Activity based costing (ABC) is an accounting methodology that assigns costs to activities rather than products or services. This enables resources and overhead costs to be more accurately assigned to the products and the services that consume them. ABC is a systematic, cause-and-effect method of assigning the cost of activities of products, services, customers, or any cost object.

ABC is based on the principle that ‘products consume activities.’ Traditional cost systems allocate costs based on direct labour, material costs, revenue or other simplistic methods. As a result, traditional systems tend to over-cost high volume products, services, and customers; and under-cost low volume.

ABC is a new term developed for determining the cost. The basic feature of ABC is its focus on activities. It uses activities as the basis for determining the costs of products or services.

Contents

- Introduction to Activity Based Costing

- Meaning of Activity Based Costing

- Definitions of Activity Based Costing

- Evolution of Activity Based Costing

- Concept of Activity Based Costing

- Objectives of Activity Based Costing

- Need of ABC System by an Organisation

- Features of ABC Method

- Characteristics of Activity Based Costing

- ABC Approach and Example of the Steps Needed To Develop ABC Data

- Requirements of ABC System

- Circumstances in which Activity Based Costing is Suitable for Product Costing

- Factors Prompting the Development of ABC System

- Terms of Activity Based Costing

- Steps Involved in ABC

- Stages of Activity Based Costing

- Uses of Activity Based Costing

- Activity Based Management

- Difference between Traditional Costing and ABC Approach

- Cost Pool and Cost Drivers

- Absorption of Overhead Expenses

- Benefits of ABC over Absorption Costing

- Advantages of Activity Based Costing

- Limitations of Activity Based Costing

- Problems of Activity Based Costing

What is Activity Based Costing: Meaning, Definitions, Objectives, Features, Factors, Steps, Cost Pool and Cost Drivers, Advantages, Benefits, Uses, Limitations and Examples

Activity Based Costing – Introduction

Activity based costing (ABC) is an accounting methodology that assigns costs to activities rather than products or services. This enables resources and overhead costs to be more accurately assigned to the products and the services that consume them. ABC is a systematic, cause-and-effect method of assigning the cost of activities of products, services, customers, or any cost object.

ADVERTISEMENTS:

ABC is based on the principle that ‘products consume activities.’ Traditional cost systems allocate costs based on direct labour, material costs, revenue or other simplistic methods. As a result, traditional systems tend to over-cost high volume products, services, and customers; and under-cost low volume.

Conventional costing systems are built on the assumption that product drives the costs directly. ABC system drives indirect and support expenses, first to the activities and processes and then to products, services, and customers, giving managers a clearer picture of economics of their operations and services.

Activities can be defined as a named process, function, or task that occurs over time and has recognized results. Activities use up assigned resources to produce products and services. Inputs are transformed into outputs under the parameters set by controls performed by the organization’s employees and their tools.

ADVERTISEMENTS:

Activities can be perceived as consumers of resources in production of materials, services, events, or information. Activities are the common denominator between business process improvement and information improvement.

Activity Based Costing – Meaning

Activity-Based Costing (ABC) is one in which costs are first identified to activities and then to the products. It is a system which focuses on activities performed to produce products. ABC system assumes that activities that are responsible for the incurrence of costs and products create the demand for activities. Costs are charged to the products based on individual product’s use of each activity.

In conventional costing system, costs are first traced not to activities but to an organizational unit, such as department or plant and then to products.Therefore it means under both ABC and Conventional costing system, the second and final stage consists of tracing costs to the product. This type of costing aims at tracing as many as costs as possible to be subsequently accounted as direct costs.

Any cost that is identified to a particular product through its consumption of activity becomes direct cost of the product. For example in traditional costing system, the cost of set up and adjustment time is considered as Factory overhead later assigned to different products on the basis of direct labour hours.

ADVERTISEMENTS:

But in case of ABC, set up and adjustment time is determined for each department and its cost is directly charged to each department. Therefore ABC tries to ascertain the factors which are responsible for each major activity, costs of these activities and relationship between activities and products.

Activity Based Costing – Definitions

In order to overcome the problems faced in traditional approach of overhead distribution, a new and more scientific approach was developed by Cooper and Kalpan known as Activity based costing. The ABC aims to identify the activities which results in currency of the cost. The main focus is on activities performed on a particular product during its production. Thus, activities are the focal point in cost calculation.

According to Cooper and Kalpan, ABC is defined an, “ABC system calculates the cost of individual activities and assigns cost to cost objects such as product and services on the basis of activities undertaken to produce each product or services”.

According to Horngren, “ABC is a system that focuses on activities and fundamental cost objects and utilizes cost of these activities as building blocks or compiling the cost of other cost objects.”

CIMA defines ABC as, “Cost attribution to cost units on the basis of benefit received from indirect activities”. Example – Ordering, handling, quality assurance etc. It can also be defined as “the collection of financial and operational performance information tracing the significant activities of the firm to product costs”.

ABC is a special costing model that identifies activities in an organization and assigns the cost of each activity with resources to all products and services according to the actual consumption by each activity.

Thus, in ABC, overhead cost is attributed to the cost centre or unit on the basis of number of activities undertaken in production.

Activity Based Costing – Evolution of ABC

ABC is based on George Staubus Activity Costing and Input-Output Accounting. The concept of ABC was developed in the manufacturing sector of the United States during 1970s and 1980s. During this time the Consortium for Advanced Management-International (CAM-I), provided a formative role for studying and formalising the principles that have become more formally known as Activity-Based Costing.

ABC lost ground in 1990s to alternative metrics such as balanced scorecard and economic value added. Various opinions were thrown open towards ABC specifying the impact of having ABC Model.

ADVERTISEMENTS:

In particular to quote the following can be considered:

1. Manually driven ABC was an inefficient use of resources

2. It is expensive and difficult to implement for small gains and a poor value and so alternative methods should be used

3. It focuses on cost allocation in operational management

ADVERTISEMENTS:

4. It helps to segregate fixed costs, variable cost and overhead cost which helps to identify “cost drivers”

ABC methodology assigns an organisation’s resource costs through activities to the products and services provided to its customers. It is generally used as a tool for understanding product and customer cost and profitability based on the production or performing processes.

Activity Based Costing – Concept

ABC is a new term developed for determining the cost. The basic feature of ABC is its focus on activities. It uses activities as the basis for determining the costs of products or services.

As quoted by Horngren, Foster and Datar, “ABC is not an alternative costing system to job costing or process costing. Rather, ABC is an approach to developing the cost numbers used in job costing or process costing systems. The distinctive feature of ABC is its focus on activities as the fundamental cost objects. In contrast, more additional approaches to developing the cost numbers used in job or process costing systems rely on general purpose accounting systems not tailored to the activities found in individual organizations. The ABC approach is more expensive than traditional approaches. ABC has the potential, however, to provide managers which information they find more useful for costing purposes.”

Therefore it is one of the effective methods of exercising cost control and can be used in designing either job costing system or process costing system.

ADVERTISEMENTS:

The CIMA official terminology defines ABC as “Cost attribution to cost unit on the basis of benefit received from indirect activities e.g. ordering, setting up assuring quality”. ABC was also defined by CIMA organization as “collection of financial and operation performance information tracing the significant activities of the firm to product costs.”

ABC aims at rectifying the inaccurate cost information. It is modern approach of indirect cost allocation. ABC does not confined itself to the allocation to indirect costs to departments as it is done in the conventional costing but it identifies individual activity as the lowest unit for indirect cost allocation. Costs allocated to each activity represent the resources consumed by it.

Activity Based Costing – Top 7 Objectives

1. To bring more accuracy in calculation of cost of products and services as compared with traditional costing system, since all products are not produced equally,

i. As some products are produced in large batches and some in small batches.

ii. As manufacturing overhead costs have increased significantly and they no longer correlate with the productive machine hours or direct labour hours.

2. To understand product and customer cost

ADVERTISEMENTS:

3. To understand profitability based on the production or performing processes

4. To have a structured analysis in respect of complex processes

5. To provide wealth of information to the management in order to help in decision making

6. To eliminate non-value adding activities due to diversity of products

7. To increase value adding activities since diversity of customer demands are growing rapidly

Activity Based Costing – Need of ABC System by an Organisation

ABC System is needed by an organisation for the purpose of accurate product costing in cases where –

(i) Production overhead costs are high in comparison to the various direct costs;

(ii) Product range of the organisation is highly diverse;

(iii) Overhead resources used by various products are very different in amounts;

(iv) Volume or quantity of production is not primary driving force for the consumption of overhead resources.

Activity Based Costing – 5 Important Features of ABC Method

Following are important features of ABC method:

ADVERTISEMENTS:

(a) Cost are pooled not on the basis of departments but according to the activities involved in the production.

(b) It charges overhead cost to product according to activities involved in the product instead of using average overhead distribution rate as in case of traditional method.

(c) It leads to more accurate cost information because of easy traceability of cost according to activities cost driver.

(d) It helps in eliminating non-value added activities thereby reducing the per unit cost of product. Thus, it helps in cost control.

(e) It results in more accurate cost calculation of a product or job.

Activity Based Costing – Top 4 Characteristics

The characteristics of activity based costing can be summarised as follows:

ADVERTISEMENTS:

1. It increases the number of cost pools used to accumulate overhead costs. The number of pools depends upon the cost driving activities. Thus, instead of accumulating overhead costs-in a single company- wise pool or departmental pools, the costs are accumulated by activities.

2. It charges overhead costs to different jobs or products in proportion to the cost driving activities in place of a blanket rate based on direct labour cost or direct hours or machine hours.

3. It improves the traceability of the overhead costs which results in more accurate unit cost data for management.

4. Identification of cost during activities and their causes not only help in computation of more accurate cost of a product or a job but also eliminate non-value added activities. The elimination of non-value added activities would drive down the cost of the product. This, in fact, is the essence of activity based costing.

Activity Based Costing – ABC Approach and Example of the Steps Needed to Develop ABC Data

ABC is used to determine the cost and benefits associated with re- engineering processes and systems. This cost and benefit analysis will then become part of the overall business case for the project.

An ABC approach will account for:

ADVERTISEMENTS:

(a) Activities or processes (comparing before and after the re-engineering project)

(b) The frequency and cost of the activity or process (comparing before and after the re-engineering project)

(c) The do-nothing scenario (what would happen if we do not do the project)

(d) Which process provides value (needed to attract and retain customers, result in operational savings)

Given below is an example of the steps needed to develop ABC data:

(a) Define the major business processes and key activities of the organization (process map)

(b) Trace operating costs and capital charges to key activities. Use existing accounting and financial data, which includes labour and capital equipment expenses and any other resource that can be changed or eliminated. Some reports to analyse include budget, general ledger, supplier invoices.

(c) Link the activities to processes and identify the cost drivers. The best way to do this is to actively engage the doers of the process. Have the doers of the process identify where the costs come from – then seek out data from that source.

(d) Summarize the total costs for each process.

(e) Once processes are re-engineered, then the new costs must be tabulated.

Activity Based Costing – Requirements of ABC System

ABC system requires the following:

1. Setting-up of an information system which could help trace all the costs to cost objects.

2. Support from top to bottom because the system involves people at all levels.

3. Integration of system into financial system. For it, computerization may be required.

The final words of comment over ABC system are that adoption, implementation and operation of the system is not an end in itself. The benefits can be derived by translating the system design and its operation into action-oriented managerial performance. Ultimately, it amounts to effective cost management for the success of the system.

Circumstances in which Activity Based Costing is Suitable for Product Costing

Activity Based Costing is suitable for product costing in the following circumstances:

1. More than one product is manufactured.

2. Overhead forms a high proportion of total cost.

3. Products are not similar. Different products are using different activities and consume different resources.

4. Overheads are not depending upon the output of the product but its complexity and diversity of operations.

For example, PCB Ltd. is manufacturing circuit board for computer monitor, TV and aeroplane. Time for manufacturing each type of circuit board is the same. However, the circuit board for the aeroplane is tested for a longer time by highly paid technicians because it must be 100% error-free.

No testing is necessary for the computer monitor or TV circuit board. In this case, overhead is depending not on output but on complexity.Here, ABC is only way out for product costing.

Activity Based Costing – 6 Factors Prompting the Development of ABC System

ABC System has developed basically on account of the limitations of the traditional absorption costing system.

The basic factors which have prompted the development of ABC System may be summarised as follows:

(i) The traditional basis of segregating costs into fixed and variable elements on the basis of their behaviour is generally considered to be unrealistic. It is due to the fact that with the growth of business, the costs have become more complex and complicated.

(ii) The traditional methods applied for absorbing overheads lay emphasis on the calculation and application of overhead recovery rates which are acceptable for the valuation of stocks for the purposes of routine financial reporting. The management does not find these traditional methods helpful in making complicated decisions related to product strategies.

(iii) The traditional absorption costing does not render any valuable assistance to multi-product concerns in making decisions regarding process technology, product-mix, product pricing etc.

(iv) The rapid development of automated production has led to growing overhead costs. According to an estimate, the normal overhead rate which was 200% to 300% of direct costs about 15 years ago, has gone upto 500% to 800%.

(v) The ever increasing and severe market competition due to globalisation has increased the necessity of more accurate product costs in order to avoid the disadvantages of under-costing and over-costing.

(vi) There has been an increase in tendency towards product diversification to secure economies of scope and increased market share requiring the ascertainment of more accurate product costs under the conditions of fast changing cost structure.

Activity Based Costing Terms – Cost Objects, Activities, Cost Pool and Cost Drivers

1. Cost Objects:

Generally, the products are cost objects, but the customers, services or locations can also be the cost objects.

2. Activities:

These consist of the aggregate of different tasks and are concerned with functions associated with cost objects. There are two types of activities-

(A) support activities,

(B) Production process activities.

Support activities are, for example, schedule production, set up machine, purchase materials, inspect items, customer orders, supplier records etc.Under the production process activity, machine products and assembled products are included within this production process.

Activity cost centres are, sometimes, similar to cost centres used under traditional costing system. In case the purchase department and purchasing activity both are treated as cost centres, the support activity cost centre also becomes identical to cost centre taken under traditional costing system.

3. Cost Pool:

It is another name given to a cost centre and, therefore, an activity cost centre may also be termed as an activity cost pool.

4. Cost Drivers:

The causes for incurrence of overhead costs are known as cost drivers. A cost driver is a factor the change of which results in a consequential change in the total cost of a related object. If its level changes, it brings a corresponding change in the level of total cost of the related cost object.

Following are some of the examples of cost drivers:

i. Machine setups

ii. Purchase orders

iii. Quality inspections

iv. Production orders (Scheduling)

v. Engineering change orders

vi. Shipments

vii. Material receipts

viii. Inventory movement

ix. Maintenance reports

x. Scrap/rework orders

xi. Machine time

xii. Power consumed

xiii. Kilometers driven

xiv. Computer-hours logged

xv. Beds occupied

xvi. Flight-hours logged.

The activity cost drivers can broadly be classified into following three categories:

A. Transaction drivers

B. Duration drivers

C. Intensity drivers.

A. Transaction drivers –

These Include types of transactions which result in overhead costs e.g., purchase orders processed, customer orders processed, inspections performed and the set-ups undertaken, all count the number of times an activity is performed.

B. Duration drivers –

Mean the amount of time required to perform an activity. Examples of duration drivers are set-up hours and inspection hours.

C. Intensity drivers –

Refer to drivers which directly charge for the resources used each time as activity is performed. Duration drivers establish an average hourly rate of performing an activity while intensity drivers involve direct charging based on the actual activity resources relevant to a product.

Activity Based Costing – 5 Essential Steps Involved in ABC

ABC involves the following steps:

Step # 1. Identifying the Activities:

The first step in ABC is to identify the major activities which take place in an organisation. The number of activities in production may differ from product to product and organisation to organisation.

The number of activities in the organisation should neither be too large or too small. An activity may be a very small activity but it should justify the cost incurred for it. An activity may be a single activity or combination of several activities. Cost-benefit analysis of each and every activity may be undertaken to judge the worthiness of activity.

Step # 2. Determining Cost Pool/Cost Centres for Each Major Activity:

Cost pool means grouping of total cost for each major activity. It simply means allocation and apportionment of various costs to a particular activity or group of activities. For example, total cost of placing orders may be grouped under ordering cost.

Step # 3. Determining Cost Driver for Each Major Activity:

Cost drivers are that activities which determine the cost. These activities result in occurrence of Overhead cost. Thus, cost driver is a factor or an event which results in consequential change in the total cost of the object.

Some of the example of cost driver are:

i. Number of setups is cost driver for setup related cost

ii. Number of production runs is cost driver for production cost

iii. Number of purchase orders is the cost driver for ordering cost

iv. Quality inspections is the cost driver for inspection cost

v. Maintenance requests

vi. Kilometer driven etc.

The activity cost drivers can be classified into 3 categories:

(a) Transaction drivers –

Transaction drivers include number of transaction which results in overhead costs e.g., inspections performed, setups undertaken, number of purchase orders etc.

(b) Duration drivers –

Duration drivers determine the duration of time required to perform an activity. Examples are number of setup hours, inspection hours etc.

(c) Intensity drivers –

It refers to the drivers which directly charge for the resource used each time an activity is performed. So the basic difference between duration driver and activity driver, is that duration charge cost on an average duration (average rate of time) in performing an activity while intensity driver is based on actual activity relevant to a product.

Step # 4. Calculation of Activity Cost Driver Rate:

Next step would be to obtain activity cost driver rate by dividing the total cost of an activity by cost driver as shown below –

Activity driver rate = Total cost of an activity/Cost driver

Step # 5. Charging Activity Cost to the Product Cost:

Cost of activity will be charged to the product using cost driver rate according to the requirement of activities of each product. For instance, a product may require 10 machine setups and 1 inspection related activity. Thus, product will be charged for both machine related set up activity cost and inspection activity cost.

Example:

The total cost of inspection related activity is Rs. 10, 0000. A batch of product consisting 10 items in a batch require 10 inspection activities. The cost drives rate will be –

Inspection cost driver rate = Rs. 10,0000/10

Rs. 10000 per batch.

The inspection related cost to each product will be 1000 Rs. (10000 for a batch of 10 items in a batch). Similarly, cost of other activities will be charged to the product to calculate total cost incurred.

Activity Based Costing – Top 4 Stages

The following are the stages in activity based costing system:

(i) All activities in the factory which create costs are identified. These activities may be design changes, inspections, material movements, material requisitions, and machine setups.

(ii) Cost of performing each of these activities is estimated.

(iii) Having identified activities and their costs, next step is to determine the basis (cost driver) for allocating activity-wise costs.

(iv) Thereafter, estimated costs of each activity are divided by the estimated number of units (cost drivers) in the activity to arrive at an overhead activity rate to charge overheads to each product/job/service taking into account the number of units of an activity.

Activity Based Costing – 6 Important Uses

(a) Focus on where the cost originates, i.e., the causes of the cost.

(b) Accurate product cost due to understanding of the cost behaviour.

(c) Identifies source of non-value added activity or wasted efforts.

(d) Strategic cost information of which long-term profitability decision for a product can be taken.

(e) Non-financial information regarding quality flexibility and value to the customer can be received.

(f) Improved cost-basis available both at head office and plant level for better decision making.

Activity Based Management – Introduction, Objectives and Classifications

Activity Based Management (ABM) aims to maximize the value adding activities while minimizing or eliminating non-value adding activities in an organization. Its overall objective is to improve efficiency and effectiveness of an organization in securing its markets. It depends heavily on Activities Based Costing (ABC) as a source of its information.

Activity Based Management (ABM) differs from Activity Based Costing (ABC). Activity Based Costing (ABC) establishes relationship between overheads costs and activities in order to ensure that the overheads costs are more precisely allocated to products, services or customers segments. While Activity Based Management (ABM) focuses on managing activities, reducing costs and improving customer value.

The basic objectives of Activity Based Management (ABM) can be stated as under:

(i) Reducing Costs –

Managers can set cost reduction targets in terms of reducing the cost per unit in relation to cost allocation base in different activities areas. For instance, a manager may aim at reducing cost of transporting the product from Rs. 5 per unit to Rs. 4.50 per unit.

(ii) Creating Performance Measures –

The Activity Based Management (ABM) system provides information and data on activity performance. The performance measures may relate to quality of the product, production cycle time, productivity of workers or satisfaction of customers etc.

(iii) Improving Cash Flow –

Targets can be set and accordingly measures can be taken for improving the liquidity of the business.

(iv) Producing Enhanced Value Product –

This is possible by eliminating or minimizing a non-value added activity i.e., an activity which neither contributes to the customer’s value nor to the organization’s need. It is a total waste.

Activity Based Management (ABM) can be classified into two categories as under:

(i) Operational ABM:

It means using Activity Based Cost information (ABC) for “doing things right”. This improves overall efficiency through identification of activities which add value to the product and those which do not add value to the product. Activities which do not add value to the product are to be eliminated or significantly reduced while activities which add value to the product are to be continued and improved.

(ii) Strategic ABM:

This refers to “doing the things right”. The activity based cost information can be used to identify the products or activities which are useful for the organization. It can also be used for customers’ profitability analysis which can help in identifying the customers who are more profitable and hence to be focused more.

It may be noted that the technique of Activity Based Management should be used by management keeping in mind the fact that decision made should in the benefit of the whole organization and not only for a particular department or division. This is because some activities may have an implicit value but may not be reflected in the financial value added to the product.

For instance, pleasant work place may not be identified as an activity adding value according to operational activity based management. However, it helps in attracting and retaining the best staff which is a great benefit to the whole organization. Similarly, a customer may be identified as a low value customer because of loss from transactions with him according to strategic ABM.

However dealing with him may lead to open up new markets and thus be profitable for the business as a whole. Moreover, ABM is more than an accounting tool. It is a system to improve strategic and operational decisions in an organization. It is not a single answer but merely one of the many tools that can be used to improve strategic and operational decisions and enhance the managerial performance of an organization.

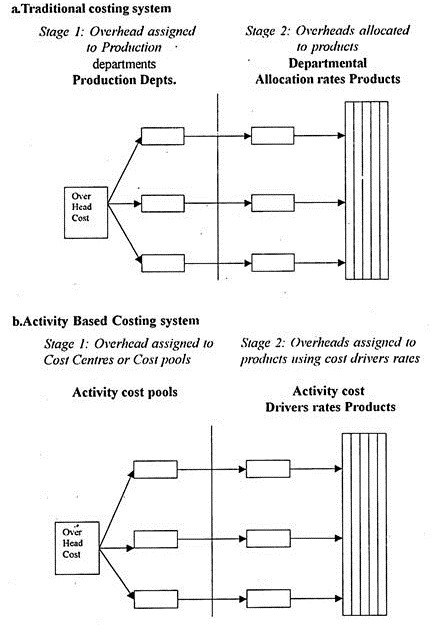

Difference between Traditional Costing and ABC Approach

In traditional costing system, overhead costs are assumed to be influenced by only units produced. It means, in traditional costing system, cost of batch level, product level and facility level activities is fixed costs, i.e., costs of these do not change as production volume changes. Unit-based cost systems apportion fixed overhead to individual products and variable overheads are directly assigned to products using the base of number of units produced.

In ABC, variable overhead is appropriately traced to individual products. The costs incurred as the units are produced have been traditionally treated as variable overhead. But when fixed overhead are apportioned on the basis of units made, as in traditional costing, such apportionment is likely to be arbitrary and also may not reflect activities and cost actually consumed by the products.

It improves product costing procedure as compared to traditional costing because it recognizes that many so called fixed overhead costs change in proportion to changes other than the production units. It means, under ABC, the other two activities-batch level and product level are assumed to influence fixed overhead costs and batch and product level, thus are accepted as non-unit based cost drivers.

The activity based costing method is helpful in ascertaining areas where cost reductions are possible. Activity based budgeting can lead to improved decision making such as fixing selling price and highlighting the area where the cost reduction is possible because it provided more detailed information about various activities involved in a product or service.

Activity based principles can be successfully applied to the art of budgeting. Activity based budgeting is an approach to budgeting that lays emphasis on budgeting the costs of activities necessary to produce and sell products and services. Activity based budgeting is especially useful in case of budgeting of indirect costs.

Traditional Costing and ABC System:

Activity Based Costing – Cost Pool and Cost Drivers (With Examples)

A cost pool is a collection of overhead costs that are logically related to the tasks being performed. A cost pool should be created for each activity. Cost pool is like a Cost centre or activity centre around which costs are accumulated.

The factors which influence the cost of a particular activity should identified, which are known as Cost Drivers. ABC is based on the assumption that cost behavior is influenced by cost drivers. It should be noted that directs costs do not need cost drivers as they can be identified directly to a product. Direct costs are themselves cost drivers. Therefore cost drivers signify factors, forces or events that determine the costs of activities.

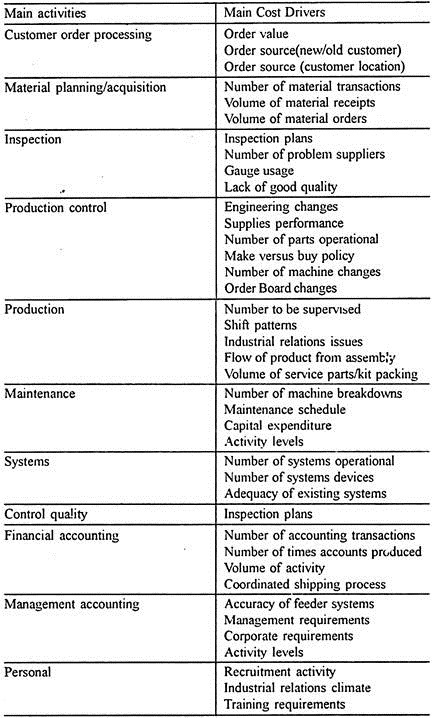

Activities and Cost Drivers:

A Case study conducted by J. Innes and F. Mitchell in their ‘Activity Based Cost Management –

A case study of Development and Implementation’ the main activities and cost drivers are identified as given below –

Examples of Cost Drivers:

1) Number of receiving orders.

2) Number of purchase orders.

3) Number of machine set ups.

4) Number of materials handling hours.

5) Value of materials in product.

6) Number of inspections.

7) Number of machine hours used on product

8) Number of direct labour hours.

9) Number to set up hours.

10) Number of despatch orders.

11) Amount of labour costs incurred.

12) Number of sellers.

13) Number of units.

14) Number of employees.

15) Number of hospital beds occupied.

16) Number of rooms occupied in a hotel.

17) Number of passenger kilometer, etc.

Activity Based Costing – Absorption of Overhead Expenses

Under Conventional or Traditional Costing System, overhead expenses are identified initially with the cost centres which comprise of both the production departments and service departments. The costs of service departments are then distributed, on some equitable bases, to the production departments. These (production) departmental overhead expenses are finally assigned, or charged, to products on a suitable basis.

That means, overhead expenses are initially identified with the cost centres (i.e., departments, divisions, branches, etc.) and then, they are identified with, and charged to, the products. It may be noted here that the prime costs are identified with, and charged directly to, the products.

With the changes in the business environment such as replacement of manual labour force by the mechanical labour force (as far as possible), diversification of product lines and service offerings, technological changes, increased number of channels of distribution and also the number and type of customers, the share of common and non-traceable costs which are popularly known as overhead expenses has been increasing.

Consequently, the use of arbitrary bases for apportionment and absorption of overhead expenses to different departments and by different products distorts the cost amounts attributable to the products. Prof. John K. Shank’s view substantiates this opinion. He opined, the traditional managerial accounting is at best useless, and at worst dysfunctional and misleading.

Hence, there is a need for more systematic and accurate system for cost ascertainment and cost control. The attempts to find a satisfactory answer to overcome the limitations of Traditional Costing resulted in the development of Activity-Based Costing.

Benefits of ABC over Absorption Costing

ABC offers the following benefits over absorption costing:

1. More realistic product costs may be produced, resulting in improved pricing and decision-making in general.

2. Management will be more aware of the link between activity and cost behaviour, and will have more incentive to focus on the relationships between these two variables.

3. Cost reduction activities within this area are more likely to be successful.

4. It may become apparent that costs are not driven solely by output volumes, and, therefore the focus on managerial attention may be significantly broadened. This may encourage managers to adopt a holistic view of the organization.

5. It facilitates the preparation of an activity-based budget by providing the management with a clear view on the details of various activities.

6. It provides a clear understanding of the underlying causes of the various business processing costs.

7. It helps in decision-making.

8. Identification of non-value adding activities helps the management to control cost.

There is a very high probability of an ABC system providing a different picture of product costs than what is provided by the traditional system. However, since both methods make assumptions about the behaviour and cause of costs, it cannot be said with certainty that ABC shall always produce more precise results than traditional costing.

Nevertheless, since there are usually more activities than cost centers and often cost driver rates are more justifiable than the rates used by absorption costing, an ABC system, most of the times, produces more accurate results.

ABC implementation can help the firm to understand the various costs involved, which will in turn enable them to analyse the cost, identify the value-added and non-value-added activities, implement the improvements, and realize the benefits. This is a continuous improvement process in terms of analysing the cost, to reduce or eliminate the non-value-added activities and to achieve an overall efficiency.

ABC has helped enterprises in answering the market need of better quality products at competitive prices. Ascertaining the product profitability and customer profitability, the ABC method has contributed effectively for the top management’s decision-making process.

With ABC, enterprises are able to improve their efficiency and reduce costs without sacrificing the value for the customer. Many companies also use ABC as a basis for implementation of a target costing concept.

ABC has also enabled enterprises to model the impact of cost reduction and subsequently confirm the savings achieved. Overall, ABC is a dynamic method for continuous improvement. With ABC, any enterprise will have a built-in competitive cost advantage and can continuously add value to both its stakeholders and customers.

Activity Based Costing – Main Advantages

Activity-Based Costing has the following advantages:

1. ABC provides more accurate and informative product costs which in turn help the management to take decisions about pricing, product lines and market segments.

2. Management of overhead cost is achieved by coupling the costs to the activities that ‘drive’ or ’cause’ them.

3. ABC can help in distinguishing between profitable and unprofitable products and customers.

4. An understanding of cost driver rate can help in budgeting overhead costs.

5. ABC helps managers to identify and control the cost of unused capacity.

6. Nowadays production processes are far more complex where direct labour costs are insignificant as compared to total costs. ABC is able to acknowledge this complexity with multiple cost drivers, some of which are not volume based.

7. Where selling prices are fixed on the basis of cost plus formula, ABC provides more reliable data for fixing selling prices.

8. In a service environment, the allocation of costs to service delivery may not be easy. The use of different cost drivers may help in allocation of costs in a better manner.

9. ABC provides more reliable data relating to activity driving costs which helps managers to improve product and process value.

Some Other Advantages:

The main advantages of ABC system are as under:

(i) Focus on Cost – ABC system focuses attention, when the cost originates or when it is the cause of the cost.

(ii) Identification of Source – It identifies sources of non-value added activity which might be a suitable force for attention.

(iii) Improved Cost Basis – It provides a better and improved cost basis both at head office level as well as at plant level, so that better decision may be taken.

(iv) Better Reporting – ABC system provides better reporting of cost of activities and their performance which will help in taking suitable decision and in improving efficiency.

(v) Accuracy in Product Cost – ABC system ascertains accurate product cost due to better understanding of the cost behaviour. Of course the apportionment of indirect cost to cost objectives is required.

Activity Based Costing – 5 Limitations of Activity Based Costing

Activity-Based Costing has the following limitations:

1. Activity-Based Costing system is time consuming and expensive to develop and implement. It is not suitable for small organisations.

2. Determination of most appropriate cost drivers is difficult.

3. In some cases finding the activity that causes the cost is impractical. For example, factory insurances, factory manager’s salary, rent, rates and taxes of the factory premises. In these cases, it is better to allocate costs on the basis of arbitrary volume. Here, ABC is not suitable.

4. A limited number of cost drivers may not fully explain the cost behavior of different items in the cost pool.

5. Implementation of ABC in service industry is difficult as the tracing of costs to service delivery may result in too many cost drivers.

Activity Based Costing – 5 Major Problems of Activity Based Costing

Problems with the ABC Approach:

(a) Cost of change will be high as everything will have to be worked out from scratch.

(b) It would be difficult to correlate the marginal increase in cost with a particular cost driver.

(c) Over a period of time, the ABC will tend to standardise the cost of activities related to a particular product or process. But in practice there will be differences in set-up time, production run, and meeting a delivery order for the product or process, as well as for different products.

(d) The ABC system will require a change due to changes associated with new products and new technology. This will put strain on the costing system and resources due to certain degree of inbuilt standardisation.

There exists catch 22 situation in the implementation of the ABC. Measure of activity performance will change again and again. A trade-off will be required between the accuracy and time spent on replacing the existing system with the ABC.

(e) The ABC is at the stage of evolution. Literature on the ABC concept at present is primarily restricted to the manufacturing environment.

The Activity Based Costing (ABC) has been successfully adopted by many Japanese Corporations. As a matter of fact, the elimination of “non-value added activities” was the secret of the Japanese capturing a significant market share with limited products and being considered a serious threat to the entire US automobile and electronics. As a result, now many US Corporations are also increasingly adopting Activity Based Costing.