Achievements of Nationalized Banks in India! Various achievements of banks in the post-nationalisation period are discussed below:

(A) Development of Banking Industry:

1. Lead Bank Scheme:

The lead bank scheme was introduced by the Reserve Bank of India towards the end of 1969 with the objective of enabling the commercial banks to assume the role of leadership for the development of banking and credit facilities throughout the country on the basis of area approach.

Under this scheme, all the districts in the country have been allotted to the State Bank Group, nationalised banks and private Indian banks. A lead bank is assigned the role of a catalytic agent of economic development through the expansion of bank branches and diversification of credit facilities in the district allotted to it.

It is made responsible for surveying the resources and potential for banking development in the district.

ADVERTISEMENTS:

The main objectives of a lead bank are:

(a) To open branches in all the important localities of the lead district;

(b) To extend maximum credit facilities for development in the district;

(c) To mobilise the savings of the people in the district and

ADVERTISEMENTS:

(d) To co-ordinate the activities of co-operative banks, commercial banks and other financial institutions in the district.

More specifically, the functions of lead bank are:

(i) To survey the sources and potential for banking development in the district;

(ii) To survey number of industrial and commercial units and other establishments which do not have banking accounts;

ADVERTISEMENTS:

(iii) To examine the facilities for marketing of agricultural produce and industrial production, storage and warehousing space and the linking of credit with marketing in the district;

(iv) To survey the facilities for stocking of fertilizers and other agricultural inputs and for the repair and servicing of equipment;

(v) To recruit and train staff for offering advice to small borrowers and farmers and for the follow-up and inspection of end use of loans

(vi) To assist other primary lending agencies; and

(vii) To maintain contacts and liaison with government and semi- government agencies.

2. Branch Expansion:

There has been a spectacular expansion of bank branches after nationalisation of major commercial banks in 1969. The lead bank scheme has played an important role in the bank expansion programme.

The number of branches of all scheduled commercial banks, which increased from 4151 to 8262 (i.e., about 100% increase) during the 18 years of pre-nationalisation-period (1951-1969), has further gone up from 8262 to 53840 (i.e., 552% increase) during the 18 years of post-nationalisation period (1969-87).

The banking coverage in the country as a whole has also considerably improved from one office for 87 thousand people in 1951 to one office for 65 thousand people in 1969 and one office for 15 thousand people in 2006. The number of bank branches in 2014 was 121535.

3. Coverage of Rural Areas:

The main thrust of branch expansion policy in the post-nationalisation period has been on increasing the banking facilities in the rural areas. There has been a significant increase in the rural branches of banks since 1969. The number of branches in rural areas having population upto 10,000 has increased from 1832 in June 1969 to 46976 in June 2014.

ADVERTISEMENTS:

The percentage of bank branches in rural areas to the total branches has risen from 22.2% in June 1969 to 37.2% in June 2011. Of the additional branches opened between June 1969 to June 2006 (i.e., 61354), 50% were in rural areas.

4. Reduction of Regional Imbalances:

Another highlight of the branch expansion policy since the nationalisation of banks has been to extend banking facilities in the deficit and unbanked areas and to reduce the regional imbalances. Systematic efforts are being made to increase banking facilities in the rural and semi- urban areas of the deficit districts of the country.

The licensing policy during the Seventh Plan period (1985- 90) aims at achieving a converge of 17000 population per bank in rural and semi-urban areas of each development block. The policy also aims at providing a bank office within 10 kms from each village.

5. Expansion of Bank Deposits:

Since nationalisation of banks, there has been a significant increase in the deposits of commercial banks. During the 18 years of pre-nationalisation period, the deposits in the scheduled banks increased from Rs. 908 crore in 1951 to Rs. 4646 crore in 1969 (i.e., about 5 times increase). Against this, during the 18 years of post- nationalisation period, the deposits increased from Rs. 4646 crore in the 1969 to Rs 107345 crore in 1987 (i.e., about 26 times increase). The deposits rose to Rs. 8336175 in 2014.

6. Change in Composition of Deposits:

ADVERTISEMENTS:

The relative proportions of demand and time deposits have also changed markedly after the nationalisation of banks. The proportion of time deposits has increased continuously from 50% in 1951 to 75% in 1969 and further to 90% in December 2014. This is a clear indication of a shift in favour of fixed deposits of the commercial banks.

7. Credit Expansion:

The expansion of bank credit has also been more spectacular in the post-bank nationalisation period. Over the period of 18 years before bank nationalisation, total advances of scheduled banks increased from Rs. 547 crore in 1951 to Rs. 3599 crore in 1969 (i.e. about 7 times increase). Against this, during the 18 years after bank nationalisation, the advances of scheduled banks increased from Rs. 3599 crore in 1969 to Rs. 63753 crore (i.e., 17 times increase). The advances increased to Rs. 6346702 crore in 2014.

8. Investment in Government Securities:

The nationalised banks were also expected to provide finance for economic plans of the country through the purchase of government securities. There has been a significant increase in the investment of the banks in government and other approved securities which increased from Rs. 1727 crore in March 1970 to Rs. 2437760 crore in 2014.

9. Financial Inclusion:

Financial inclusion has been embodied as an objective of economic policy in India since independence. However, since 2006, it has been an explicit policy endeavour of the Reserve Bank. Various initiatives have been undertaken by both the Reserve Bank and the Government of India to ensure universal financial access especially post-2005.

ADVERTISEMENTS:

Greater financial inclusion will include:

(i) Making banking outlets available or closer to the villagers.

(ii) Creating product-specific awareness to ensure greater usage of these products.

(iii) Creating greater awareness about banking service among women and among rural households with relatively incomes.

(iv) Formulation of products linked to economic status of the borrowers thereby providing opportunities for using banking products and services.

In 2010, the scheduled commercial banks adopted financial inclusion plans containing self-set targets for financial inclusion for a span of three years.

ADVERTISEMENTS:

In 2013, after the three year period, the progress with regard to financial inclusion can be listed as follows:

(i) Almost all unbanked villages with a population of more than 2,000 have been covered by banking outlet.

(ii) The villagers with the population of more than 2,000 are being provided with a banking outlet through branch business correspondents and other modes.

(iii) Greater attention is now being given to unbanked villages with a population of less than 2,000.

10. Pradhan Mantri Jan Dhan Yojana:

Pradhan Mantri Jan Dhan Yojana, launched on August 28, 2014, is a massive financial inclusion scheme with a record 1.5 crore bank accounts opened on the inaugural day. The scheme aimed at ending the financial untouchability for the poor by providing them bank accounts and debit cards. The scheme was expected to cover 7.5 crore people by January 26, 2015, who will be provided zero-balance accounts with ‘RuPay’ debit cards, life insurance cover of Rs. 1 lakh. Later, the account holders will be provided an overdraft facility up to Rs.5000.

11. Women’s Bank – Bharatiya Mahila Bank Limited:

With a view to promote gender equality and economic empowerment of women, the Government of India took a decision to set-up an all-women bank, Bharatiya Mahila Bank Limited (BMB), in 2013 to address the gender-related aspects of financial access to all sections of women, empowerment of women and financial inclusion.

ADVERTISEMENTS:

To achieve economic empowerment, women need equal access to economic institutions and control of assets. Opening of BMB is the first major step in this direction.

The government has infused an initial capital of Rs. 1,000 crore in BMB. The bank has been incorporated and The Reserve Bank has already issued a banking license to the bank. BMB has become functional after its inauguration on November 19, 2013. The target customers will be individual women, self-help groups, business establishments owned by women. The bank will emphasise on funding for skill development to help in economic activity. The access to finance and banking not only helps to empower women but also broaden the social base of development.

(B) Financing of Priority Sectors:

1. Lesser Importance to Big Industries:

The sectoral deployment of credit has undergone a great qualitative change after the nationalisation of banks. In the pre-nationalisation days, large and medium industries and wholesale trade account for about 78% of the total bank credit, while agriculture accounted for only 2.2% of the total bank credit.

The share of large and medium industries and wholesale trade in the total bank credit has declined to about 36% in 2009. Correspondingly, the share of agriculture, small industries and other priority sectors, food procurement agencies, exports, has increased.

2. Advances to Priority Sectors:

One of the main objectives of nationalisation of banks was to extend credit facilities to the borrowers in the so for neglected sectors of the economy. To achieve this objective, the banks formulated various schemes to provide credit to the small borrowers in the priority sectors like agriculture, small scale industry, road and water transport, retail trade, and small business.

Considering the necessity of meeting specific credit requirements of the weaker sections, consumption credit has been included in the priority sectors. Similarly, small housing loans to scheduled castes/tribes and weaker sections have also been considered as priority sector loans.

ADVERTISEMENTS:

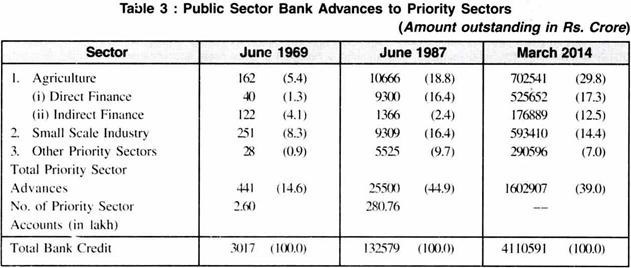

Distinctive features of the advances made available to the priority sectors after bank nationalisation are given below (see Table 3):

(i) The number of borrowed accounts of the priority sector with the public sector banks has increased from 2.60 lakh to 483.39 lakh between June 1969 to March 2011.

(ii) The total credit provided by the public sector banks to priority sectors has increased from Rs. 441 crore in June 1969 to Rs. 1602907 crore in 2014. As a result, the share of priority sectors in the total credit has increased from 14.6% in June 1969 to 39% in 2014.

(iii) Agricultural credit increased from Rs. 162 crore (i.e., 5.4% of the bank credit) in June 1969 to Rs. 702541 crore (i.e., 29.8% of the total bank credit) in 2014.

(iv) Direct finance to agriculture which was only Rs. 40 crore (i.e., 1.3% of the total bank credit) in June 1969, has gone up to Rs. 525652 crore (i.e., 17.3% of the total bank credit) in 2014.

(v) Bank credit to small scale industries has also increased significantly from Rs. 251 crore (i.e., 8.3% of the total bank credit) in June 1969 to Rs. 593410 crore (i.e. 14.4% of the total bank credit) in March 2014.

ADVERTISEMENTS:

(vi) Bank credit to other priority sectors like, road and water transport operators, retail trade, small business, professional and self-employed persons, education, consumption loans, housing loans etc. has also increased from Rs. 28 crore (i.e., 0.9% of the total bank credit) in June 1969 to Rs. 290596 crore (i.e., 7% of the bank credit) in March 2014.

3. Agricultural Finance:

After nationalisation, the commercial banks have been giving special attention to the financial needs of agriculturists and of rural areas.

This is clear from the various measures taken by the public sector banks:

(i) Larger and growing proportion of credit is being extended to the agriculturists. The proportion of agricultural credit to the total bank credit has grown from 5.4% in 1969 to 17.1% in 2014.

(ii) The strategy of agricultural finance by the banks has been- (a) to take note of various in balances in the agricultural development and to take measures to correct them; (b) to give a big push to agricultural development in terms of investment, management and policy; and (c) to develop untrapped potential in the neglected regions.

(iii) The banks provide direct financial assistance to the agriculturists in the forms of- (a) short-term crop loans; (b) term loans for purchasing animals and farms machinery, constructing wells and tube-wells, levelling or developing land, etc., (c) loans for allied activities such as dairying, poultry farming, piggery, bee keeping, fisheries, etc.

(iv) The commercial banks provide indirect financial assistance to the agriculturists in the following forms- (a) they finance cooperative societies to enable them to expand their production credit to the farmers; (b) they provide indirect finance for the distribution of various agricultural inputs; (c) they extend credit to firms or agencies engaged in the supply of agricultural machinery on hire-purchase basis or otherwise; and (d) they subscribe to the debentures of the central land development banks and also grant them loans.

(v) The commercial banks have started many innovative schemes to ensure larger flow of credit to the needy farmers and its effective utilisation. Some such schemes are- (a) agricultural development branches of the State Bank of India; (b) village adoption schemes; (c) gram vikas kendras of Bank of Baroda (d) rural financing centres of Dena Bank; (e) project- lending with refinance facility from ARDC (now NABARD) (f) linkage of lending with development activities.

(vi) Since 1975, the State Bank of India and nationalised banks are sponsoring regional rural banks to extend cheap credit to small farmers, rural artisans and others.

(vii) To help the small but potentially viable farmers, the commercial banks have set up Farmer’s Service Societies in SFDA areas (Small Farmers Development Agency areas) for providing such farmers credit facilities, ensuring the supply of inputs, and helping in the marketing of produce.

(viii) The commercial banks have been increasingly adopting area approach in agricultural lending by selecting groups of villages in different areas and meeting total credit needs of fanners in those villages.

(ix) Kisan Credit Card Scheme was introduced in 1998-99 to facilitate the flow of timely and adequate short term credit to the farmers.

4. Bank Credit for Small Scale Industries:

Small scale industries sector has also been recognised by the government as an important productive sector of the economy which deserves special financial assistance by the commercial banks. Keeping this in mind, various facilities and concessions have been made available to this sector from the banks, particularly after their nationalisation in 1969.

The following are the important bank credit facilities given in the small scale industries:

(i) Small scale industries sector has been treated as a priority sector for bank loans.

(ii) Short period and term loans are provided to the small scale industries at concessional rates of interest.

(iii) Banks have been instructed not to insist on margins and guarantees from the borrowers from small scale sector.

(iv) Banks have also been directed that the periods of repayment should be related to the surplus generating capacity of the unit, and should not be fixed on an adhoc basis.

(v) Special cells have been set up in the banks to provide guidance to the borrowers from small seals sector.

(vi) Advances to the small scale industries are protected by a guarantee from Deposit Insurance and Credit Guarantee Corporation under its credit guarantee scheme.

(vii) Commercial banks also provide financial assistance for setting up of industrial estates.

(viii) Industrial Development Bank of India (IDBI) provides the following facilities to the commercial banks with a view to assist them in financing small scale industries:

(a) If refinances loans and advances extended by the commercial banks to small scale industries units.

(b) It launched the National Equity Fund Scheme in 1988 for providing support in the form of equity to tiny and small scale industrial units. This scheme is administered through nationalised banks,

(c) Small Industries Development Bank of India (SIDBI) was set up as wholly owned subsidiary of IDBI in 1989 as the principal institution for promotion, financing and development of industries in the small scale sector. It took over all the IDBI functions and schemes relating to the small scale industries.

(ix) Bank credit to small industrial units increased from Rs. 251 crore in June 1969 (8.3% of the total bank credit) to Rs. 593410 crore in March 2014 (14.4% of the total bank credit).

5. Banks and Export Promotion:

In a developing economy like India, there is a great need to promote exports in order to earn sufficient foreign exchange to be able to meet the country’s large and growing foreign exchange obligations. In view of this, the government has taken a number of measures to enable the commercial banks to provide sufficient and easy finance to the exporters.

(i) Exports have been officially recognised as a priority sector for the allocation of bank credit. Thus the commercial banks extend financial assistance to the exporters on priority basis and relatively liberalised terms. As on March 2011, aggregate export credit of banks was Rs. 42486 crore.

(ii) Banks give finance to exporters at two stages, i.e., at the pre-shipment stage and the post-shipment stage. The financing is done at concessional rate of interest. The purpose of charging low interest rate on export advances is to reduce the cost of the product and make it competitive in the international market.

(iii) To induce banks to increase their credit for exports, the RBI has been providing increasingly liberal finance to them for such credit and at low concessional interest rates.

(iv) In its credit policy, the RBI has been fixing credit ceilings from time to time and requiring the commercial banks to observe specified incremental net non-food credit-deposit ratio. But, exports have been kept onside the framework of this stipulated credit-deposit ratio.

6. Housing Finance:

Housing finance is another priority sector and the public sector banks play a crucial role in this area. The major issue in respect of housing finance is how to bridge the gap between the demand for housing finance and its supply from all sources put together.

In this regard, following measures have been taken:

(i) At the national level, National Housing Bank (NHB) has been set up in 1988 as an apex institution to promote and develop specialised housing finance institutions at regional and local levels.

(ii) Other national level institutions providing housing finance are:

(a) Housing and Urban Development Corporation Ltd. (HUDCO).

(b) Housing Development Finance Corporation of India Ltd. (HDFC).

(iii) A broad policy of minimum allocation for housing finance by commercial banks has been adopted and the scheduled commercial banks were advised to allocate 1.5% of their incremental deposits.

(iv) 20% of bank credit should be by way of direct lending of which at least half should be in the rural and semi-urban areas.

(v) 30% of bank credit should be extended in indirect way in the form of term finance.

(vi) The balance of 50% of bank credit for housing should be made use of subscription to the guaranteed bonds and debentures of the National Housing Bank (NHB) and Housing and Urban Development Corporation Ltd., (HUDCO).

(vii) The ceiling of Rs. 10 lakh per borrower for direct lending has been fixed.

(viii) As at the end of March 1991, 9 banks had set up housing finance companies or subsidiaries or participated in equities of housing finance companies set up by other institutions.

(ix) The outstanding amount of housing loans by the public sector banks has increased from Rs. 323 crore in March 1992 to Rs. 235484 crore in March 2014.

7. Credit to Weaker Sections:

In order to increase the flow of bank credit to the smaller and poorer borrowers the government has broadened the concept of weaker sections of the society. Now the weaker sections include small and marginal farmers, landless labourers, tenant farmers and share croppers, artisans, village and cottage industries, beneficiaries of Integrated Rural Development Programme, scheduled castes and scheduled tribes, and beneficiaries of differential rate of interest scheme. By March 2010, these weaker sections have been provided the bank credit of Rs. 212215 crore which accounted for 10.2% of the total credit of public sector banks.

8. Differential Rate of Interest Scheme:

With a view to provide bank credit to the weaker sections of the society at a concessional rate, the government introduced the differential rate of interest scheme from April 1972. Under this scheme, the public sector banks have been providing loans at 4% rate of interest to the weaker sections of the society who do not have any tangible security to offer, but who can improve their economic condition with the financial support from the banks.

The scheme has shown notable progress. As on March 31, 2010, the outstanding differential rate of interest credit was of Rs. 752 crore.

9. Kisan Credit Card Scheme:

Kisan Credit Card scheme was introduced in 1998-99 to provide better access to short-term institutional credit (i.e., from commercial banks and Regional Rural Banks) to farmers.

The salient features of the scheme are given below:

(i) Farmers eligible for production credit of Rs. 5000 or more are eligible for issue of Kisan Credit Card.

(ii) Eligible farmers are to be provided with a Kisan Card and passbook or Card-cum-passbook.

(iii) There is a provision of revolving cash credit facility involving any number of drawals and repayments within the limit.

(iv) Entire production credit needs for full year plus ancillary activities related to crop production are to be considered while fixing limit.

(v) Limit will be fixed on the basis of operational land holding, crop pattern and scale of finance.

(vi) Sub-limits may be fixed at the discretion of banks.

(vii) Card will be valid for 3 years subject to annual review.

(viii) Each drawal has to be repaid within 12 months.

(ix) Conversion/reschedulement of loans are also permissible in case of damage to crops due to natural calamities.

(x) As incentive for good performance, credit limit can be increased.

(xi) Security, margin, rate of interest will be as per RBI norms.

(xii) Operations may be through issuing branch or at the discretion of bank, through other designated branches.

(xiii) Withdrawals will be through slips/cheques accompanied by card and passbook.

The scheme has gained popularity and its implementation has been taken up by 27 commercial banks, 334 Central Co-operative Banks, and 187 Regional Rural Banks upto December 2000. The number of cards increased from 6.1 lakh at the end of March 1999 to 878.30 lakh at the end of Nov., 2009.

The banking system has issued 1078.36 lakh Kisan Credit Cards (KCCs) involving total sanctioned credit limit of Rs. 52705 crore as on October 31, 2011. The share of commercial banks stood at 45.6% of the total number, followed by cooperative banks at 39.4% and Regional Rural Banks at 15.1%.

10. Mudra Bank:

Pradhan Mantri Micro Units Development and Refinance Agency (MUDRA) Yojana was launched on April 8, 2015, with the objective of ‘funding the unfunded’. The MUDRA Yojana or bank, which has a corpus of Rs. 20,000 crore, can lend between Rs. 10, 000 to Rs.10 lakh to small entrepreneurs. The scheme has been set up for development and refinance activities relating to micro units. It will provide refinance to banks and other institutions at 7%.

There are about 5.77 crore small business units. Initial 3 schemes have been named ‘Shishu’, ‘Kishor’ and ‘Tarun’ to signify the stage of growth and funding needs. ‘Shishu’ would cover loans up to Rs. 50,000 while ‘Kishor’ above Rs. 50,000 and up to Rs. 5 lakh. ‘Tarun’ category will cover loans of above Rs. 5 lakh to Rs. 10 lakh.

Critical Appraisal:

Undoubtedly, the commercial banks in India have made phenomenal progress after nationalisation. But, the critics not only point out various inadequacies and limitations of public sector banks, but also express fears about the dangers of nationalisation.

Various defects of commercial banking system in India, particularly, after nationalisation of banks are discussed below:

1. Criticism by Estimates Committee:

The Estimates Committee of Lok Sabha (1975) headed by Mr. R.K. Sinha has expressed dissatisfaction over the working of nationalisation banks. The Committee is of the view that nationalised banks have largely failed in achieving the main objectives of bank nationalisation, particularly, granting of loans to the priority sectors and removing regional disparities through developing banking facilities in backward areas.

The banks have no machinery to see that “the finance from the public institutions are in fact, going to productive uses in the large public interest.”

2. Insufficient Help to Priority Sectors:

In spite of much increase in the loans advanced to the priority sectors, the total help is not sufficient for the large size of these sectors. The rate of increase in the advances to the priority sectors which was rapid in the initial years of post-nationalisation period has slowed down in the later years. The advances to the priority sectors as a proportion to total bank credit increased from 14.6% in June 1969 to 22.2% in June 1971.

But between June 1984 and June 1990, the proportion increased only from 39% to 42%. The main reason for this slow progress was that, on the one hand the bank officials were not imbued with the new objectives of banking and, on the other hand, they were more worried about the unsatisfactory recovery performance.

3. Inadequate Facilities in Rural Areas:

No doubt, much progress has been made in expanding bank branches in respect of bank expansion, deposit mobilisation and credit expansion in rural areas. But, it is not adequate to meet the financial needs of the population living in the rural areas.

The magnitude of the problem is clear from the fact that at present only about 5% villages are covered by the commercial banks directly or indirectly. The stipulated deposit-credit ratio of 60% has not been achieved in the rural areas.

4. Regional Imbalances:

Though the overall expansion in the bank branches has taken place in the country, their expansion is not equitably distributed among the different states. According to the Reserve Bank’s reports, about half of the banking institutions concentrate in the two regions, i.e., southern and western region comprising five states, namely, Maharashtra, Gujarat, Kerala, Tamil Nadu and Karnataka. On the other hand, the states like Assam, Jammu and Kashmir, Manipur, Nagaland, Orissa, Tripura, Uttar Pradesh and West Bengal still continue to remain bank-deficient states.

5. Insufficient Deposit Mobilisation:

Despite good progress on the deposit mobilisation front, much remains to the done. Deposit mobilisation by the public sector banks has been about 16 to 17% per annum since nationalisation.

On the other hand, it has been found that the foreign banks and the smaller private banks have received much greater increases in deposits. The fact is that with the increase the total savings in the country, there still exists a larger scope for expansion of deposits.

6. Problem of Liberal Credit Policy:

Although liberal credit policy is necessary for providing financial support to the weaker sections of the rural community, but such a policy may prove harmful for stability of the banking system. The experience of the nationalised banks has shown that these banks are now facing the problems of heavy overdue loans and economically unviable branches.

7. Sound Principles Ignored:

Normally, the growth of credit should go hand in hand with growth of deposit mobilisation. But in the initial years of nationalisation, the credit expansion of banks was about 24% as compared to the deposit expansion of about 17%. This was an unwise and risky trend. Later on, however, the credit expansion has been proportionate to the expansion in deposits.

8. Low Profitability:

A major defect of banking after nationalisation is that the nationalised banks are either operating under losses or experiencing falling dividends. The profits of the commercial banks, which were quite high during fifties and sixties, have declined considerably in the post-nationalisation period.

Low profitability is caused by two types of factors- (a) the factors which push up costs, such as, inefficiency, bureaucratic attitude, increasing expenditure on bank staff, expansion of branches, absence of effective cost control measures, etc.; and (b) the factors which reduce bank earning such as, advances to the priority sectors at concessional rates, large overdue because of non-return of loans, increase in statuary liquidity ratio and cash-reserve ratio, etc.

9. Low Efficiency:

Nationalisation has created bureaucratic attitude in the functioning of banking system. Lack of responsibility and initiative, red-tapism, inordinate delays are common features of nationalised banks. As a consequence, the efficiency of these banks has reduced.

10. Political Pressure:

Political interference also disturbs the smooth working of the nationalised banks. Political pressure in the granting of loans to particular parties, the selection of personnel, opening of branches, etc, creates difficulties for these banks.