The below mentioned article provides short notes on the Effect of Shift in Aggregate Demand.

We may now examine the effects of a shift in aggregate demand curve due to any change in government policy such as an unexpected increase in the money supply by the central bank.

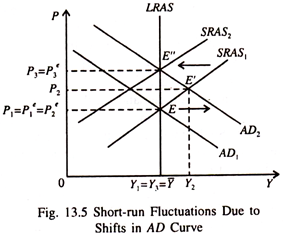

In the short run as the economy moves from point E to E’ in Fig. 13.5, the general price level rises from P1 to P2.

Since this price rise was unexpected, the expected price level remains unchanged at Pe2, and output rises temporarily from its natural rate from Y1, to Y2 as the economy moves along the short-run AS curve. This means that actual output goes above the natural rate. Thus the unanticipated increase in aggregate demand enables the economy to prosper.

ADVERTISEMENTS:

However, the prosperity is of a short- term nature. In the long run, the expected price level rises enough (to Pe3) to be equated to actual price level. This causes the short- run aggregate supply curve to shift upward.

As the expected price level rises from Pe2 to Pe3, the economy moves from point E’ to E”. The actual price level rises from P2 to P3 causing output to fall from Y2 to Y3. Thus in the long run increase in price level from P1 to P3 far exceeds the price rise from P1 to P2 in the short run. This means that as the economy returns to a new long-run equilibrium point E”, output returns to its natural level — but at a much higher price level.

Thus we see that money has a neutral effect on the economy in the long run (as is shown by the movement from E to E”). Monetary expansion increases only the price level,’ but not output. However, in the short run, an increase in money supply leads to a rise in the general price level (as is shown by the movement from E to E”).

ADVERTISEMENTS:

Thus there is no contradiction between the short- run and long-run effects of monetary expansion due to adjustment of expectations about the general price level.