Let us make an in-depth study of the International Monetary Fund (I.M.F):- 1. Introduction to IMF 2. Establishment and Operation I.M.F. 3. Objective of the I.M.F 4. Functions of I.M.F.

Introduction to I.M.F:

The International Monetary Fund (I.M.F.) is an international monetary institution established by 44 nations under the Bretton Woods Agreement of July 1944.

This fund is the creation of two different plans—one prepared by Mr. Keynes, an American author and other by Mr. White, a British author and were named after them as Keynes Plan and White Plan.

The two sets of proposals were subjected to intensive discussion and served as the basis for the Bretton Woods conference.

ADVERTISEMENTS:

The conference decided to set up two organisations:

(i) International Monetary Fund (I.M.F.), and

(ii) International Bank for Reconstruction and Development (I.B.R.D.) popularly known as World Bank.

Establishment and Operation I.M.F.:

The International Monetary Fund was established on 27th December 1945 but it actually started operations from 1st March 1947 and the first transactions were made in May 1947. The funds of the I.M.F. are subscribed to by the member countries. Each member country subscribes to the Fund as per its quota fixed by the I.M.F. at the time of joining the fund. 25% of the quota or 10 per cent of the members holding of the gold and U.S. dollar whichever is less is subscribed to in gold and the remainder in national currency.

ADVERTISEMENTS:

Now, the system of depositing gold as a part of its subscription has been discontinued and the accounts of I.M.F. are kept in S.D.R. (Special Drawing Rights). The fund has 185 member countries, accounting for about 80 per cent of the total world production and 90 per cent of the total world trade.

Objective of the I.M.F.:

The purposes and objectives of the fund has been laid down in Article 1 of the original Articles of Agreement and within the frame work the fund functions.

The objectives are as under:

1. To promote international monetary co-operative through a permanent institution which provides the machinery for consultation and collaboration in international monetary problems?

ADVERTISEMENTS:

2. To facilitate the expansion and balanced growth of international trade and to contribute there by to the promotion and maintenance of high levels of employment and real incomes.

3. To promote exchange stability and orderly exchange arrangements and to avoid competitive devaluation.

4. To help in the establishment of a multilateral system of payments in respect of current transactions between members and in the elimination of foreign exchange restrictions.

5. To provide means for international adjustment, superior to deflation by making available increased international reserves.

6. To lend confidence to members by making the funds resources available to them under adequate safeguards and providing them with opportunity to correct mal-adjustments in their balance of payments.

7. To shorten the duration and lessen the degree of dis-equilibrium in the international balance of payments to members.

Functions of I.M.F.:

The functions of I.M.F. can be discussed under the following three heads:

(i) Regulatory Functions:

In its regulatory aspect

ADVERTISEMENTS:

(a) The I.M.F. administers a code of good behaviour in international payments,

(b) It regulates exchange rate practices, and

(c) It watches international payments.

(ii) Financial Functions:

(a) It offers medium term loans to the national monetary authorities to enable them to make up their balance of payment deficits,

ADVERTISEMENTS:

(b) The I.M.F. resources come from the member countries based on an established quota as fixed by the I.M.F. in terms of S.D.R. (Special Drawing Rights) and members own currencies,

(c) I.M.F. may borrow from its industrial member countries under certain conditions as set forth in the or “General arrangements to borrow”.

(iii) Consultative Functions:

(i) I.M.F. provides a forum for international co-operation,

(ii) It is a source of counsel and technical assistance to its members,

ADVERTISEMENTS:

(iii) Quota is used to determine:

(a) The voting power of members,

(b) Their contribution to fund resources

(c) Their access to these resources and their share in the allocation of S.D.Rs. (Special Drawing Rights).

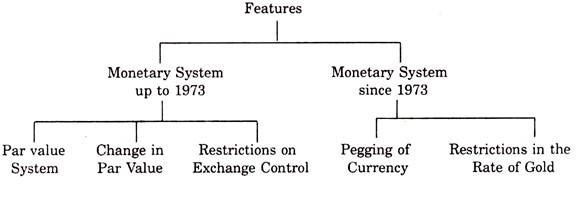

Main Features of International Monetary System:

Monetary System up to 1973:

(1) Par Value System:

ADVERTISEMENTS:

(a) The exchange value of member’s currency was fixed by I.M.F. in terms of gold,

(b) The values of different currencies were fixed in terms of dollars,

(c) Dollars was used as an intervention currency and was as good as gold,

(d) The member countries prefer to keep their reserves with the I.M.F. in dollars rather than gold because dollar reserves earned interest while gold reserve did not.

(2) Change in Par Value:

(a) In order to maintain short-term equilibrium in balance of payment situation, member countries were free to borrow funds from the fund as per rules,

ADVERTISEMENTS:

(b) If the I.M.F. help did not serve the purpose, the member country could be allowed to devalue its currency,

(c) For this purpose there was no need to take permission from the I.M.F. to devalue the currency upto 10 per cent but permission of the devaluation of currency was necessary if the proposed change was more than ten per cent,

(d) It could be allowed provided I.M.F. was to satisfy that:

(i) There was a fundamental dis-equilibrium, and

(ii) the devaluation would be the right remedy in the circumstance for solving the fundamental dis-equilibrium. Fundamental dis-equilibrium has not been defined anywhere but it can be taken as the severe depression abroad with prolonged unemployment at home.

(3) Restriction on Exchange Control:

ADVERTISEMENTS:

There was restriction on exchange control except:

(i) When a member’s currency was under massive attack, and

(ii) When the fund declared certain currency as scarce.

Monetary System Since 1973:

There was a big change in the monetary system in 1973. Since then the system is:

1. Pegging of Currency:

A member can now Peg its currency to:

ADVERTISEMENTS:

(i) Either a single major currency,

(ii) A basket of currencies, or

(iii) Allow it to float independently, or

(iv) Adjust it to a set of indicators.

Thus, there is a complete departure from the Par Value System. It is subject to Sur Vigilance (Vigilant or Watchful).

2. Reduction in the Rate of Gold:

One-third of the gold reserve with I.M.F. was disposed of to create a “TRUST FUND” to provide the additional support to member countries in balancing their balance of payments at concessional terms. S.D.R. (Special Drawing Rights) is now the unit of account for funds transactions.

Assistance Provided By the Fund:

The Fund provides the following assistance to member countries:

1. Reserve Tranches:

If a member country draws up to 25% of its ‘Quota’ it is said that it has utilised its gold tranche or reserve branch. The I.M.F. has no objection on such drawings.

2. Credit Tranches:

(i) Drawing of more than 25% of its Quota (Reserve tranche) is said to be credit tranche,

(ii) A member country can withdraw up to 125% (25% reserve tranche + 100% credit tranche) in four installments of its Quota with the I.M.F.,

(iii) The credit tranches are subject to examination by the Fund,

(iv) The drawings are to be repaid within 3 years,

(v) No interest is charged on first 25% of the Quota but there is service charge,

(vi) Interest beyond 25% is charged with increases with cumulative increase in the drawings.

3. Compensatory Financing:

(i) A member country can also draw up to 100% of its Quota under compensatory financing,

(ii) This facility is designed to extend the support to those member countries producing primary goods and is suffering from fluctuations in receipts from exports.

Conditions of drawing money are:

(a) Export shortfall is a short-term one;

(b) It is largely attributable to circumstances beyond the control of the member;

(c) The member will co-operate with the fund in an effort to solve the balance of payments difficulties;

(d) Request for drawing beyond 50% of Quota are considered only if the fund is satisfied that the member country is co-operating with the fund.

4. Buffer Stock Financing:

This facility is also in addition to those normally available to a member. This facility is designed to finance the member’s contribution to buffer stock arrangements in commodity agreements approved by United Nations. Drawings under this scheme are permitted up to 50 per cent of Quota of the respective country. The member is expected to co-operate with the fund in an effort to solve its balance of payments difficulties.

5. Medium-term Assistance to Member Countries in the Following Special Circumstances of Balance of Payments Difficulties:

(a) Serious payments imbalance due to structural mal-adjustments in production, trade and prices,

(b) Slow growth, and

(c) An inherently weak balance of payments position preventing the pursuit of active development policy.

For this type of help-member is required to submit detailed statement of policies and measures for the first and the subsequent twelve months period. Drawings may be made in installments extending up to years subject to performance clauses relating to implementation of key policy measures.

6. Supplementary Financing Facility:

This is intended to enable the fund to expand its financial assistance to these members that may face payments imbalances that are large in proportion to their economies and Quotas in the fund. This assistance is given only subject to the relevant policies of the fund and performance criteria.

7. Oil Facility:

This facility was extended to members facing balance of payment facilities due to rise in oil prices.

8. Enlarged Access Policy:

Under this scheme a member can borrow 150% of Limited Quota per year or 450% over a period of three years to cumulative use of funds resources to 600% of the Quota (excluding drawing under compensatory buffer stock or outstanding facility under oil facilities).