In this article we will discuss about the quasi-rent by Marshall.

Sometimes it is observed that the price-elasticity of supply (e) of an input is less than infinity (0 < e < ∞) in the short run, but in the long run, its supply becomes perfectly elastic (e = ∞) and that is why the input is able to earn economic rent only in the short run—it cannot earn rent in the long run.

The rent that such an input earns only in the short run, has been named quasi-rent by Marshall. Marshall has said that generally, man-made machines and appliances are the inputs that are able to earn quasi-rent. Following Marshall, we may explain the concept of quasi-rent in this way.

We shall designate the fixed inputs used by a competitive firm as the firm’s “plant”. In the short run, the supply of plants is completely inelastic. That is why the number of firms in the industry remains unchanged in the short run.

ADVERTISEMENTS:

The firm would continue the production of its output in the short run so long as its revenue is at least equal to its variable cost. That is, in the short run, at any given price of the good, the firm would produce the profit-maximising or loss-minimising output for which it has TR ≥ TVC, or, AR (= p) ≥ AVC.

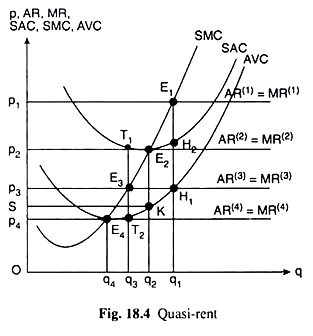

For example, in Fig. 18.4, the firm may produce the output q4 at the price p4, because, at the point E4(p4, q4), it has AR (= E4q4) = AVC (= E4q4), or, the firm may produce the output q3 at the price p3, because at the point E3(p3, q3), it has AR (= E3q3) ≥ AVC (=T2q3). Similarly, at p = p2 or p1, the firm may produce the outputs q2 or q1, because at the points E2(p2, q2) or E,(p1, q1), it has AR ≥ AVC, or, TR ≥ TVC.

Now, at the point E4(p4, q4), the firm has AR = AVC, or, TR = TVC. Here the revenue that the firm earns is the income of the variable factors, because all the revenue is used to meet the variable costs, and nothing is left for the plant.

That is, the plant earns a zero income, and here the firm’s negative pure profit is TR – TC = TVC – TVC – TFC = – TFC (TR = TVC). Yet the firm would continue to use the plant since its TR is not less than TVC, or, AR not less than AVC.

ADVERTISEMENTS:

It follows from above that the supply of plant in a competitive industry would remain unchanged in the short run even if a plant earns a zero income, i.e., it follows that, in the short run, the minimum supply price of the plant is equal to zero.

In other words, the supply of plant in the short run is completely inelastic (e = 0). Therefore, at p = p4 and q = q4, the plant’s income is zero and its minimum supply price is zero, and so, the amount of rent it is able to earn at p = p4 is also zero.

Let us now see what is obtained when the price is larger than p4 and smaller than the breakeven price p2, say when p = p3. At p = p3, the firm’s AR > AVC or TR > TVC. Here the difference between TR and TVC is E3T2 x q3. This is the amount that is available as the income of the plant, and all this income is the plant’s economic rent (quasi-rent) since its minimum supply price is zero.

Here, since the surplus of TR over TVC, or, quasi-rent of the plant, is less than the TFC (= T1T2 x q3) of the plant, we may say that the rent that the plant obtains here is positive but ‘abnormally low’ since it does not cover the firm’s TFC.

ADVERTISEMENTS:

We may now see what happens if price is larger than p3 and it is equal to the break-even price p2. At p = p2, the firm’s surplus of TR over TVC is E2K x q2 which is the quasi-rent of the plant and which is equal to the firm’s TFC.

Since here the rent covers the whole of the TFC of the plant, the rent here may be considered as ‘normal’. Here, since the rent of the plant is just equal to TFC, the firm’s pure profit increases from negative to zero. In other words, the firm now is able to earn just the normal profit.

Lastly, let us see what is obtained if the price of the good is greater than the break-even price, p2. Let us suppose the price is p1. At this price, the surplus of TR over TVC is equal to E1H1 x q, which is now the quasi-rent that the plant can earn in the short run.

Since the amount of rent now is even greater than TFC by the amount E1H1 x q1, we may consider that rent of the plant now is ‘super-normally high’, for it is greater than what the firm needs to bear the plant’s TFC. The firm now is able to earn supernormal profits or, a positive pure profit which is equal to the difference, E1H2 x q1, between the amount of quasi-rent and TFC.

In the above analysis, we have elaborated on Marshall’s concept of quasi-rent which is earned by the competitive firm’s plant in the short run. In the long run, however, the plant cannot earn any rent, because, now its supply is perfectly elastic (e = ∞) In the long run, the firm can adjust the size of its plant in accordance with its needs, and new firms with new plants may join the industry.

Since the supply of plant is perfectly elastic, more and more of it now can be obtained at its fixed minimum supply price, i.e., unlike in the short run, in the long run, the minimum supply price of the plant is not zero, it is something positive and constant.

Given all these, if the firms happen to earn more than normal profit in the short run and the plants earn super-normally high quasi-rent, the number of firms would increase in the long run. As a result, supply of the good would increase and its price would decrease. This process would go on till the price decreases to such a level that the TR and TC of the firm would become equal and the firm would earn only normal profit.

Once this point is reached the firms (and the industry) will be in long-run equilibrium at the minimum point of their LAC curves. But in the long run, the firm’s total cost means total variable cost which includes the cost of all the inputs including that of the plant.

ADVERTISEMENTS:

Therefore, in the long run, there is no surplus of TR over TVC, i.e., there is no rent, nor is there any input with perfectly inelastic supply (like the plant in the short run).

We may also consider the point from the point of view of the plant of the firm. Since the plant is a variable input in the long run and its supply is perfectly elastic, the minimum supply price of the plant is a positive constant.

Therefore, if in the long run, the size of a firm’s plant increases, or, the number of plants in the industry increases along with the number of firms, each unit of plant gets a price which is equal to its minimum supply price, and, therefore, rent earned by each unit of plant is zero, i.e., now the input “plant” cannot earn any rent.

On the other hand, if the quasi-rent of the plant in the short run is less than the TFC, the firm earns less than normal profit. In the long run, therefore, the firms would be leaving the industry.

ADVERTISEMENTS:

As a result, the supply of the good will fall and the price will rise. This process would continue till the price rises to such a level that the existing firms would be able to have TR = TVC (= TC), i.e., they would be able to earn the normal profit.

Once this point is reached the firms (and the industry) will be in long run equilibrium at the minimum points of their LAC curves. Since there is no surplus of TR over TVC, rent does not emerge in the long run and also there is no input with completely inelastic supply.