led to the weakening of effectiveness of standard costing in operation.

Some companies believe that standard should be changed each year. If fundamental concepts of standard costing are kept in mind, there is neither reason nor logic for this argument.

The passage of time has nothing to do with the question of revising the standard. The standards should be changed only when they reflect something which no longer exists.

Since basic standards are used fairly for a long time like index numbers for a particular base year, they should be changed only under the following circumstances:

(i) Change in the method of manufacture.

(ii) Change in the plant capacity.

(iii) Disparity between base standard and actual performance is so substantial that standards lose their significance.

Standard Costing – Estimated Costs (With Reasons)

Predetermined costs may either be estimated costs or standard costs. Estimated cost is a predetermined cost for a future period under normal conditions of operations.

Kohler defines estimated cost as “the expected cost of manufacture or acquisition, often in terms of a unit of product, computed on the basis of information available in advance of actual production or purchase.” Estimated costs are thus prospective costs. While making cost estimation, however, allowance is generally made for price fluctuations.

Cost estimation is made for submitting tenders or quoting price of a product or a unit of service. When cost estimation is made, it does not mean that cost ascertainment is done away with.

A concern needs both historical costing and estimated costing for the following reasons:

(i) Estimated costs help controlling actual costs while work is still in progress.

(ii) Operating efficiency can be measured if both actual costs and estimated costs are available side by side.

(iii) When actual costs are analysed in the light of estimated costs, it is possible to know the stages at which wastage of materials or labour time has occurred.

(iv) When a new product is introduced in the market, its selling price can be rationally determined by making cost estimation.

Difference between Standard Cost and Budgetary Control (With Points of Similarities)

Standard Cost versus Budgetary Control:

Both standard costing and budgetary control aim at the objective of maximum efficiency and managerial control. Standard cost and budgetary control have the same principle, viz., setting up standards or target, comparing actual performance with the predetermined standards, analysing and reporting of variances.

Without standard cost figure, preparation of budget or a real budgetary control system cannot be achieved.

Similarity – between Standard Cost and Budget:

1. Both aim at the determination of cost in advance.

2. For both of them predetermined standards are fixed.

3. In both of them actual costs are compared with standard costs.

4. Both require periodic cost reports.

5. Both aim at the maximum efficiencies and managerial costs. But they differ in scope and technique.

Budgetary Control and Standard Costing Compared:

Budgetary Control:

1. It is extensive in its application, as it deals with the operation of department or business as a whole.

2. Budgets are prepared for sales, production, cash etc.

3. It is a part of financial account, a projection of all financial accounts.

4. Control is exercised by taking into account budgets and actuals. Variances are not revealed through accounts.

5. Budgeting can be applied in parts.

6. It is more expensive and broad in nature, as it relates to production, sales, finance etc.

7. Budgets can be operated with standards.

Standard Costing:

1. It is intensive, as it is applied to manufacturing of a product or providing a service.

2. It is determined by classifying recording and allocating expenses to cost unit.

3. It is a part of cost account, a projection of all cost accounts.

4. Variances are revealed through different accounts.

5. It cannot be applied in parts.

6. It is not expensive because it relates to only elements of cost.

7. This system cannot be operated without budgets.

Difference between Standard Cost and Estimated Cost

(1) Emphasis

In standard costing system, it is decided that what should be the cost of a produced. But under estimated cost, the emphasis is on actual costs and it tells what cost will be. The success of estimate is measured by nearness to actual costs.

(2) Revision

Under standard costing, standard are not revised but in estimated costs expected changes may occur which are nearer to actual costs.

(3) Stability

Standard costs are more stable than estimated costs because estimated costs are set on the assumptions of free movement of cost.

(4) Accuracy and Reliability

Standard costing is a scientific method of cost control and it is more reliable and accurate, whereas estimated cost are not so precise and reliable.

(5) Basis of Determination

Estimated costs are based on historical data, while standard costs are based on scientific analysis and engineering studies.

(6) Barometer of Efficiency

Standard costs possesses management opinion and they are used as a device of measuring efficiency in operation. But this idea of efficiency does not prevail in estimated costs.

(7) Application

Standard cost are applied in those concerns, where complete costs records are maintained while estimated costs can be used in every situation.

Setting up of Standards

Standards are set up for each element of cost, viz., direct material, direct labour, variable overheads and fixed overheads. The work of standards setting may be carried out by a special committee called ‘standards committee’, comprising cost accountant, work study engineer, production engineer, purchase manager, etc.

1. Direct Material Cost Standard:

The determination of direct material cost standard would involve:

(i) Determination of quantity standards, and

(ii) Determination of price standards

For determining material quantity standards for each material going as an input in the product, it is necessary to develop a product design and material specification in a scientific manner on the basis of experiments/test runs.

These specifications must be adhered to except in special circumstances when a revision is to be effected. If quantity standards are being set for a process industry, then standard (normal) process loss, if any, should also be decided on the basis of past experience or scientific analysis.

Standard prices for all materials should be determined after considering prevalent market, prices, expected fluctuations in prices, foreseeable economic and political factors, stock in hand and material in transit or on order.

2. Direct Labour Cost Standard:

The setting up of standard labour cost for each product would require:

(i) Ascertainment of various labour grades and requirement of their labour hours for each product. The standards of performance may be determined on the basis of time and motion study.

(ii) The labour hour rate for each type of labour-(skilled, semi-skilled, unskilled, etc.) may be fixed by evaluating wages, pay scales, remuneration, etc., of each category of personnel.

3. Variable Overhead Standard:

As the name indicates, variable overheads vary with production volume. This means variable overhead per unit or per hour will remain unchanged irrespective of the volume of production.

Hence, variable overhead standard is expressed in terms of per unit or per hour. These standards will also be set up on the basis of scientific analysis.

4. Fixed Overhead Standard:

It requires:

(i) The determination of budgeted fixed overhead for a period

(ii) Budget output in units or standard hours during the period

(iii) The number of hours expected to be worked during the period

Stages Involved in the Process of Standard Costing

The term ‘standard cost’ has been defined as a predetermined cost which is calculated from the management’s standards of efficient operation and the relevant necessary expenditure.

Thus, standard cost is the normal cost under the ideal circumstances. It may be used as a base for the purpose of price fixation and submission of quotations. Moreover, the standards when compared with the actual cost may also be used as tools for cost control and as a yardstick for measuring efficiency of performance, which is possible with standard costing system.

As such, the process of standard costing involves the following stages:

(1) Predetermination of technical data related to production i.e., details of materials and labour operations required for each product, the quantum of inevitable losses, level of activity etc.

(2) Predetermination of standard costs in full details under each element of cost i.e., Labour, Material and Overhead.

(3) Comparison of actual performance and costs with standards and working out the variances i.e., the difference between the actual and the standards.

(4) Analysis of variances in order to determine the reasons for deviations of actuals from the standards.

(5) Presentation of information to the appropriate level of management to enable suitable action being taken, or revision of standards.

It should be noted in this connection that standard costing is not a separate system of accounting but only a technique used with the intention of controlling the costs.

Though it can be used in case of all methods of costing like job costing, process costing etc.; it can be more effective in case industries producing the standard products on continuous basis.

Steps Involved in the Introduction of a Standard Costing System

Introduction of standard costing system involves the following steps:

Step # 1. Setting up of Standards for Each Element of Cost:

Standards should be set up for each element of cost, viz., direct material, direct labour and overhead, However this is a complex task. Standards must be set up rationally and carefully. They should be neither low nor high.

A low standard which everyone can achieve does not bring out the best performance. On the other hand, too high a standard being impossible to achieve, is treated with disdain and indifference. Setting up right standards requires cooperation of various line managers in the organisation. It is not merely an accounting job.

Step # 2. Study of the Technical Aspects of Production Process:

Before introducing standard costing system in an organisation, a complete study of various methods of manufacturing and the processes is required. The total production process may be subdivided into various sub-processes of manufacture.

The amount of losses-normal or abnormal, in each sub-process over a considerable period of time should be examined. The number of detectives and their cost of rectification should be looked into by going through the previous production records.

The study of previous records ensures the working out of the normal efficiency of labour in each production process. This study of the technical aspects of the factory is essential to base the system of standard costing on the actual situation in the factory.

Step # 3. Review of Existing Costing and Budgetary Control System:

The existing costing system should be reviewed with special reference to the existing records and forms. For clear definitions of standard costs, the existing costs in general and the methods of allocation and apportionment of overheads in particular should be studied.

This is important since the standard costing system is to be built on the basis of the existing system of costing, budgeting and internal control procedures. The existing cost system should be reviewed with special reference to the existing cost system should be reviewed with special reference to the existing records and forms.

This is important since the standard costing system has to be established as an extension to the existing costing system.

Step # 4. Study of the Organisation Chart:

The organisation chart showing the various lines of authority and responsibilities should be studies. It will help in supplying basic data regarding various operations of the undertaking.

Step # 5. Determining the Type of Standard:

A study should be conducted to determine the type of standard to be used i.e. whether current, basic or normal standard. The choice of the standard depends upon two factors, viz., its effectiveness for cost control, and as a measure of productive efficiency within or outside the accounting system as statistical data.

Step # 6. Enlisting Cooperation of Executives:

For the success of the standard costing system cooperation of the factory executives for fixing the quality and efficiency standards is essential. A system of standard costing would be successful only if it receives the full support from various line managers.

If the managers view it merely as an imposition by the accounting department, they will never cooperate within. To secure the cooperation of executives, it is essential to clearly that the system is for overall benefit and would be run only if they find it useful.

A standard cost committee comprising important line managers may be formed to discuss various preliminary problems regarding the standard costing system.

Step # 7. Preparation of Manual:

A detailed manual should be prepared for the guidance of the staff. The manual should briefly describe the system to be followed and the benefits there of.

The responsibilities of various functionaries for different activities and the supply of cost data should be clearly demarcated. Various activities must be clearly detailed and the whole procedure of the system outlined.

Step # 8. Training of Staff:

The office staff required to operate the system should be properly trained. When the system comes into force, a number of alternations would be required in the scheme of making accounting entries and in the flow of documents.

Step # 9. Setting Physical Standards:

The standards of physical activity for various departments should be worked out. For direct materials, standard quantity has to be determined with reference to quality and size of materials required for each unit of production.

The standard quantities of material are developed by the technical sections, drawing office or the laboratory after a product study or engineering study which examines the details of materials and plant conditions.

Step # 10. Study of Labour and Machine Operations:

Each item of manufacture should be studied in detail to discover various operations to be performed by labour and machines, different grades of labour to be employed, plant, machinery and tools to be needed, departments in which various operations to be carried out, and the standard time required for performance of such operations. This study will enable the setting up of labour and machine cost standards.

Normally, time and motion study or past records of performance are useful in this regard.

Step # 11. Study of Market Conditions:

For developing cost standards, they study of market conditions and the tired of prices for a definition period in future is made. This study will be of great help in determining material price standards.

The labour cost standards can be set up by studying data regarding the wage rates to be paid. For determining the cost standard for overheads, overhead costs and the level of activity in a budget period should be estimated. The standard overhead rate will be arrived at by dividing estimated overheads by the estimated level of activity for the budget period.

Difference between Basic Standard and Current Standard

A standard established for use over a long period is known as the basic standard. Basic standard remains unaltered over a long period. Its use is to show long-term trends, and it operates in a similar way to index numbers.

Basic standard is also known as the ‘bogey’ standard. It reflects the costs that would have been incurred in a certain past period or the base period. This standard is used for items or costs which are likely to remain constant over a long period. Such a standard is, therefore, set on a long-term basis and are very rarely revised.

Basic standard is a static standard. It is revised only when new products are introduced or the existing ones are so modified as to be considered to be practically new. Although there is saving in clerical cost of setting the standard, basic standard cannot be used to highlight current efficiency or inefficiency.

This is because of the fact that the standard does not represent what should be attained in the present period. Hence, not being useful for cost control, basic standard is rarely used except as a basis for preparing current standard.

A standard established for use over a short period of time and related to current conditions, is known as the ‘current’ standard. This standard shows what the performance should be under current conditions.

Conditions during which period the standard is used are known as current conditions. Current conditions take into consideration material and labour price changes during the period when the standard is used.

The current standard is used for items or costs that undergo changes from one period to another. The standard gets revised from period to period, since the same is meant for a short period of time, i.e., one year. Normally, current standard is used by all types of businesses for variance analysis and decision making.

Thus, current standard, which is related to current conditions, reflects the performance that should be attained during the period for which the standard is used. This type of standard is thus realistic and capable of attainment.

However, its frequent revision increases clerical costs. Further, it does not provide a stable basis of measurement of the actual performance due to its frequent revisions; it is also not useful for studying the long-term trend of costs.

Current standard may be based either on ideal standard or expected standard. While ideal standard is that which can be attained under the most favourable conditions, expected standard is that which is expected to be attained during a specified budget period.

It is a target which is attainable and can be achieved if the expected conditions operate during the period for which the standard is set. It represents what should be achieved under actual conditions when plant and other facilities have been made by positive action, as efficient as possible.

While setting the expected standard, due allowance would be made for such contingencies as wastage, spoilage, lost time, etc. As such, the expected standard is realistic, capable of achievement and provides an incentive to operating personnel to improve performance. It can be used for product costing, cost control, inventory valuation, and as a basis for budgeting.

Expected standard would be revised periodically to reflect the conditions expected to prevail during the ensuing period when the standard applies.

Its frequent revision is thus, the only disadvantage of this type of standard. But, yet, the term ‘standard’, in cost accounting usually means expected standard based on attainable efficient production.

Physical Standards – Purposes, Steps, Bases and Problems

Non-monetary standards are known as ‘physical’ standards. These standards relate to material consumption quantity, labour processing time, etc. They are expressed in primary levels, e.g., material quantity in kilograms or liters, hours in units of time, hours of plant capacity, units of output, etc.

Physical standards are generally constant over a long period of time unless there is a significant change in production technology, methods of work, etc. Physical standards of manufacturing activity refer to –

a) specification to products and materials,

(b) method of manufacture, and

(c) equipment to be used.

The purposes of setting physical standards are:

(a) To lay down expectations as regards the nature, type and quality of material required for production;

(b) To determine the average normal time required for completing the product;

(c) To secure economies of manufacture; and

(d) To set selling prices in advance to make it possible to estimate the cost.

Steps Incidental to Adoption of Physical Standards:

In the case of manufacturing organisations, physical standards are set by the engineering department. In fact, it is the industrial engineering department which is the responsibility center with regard to setting physical standards.

It is, therefore, necessary to note that the cost accounting department has no role to play in setting the physical standards.

Since the physical standards are the bases for standard costs, it is necessary to take the following preliminary steps for setting the physical standards:

(i) Material Quality – Material quality affects the finished product. In order to fix responsibility for adverse variances in respect of material usage, it is necessary to carry out adequate inspection of materials and parts.

(ii) Labour Skills – It is also necessary to ensure that the right type of personnel with the requisite skills is engaged for each type of work. Recruitment should be based on proper job analysis as otherwise; it may be difficult to explain labour cost variances.

(iii) Communication of Changes – Any change in the physical standards affected by the engineering department should be notified to the cost accountant to enable him to revise his costs as and when changes are introduced in the physical standards.

In order to successfully implement physical standards, it is necessary to ensure close co-operation and co-ordination between the engineering and costing departments.

Bases of Fixing Physical Standards:

The following are the bases of fixing physical standards:

(a) Theoretical or Maximum Efficiency Basis (Ideal Standard) –

Costs under this basis represent the best performance possible with the equipment available. Allowance is made only for rest periods and personal needs of operating personnel but not for waste, spoilage or time lost. Such standards cannot be attained in actual practice but are set as goals so that the factory can work to improve and achieve such goals.

(b) Attainable Good Performance Basis (Practical/Normal Standard) –

Standards set on this basis, make allowance for waste, spoilage, time lost, etc. to the extent that management considers them necessary while setting the standards. Such standards can be more practical or even made better by efficient performance.

(c) Average Past Performance Basis (Past Actual) –

Standards set on this basis are based on the past average performance. Such standards are generally less suitable compared to practical/normal standards.

Problems in the Way of Fixation of Physical Standards:

Practical difficulties to be faced while setting physical standards vary from industry to industry.

However, some of these difficulties are:

(a) New Product –

When new products are manufactured for sale, material quality requirements and labour skill requirements may not be accurately determined. Sometimes, it may become necessary to employ workers who have no experience in the job.

This creates a problem of setting material consumption rates and standard time because of the fact that it becomes necessary to make adjustments for the lack of experience of workers.

(b) Technological Changes –

Technological changes may necessitate installation of sophisticated machines. In the case of such machines precise estimation of output and standard of efficiency achievable will create difficulties until after a long time when the working conditions are settled. Setting standards for these machines and estimating the standard costs will require considerable amount of work.

(c) Product Improvement –

Changes and modifications are usually made in the existing product lines towards the end of their normal life cycle. Manufacturers also go in for product diversification to improve profitability.

These may create difficulties in accurately determining material consumption standards, methods of work using new tools, processing requirements, etc. and labour hours for processing.

(d) Material Quality –

Standards of material specifications are established based on certain assumptions as to quality. If the materials are not available as per quality specifications, the standards may not be achievable. The impact of use of second grade materials must be properly assessed.

(e) Varying Methods of Work –

There may be various ways in which the materials can be processed into finished output. Each of these methods of work has different material requirements, labour processing time, machine operating time, etc.

It is difficult to precisely ascertain the right combination of standards. For example, steel bars of 9 mm. diameter may be processed by grinding either 12 mm. bars or 13 mm. bars.

The problem actually is how to use the raw material with least waste and how to determine the maximum amount of material that will be allowed for a unit of product.

(f) Basis of Setting the Standards –

Physical standards may be set on ideal basis, practical basis or past actual basis. The cost accountant is confronted with the issue of choosing the right basis of standards to be adopted.

Generally, the practical basis (attainable good performance) should be used, but the corresponding data may not be available.

Standard Costing – Variance Analysis: Meaning, Requirements, Two-Way, Three-Way and Four-Way Variance Analysis

Literally, a variance means an exception or deviation. A variance denotes the difference between standard/pre-determined cost of an object and its actual cost. It is resultant figure when the actual cost is compared against the expected costs. Variances, in fact, are financial performance gaps— difference between benchmarks and actual costs.

The object of variance analysis is to detect the operating problems and report them so that the corrective action may be taken where possible. Variances provide feedback information for management control. They serve as red flags to alert management.

Requirements of Good Variance Analysis:

The following five conditions are necessary before a standard cost system can be used effectively for control and evaluation:

1. Standards must be accurate.

2. It must be possible to control the production variables.

3. It must be possible to measure the performance accurately. Variance information should be simple to be effective.

4. Responsibility for variances must be pinpointed.

5. Performance variances should be separated from cost variances.

Two-Way, Three-Way and Four-Way Variance Analysis:

Jobs or processes are charged with costs applicable to them on the basis of standard hours and the standard factory overhead rate. At the end of each week or month, overhead actually incurred is compared with the overheads charged into process using the standard overhead rate.

The difference between these two figures is called overall or net factory overhead variance.

An alternative approach to analyse overall factory overhead variances is-

1. Two-way,

2. Three-way, and

3. Four-way Variance method.

1. Two-Variance Method:

Under this method, the following two variances are calculated:

i. Controllable Variance

ii. Volume Variance

i. Controllable Variance:

It is the difference between actual overheads incurred and the budgeted overheads based on standard (or allowed) hours for actual output.

The formula is:

Controllable Variance = Budgeted overheads – Actual overheads

It consists of variable expenses only. The controllable variance is the responsibility of foreman of the department.

ii. Volume Variance:

It is the difference between the budgeted overheads and the standard overheads absorbed in production.

The formula is:

Volume Variance = Budgeted overheads – Recovered overheads

Where, recovered overheads = Std. hours for actual output x Std. overhead rate

The volume variance consists of fixed expenses only. It indicates the cost of capacity available but not utilised or not utilised efficiently and is considered the responsibility of the top management.

2. Three-Variance Method:

Under this method, the following three variances are calculated:

i. Spending Variance

ii. Idle Capacity Variance

iii. Efficiency Variance

i. Spending Variance:

It is the difference between actual overhead incurred and budgeted overheads based on actual hours worked.

The formula is:

Spending Variance = Budgeted overheads (based on actual hours worked) – Actual overheads

The spending variance is the responsibility of the foreman who is expected to keep his actual expenses within the budget.

ii. Idle, Capacity Variance:

It is the difference between the budgeted overhead based on actual hours and the actual hours multiplied by the standard fixed overhead rate.

The formula is:

Idle Capacity Variance = (Budgeted Capacity – Actual Capacity) x Standard fixed overheads rate

An idle capacity variance indicates the amount of overheads that is either under or over- absorbed because actual hours are either less or more than the hours on which the overhead rate was based.

iii. Efficiency Variance:

It is the difference between actual hours worked multiplied by standard overhead rate and the standard hours multiplied by the standard overhead rate.

The formula is:

Efficiency Variance = (Standard hours – Actual hours) x Standard overhead rate

The efficiency variance consists of fixed and variable expenses and results because actual hours used are more or less than the standard hours.

Causes for this variance are- inefficiencies, inexperienced labour, change in operations, new tools, different types of material etc. This variance and its causes reflect the effect of labour efficiency variance on factory overheads.

3. Four-Variance Method:

Here, the efficiency variance of the three-variance method is further analysed into fixed and variable components.

i. Fixed Overhead Efficiency Variance:

It is calculated as under:

Fixed Efficiency Variance = (Standard hours – Actual hours) x Standard fixed overhead rate

ii. Variable Overhead Efficiency Variance:

It is calculated as under:

Variable Efficiency Variance = (Standard hours – Actual hours) x Standard variable overhead rate.

The sum of spending and variable efficiency variances equals the controllable variance.

Controllable Variance = Spending Variance + Variable Efficiency Variance.

The sum of fixed efficiency variance and the idle capacity variance is equal to volume variance

Volume Variance = Idle Capacity Variance + Fixed Efficiency Variance.

Distinction between Ideal Standard and Normal Standard

An ‘ideal’ standard is one which can be attained under the most favourable conditions. It represents the level of performance attainable with the ‘best’ or ideal set-up, i.e., best quality materials at favourable prices, highly skilled labour and best equipment. This standard focuses on maximum efficiency in the utilisation of resources, i.e., maximum output with minimum cost.

As such, no provision is made for machine breakdown, shrinkage or spoilage of materials.The resulting favourable variances will be of the nature of reminder to managerial personnel of the need for overall improvement in the concern’s operations. However, ideal standards are not attainable in practice. Hence, they are not widely used.

‘Normal’ standard represents the level of performance attainable under normal operating conditions, i.e., normal efficiency, normal sales, normal production volume, etc. It focuses on the practical attainable efficiency, after taking into consideration normal imperfections.

Normal standard is the average standard which can be attained over a future period of time covering one trade cycle. This average standard takes into consideration both booms and depressions. The variances disclosed under this standard are deviations from normal expectations. Hence, they are disposed of as per the policy of the concern.

The setting of this standard is difficult since it requires a fair degree of forecasting. Further, it is not attainable if the anticipated conditions do not prevail over a future period of time. Consequently, this type of standard is of very little use for cost control.

Standard Costing – Advantages

1. It helps the management in formulating price and production policy.

2. It is a yardstick of performance. Standard costs are compared with actual costs, and the differences are analysed and effective cost control is taken. Thus reduction of cost is possible by increasing the profits.

3. It reduces avoidable wastages and losses.

4. It facilitates to reduce clerical and accounting cost and managerial time.

5. It creates cost consciousness among the personnel, because the variance analysis fixes responsibility for favourable or unfavourable performances.

6. Executives become more responsible, as it shows clearly who is responsible for the cost centers.

7. By the variance analysis and reporting, “the principle of management by exception” is facilitated. Management must concentrate their attention on variations only.

8. It aids in budgetary control and in decision-making.

9. Opening stock and closing stock are valued at the standard price. This helps in the preparation of Profit and Loss Account for a short period—say a week, a month etc.

10. It facilitates timely cost reports to management and a forward-looking mentality is encouraged at all levels of the management. It is a basis for the implementation of an incentive system for the employees.

Standard costs form a basis for future planning, preparation of tenders, fixation of price etc. Otherwise, or in the absence of standard cost, decision will be based on actual cost.

The prices of material, labour etc. may change from time to time. There must be a fixed cost structure based on normal standard efficiency. Thus it helps the management in formulating price and production policy.

When standards have been fixed, the section-heads safely delegate the responsibility to the workers. The standard of activity can be measured through the costing reports.

Introduction of standard cost facilitates timely reporting. The management gives attention to the variances and takes corrective steps. The costing reports, based on standard cost, reveal the overall result of the manufacturing side.

Standard Costing – 7 Limitations

1. It is costly, as the setting of standards needs high technical skill.

2. Keeping of up-to-date standard is a problem. Periodic revision of standard is a costly thing.

3. Inefficient staff is incapable of operating this system.

4. Since it is difficult to set correct standards, it is difficult to ascertain correct variance.

5. Industries, which are subject to frequent changes in technological process or the quality of material or the character of labour, need a constant revision of standard. But revision of standard is more expensive.

6. For small concerns, standard costing is expensive.

7. It is difficult to apply this method where production takes more than one accounting period. Standard costing may not be effective in industries which deal in non-standardised products or jobs according to customer’s requirements.

Standard Costing – Advantages of Standard Cost

(i) Simple and Economical – Standard cost is simpler and economical and it requires less work to do.

(ii) Valuable Guidance – They provide a valuable guidance to management in the formulation of price and production policies.

(iii) Delegation of Authority – They facilitate delegation of authority and management by exception.

(iv) Controlling Actual Cost – It provides yardstick for controlling actual costs. Timely action is taken against inefficiency and extravagance.

(v) Useful in Planning – They are very useful in planning and budgetary control as they are predetermined cost.

(vi) Cost conscious – It makes the employees cost conscious and efficient one.

Standard Costing: Meaning, Objectives, Advantages, Limitations, Computation and Analysis of Variances

Standard Costing:

It is very difficult to compare and find out the reasons of cost fluctuation through Historical Costing, as it ascertains costs after they have been incurred. The reasons for cost fluctuation apart from variations in output (or units produced) may be detected through introductions of standard costing. Its utility are increasing day by day in advanced countries, like U.S.A., Great Britain etc.

The term standard is a predetermined measurable quantity set in defined conditions against which actual performance can be compared. In a word, we can say the term standard refers to predetermined rate against which performance is judged.

Standard-cost is defined by CIMA in the following way:—A predetermined calculation of how much cost should be used under specified working conditions.

It is built up from an assessment of the value of cost elements and correlates technical specification and qualification of material, labour and other costs to the prices and/or usage rates expected to apply during the period in which the standard cost is intended to be used.

Its main purpose is to provide basis for control through variance accounting for the valuation of stock and work-in-progress and in some cases for setting prices.

The technique by which standard costs are used is known as—Standard costing. It involves the setting of predetermined cost estimates in order to provide a basis for comparison with actual. Standard cost is universally accepted as an effective tool for cost control in industries.

Objective of Standard Costing:

The objectives of standard costing are:

(a) To provide an accepted basis for assessing performance and efficiency.

(b) To control cost by introducing standards and analysis of variances.

(c) To assist in setting budgets.

(d) To motivate staff and management.

(e) To help in assigning responsibility for non-standard performance in order to correct deficiencies or to capitalise the benefits.

(f) To provide basis for estimating.

(g) To provide guidance on possible ways for improving performance.

Advantages of Standard Costing:

A standard costing has many advantages, some of them are:

(a) Standard costing provides the guidance which helps the management in performing their managerial functions such as in formulating policies, in determining prices etc.

(b) Standard costing highlights areas on strengths and weaknesses.

(c) It acts as yardsticks against which actual costs are compared. Thus it facilitates effective cost control and provides necessary information for cost reduction.

(d) It acts as a form of feed forward control that allows an organisation to plan the manufacturing inputs required for different levels of output.

(e) It will help prompt preparation of profit and loss account for short period.

(f) It stimulates cost consciousness of all executives because in the variance analysis the responsibility for favorable or adverse performances is identified.

(g) It helps to trace or allocate manufacturing costs to each individual unit produced.

Limitations of Standard Costing:

The following limitations are leveled against standard costing:

1. Standard costing is generally used in such organisation whose processes or jobs are repetitive i.e. it cannot be used in all organizations.

2. A lot of input data is required which is expensive.

3. If standards are not revised it will be harmful instead of helpful.

4. Revision of standards is costly.

5. Standard costing may be unsuitable to the non-standard jobs which are manufactured according to customers’ specifications.

6. It is very difficult to distinguish between controllable and uncontrollable variances.

7. Some variances cannot be explained properly.

8. It may require high degree of technical skill as standard is based on technical assessments.

Computation of Standard Cost and Actual Cost:

First we are to work out the standard cost element wise for the actual output or production, say standard cost of material for the actual units produced or the standard cost of labour for the output, or the standard overhead cost for the actual production.

Thereafter each standard cost figure is to be deducted from the actual cost of inputs of materials or cost of labour or cost of overheads respectively, and the result is called cost variances. If the standard cost is higher than the actual cost then this variance is to be considered as favorable to an organisation. But if the actual cost is higher than the standard cost then the result is to be considered as adverse.

Now these element-wise cost variances are analysed critically to find out the exact causes or circumstances leading to it, so that the management can exercise proper control. A suitable analysis will reveal that some of the variances are controllable while others are not so.

For example if materials are mixed at the time of production deviating from the standard ratio as fixed by the experts or engineers and due to that cost is more than the standard fixed, the result is adverse to the organisation and then the responsibility can be fixed on the production supervisor and this cost is controllable.