The five theories of interest are as follows: 1. Productivity Theory 2. Abstinence or Waiting Theory 3. Austrian or Agio Theory 4. Classical or Real Theory 5. Loanable Fund Theory.

1. Productivity Theory:

According to productivity theory, interest can be defined as a reward for availing the services of capital for the production purpose.

Labor that is having good amount of capital produces more as compared to the labor who is not assisted by good amount of capital.

For example, farmer having tractor to plough the field produces more as compared to the farmer who does not have it. Thus, interest is the payment for the productivity of capital.

ADVERTISEMENTS:

However, the productivity theory is criticized on the following grounds:

i. Focuses only on the causes for what the interest is paid, not on the determination of interest rates.

ii. Assumes that interest is paid due to the productivity of capital. In such a case, pure interest should vary as per the productivity of the capital. However, pure interest is the same in money market during the same period of time.

iii. Lays emphasis on the demand of interest, but ignores the supply side of capital.

ADVERTISEMENTS:

iv. Fails to explain how the interest is paid for the loan borrowed for consumption purposes.

2. Abstinence or Waiting Theory:

The abstinence theory was propounded by Senior. According to him, interest is a reward for abstinence. When an individual saves money out of his/her income and lends it to other individual, he/she makes sacrifice. The term sacrifice implies that the individual refrains from consuming his/her whole income that he/she could spent easily. Senior advocated that abstaining from consumption is unpleasant. Therefore, the lender must be rewarded for this. Thus, as per Senior, interest can be regarded as the reward for refraining from the use of capital.

Abstinence theory was also criticized by a number of economists. According to the theory, an individual feels unpleasant when they save as it reduces his/her consumption. However, rich people do not feel unpleasant while saving because they are able to meet their requirements.

Therefore, Marshall has replaced the term abstinence with waiting and described saving in terms of waiting. He states that saving is done by transferring the present requirement to the future and the person needs to wait for meeting those requirements. However, people do not want to wait rather they are motivated to save money by providing a certain amount of interest.

3. Austrian or Agio Theory:

ADVERTISEMENTS:

Austrian theory is also termed as psychological theory of interest. This theory was advocated by John Rae and Bohm Bawerk in an Austrian school. According to Austrian theory, interest came into existence because present goods are preferred over future goods. Therefore, the present goods have premium with them in the form of interest. In other words, present satisfaction is of greater concern as compared to future satisfaction.

Therefore, future satisfaction has certain type of discount if compared with present satisfaction. The interest is the discounted amount that is required to be paid for motivating people to invest or transfer their present requirements to future. For example, an individual has to make a choice between two options.

He/she can either have Rs. 500 now or the same amount after a year. In such a case, he/she would prefer to have Rs. 500 in present. However, in case, the individual has a choice of getting Rs. 500 in present and Rs. 600 after one year.

In such a case, he/she would be more inclined toward getting Rs. 600 after a year. Thus, the extra payment of Rs. 100 would compensate the sacrifice involved in delaying his/her present satisfaction. The extra payment of Rs. 100 in the given case is considered as interest.

Agio theory’ has been criticized by various economists on the following grounds:

i. Lays too much emphasis on the supply aspect and ignores the demand aspect

ii. Does not focus on the determination of rate of interest

4. Classical or Real Theory:

Classical theory helps in the determination of rate of interest with the help of demand and supply forces. Demand refers to the demand of investment and supply refers to the supply of savings. According to this theory, rate of interest refers to the amount paid for saving.

Therefore, the rate of interest can be determined with the help of demand for saving money to be invested in the capital goods and the supply of savings. Let us understand the concept of demand of investment. Capital goods are used for the production of consumer goods and provide returns continuously for many years.

ADVERTISEMENTS:

However, a certain degree of uncertainty is associated with capital goods due to their future use. In addition, operation and maintenance costs are involved in using capital goods. This makes organizations to calculate the net expected return on the marginal cost that is represented as the percentage of cost of capital good.

In case, an organization has similar type of capital goods, then the increase in one more capital good would not yield them high revenue. The increase in the rate of interest would result in the fall of demand of capital goods.

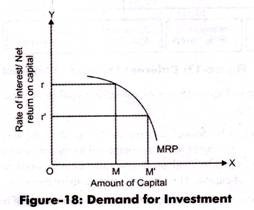

Figure-18 shows the demand for capital investment:

ADVERTISEMENTS:

In Figure-18, MRP represents the marginal revenue productivity curve. When the demand of capital is OM, then the rate of interest is Or. The net rate of return becomes equal to the current rate of interest (Or) at the OM demand of capital.

In case, the rate of interest decreases to Or’, then the demand of capital increases to OM’. The net rate of return is equal to Or’ when the amount of capital demanded is OM’. The demand for capital goods increases with a decrease in the rate of interest.

On the other hand, the supply of capital increases by the amount saved by an individual and the saving is done by transferring the present requirement to the future requirement. The rate of interest would increase with the increase in the amount of saving by an individual.

The rate of interest can be determined with the help of demand of investment and supply of savings. It would be the point of equilibrium where demand and supply intersects each other or get equal.

ADVERTISEMENTS:

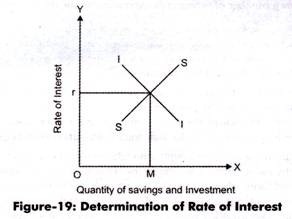

Figure-19 shows the determination of rate of interest with the help of demand and supply curves:

In Figure-19, SS is the supply curve of saving and II is the demand curve of investment that intersect each other at Or rate of interest with quantity of saving and investment is OM. OM represents the amount that is lent, borrowed and used for investment. The rate of interest can be changed by changing the demand and supply of savings and investment.

The classical theory is criticized by Keynes due to various reasons, which are as follows:

i. Assumes the full employment of resources, which is not true in reality. This is because if one resource is reduced from one production process, then it would be utilized for other production process. On the contrary, if resources are available in abundant, then there is no need to save them.

ii. Assumes that investment can be increased only when individuals reduce their consumption. This is because if the consumption is less, then the saving would increase, which would lead to the increase in investment. However, if the demand of capital goods decreases, then the incentive to produce capital goods would also decrease. This would result in the decrease of investment.

ADVERTISEMENTS:

iii. Assumes that there is no change in the income level of an individual. Thus, according to classical theory, saving and investment become equal due to change in rate of interest. However, according to Keynes theory, savings and investment become equal because of changes occur in the income level of an individual.

5. Loanable Fund Theory:

Loanable fund theory agrees with the view that time preference plays an important role in determining the occurrence of interest. This theory is also termed as neo-classical theory of interest. According to neo-classical economists, interest is the amount paid for loanable funds. It focuses on the determination of rate of interest with the help of demand and supply of loanable funds in the credit market. Let us understand the concept of supply of loanable funds.

The supply of loanable funds depends on the following factors:

i. Savings:

Act as one of the sources of loanable funds. The loanable funds in the form of saving are classified as ex-ante saving and Robertsonian sense. Ex-ante saving refers to the saving that an individual plans according to his/her expected income and expenditure in the starting of a year or financial year or for a month.

On the other hand, Robertsonian sense refers to the saving that is produced by taking the difference of previous period income and present period consumption. In both the types of savings, the savings are different at different rate of interest. Savings are dependent on the income level that vanes with the rate of interest. The increase in the rate of interest would result in the increase of the level of saving and vice versa.

ADVERTISEMENTS:

In the context of organizations, the amount left after distributing the profit in the form of dividends is termed as the saving of an organization. The savings of an organization depends on the rate of interest prevailing in the market. Increased rate of interest would encourage organizations to increase savings instead of borrowing money from loan market.

ii. Dishoarding:

Involves reduction in the money stock of an organization. Therefore, in the previous money stock, the liquidity of money is high that can be utilized in the present time as loanable funds. The higher the rate of interest, the more would be the money dishoarded and vice versa.

iii. Credit by bank:

Refers to the loan provided by bank to the organizations. Banks can increase or decrease the money lend to an organization on the basis of certain criteria. The supply of loanable funds increases with the increase in the money created by banks. The supply curve is interest elastic for loanable funds. The higher the rate of interest, the more the bank would lend money and vice versa.

iv. Disinvestment:

ADVERTISEMENTS:

Refers to the situation when the existing capital goods of an organization are reduced or the stock of the organization is less than the previous stock. In such a condition, the fund that is used for the replacement purposes are used as loanable funds.

According to Bober, ”Disinvestment is encouraged by the somewhat by a high rate of interest on loanable funds. When the rate is high, some of the current capital may not produce a marginal revenue product to match this rate of interest. The firm may decide to let this capital run down and to put the depreciation finds in the ban market”

After determining the factors that influence the supply of loanable funds, let us study the demand for loanable funds. The demand for loanable funds depends on investment, consumption, and hoarding of income. Organizations require loanable funds to a greater extent for expanding the stock of capital goods, such as machines and buildings.

The demand for loanable funds depends on the extent to which organizations require loanable funds. Interest is the price at which the loanable funds can be bought. Organizations require loanable funds at which the net rate of return on capital goods is equal to the rate of interest.

The higher rate of interest demotivates organizations to buy capital goods or expand their stock of capital goods. Therefore, the demand of loanable funds is interest elastic for organizations; therefore, the demand curve would slope downwards.

Another major constituent of demand for loanable funds is the requirement of funds b) individuals for consumption. Generally, individuals require loanable fund when they desire to purchase something out of their budget or the consumer goods that they cannot afford from their present income. The lower the rate of interest, the higher would be the demand for loanable goods. Therefore, the demand for loanable funds is interest elastic for individuals; thus the demand curve slopes downward.

ADVERTISEMENTS:

Along with organizations and individuals, there are some people who require loanable goods for hoarding purposes. Hoarding refers to the holding of some part of income by the individuals for future use. In hoarding, the supplier and buyer of loanable funds is the same person.

A person may want to hold funds when the rate of interest is low. On the contrary, he/she may use his/her funds by investing in new projects, when the rate of interest is high. Therefore, the demand of loanable funds is interest elastic for hoarding purpose; thus, the demand curve slopes downward.

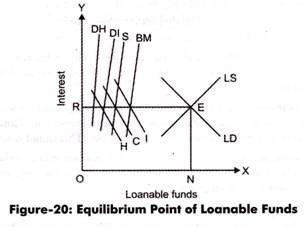

Figure-20 shows the interaction between the demand and supply curve of loanable funds to reach at equilibrium position:

In Figure-20, DH represents dishoarding curve, BM is bank credit curve, S represents saving curve, and DI is disinvestment curve. LS represent the supply of loanable funds, which is produced by summing up the DH, BM, S, and DI curve. Similarly, H represents hoarding, C is consumption, and I is investment, which together form LD.

In Figure-20, LD is the demand for loanable funds. The point at which the demand and supply curve of loanable funds intersect each other is termed as equilibrium point (E). At point E, the rate of interest is OR with ON loanable funds. Therefore, OR would be the equilibrium rate of interest in the credit market.