In this article we will discuss about:- 1. Concepts of Deficit Financing in India 2. Role of Deficit Financing 3. Safe Limits.

Concepts of Deficit Financing in India:

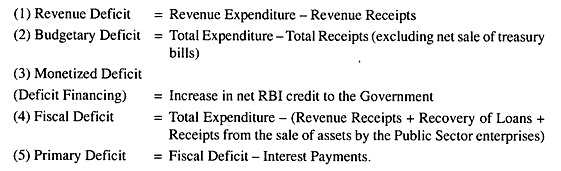

The issue of definition and measurement of deficit financing is sometimes confusing. We are familiar with different concepts of deficit, and in India, the concepts of Revenue Deficit, Budgetary Deficit, Monetized Deficit, Fiscal Deficit and Primary Deficit have been listed in the official documents in recent years.

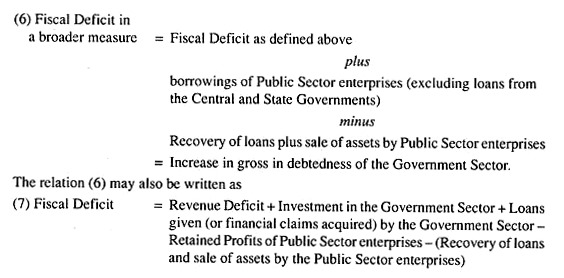

Rakshit (1991) has used the broad measure of fiscal deficit incorporating the borrowings of public sector enterprises. In terms of his measure fiscal deficit should be defined in broader way. Thus,

The impact of fiscal deficit is different from that of monetized deficit or deficit financing. Rakshit (1991) believes that although fiscal deficit as a proportion of the gross domestic product (GDP) was alarmingly high in the 1980s, it cannot account for the rate of inflation during the 1980s and that there has been no significant relationship between import-export gap and fiscal deficit. Rakshit (1991) and Bhattacharya (1991) identified the macroeconomic effect of fiscal deficit through the investment-saving relation in the private and the government sectors.

To keep close to the budgetary practice and to facilitate the use of budgetary data, borrowing from the Reserve Bank of India (RBI) or monetary deficit prior to 1997-98 was related to the issue of 91-day treasury bills. Another measure of financing the deficit is the running down of the Government’s cash balances. Since the running down of the Government’s cash balances was usually nil or negligible, the short-term borrowing from the RBI was taken to be the measure of deficit financing.

But the definition of deficit financing as net RBI credit to the government as given by the Chakraborty Committee is broader and more appropriate, but even that does not indicate the full monetary impact of budgetary operations since, for example, it excludes foreign grants spent domestically and the receipts of profits from the RBI.

In recent years, the monetized deficit as defined by the Chakraborty Committee, and the monetized deficit as traditionally measured in India have been fairly close as percentage of GDP. The proportion of the Central Government deficit financed by net RBI credit increased from less than 16 percent in the early 1970s to nearly one-third during the latter half of the 1980s.

ADVERTISEMENTS:

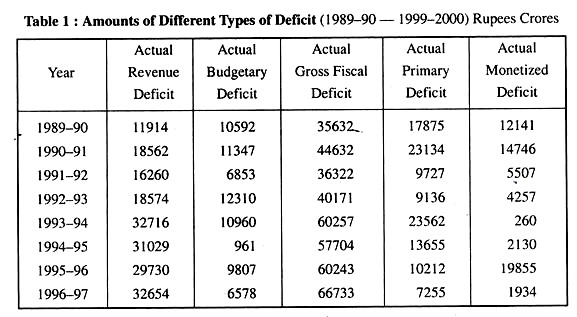

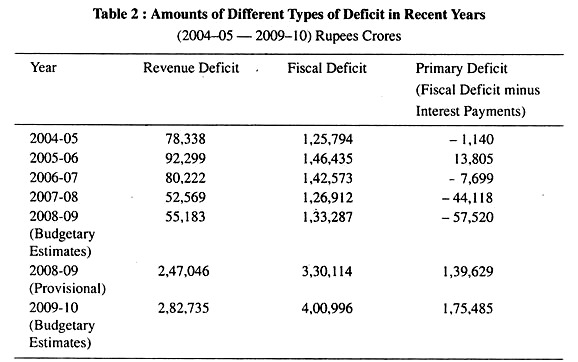

There has been little change in the ratio of tax revenue to GDP after economic reforms. In 1990-91, prior to economic reforms, the revenue deficit was 3.5 percent of the Gross domestic product. It fell to 2.7 percent in 1991-92. It fell to 1.1 percent of GDP in 2007- 08, but rose to 4.4 percent in 2008-09 and 4.6 percent in 2009-10. Fiscal deficit of the Government of India rose from 8.4 percent of GDP in 1989-90 to about 9.8 percent in 1990-91.

It came down to 6.5 percent in 1991-92 and to 5.7 percent in 1992-93. It again rose to 7.5 percent of GDP in 1993-94. The concept of budgetary deficit lost its relevance since 1997-98 with the discontinuance of ad hoc treasury bills. The definition of deficit financing as suggested by the Chakraborty Committee was accepted and the traditional concept of deficit financing was modified.

Fiscal deficit showed a downward trend since 2004-05 except a marginal rise in 2005-06 and it came down to 2.5 per cent of GDP in 2007-08. But the expansionary fiscal stance to cope with the economic depression in 2008- 09 raised the fiscal deficit to 5.9 per cent and 6.5 per cent of GDP in 2008-09 and 2009-10 respectively.

The recent increase in fiscal deficit of the Central Governments may be ascribed to the two fiscal packages announced in December 2008 and January 2009, by the Government to deal with the impact of the global financial crisis on the Indian economy. To this should be added the additional financial liability to waive the loans and interest on loans taken by farmers from the nationalized banks.

ADVERTISEMENTS:

Another reason for the all-round deterioration in the fiscal scenario may be ascribed to the growing burden of allowing heavy pay hike of the Central Government employees on the recommendation of the Sixth Pay Commission. The following table indicates the magnitude of revenue deficit, budgetary deficit, gross fiscal deficit, primary deficit and actual monetized deficit (or deficit financing) from 1989-90 to 1996-1997.

The magnitudes of revenue deficit, fiscal deficit and primary deficit in recent years have been shown in the following table.

The expansionary fiscal stance since 2008-09 has been designed to boost demand to counteract the impact of economic crisis. The fiscal deficit has been increasing at an alarming rate, Prior to India’s economic liberalisation in 1991, the Ministry of Finance of the Government of India was not that much worried over fiscal deficit as had been expected of it since the Government could raise funds from the market, the nationalized banks, and other financial institutions. Ultimately the situation led to an internal debt trap.

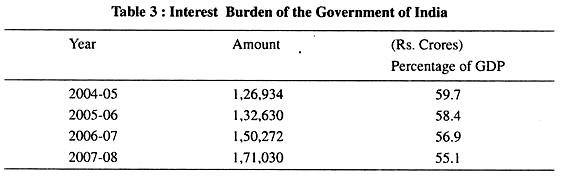

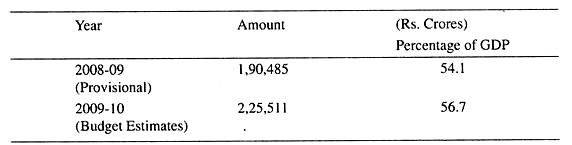

Non-plan expenditures continued to grow at a fast rate. It was only when the World Bank, the IMF and other international institutions insisted on reducing fiscal deficit as the prior condition of giving loans, the Government was compelled to take stringent measures to control non-plan expenditure. The financing of growing deficits led to an immense increase in public debt and other liabilities. This also led to growing burden of interest payments in recent years which is evident from the following table.

About 48 per cent of the current revenues of the Government of India is spent for interest payments. This forces the Government to borrow further for financing revenue deficit. Thus, an internal debt trap is created. The interest on outstanding internal liabilities stood at Rs. 28,94,434 crores in 2009-10 as per budget estimates. It has been observed by the Thirteenth Finance Commission that the combined (centre and the states) debt-GDP ratio was 82 per cent in 2009-10.

ADVERTISEMENTS:

The gross fiscal deficits of the states showed a declining trend from 3.3 percent of GDP in 2004-05 to 1.4 per cent of GDP in 2007-08 because of the:

(i) Implementation of the Fiscal Responsibility and Budget Management Act (FRBMA),

(ii) The award of the Twelfth Finance Commission in terms of grants,

(iii) Incentive scheme of debt consolidation and waiver linked to fiscal consolidation under fiscal rules,

ADVERTISEMENTS:

(iv) Introduction of state-level VAT, which proved to be a very buoyant source of revenue receipts.

It is expected that after the implementation of the proposed Goods and Services Tax (GST) the debt-GDP ratio of the states will further come down.

Deficit financing in the traditional sense implies either the running down of the accumulated balances to finance a budgetary deficit or the borrowing of the government from the banking system, particularly from the central bank of the country which in its turn prints new money on behalf of the government.

In the early years of planning, deficit financing in certain cases had been described as the financing of a deliberately created budgetary deficit, the method of financing usually being borrowing of a type that resulted in a net addition to aggregate public expenditure. This implied that borrowing either resulted in the activisation of idle deposits held in banks by private individuals or creation of deposits by the banks directly undertaking the purchase of government securities.

ADVERTISEMENTS:

In the U.S.A. the term ‘deficit financing’ denotes the gap between the revenue receipts of the state and aggregate budget expenditure including capital outlay and covers all the means of closing the gap, viz., use of cash balances, borrowing from the Federal Reserve System and loans from the public.

In India ever since the initiation of planning, deficit financing has been supposed to be an instrument of financing economic development. The essence of such a policy lies in government spending in excess of the revenue it receives in the form of taxes, earnings of state enterprises, loans from the public deposits and funds and other miscellaneous sources. In India, deficit financing from the very beginning, has been treated mainly in terms of an expansion of currency through printing of new money.

But the concept of deficit financing has now changed. In the first place, categorisation of deficit as revenue deficit, budgetary deficit, fiscal deficit and primary deficit had not been in practice in the first forty years of planning. This is of recent origin. Secondly, after the publication practice in the first forty years of planning.

This is of recent origin. Secondly, after the publication of the Chakraborty Committee Report, there has been a distinct change in the interpretation of deficit financing. Thirdly, ad hoc treasury bills for 91 days against which the Government of India used to borrow money from the Reserve Bank of India have been discontinued.

As such, the concept of budgetary deficit has lost its relevance. This is apparent from the Table 1 given above. The concept of deficit financing prevailing prior to 1997-98 fiscal year reflected only the amount of or the changes in the level of treasury bills lying outstanding with the RBI. The fact is that changes in the dated securities lying with the RBI do not necessarily reflect the corresponding changes in the existing money supply and thus it does not fully reflect the monetary impact of the fiscal operations of the Government.

Now, to finance an excess of expenditure over revenue, the Government of India takes ways and means advances from the Reserve Bank of India. An accord between the Government of India and the Reserve Bank of India in 1994 eliminated the automatic monetisation of the Central Government’s fiscal deficit by gradually phasing out ad hoc treasury hills by 1997.

ADVERTISEMENTS:

Instead, the system of taking ways and means advances from the Reserve Bank was introduced. The fiscal-monetary coordination has been strengthened through the enactment of the FRBM Act, 2003, which, placing limits on deficits, prohibits the borrowing from the Reserve Bank from the fiscal year 2006-07 except by way of ways and means advances or under exceptional circumstances. Reserve Bank would, however, still be able to buy or sell Government securities in the secondary market consistent with the conduct of monetary policy.

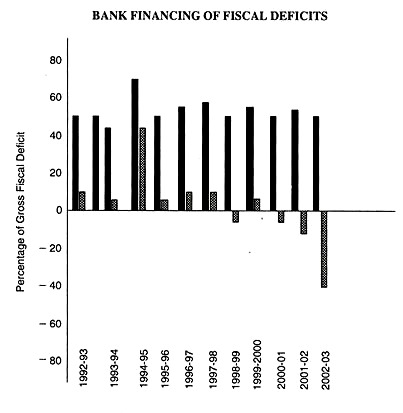

The Government of India announced its aim at achieving a zero revenue deficit over the next four years after 1997-98. It would be instructive if we now consider the magnitude of bank financing of fiscal deficits. The above chart shows that while the fiscal deficit of the Central Government is still high, the share of net bank credit to the Government in financing the fiscal deficit is also very high.

The FRBM Act has also put limits on the fiscal policy. The Act also seeks to eliminate the revenue deficit by March 2008. But although revenue deficit may be eliminated by legislation and on paper, the fact remains that the fiscal deficit cannot be wiped out, and the excess of expenditure over revenue simply adds to fiscal deficit. By deficit financing we today mean financing of fiscal deficit.

Role of Deficit Financing:

Whatever may be the appropriate concept of deficit financing, the excess of expenditure by expansion of currency is a fact. The use of the instrument of deficit financing as a source of development finance has been subject to controversies among the economists. We here examine the views in favour of as well as against deficit financing in a less developed economy like India. Rao (1953 : 2-14,32-35) argues that the purpose as well as the effect of deficit financing undertaken in developed countries is different from that in less developed countries.

ADVERTISEMENTS:

The developed countries may have underemployed resources and underutilized labour, and this may induce these countries to undertake deficit financing to buoy up the level of aggregate demand and stimulate the economy to come out of possible depression or recession. Given a situation of ‘underproduction’, an expansion of aggregate demand consequent upon deficit financing is expected to lead to increase in output, price level and the rate of return.

Blinder and Solow (1973) argue that ‘debt financing’ of government expenditure through borrowing from the central bank of the country is expansionary in the Keynesian sense even when output is supply constrained. But the Keynesian economics in this respect is not consistent with the competitive market economy and the optimising behaviour of rational economic agents and it also lacks micro foundation.

Rao (1953) draws attention to the different situation in India which shows insufficient equipment and utilisable (but not actually utilised) resources and high disguised unemployment, a situation in which deficit financing, if properly monitored, may promote capital formation and thereby make an efficient use of the available labour force. Rao’s argument is based on the view that deficit financing in India is likely to result in an increase in productivity or output per worker.

In India, the private sector in the earlier years of the planning exercise was not in a position to provide the necessary investment for industrialisation, and so the public sector investment, in the core sectors was of critical importance to ensure capital formation. Deficit financing at that time was of critical importance as a means to finance massive public sector investment.

At the initial stages of such investment long gestation period appears and this may not generate savings immediately, and there may be a gap between voluntary saving and investment. The gap may be covered by forced savings produced through a rise in prices under the impact of expanding government expenditure.

Again, once economic development gets started and capital formation as well as the growth rate show rising trend, the voluntary saving and investment increase to close the gap. The supporters of deficit financing argue that if deficit financing is appropriately managed or monitored, price level would not be highly inflationary though a positive rate of inflation would emerge.

ADVERTISEMENTS:

But the question is, what are the yardsticks of the appropriate management of deficit financing?

In an answer to this question, the following issues are relevant:

(a) The scale of investment and the nature of investment to be undertaken;

(b) The purpose behind the use of deficit financing;

(c) The gestation lag between the investment financed by budgetary deficit and the receipt of return from that investment;

(d) Wage rigidity;

ADVERTISEMENTS:

(e) Inter-sectoral mobility of resources;

(f) Whether the investment undertaken is effective in bringing about an increased flow of consumption goods and the time to be taken for raising the supply of consumption goods; and

(g) Whether the monetary vis-a-vis fiscal policies framework is in a position to contain the rising price trends.

Rao’s model (1953) is too simplistic and is possible only in an ideal case. Economic development in LDCs financed by budgetary deficit results in increased dependence on monetary expansion and this is sure to invite inflationary pressure and distort economic stability. Brahmananda (1980 : 231-36) argues that conditions are more conducive to the use of deficit financing as an instrument of development in a country like India than in industrialized countries.

His arguments are as follows:

(a) In India, the proportion of currency to money supply is higher than that in developed countries and as such, the money-supply augmenting effect is not of that magnitude as in industrialized countries;

(b) The demand-boost effect of deficit financing in India is not of that magnitude as in developed countries since currency has a lower income velocity;

(c) The liquidity effect of deficit financing in a country like India is of less importance than in a developed economy because of the relative underdevelopment of diverse financial intermediaries;

(d) As the Indian economy (prior to the introduction of economic reforms with a switchover to liberalisation and market economy) had a planned pattern of investment and as the pace of private investment in fixed assets had been subject to regulatory measures like industrial licensing, exchange allocation and capital issues control, India was in a better position to put a brake on accelerating investments in undesirable channels, than in a developed economy;

(e) As the Indian economy has a surplus of unskilled labour and as the country has also not been suffering from a dearth of trained and professional manpower, it would not be difficult to carry through productive investment without facing labour and skill shortages; and

(f) Prevalence of wage rigidity in the country would also be an aid to the same. Brahmananda’s (1980) argument is that in the context of a planned economy which is augmenting its growth potential year after year, deficit financing may not necessarily be inflationary, but may actually result in increased production, higher efficiency in production technology and therefore, a decline in Prices.

The Report of the Committee to Review the Working of the Monetary System in the Indian Economy (1985 : 45-50, 213-28), popularly known as the Chakraborty Committee also suggests a similar role for deficit financing in India.

It is also theorized that growth rate in the economy depends on the capital-output ratio, the rate of saving, investment priorities, efficiency in utilisation of existing capacity technological factors’ investment climate and a host of other factors, and deficit financing with proper monetae targeting may not necessarily be inflationary in its impact.

Chakraborty (1986) in a reexamination of the Report of the Committee chaired by him has asserted that deficit financing in certain circumstances may be a useful device for transferring resources which are generated in one sector of the economy to another and from the private to the public sector. But it can perform such a role only if it is done in moderation and only in suitable circumstances.

He further says that if it (i.e. deficit financing) is done in excess, it can lose not only its effectiveness but also can create perversities in the asset placement process. One does not have to be a believer in doctrine of ‘neutral money’ or an arcane version of ‘monetarism’ to reach such a conclusion. It is a conclusion to which a good Keynesian can easily subscribe.”

Since economic growth and price stability are the twin objectives of development planning in India, the use of deficit financing as an instrument of financing growth should be carefully pursued so that it may not ultimately distort price stability. Minhas (1987) argues that the Keynesian pump-priming track to stimulate demand to coax out much larger output supplies than those produced by the existing, but temporarily idle, machines and plants are not applicable to India.

According to him, not such excess but un-utilised capacity in plants and machinery exists, though the prevalent inefficient use of production facilities in Indian industry is a different issue. Minhas further comments that the argument that deficit financing leads to the use of surplus labour for capital formation is also not applicable in India. According to him, deficit financing in India has led to an increase in current expenditure and has hardly served the purpose of investment.

Therefore, the additional expenditure attributed to deficit financing does not lead to additional output; it simply creates inflionary pressure. Chelliah (1992) argues that deficit financing to counter or cure recession and unemployment of a cyclical nature has not been quite successful in the industrial countries.

However, recession-induced deficit finance might be advocated if full employment revenues are shown to result in a balance or surplus. He argues that deficit financing in a country to tide over a recession has no role in fiscal policy.

Then, what should be the size of deficit financing? Chelliah’s answer to this question is as follows: The size of deficit should not be more than the total of capital or income-raising expenditure like meeting remunerative capital formation,—a proportion of current expenditure designed to increase social capital and productivity and the requirements of financial investment.

If the rate of savings in the economy is constant, the scale of deficit financing by the Government may be kept constant as a percent of increase in GDP in order that the non-Government sector may be assured of a deficit share of savings. Then, D = x ∆Y

So, D/Y = x ∆Y/Y

where D = budget deficit, Y = GDP, x = the constant proportion of ∆Y borrowed by Government from the central bank of the country.

In a steady state where rate of increase in income is constant, the ratio of budgetary deficit to the GDP would remain constant. If the rate of growth of the economy is accelerating, D/Y will increase and if necessary, the value of x can be reduced by discretionary policy action.

The possibility of deficit financing to bring unemployed resources into new production has been supposed to be limited largely due to unskilled workers in the less developed countries and, unfortunately, even in this case the net increase in production for capital formation may be neutralized by increased consumption such employment entails.

Moreover, there are bottleneck limitations imposed by the fact that there are usually few, or no, unemployed skilled workers, tools, machinery and, often, raw materials needed to complement the unskilled workers’ efforts. Of course, in India, at present, we find large number of unemployed skilled workers, and as such, this view regarding such a bottleneck limitation may not be acceptable.

An important issue is related to the question of the extent to which deficit financing can induce or force increased savings. That is to say, whether deficit financing is conducive to a transfer of real resources from consumption to investment. As long as a large part of the economy has not yet been monetized, there may well exist a large untapped saving potential. It does not mean that in a monetized economy deficit financing may not force increased saving.

Even in a monetized economy some savings may be generated via deficit financing and without inflation if the increase in money in circulation is limited to something less than the increase in productivity. With low marginal rates of saving and taxation in a number of LDCs, the multiplier effect of increased public investment financed by budgetary deficit is likely to be high.

In India, however, the marginal rate of taxation was high prior to 1991-92. So, the multiplier effect of deficit financing was not as high as had been expected. But even if the multiplier effect is likely to be high, the elasticity of supplies in response to price increases and pressure of demand is likely to be low. Immobility of resources between sectors very often creates supply bottlenecks.

In case a LDC, economy is in the grip of a combination of high multiplier, low elasticity of supply and immobility of resources, deficit financing of public investment is particularly dangerous, at least until these characteristics have been modified prior to, or simultaneous with, the deficit financed expenditure.

In certain cases, as has been pointed out by Rao (1953) and Brahmananda (1980), deficit financing in a country like India can, no doubt, be a useful instrument for better utilizing the unused and underutilised resources in the economy. If idle resources including idle manpower are brought into productive uses, deficit financing may provide opportunities for gainful employment.

But the success of deficit financing in mobilising surplus labour for capital formation depends upon the proper availability of food supply or provision for adequate food security (so as to contain the rise in prices of foodgrains) for the unproductive dependents on the labourers migrating from agriculture to industry and construction activities, and also upon the availability of capital equipment to work with.

If deficit financing encourages mild inflation or functional price rise, or slow but steady rise in price level, it can contribute to economic growth. But steps should be taken to guard against chronic inflation that may be the outcome of structural and institutional constraints when deficit financing on a massive scale is taken recourse to.

Usually, functional price rise helps the proper functioning of the economy in so far as it enables the entrepreneurs or investors to make fair anticipatory calculation about the future price movement and accordingly adjust their investment behaviour.

Deficit financing may also encourage the banking sector to enhance their advances and also to increase their deposits. Other financial intermediaries also may become active in their activities. This would enhance the circulation of money. This may also have an impact on foreign trade. A rise in prices in the domestic market may induce the potential exporters to sell off their goods within the economy instead of waiting for exports.

The expansion of the export market may thus be affected since the domestic market becomes the source of profits. But this may be the case provided there is domestic demand for the goods which could otherwise be exported. The initial effect on exports here arises from increased demand induced by deficit finance, and from the relenting rise in prices relative to those in competing or importing countries.

But even if there is no diversion of products from the export market to the domestic market inflationary price increases tend to be transmitted to the export sector mainly through adjustment of wages to a higher cost of living, and the increase in wage-cost discourages export.

Inflation may, however, be self-destroying even in a situation of monetary expansion induced by deficit financing when the completion of deficit-financed investment projects would, after a time gap, lead to a rise in the output and supply of wage-goods. This self-liquidating inflation may also follow from the Keynesian hypothesis of the stability of consumption function.

So long as the people receiving extra money income coming through monetary expansion continue to save and spend this extra income in certain stable proportions, and in addition, so long as marginal propensity to consume remains less than unity, this extra money income ultimately tends forwards a stable equilibrium level. But things may also move otherwise.

If in a situation of demand-induced inflation as a monetary phenomenon, there is a growing anticipation that the prices will keep on rising still further with added momentum, that may force the income-earners to dissave and to store up the necessities for life. Here, the marginal propensity to consume may be equal to unity or even greater than unity thereby invalidating the Keynesian hypothesis of long-run stability of money-income growth.

Safe Limits of Deficit Financing:

There is, of course no denying the fact that the process of deficit financing, if carried on judiciously within its safe limit and hence with due care and prudence, can play an important role in the process of economic development. The question of safe limit to deficit financing is an issue as to how far the economy can safely bear the impact of deficit financing. The safe limit is related to the extent of un-utilised capacity in the economy.

Un-utilised capacity may exist in both the developed and the less developed economies. But while deficit financing in a developed economy may be helpful to bring into use the un-utilised productive resources, thereby contributing to an increase in real national income, in a less developed economy, the inter- sectoral resource immobility, market imperfections, supply inelasticity and institutional constraints may actually create a situation where too much money chases too few goods.

The safe upper limit to deficit financing is also related to the balance of trade situation, the investment trend and the extent to which people prefer to hold their savings in the form of cash balances. If deficit financing can bring the un-utilised resources into use for raising the supply elasticity of exportable goods in the event of a deficit in the balance of trade, and if the investment trend in both the public and the private sector is conducive to the promotion of investment in the export sector, the situation would act as a cushion against an increased money supply.

So long as the deficit-finance-induced inflation is relatively mild, the price rise may well serve to increase the profits of the industrial and mercantile classes, and by so doing increase their savings. If the entrepreneurs hoard this cash, or pay off past bank loans, or buy Government bonds, the inflation tends to taper off very quickly, and it induces the required saving for investment.

Deficit financing in that case will be within safe limit. But if, as it is equally likely, this group spends their funds without caring for bringing idle resources into productive use, they feed the inflation. The policy of the Government should in that case aim at tapping & profits and the cash balances of the industrial and mercantile classes to bring it into productive use.

In order that financing of deficit may not lead to galloping inflation, a set of policy prescriptions may be considered:

(1) Most of the investments arising out of deficit financing should be made on productive projects with short gestation lag.

(2) There should be increased emphasis on raising the supply of food and essential consumption goods or wage goods when deficit financing is to be undertaken in our country.

(3) Deficit financing should be spread over for moderately short period of time, and precautionary steps should be taken to remove the bottlenecks connected with technical skill, capital equipment, strategic raw materials, foreign exchange reserve and transport, etc.

(4) Mobility of resources should be encouraged by the Government, and for this purpose, incentive measures should be undertaken.

(5) Doses of deficit financing should not be abruptly high, and adequate monetary, fiscal and physical anti-inflationary measures are to be properly pressed into service.

The alternatives to deficit financing open to India for raising the required resources to finance development are either to rely more on taxation or to seek more foreign aid. None of these alternatives can be or should be pursued to the extremes but these are different issues.