Meaning:

We all are familiar with the term ‘Profit’. It is quite a common-place word, but different people use it in different senses.

In Economics, however, the term has a precise meaning. Profit may be defined as the net income of a business after all the other costs—rent, wages and interest etc., have been deducted from the total income.

Profits are, therefore, uncertain and vary from person to person and from firm to firm. They may become zero, when costs are equal to income, and if the costs are higher, profits may actually be converted into loss.

ADVERTISEMENTS:

Entrepreneur’s Reward:

Pure profit is the reward of entrepreneurial functions. It is what an entrepreneur gets purely as an entrepreneur. What he gets as a landlord, manager or capitalist is deducted from the total profits. Hence, Pure Profit is an amount which accrues to the entrepreneur for assuming the risk inseparable from business.

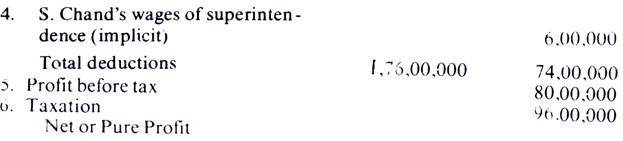

It is a reward for assuming the final responsibility, a responsibility which cannot be shifted to anybody else. A practical example will show how profits are calculated. Let us suppose that Mr. S. Chand starts a bookshop with a capital of Rs. 1, 00,000. We further assume that the premises belong to him and his nephew works for him without receiving any wages.

The following balance sheet shows income, expenses and profits of the business for one year:

The above account shows the nature of profits. The meaning of gross profits too is clear. There are factors for which S. Chand does not pay. They belong to him, but ordinarily they could not have been obtained without payment. Therefore, these payments, though implicit, must be deducted to find out the net or pure profit of the business.

True Profit is thus a Residual Element:

Profit is arrived at after the other three factors of production have received their remunerations out of national income. If may become zero or even negative temporarily. But, in the long run, it must be positive, for otherwise the entrepreneur will give up his independent activity and take to service for wages.

ADVERTISEMENTS:

Gross and Net Profits:

We are now in a position to analyse gross profits.

They are the difference between total sale proceeds and total expenses over a year and include the following besides net profit:

(a) Rent of the employer’s land or premises:

Had similar premises been taken on rent, the amount would have been added to costs. An equal figure should be deducted from gross profits to find out net profit.

(b) Interest on entrepreneur’s capital:

The interest on borrowed capital is usually deducted before profits are worked out. Hence the interest which the owner’s own capital would have earned elsewhere should be taken out before we can determine net profits.

(c) Wages of management:

The entrepreneur may be himself providing the services of management. If he had been employed elsewhere he would have earned some wages. An equal amount has; therefore, to be deducted before net profits can be discovered.

ADVERTISEMENTS:

(d) Maintenance charges:

It is but reasonable that capital should be maintained intact. Worn-out pieces should be replaced at the proper time. To do this, it is necessary to maintain a depreciation fund. All expenses for this purpose should be deducted out of gross profits. If this is not done, profits will appear to be large for a few years but one day the business will fail, because no funds will be available to replace fixed assets like machinery.

(e) Net Profits:

If we deduct from gross profits the above items, we shall get pure or net profits. The entrepreneur is entitled to the following different kinds of payments which form a part of his net profits.

ADVERTISEMENTS:

Reward for risk-taking:

Every business faces some risk of loss. But the risk of loss from market-fluctuations has to be borne by the entrepreneur himself, and he will shoulder it only when he has hopes to be paid for it.

Reward due to a monopolistic position:

A particular entrepreneur may earn extra income due to his control in the market over the entire supply of the commodity he produces.

ADVERTISEMENTS:

Reward for better bargaining:

If a business man is skillful in making bargains, he earns more.

Windfalls:

A sudden change in market conditions may bring in a large gain just by chance. For instance, manufacturers of arms and ammunitions may earn much, if war breaks out.

Theories of Profit:

Several theories have been put forward by way of explanation of profit Let us examine some of tin well-known among them.

ADVERTISEMENTS:

Runt Theory of Profit:

The Rent Theory of Profit was propounded by an American economist F.A. Walker. He was the first to introduce a distinction between a capitalist and an entrepreneur into English economic theory. An entrepreneur need not be a capitalist. He is a person who may undertake a business without using any of his own capital.

Rent of Ability:

Walker regards i profit as rent of ability. Just as there are different grades of land, there are different grades of entrepreneurs. The least efficient entrepreneur, who must remain in the field of production to meet the current demand, just recovers his cost of production and nothing besides.

Above him are entrepreneurs of superior ability. Just as rent arises because of the differential advantage enjoyed by superior land over the marginal land, similarly profit also is the reward for differential ability of the entrepreneur over the marginal entrepreneur or the no-profit entrepreneur.

Profit is thus like rent and, like rent it does not enter into price. Wages of management are not profit. The marginal employer only earns the wages of management, and no more. With a slight unfavorable turn of prices or costs, he would prefer to work as an employee rather than as an employer. Wages of management thus must be paid to keep up the given supply of entrepreneurs. Such wages thus enter into price.

ADVERTISEMENTS:

Criticism:

This theory has the same weakness as Ricardo’s theory of rent:

(i) The employer, who will leave the business with a slight unfavorable turn of events, is not necessarily the least efficient. He may be higher up in the scale and may be attracted by more profitable alternative employments.

(ii) The theory, moreover, does not explain the real nature of profits; it merely provides at best a measure of profits.

(iii) Also, it is wrong to say that profits Jo not enter into price. They may not enter into price in the short period but they must do so in the long run. Unless the price of the commodity he sells is high enough to compensate the entrepreneur by ensuring the payment of normal profit, he will quit the business. In this way, the supply of the commodity will decrease and its price rise to include normal profit. Hence profit enters into price in the long run.

(iv) Finally, the theory fails to explain the size of the profit. The profit arises from scarcity of employers and the theory of profits must explain the cause of this scarcity.

ADVERTISEMENTS:

There is no doubt that there is differential element in profit ‘superior entrepreneurs earning higher profit. But the analogy ends here. There can be no-rent land but there cannot any no-profit employer. If he does not get profit in the long run, he will join the ranks of salaried employees.

Nevertheless profit does container element of rent because of differences in the ability of the entrepreneurs. But it is not entirely of the nature of rent.

Dynamic Theory:

This theory is associated with the name of J. B. Clark, who is of the opinion that there can be no profit the static world where size and composition of the population, the .number and variety of human tastes and desires, techniques of production, technical knowledge, commercial organisation, etc. remain constant. In a world like this, everything is known and is knowable and can be accurately foreseen. There is no risk, and hence no .profit Costs and selling price are always equal, and there can be no profit beyond wages for the routine work of supervision.

But we are not living in a stationary state. Ours is a dynamic world and some changes are constantly taking place. The clever entrepreneur foresees these changes. He is a pioneer. Somehow by invention or otherwise, he lower his cost of production and makes profits.

The changing world offers limitless opportunities to the far-sighted, daring and clever entrepreneurs to make profits by turning the facts of the situation in their favour. It is only because the world is dynamic that it is possible for them to keep the lead and reap the profits. In a static state, profits will disappear, and the entrepreneurs will only earn wages of management.

ADVERTISEMENTS:

Criticism:

Prof. Knight, however, is of the opinion that only those changes which cannot be foreseen and which cannot be provided for in advance will yield profits and not others. He says, “It cannot, then, be change, which is the cause of profit, since if the law of change is known as in fact is largely the case, no profits can arise. Change may cause a situation out of which profit will be made, if it brings about ignorance of the future”. Thus, it is the ignorance of the future or uncertainty, and not necessarily change, which, according to Knight, is the cause of profit.

Reward for Risk-bearing:

Most people do worry about the risk which makes them hesitate to take a plunge in business. The greater the risk, the higher must be the expected gain in order to induce them to start the business. All businesses are more or less speculative, and unless the risk-taker is going to be amply rewarded, business will not be started.

As risk acts as a great deterrent, the supply of entrepreneurs is kept down, and those who do take the risk earn much more than the normal return on capital. Hence profits are regarded as a reward for risk-taking or risk-bearing. The theory of profit is associated with F. B. Hawley’s name. He says, profit is the reward for risks and responsibilities that the undertaker…. subjects himself to.

Drucker mentions four kinds of risks: replacement, risk proper, uncertainty and obsolescence. Replacement, generally known as depreciation, is calculable and is counted as a cost. Obsolescence is the least calculable but is also an item in the costs. Risk proper (i.e., risk of marketability of the product) and uncertainty are not costs in the conventional sense, but are charges against profits:

They may be called costs of staying in business. Physical risks like fire accident, etc., can be provided against by insurance, and are, therefore, and included in costs. There are, however, risks that cannot be foreseen, and hence cannot be provided against. It is for undertaking these risks that an entrepreneur is rewarded.

Criticism:

However, there is the view that though profits do contain some remuneration for risk-taking, the high profits made by the entrepreneur cannot in their entirety be attributed to the element of risk. They are not, at any rate, in proportion to the risks undertaken. On the contrary, it is pointed out by Carver that profits arise not because risks are borne, but because the superior entrepreneurs are able to reduce them.

We might say—though it may seem paradoxical—that profits are made not because risks are borne but because they are avoided. Still it cannot be denied that great deals of pure profits are the reward for risk-bearing.

Reward for Uncertainty-bearing:

According to Prof. Knight, it is uncertainty-bearing rather than risk-taking which is the special function of the entrepreneur and leads to profit. We have seen that there are certain risks which are foreseen and provided against. Risks of death and of accident like fire and ship sinkings are statistically determinable.

Their incidence is measurable. The insurance companies undertake these risks in return for premia paid to them. The payments of these premia are included in the cost of production. The entrepreneur gets no profits on account of these risks. Hence risk-taking is not the function of the entrepreneur but of insurance companies.

But the genuine economic risks, e.g., risks of the marketability of the product due to shifts in demand, are unforeseen and unpredictable. Knight will not call them risks but uncertainty. The term ‘risk’ is applied to those dangers which can be known and foreseen. The entrepreneur gets remuneration for bearing uncertainties (unforeseeable risks) and nothing for the risks which have been foreseen, the incidence of which is on insurance companies.

Just as waiting (capital) is a factor of production, uncertainty-bearing has also been given the status of a factor of production. Like other factors of production, uncertainty-bearing has a supply price, i.e., unless a certain return is expected, no entrepreneur will be induced to face the uncertainty.

The supply of this factor, uncertainty-bearing, depends on the temperament of the entrepreneur, the total resources at his command and the proportion of these resources which he is inclined to expose to uncertainty.

A rich entrepreneur of a bold and venturesome spirit, who has made up his mind to invest a big proportion of his wealth, can bear greater uncertainty. A greater gain is necessary to induce an entrepreneur to expose a larger proportion of his capital than when only a small proportion is risked.

It must be borne in mind that it is the combination of uncertainty-bearing and capital which brings a reward to the entrepreneur in the form of handsome profits. Capital alone by itself is inert and lifeless, and uncertainty-bearing without capital has no meaning. It is only capital which can be exposed to risk. And this combination is a rare one. An entrepreneur of a speculative turn of mind may have little capital at his command. On the other hand, there may be an extraordinarily rich man but he may be timid.

Criticism:

The theory of uncertainty-bearing, as a cause of profit, has been criticised on the following grounds:

(a) Uncertainty is not the only factor that limits the supply of entrepreneurs. Lack of funds, lack of knowledge, lack of opportunities and the presence of economic friction are some of the factors that restrict the supply of entrepreneurs.

(b) Uncertainty-bearing is not the sole function of the entrepreneur. The profit that he gets is also the reward for other services that he renders, e.g., initiating, coordinating, and bargaining.

(c) Uncertainty-bearing cannot be elevated to the status of a factor of production. It is an element of real costs which means exertion, abstinence, sacrifice, etc., as distinguished from money cost. Cost is not generally measured in terms of real cost. We know that capital is a factor of production but not abstinence that is needed to have capital.

Innovations Theory:

It is the dynamic changes which give rise to profits according to the dynamic theory of profits. American economist Joseph Schumpeter has singled out for special treatment the par; played by innovations. The daring and the dynamic entrepreneurs continue to hit at one innovation or another, keeping their business ahead of others and thus making handsome profits.

According to Schumpeter, the principal function of the entrepreneur is to make innovations and profits are a reward for successful innovations. To Schumpeter, the principle function of the entrepreneur is to make innovations and profits are a reward for performing this important function.

Schumpeter has given the term ‘innovation’ very wide meaning. Discovery of a new material or a new technique of production resulting in a lowering of the cost of production or improving the quality of the product is an innovation. Any new measure or new policy initiated by the entrepreneur comes under innovation in the sense in which Schumpeter uses the term.

Innovations may be of two types:

(a) Those which change the production function and reduce the cost of production, and

(b) Those innovations which stimulate the demand for the product, i.e., which change the demand or utility function.

In the first type are included the introduction of new machinery, improved production techniques or processes, exploitation of a new source of raw material or a new and better organisational pattern for the firm.

The second type of innovations are those which are calculated to increase the demand for the product by introducing a new product or a new variety of an old product, new and more effective mode of advertisement, discovery of new markets, etc.

Success of any of these innovations brings a handsome increase in profits. Profits increase because either the cost of production is lowered or the product fetches a higher price. It may be pointed out, however, that profits owing to innovations are only temporary and tend to be competed away. Sooner the innovations come to be innovations the rivals, they cease to be innovations or lose their novelty.

Only when the innovation is dot patented can the originating entrepreneur continue to make innovations and enjoy the profits world and a progressive economy h superior entrepreneur continue to make innovations and enjoy the profits thereof. As Stigler observes “these profits may exist for a considerable time because of the ignorance of other firms of their (innovations) existence or because of the time required for the entry of new firms. More important, the successful innovator can continuously seek new disequilibrium profits since the horizon of conceivable innovations is unlimited.”

We may also remember that profits are both the cause and effect of innovations. Profits serve as a necessary incentive for making innovations; hence profits are a cause of innovations. But since innovations result in profits, profits are also the effect of innovations.

Criticism:

Schumpeter’s innovation theory can be criticised on the same ground as Clark’s dynamic theory:

(a) Schumpeter also like Clark ignores uncertainty as a source of profit.

(b) He also denies that risk-bearing plays any role in the determination of profit.

Monopoly and profit:

The monopolist is able to control output so that the price is not allowed to fall to the level of cost, as is the case under competition. By restricting entry of new firms into business by means of agreements and through the use of patent rights and similar devices, monopolists are able to reap monopoly profits. But the most common source of monopoly profit lies in monopolistic competition or product differentiation

An element of monopoly profit cap also be traced in what have been called innovation profit or pioneering profit. A firm which produces a new product, or is able to discover a new material or a cheap process or a new market, will always be able to make extra gains, till its rivals make an inroad into its business. The ability of the monopolist to enjoy monopoly power and make profit depends ultimately on the restrictions they are able to impose on the entry of the new firms.

Conclusion on Theories of Profits:

We have discussed abovethe various theories of profit the question arises which theory shall we accept’.’How does protitarise? Here we are thinking of not gross profits but net profit… The fact is that, in the real world, there are several causes which give rise to profit, but the principal cause is uncertainty. It is uncertainty which is the basic cause of profit.

This uncertainty is due to the dynamic nature of the world. In this real world of ours, some or the other change is always taking place. No entrepreneur can foresee all these changes nor are the circumstances under his control.

That the world is dynamic is due to two sets of factors:

(a) internal and

(b) external

In other words, there are certain changes which the entrepreneur himself brings about, such as innovation, and there are other changes which are brought about by external forces.

The external changes are of two kinds:

(a) Regular changes, like trade fluctuations, which affect all profits and

(b) Irregular changes, such as breaking out of fire, earthquake, floods, strikes, change in tastes, changes due to government policies, war, etc.

Thus, profit irises on account of the occurrence of changes in the economy. In the static world, there is no change, hence no profit in an economy where nothing changes, there can be no profit. But only such changes are the causes of profit-as cannot be foreseen, as we have read in Knight’s theory. However, in a static world, profit can arise in one way, i.e., owing to monopoly. The monopoly profit arises in the dynamic world also. Besides monopoly, profit arises also from any other position of advantage.

In short, we can say that there are two main sources of profits:

(a) Uncertainty, and

(b) Position of special advantage, monopoly or otherwise.

Thus, there is no single theory which will explain profit but a synthesis of all the theories mentioned above. Profit is a reward for the services of the entrepreneur. The supply of the entrepreneurial ability is limited, whereas the demand for their services is very great. The rate of profit, at any given moment, will depend on the interaction of demand and supply of entrepreneurial ability for risking capital and, in the long run, it must be such as to call forth and maintain the supply of entrepreneurial services.

Why Profits Vary:

The main reason of inequality in profits lies in the differences in the ability of entrepreneurs. Ability is mainly God-given. Some persons can make better bargains, others are better organizers, still others are better judges of men, and so forth. It is this reason which mainly causes differences in profits.

There are a few other reasons too. For instance, one person may have enough capital to finance a business, another may not. Again, one entrepreneur may have at his disposal some business secrets which are not available to his rivals. He would then be in a position to earn larger profits.

Will Profits Fall to Zero?

It may be mentioned in the end that profits tend to decline due to competition but they will never become zero, as otherwise all enterprise would end.