Learn about the comparison between the Classical View and Keynesian View of Macro-Economy.

Before the publication of Keynes’ General Theory in 1936, economists all over the world believed in classical view of the economy. The classical economists were little concerned with unemployment, because they adhered to the Say’s Law of Markets, put forward in 1803. According to the Say’s Law, ‘supply creates its own demand’. Therefore, overproduction or under-consumption is a logical impossibility.

The most important implication of Say’s Law is that there is no essential difference between a monetary economy and a barter economy. Whatever is produced by the economy will be automatically bought.

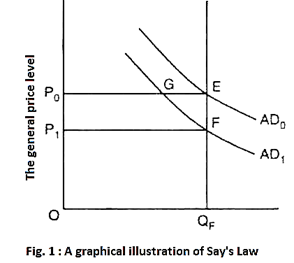

The Say’s Law is illustrated in Fig. 1. The classical economists assumed wage-price flexibility, i.e., wages and prices would always move up or down to eliminate any excess demand or supply. In Fig. 1 AS is the aggregate supply curve at full employment and OQF is the maximum output society is capable of producing.

Now, suppose, due to reduction in money supply or any other reason the aggregate demand falls. In this case the demand curve shifts down to AD1 from AD0, and the general price level will fall to OP1 from Op0. Thus according to Say’s Law, “supply creates its own demand as prices move to balance demand with aggregate supply.” In other words, prices and wages adjust upward or downward to ensure that aggregate demand equals full employment (potential) output. Output does not fall in the event of a fall in demand.

In fact, all major economic thinkers before Keynes subscribed to this view that over-production was impossible. As A.C. Pigou commented (in his famous book: The Theory of Unemployment): “with perfectly free competition there will always be a strong tendency toward full employment. Such unemployment as exists at any time is due wholly to the frictional resistances (that) prevent the appropriate wage and price adjustments being made instantaneously.”

Keynes pointed out that, if prices and wages are inflexible full employment is not a logical possibility. Instead an economy can suffer from long spells of inflation or unemployment or both at the same time (i.e., stagflation). Let us go back to Fig. 1.

Suppose, wages and prices were kept fixed at level OP0. Now, if aggregate demand falls and the demand curve shifts from AD0 to AD1, supply will no longer create its own demand. Instead equilibrium would move to point G and GNP would fall below the potential (full employment) level.

ADVERTISEMENTS:

This, in essence, is Keynes’ criticism of Say’s Law in particular and the postulates of classical economists in general. Moreover, monetary and fiscal policies affect interest rates and the level and composition of output.