Read this article to learn about the matrix approach, importance and considerations in developing economies of social accounting of national income.

Matrix Approach to Social Accounting:

When we speak of national accounts, we always imagine receipts (income) and payments (expenditure).

National income data can either be presented in the familiar way of accounting known as the double entry system or it can be presented in the form of a matrix.

The matrix presents figures of aggregate economic activities of a country in an organised and tabular form. It is a rectangular arrangement of data in rows and columns.

ADVERTISEMENTS:

The first step in the presentation and preparation of such accounts is to classify ‘transactions’ into two groups, called ‘sectors’, which may be called ‘firms’ and ‘households’; corresponding to the activities of ‘production’ and ‘consumption’. All persons concerned with production must also be consumers, though the reverse may not be true. ‘Firms’ are all organizations using the services of factors of production for producing goods and services. Households’ are all persons or groups of persons—wage earners, salary earners, businessmen, property owners receiving payment for services rendered by them to firms.

The figures, however, can be arranged in various ways. The term ‘accounts’ implies an organized arrangement of figures relating to economic activity of a given region. One popular set up, in which transactions of an economy can be neatly represented is called a matrix—a rectangular arrangement of numbers and symbols.

A matrix consists of a set of rows and columns of figures, each row in the type of ‘matrix’ used for social accounts contains the receipts of one sector and each column contains the payments of one sector, so that each sector has one row and one column, and the payments from one sector to another are shown in the space where the column of one and the row of the other cross one another.

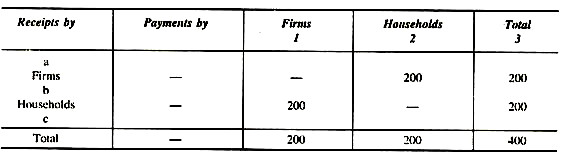

A very simple matrix should look like this:

ADVERTISEMENTS:

Matrix I

This matrix attempts to state an ordinary but vital fact that, in a self-contained economy in which all goods produced were simultaneously consumed, total payments by ‘households’ on the purchase of goods (called expenditure) would equal total receipts by firms in respect of the sale of goods and that total payments by firms to households in respect of the purchase of services of factors of production, which include profits, would equal total receipts by households in respect of the sale of these services (called income).

It also shows that the total expenditure would equal total income. Thus, numerical values of total ‘income’, total ‘product’ and total ‘expenditure’ are equal. In fact, each of these is so defined in national income studies that we really have not three different entitles of the same size but three different names for the same numerical magnitude, though distinction has relevance in relation to forecasts.

ADVERTISEMENTS:

The first step in the development of more complex matrix is taken the moment we bring in the fact that part of the output of firms, in the creation of which incomes are paid to owners of factors of production, will normally not be sold as consumption goods but will be acquired by other firms or retained by the same firms.

This may include both stocks of raw materials and capital equipment, work-in-progress and finished goods held by firms.

From the matrix it is clear that the two sectors are interdependent. The matrix form emphasises the equality between the income of one sector and the expenditure of the other provided the economy is entirely self-sufficient.

The most important advantage of using the matrix form of social accounting is that it is both brief and clear and gives at a glance the entire picture of the economic activities being performed. On the other hand, the double entry system used in accounting provides a double check on the data and may, therefore, be more accurate than the matrix form. In actual practice whether we use the matrix form or the double entry form will depend on the purpose for which the accounts are being compiled.

It is quite possible that the entire product of firms may not be sold or used as consumption goods.

It may be that part of it will be retained either as capital equipment or as stocks of raw materials and semi-finished goods. The value of this part of the aggregate product would, strictly speaking, form part of investment. Therefore, the total output will be equal to consumption goods plus investment(Y = C + I).

We can introduce investment and saving into the matrix form by showing in the firms sector payments to factors in excess of expenditure on consumption goods by household sector. Similarly, in the household sector the receipts in excess of expenditure will be equal to the savings.

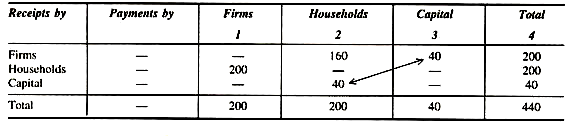

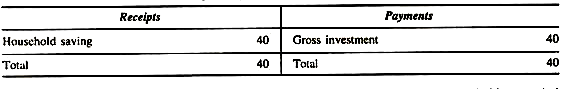

It means that a new row and a new column will have to be added to indicate investment as follows:

Matrix II

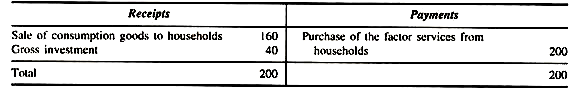

Firms

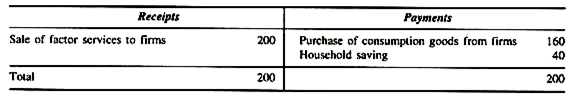

Households

ADVERTISEMENTS:

Capital (Saving-Investment):

This matrix shows the amount of saving by households as a payment from households to capital and this amount equals the payment by capital to firms for investment. This process of financial investment is called the ‘capital account’. This account can be more detailed in order to compute the sources of saving and the pattern of allocation of investment in different sectors of the economy.

The capital account does not stand for a particular sector of the economy, but it would be possible to have a capital row and a capital column for each sector. The total spending on C and I in the above matrix is 200 and it is called gross expenditure which is equal to gross income. The figure 40 represents and ‘addition to wealth’ which may be used for fixed capital or working capital.

ADVERTISEMENTS:

Importance of Social Accounting:

1. One great use of the system of social accounts is to help to build up a general picture of an economic system enabling us to understand how and why it functions in the way it does. The increase or decrease in various sector magnitudes shows not only the rise and fall in the individual sectors but also in the entire economic system. These accounts show clearly the rate of growth, imbalances, if any, which could be set right. These social accounts classify and summarize in a purposeful way the various transactions that take place in the economy.

2. Basically, these accounts provide detailed information concerning the performance of an economy, as the economy becomes more complex, the necessity for complete and accurate information becomes very important. From these accounts important aggregates concerning national product, income, consumption, investment, saving, exports, imports, taxes and government expenditure can be easily derived.

3. The government sector account and the rest of the world or foreign sector account enable us to have complete picture of the entire taxation and expenditure structure of the economy, including the problems relating to balance of payments and international trade, which can be thoroughly analysed and investigated on the basis of information provided by these sector accounts.

4. Social accounting throws light on certain basic features in the economic environment which may change rapidly. The analysis of economic fluctuations and the forecasting of the future level of income or activity can be attempted in a clear and scientific manner with the help of these accounts.

5. It is, however, in the field to public policy that social accounting acts as an important tool and the techniques of social accounting and their applications are discussed and developed. According to the National Accounts Review Committee of the National Bureau of Economic Research, “National social accounting system is one of the chief tools for the formulation of government economic policy and of business policy”.

ADVERTISEMENTS:

According to Richard and Stone, “Social accounting is concerned with a comprehensive, orderly, consistent presentation of the facts of economic life, in which the concepts, definitions and classifications adopted lend themselves to actual measurement and within this limitation, correspond to those which appear in economic theory and so can be used for economic analysis.”

It is true, that the use of national income and social accounts is still at the experimental stage. Even then, with the current pre-occupation of full employment problems and with the problems of providing aid to poor countries, the interest in social accounting, far from diminishing, is on the increase. In the U.S.A.,these five sector accounts mentioned above are the most widely used to judge the overall performance of the economy.

But simple aggregates used in these accounts are being increasingly supplemented by other forms of social accounting, In any event, the development of the various forms of national income and social accounts must be ranked as one of the most important achievement of economic science within the last three or four decades.

It does not require much foresight to predict, that the next decade or so, will see an even greater intensification in the pace of development in this area. As more and more nations take to various forms of economic planning, accurate and comprehensive system of social accounting will become indispensable.

Not much progress has been made in efforts to construct a comprehensive system of social accounts. That way we measure the nation’s social health in the same way that economic accounts measure the nation’s material health. These accounts measure via a set of social indicators, social progress.

According to ‘Toward A Social Report’—this would require the development of quantitative measures of the factors that help (or hinder) the individual citizen to live a full and healthy life within a decent social and physical environment. Among such factors are health and illness, the expenditures of social mobility, the quality of the physical environment, the extent and incidence of poverty, conditions of public order and safety, the availability of educational and cultural opportunities and the existence and extent of alienation in society.

ADVERTISEMENTS:

Practical difficulties confront everywhere to construct a set of social accounts comparable to economic accounts now in use but these difficulties are not difficult to surmount. What is difficult in social accounts, is the development of a single, unified statistics comparable to GNP that would be a barometer of the nation’s social health.

Considerations of Social Accounting in Developing Economies:

It may be useful to keep in mind special considerations in preparing the social accounts of developing countries. The flow aspect of social accounting defined as systematic records of economic transactions, covers three systems, mainly—“the national income and product accounts”; ‘the How of funds account’; ‘the input-output accounts’. The work done on each of the sector accounts is of a very limited and specific nature. In other words, it is not specially suited and oriented to meet the requirements of developing countries. In this connection, H.T. Oshima’ has pointed out some basic differences in the major analytical requirements of national income accounts prepared in Asia, developed and other developing countries.

The major problem in Western developed country is the cyclical (or secular) tendency of saving to run in excess of investment. Whereas, the main problem in underdeveloped or developing countries is to mobilise potential savings by locating in the economy, various sources of saving, so that the pace of development could get a fillip. Since savings in such economies are less than investment, these accounts are to be so designed that these are able to bring out the current income flows—which go into conspicuous and unproductive consumption. The attempt is to divert these savings into investment channels.

The main institutional difference between the developed and under-developed countries is that, practically, all production is done on factory basis in the former and on the household basis in the latter. Households in poor economies constitute the main decision-making body in the private sector. The household behaviour patterns with regard to labour force participation, consumption, saving etc. are different in the rural and urban areas.

Due to the multiplicity of behaviour patterns, a single consolidated household account fails to provide sufficient and right type of information for many policy decisions. For example, the patterns of consumption show important rural-urban differences both with respect of quality and quantity of commodities consumed. There is difference in the monetized and non-monetized consumption in these countries. Such rural-urban differences exist both with regard to the magnitudes and forms of accumulation for savings.

A good portion of saving is indistinguishable from the physical investment in rural areas. Capital formation in these areas is low and capital consumption is very high. People in rural areas are unaware of the various alternative ways of using their funds, like investment in bonds and shares, in fact, purchase of land, jewellery etc. are the most popular forms of investment. Similarly, there is dualism in financial transactions and the functioning of capital markets, their loan patterns; rate and structure of interest also differ significantly in the organised and un-organised capital markets. The public sector has come to play an important role in these economies and has far-reaching influence on the economic and social activities that are performed.

ADVERTISEMENTS:

The need of the hour is, therefore, to develop an alternative system of social accounting for developing countries and to evolve such social accounting framework for such countries which will suit their institutional structure and accomplish their special requirements of growth. A notable attempt has been made in this direction by United Nations. Three sets of supplementary accounts have been designed to attain this objective. These supplementary accounts relate to special areas—rural and urban, they relate to key kinds of economic activities and also include the transactions of the public sector.