The following points highlight the top ten large scale industries in India. The large scale industries are: 1. Tea Industry 2. Jute Industry 3. Cement Industry 4. Sugar Industry 5. Paper Industry 6. The Engineering Industry 7. Food Processing Industry 8. Information Technology and Electronics Industry 9. Software Industry 10. Automobile Industry.

Large Scale Industry # 1. Tea Industry:

Tea industry is occupying a very important place in Indian economy. It is also one of the traditional industries of the country. In the initial part of 19th century tea plantation was started in India by the British planters. In 1933 tea plantation was started in Assam. In 1938, India exported tea for the first time in England.

After that in 1965 some tea gardens were established in India with lie patronage of the Government. Later on the tea industry started to expand under the patronage, ownership and management of European merchants. In this way more than 60 per cent of the tea gardens established in India were under the ownership of European merchants.

In 1955, total area under tea cultivation in the whole country was 3.2 lakh hectares.

ADVERTISEMENTS:

India is the major producer of tea, producing maximum amount of tea among all the tea producing countries of the world. Total number of workers engaged in the tea industry of India is around 11 lakh. In India tea is produced in the states like Assam, West Bengal, Tamil Nadu, Kerala and East Punjab. Assam alone produces more than 50 per cent of the total tea produced in India.

Tea industries in India had to face serious setback during 1956 with the fall in the price of tea in the international market at a very low level. Since then Government has taken various measures for the development of this industry. Reserve Bank of India and other commercial banks have advanced a huge amount of loan for the development of this industry.

Total production of tea is thus gradually increased from 277 million kgs in 1950-51 to 423 million kgs in 1970-71 and then to 568 million kgs in 1980-81 and finally to 967 million kgs in 2010-11. The provisional production figures for 2013-14 are 1208.8 million kgs.

India is the largest producer and consumer of tea in the world and accounts for around 27 per cent of world production and 13 per cent of world trade. Export of tea is around 20 per cent of domestic production. Of late, some quantity of tea is imported for blending and re-exports. Under the present foreign trade policy, import of tea is permitted with an import duty of 100 per cent.

ADVERTISEMENTS:

Total volume of export of tea from India was 183.1 million kg in 2003-04 and that of total import was 22.5 million kg in 2C02-03. Total domestic consumption of tea in India was 714 million kg in 2003-04.

It should be mentioned here that in Five Year Plans the Government has accorded a great emphasis on the development of tea industry in India as this industry is generating huge employment opportunities and is earning a good amount of foreign exchange regularly through the export of tea.

According to the current trend, the country would be able to produce 900 million kg by the turn of the century though it would try hard to reach the ambitious target of 1000 million kg.

Perspective Plan or ITA:

The Indian Tea Association (ITA) in collaboration with 66 leading large and medium companies has drawn up a 10 years perspective plan to substantially increase the production of tea in the country to the extent of 1079 million kg by the year 2006. The progranune would generate an estimated additional crop to the extent of approximately 300 million kg. With a production level of 1079 million kg by 2006, the exportable surplus would be 255 million kg.

ADVERTISEMENTS:

The two tier perspective plan would present a more aggressive approach based on a higher level of availability of land, increased rate of replanting, in filling and rejuvenation, bringing in more areas under irrigation and drainage and a major improvement in field management practices especially in low yielding gardens which would produce a surplus of 255 million kg. exportable tea.

The total fund requirement of the industry to implement its ten year programme, would be around Rs 5,570 crore approximately from its internal resources and the balance could be achieved with the support of State Governments and Central Government by way of reduction of tax rates.

The Indian Tea Association has also made a proposal for the setting up of a National Tea Council whose task would be to chalk out a national strategy for the production of lea in the country, which has already been accepted in principle by the Union Commerce Ministry.

Problems:

Tea industry in India has been suffering from various problems like:

(a) Fluctuation in its price in the export market,

(b) High unit cost of production,

(c) Too much dependence on London Tea auction market,

(d) Poor quality,

(e) Increasing demand of the new averages both in domestic and foreign market and

ADVERTISEMENTS:

(f) Increasing competition from other countries in the export market.

Remedial Measures:

Thus, steps should be taken to increase the demand for tea both within and outside the country through quality improvement and vigorous campaign. Thus, the government of India has taken certain steps to improve the condition of tea industry in India.

These include:

(a) Drive to increase both internal and external demand for tea,

ADVERTISEMENTS:

(b) Development of tea board in various countries of the world for raising the volume of tea export through different schemes,

(c) Exemption from export duty and tax on tea, and

(d) Advancing loan from State Bank of India, Industrial Finance Corporation of India, State Financial Corporation of India and NABARD.

Special Purpose Tea Fund (SPTF):

In the mean time, on December 28, 2006, the UPA Government cleared a bailout package for the tea industry which envisages long term benefits to the ailing industry that has been facing stiff competition from countries like Sri Lanka, Kenya etc.

ADVERTISEMENTS:

This package paves the way for the setting up of Special Purpose Tea Fund, (SPTF) with an outlay of Rs 567.10 crore under Tea Board for funding re-plantation and rejuvenation of age old tea bushes which is again aimed at improving the age profile of tea plantations.

The comprehensive package clears the way for implementation of the SPTF programme till the end of remaining part of 2006- 07 and its continuance in the Eleventh Five Year Plan. The Union Budget 2007-08 has also allocated Rs 4,760 crore for the SPTF.

About 50 per cent of the above fund would be utilised in Assam which is likely to benefit tea plantation running into 80,000 hectares in Assam. Union Budget 2008-09 has allocated Rs 40 crore for the SPTF.

The Tea Board of India has set a 15-year deadline for completing its re-plantation drive covering two lakh hectares which would help rejuvenate the existing tea areas. Moreover, the Twelfth Plan has allocated Rs 1,425 crore for the development of tea industry as proposed by the Tea Board. This also includes Rs 200 crore for small tea gardens.

Large Scale Industry # 2. Jute Industry:

Jute industry is one of the most important traditional industries in India. The Jute industry was established for the first time in India in the year 1885. The first power driven jute mill was set up at Rishra, near Kolkata.

After that a number of Jute mills began to set up near Kolkata just by the two sides of Hoogly River. During 1930, i.e. during the period of great depression, this industry had to face a serious setback. But during the Second World War this industry had again reached to its peak position.

ADVERTISEMENTS:

At present there are 73 Jute mills in India with nearly 44,990 looms out of which only 70 units are in operation.

Total production of Jute textiles in India has gradually increased from 837 thousand tonnes in 1950-51 to 1060 thousand tonnes in 1970-71 and then to 1392 thousand tonnes in 1980-81 and then declined to 1200 thousand tonnes in 1987-88. But the production again increased to 1450 thousand tonnes in 1990-91 and then again declined to 1310 thousand tonnes in 1992-93 and finally increased to 1591 thousand tonnes in 1999-2000.

But the total volume of export of Jute textiles in India has been declining from 790 thousand tonnes in 1950-51 to 640 thousand tonnes in 1970-71 and then to 121 thousand tonnes in 1997-98.

On the contrary total consumption of Jute textiles within the country has increased from 120 thousand tonnes in 1950-51 to 480 thousand tonnes in 1970-71 and then to 1230 thousand tonnes in 1990-91. Since the partition of the country, Jute industry has been facing a serious crisis due to acute shortage in the supply of raw jute. At present more than 70 per cent of the area under jute lies in Bangladesh.

In 1951, total production of raw jute in India was only 3.3 million bales as compared to its total requirement of 72 million bales. To meet this gap, various programmes were undertaken during the plans for intensive and extensive cultivation of jute in the country.

Accordingly, the yield per hectare rose from 1040 kgs in 1950- 51 to 1800 kgs in 1990-91. As a result of which total production of raw jute has increased gradually to 4.9 million bales in 1970-71 to 10.9 million bales in 1985-86 and then to 16.2 million bales in 1989-90 and then declined to 10.9 million bales in 1991-92. In-spite of being the largest producer of raw jute in the world, its total production is still insufficient to meet its own requirement.

ADVERTISEMENTS:

The Jute Corporation of India was established by the Government for undertaking price support, commercial and buffer stock operations and for export and import of jute. Total production of jute textiles also rose from 8.9 lakh tonnes in 1950-51 to 14.3 lakh tonnes in 1990-91 and the production declined to 12.9 lakh tonnes in 1991-92.

Jute industry has now diversified their products and the mills are now producing also cotton bagging, jute tarpaulin, jute carpets, carpet backing, paper lined hessian, jute webbing and jute cloth.

As on January, 2012, total number of looms installed in jute industry stood at 49,529. During 2012-13 (April-March), total production of jute goods was at 1591.3 thousand MT compared to 1582.4 thousand MT in the corresponding period of 2011-12 showing a marginal rise of 0.6 per cent over the previous year.

During 2012-13, domestic consumption of jute goods was 1399 thousand MT (87.9 per cent of the production). Annually, the export of jute products ranges between Rs 1400 to 1500 crore. This jute industry is providing direct employment to 2.5 lakh persons and near about 40 lakh rural families are regularly deriving their livelihood from jute cultivation.

Problems:

The jute industry in India is suffering from numerous problems.

These problems are:

ADVERTISEMENTS:

(a) Irregular and inadequate supply of raw materials,

(b) Problem of obsolete and worn-out plants and difficulties in their modernisation,

(c) Higher unit cost of production leading to high prices,

(d) Fluctuation in the production leading to high prices and

(e) Increasing competition from synthetic substitute goods both in home and foreign market.

Remedies:

Considering the problems of jute industry, proper steps should be undertaken to increase the degree of viability of this industry.

ADVERTISEMENTS:

In the meantime, the Government of India has taken the following short- term steps:

(a) Re-introduction of cash-compensatory support for all varieties of jute goods exported since 1981;

(b) Advising the cement, fertilizer and other industries to use only new gunny bags for packing; and

(c) Advancing additional credit to jute mills for purchasing raw jute from growers.

The Government of India has also announced a package of financial assistance from banks and from Industrial Reconstruction Corporation of India (IRCI) for the development of sick jute mills. In recent years, the Indian Jute Industry is now modernising its post-spinning equipment by introducing new high speed machines and installation of broadlooms for the production of carpet backing.

In recent years, the demand for carpet backing cloth produced in India has increased in United States. Thus the strategy of development of the Indian Jute Industry should be to discover new products along with its new uses.

Large Scale Industry # 3. Cement Industry:

Although the cement manufacturing was started in Tamil Nadu as early as in 1904 but the systematic manufacturing of cement was started in 1914 by the India Cement Company Ltd. at Porbundar, Gujarat. In India, there are at present 124 large cement units and 300 mini cement plants.

Total installed capacity of these cement units is about 151.0 million tonnes. Total production of cement in the country also rose from a mere 2.7 million tonnes in 1950-51 to 14.3 million tonnes in 1970-71 and then to 51.7 million tonnes in 1991-92 and finally to 262.6 million tonnes in 2013-14. Total employment generation by cement industry is more than 2 lakh.

In 1981, the government had announced guidelines to set up mini-cement plant in order to ensure that such cement plants are set up primarily for exploiting limestone reserves available in different remote and inaccessible parts of the country.

The production capacity of these mini-cement plants varies between 50 tonnes to 200 tonnes a day. These mini cement plants are mostly established in the backward areas of Andhra Pradesh and Madhya Pradesh.

Problems:

The cement industry in India has been suffering from different problems.

These include:

(a) Under-utilization of production capacity due to drastic power cuts, coal shortages, lack of furnace oil and inadequate availability of wagons;

(b) Cost escalation and rigid pricing leading to low profitability;

(c) Partial control and dual pricing;

(d) Excessive burden of excise duty, lack of adoption of cost-efficient technology; and

(e) Unrealistic distribution policies followed by the government.

In order to improve the conditions of this industry, the government introduced partial decontrol in February, 1982. As a result of this policy incentive, the installed capacity and production of cement increased significantly and the country attained self-sufficiency in the production of cement.

Consequently, from March 1989, the government withdrew all price and distribution control. Moreover, as the MRTP companies have been offered licenses to produce cement thus many industrial houses viz., Larsen and Toubro, DCM, Raymond, Woolen Mill, Coromondal Fertilizers, I.K. Synthetic etc., have already entered into the production of cement.

In order to increase the production of cement in India, a massive modernisation and expansion programme involving Rs 2400 crore is chalked out by the cement industry. Eleventh Plan has set the target to increase the production of cement to 269 MT at the end of the Plan.

Large Scale Industry # 4. Sugar Industry:

In India the sugar industry had its origin in 1903 when a sugar factory was established each in Bihar and Uttar Pradesh. In 1950-51, there were 138 sugar factories in India and their total production was only 11.34 lakh tonnes. In order to meet its growing demand, more and more sugar factories were established. As on 31st May, 1988, there were 414 sugar factories in India with a licensed capacity of 10.4 million tonnes.

Out of this 386 factories were in operation. Sugar industry employs about 3.25 lakh workers besides generating indirect employment for 25 million sugarcane growers. Total production of sugar increased from 11.3 lakh tonnes in 1950-51 to 37.4 lakh tonnes in 1970-71 and then to 120.47 lakh tonnes in 1990-91 and finally to 282.0 lakh tonnes in 2006-07 and then again decreased to 245.5 lakh tonnes in 2013-14.

Bihar and U.P were two largest producers of sugar producing about 60 per cent of sugar in 1960. But with the expansion of the industry in other states like Maharashtra, Andhra Pradesh, Tamil Nadu and Karnataka, the share of production of Bihar and U.P. had declined to 28 per cent in 1980-81 and the share of Maharashtra rose from 17 per cent in 1960 to 40 per cent in 1980-81. In the meantime, the government set up a Sugar.

Development Fund in 1982 which was funded by transfer of proceeds of sugar cess imposed on sugar production in the country.

The idea was to advance soft loan to the sugar producing units for their rehabilitation and modernisation and for production of sugarcane in and around the sugar factory area. Total amount of fund allocated is Rs 900 crore and out of which the Fund advanced loan to the extent of Rs 490 crore for the said purpose.

Problems:

The sugar industry of India has been suffering from various problems.

These include:

(a) Shortage in the supply of sugarcane,

(b) Cost escalation and unfavorable price conditions,

(c) Old and obsolete machinery and

(d) Faulty government policy lacking a long-term perspective which varied between complete control, partial controls and decontrol.

In-spite of all these difficulties, sugar industry of India has been expanding at a very fast pace. This industry has a very bright future considering abundant supply of raw materials, huge market and availability of cheap labour. But the sugar economy continues to be a highly controlled one.

This policy regime in the industry needs review with the objective of making the industry globally competitive, and generating export surpluses while ensuring adequate domestic availability. The Government is at present actively considering a package of structural reforms in this sector.

Large Scale Industry # 5. Paper Industry:

Paper industry is another important industry of the country. Since 1925 this industry was operated under protective tariff and thus earned a huge profit regularly. This led to a rapid progress of this industry during the period of planning. India’s huge forest resources are providing raw materials to this industry in abundant quantity.

Total installed capacity of this paper industry gradually rose from 4 lakh tonnes in 1960-61 to 62 lakh tonnes in 2002-03. Again the total production of paper and paper board also increased from 1.16 lakh tonnes in 1950-51 to 7.55 lakh tonnes in 1970-71 and then to 20.88 lakh tonnes in 1990-91 and then to 41.30 lakh tonnes in 2011-12.

Total production of newsprints also rose from 0.4 lakh tonnes in 1960-61 to 3.1 lakh tonnes in 1992-93.

There are 652 industrial units producing paper and paper board under private sector at present, besides some public sector units run by Hindustan Paper Corporation. In 2012-13 there are 759 number of paper mills operating in the country both in the private and public sector.

The total installed capacity of paper industry is nearly 12.7 million tonnes in 2012-13 out of which 1.37 million tonnes are buying idle due to closure of 107 units mostly due to pollution problem. Accordingly, total operating capacity is now around 11.33 million tonnes.

Indian paper industry has exhibited resilience and has shaped up well in the face of increasing competition from overseas players. But the problems faced by the paper industry still quite acute. The issues related to availability of fibrous raw material, technological obsolescence, cost escalation, quality and environment etc. still remain to be largely addressed.

The working group on pulp and paper industry has identified the following targets of the Twelfth Five Year Plan based on production and consumption (a) the production of paper, paper board and newsprint by the year 2016-17 is estimated, to be 16.7 million tonnes and (b) correspondingly, the consumption of paper, paper board and newsprint is estimated to touch 18.4 million tonnes.

Problems:

The paper industry in India has been suffering from various problems.

These include:

(a) High cost of production,

(b) Scarcity of raw materials,

(c) Problems of royalties and leases,

(d) Overcapacity and under-utilisation of capacity,

(e) Growing sickness of small and medium paper units and

(f) Serious shortfall in the production of newsprint.

But this industry is one of the very important industries of the country. In order to improve the condition of this industry, steps must be taken for higher capacity utilisation through renovation and modernisation of large mills. Moreover, paper mills have to introduce plantation forestry in order to meet its scarcity of raw materials.

In the meantime, the government has taken various steps for the improvement of paper industry. These include excise rebate to small units, abolition of custom duty on the import of paper pulps and wood chips, infrastructural support and withdrawal of control over price, production and distribution of white printing paper.

Moreover, the facility of broad banding has also been extended to this industry for the diversification of its output.

Large Scale Industry # 6. The Engineering Industry:

Engineering industry is one of the recently developed industries of the country. Since the Second Plan onwards, a good amount of investment was diverted towards the industrial sector. Accordingly, a huge investment was made in the heavy and capital goods industries. In order to strengthen the base of these industries, development of engineering industry was a must.

Thus, since the Second Plan onwards, the engineering industry was gradually being developed in the country. In 1950-51, machine tools worth RS 3 million was produced along with some other products like automobiles, diesel engines, tractors, bicycles, motor cycles etc. which constituted nearly 7.5 per cent of the industrial output.

At present engineering industrial sector is contributing nearly 31.2 per cent of total industrial output.

The employment in the engineering industry is nearly 28 per cent of the total industrial employment in the country. Total investment in the engineering industry accounts nearly 31.5 per cent of the total industrial investments of the country and share about 69 per cent of the foreign collaboration in force.

With the expansion of engineering goods sector, the share of engineering goods export to total export earnings also increased from a mere 1.3 per cent of industrial investment in 1960-61 to 11.9 per cent in 1990-91.

A good number of industrial units both in public and private sector are now engaged in the production of steel plant equipment, transport equipment, mining equipment, process equipment of chemical, petrochemicals, fertilizers, petroleum and various other mechanical equipment. All these are included in heavy equipment and machinery industry.

Industrial units like Bharat Heavy Plates and Vessels Ltd. (BHPV), Mining and Allied Machinery Corporation, Burn Standard and Co. Ltd. Braithwaite’s, Jessop and Co. Ltd. are all included in this heavy equipment and machinery group. Moreover, heavy Electrical Engineering industries are also producing various power plants equipment.

Bharat Heavy Electricals Ltd. (BHEL) is the major public sector company in this group. Again various other industrial units are engaged in the production of machine tools and transport equipment’s. Hindustan Machine Tools (HMT) is a major public sector company working in this group.

Besides, there are some other light mechanical engineering industries engaged in the production of sewing machines, typewriter, bicycles, wrist watches, razor blades etc. There are also many light electrical engineering industries engaged in the production of electric fans, dry cells, electrical lamps, domestic refrigerator, washing machines.

Moreover, the electronic industry has been producing both consumer electronics and industrial electronics like computers etc. This electronic industry has maintained a high growth rate for almost three decades.

Starting from Rs 15 crore in 1960, the production of this sector today reached the level of Rs 10,000 crore. The annual average growth rate of this sector which was 25 per cent during 1960s gradually picked up to over 30 per cent during 1980s. In 1994-95, the electronic industry achieves a growth rate of 17.0 per cent and anticipated a growth rate of 22 per cent in 1995-96.

The electronic industry stands substantially deregulated under the new industrial policy for its further expansion.

Problems:

The engineering industry is also suffering from various problems like:

(a) Low capacity utilisation,

(b) Rising cost of production,

(c) Stiff competition in the international market and

(d) Government policy for liberal imports of machinery and other engineering goods which have created serious problems for the indigenous industry producing these engineering goods.

Large Scale Industry # 7. Food Processing Industry:

Food processing industry is another recently developed industry of the country. In the initial period of development, the food processing industry did not get much prominence. Subsequent to the deregulation of food industry under the New Industrial Policy of 1991, this industry was able to attract the attention of the investors for further investment into it for its development.

At present the installed capacity of fruits and vegetable processing industry has been increasing steadily. The capacity of the industry (excluding fried and sun-dried fruits and vegetable products) increased from 7.08 lakh tonnes as on January 1990 to 14.02 lakh tonnes in January 1995 and then to 20.80 lakh tonnes as on January 1999.

But the production of processed products increased from 6.76 lakh tonnes in 1995 to 9.40 lakh tonnes in 1999. The market and prospect of food processing industry in India has been growing steadily fuelled by strong domestic demand for processed food and beverage products spurred by increase in income level, increasing number of women joining the work force, rapid urbanization, changing lifestyle and mass media promotion.

India is considered as the world’s second largest producer of food but the processed food industry of India relatively small in size.

The most promising areas of growth are fruit and vegetable processing, meat, poultry, dairy and seafood, packaged/convenience food, soft drinks and grain processing. Growing emphasis on the rapid growth of processed food exports from India has been providing substantial stimulation to this industry.

As a result, the need for adopting superior technology, food processing and packaging machinery has become very important in order to ensure quality for Indian food products in the international market which demand high quality standards. Thus, the prospect of food processing machinery industry and packaging industry is also becoming richer.

It is expected that food processing sector is likely to grow at a healthy pace considering the rapid changes in food habits and consumerist culture developing in the country.

Till December 2000, 6,427 Industrial Entrepreneurs Memorandum (IEMs) have been filed in the food processing sector envisaging an investment of Rs 53,819 crore. Out of the IEMs filed during the period, 678 IEMs envisaging an investment of Rs 7,517 crore have already been implemented.

Besides, for setting up 100 per cent Export Oriented Units/Joint Ventures in various food processing sectors, 1,132 approvals have been granted till November, 2000 envisaging an investment of Rs 19,388 crore.

Out of the total investment of Rs 73,207 crore approved in this sector, the foreign investment, involved in this sector is Rs 10,992 crore. Till October 1999, 848 projects have already gone into commercial production. Total foreign investment inflow in the sector till October 2000 is around Rs 2,595 crore.

The production of processed fruits and vegetables declined by about 5.2 per cent in 1997-98. However, exports of processed fruits and vegetables are estimated to increase to Rs 889 crore in 1998-99 as compared to Rs 745 crore in 1997-98. Production of milk products is estimated to have increased to 306 thousand tonnes in 1998 as compared to that of only 290 thousand tonnes in 1997.

The production of milk powder and infant milk food is estimated to have increased from 2.22 lakh tonnes in 1998 to 2.25 lakh tonnes in 1999. Exports of animal products (including milk products) increased to over Rs 1,100 crore in 1998-99 as compared to that of Rs 910 crore in 1997-98.

Total exports of miscellaneous processed foods (inclusive of processed fruits and juices) which was Rs 974 crore in 1996-97 has declined to Rs 528 crore in 1997-98 and then increased marginally to Rs 3,176 crore in 2008-09.

Marine fish harvest experienced a 7.1 per cent growth in production in 2006-07 and export of marine products during 2008-09 were worth of Rs 8,608 crore with a share of 1.04 per cent in the total earnings during the year as compared to that of Rs 7,620 crore in 2007-08.

In the mean time, a good number of foreign companies started to show their interest on food processing sector in India. During the period January 2000 to March 2006, top 20 foreign companies have invested an amount of Rs 1711.22 crore in food processing industries of the country.

There has been a robust growth in both the registered and unregistered manufacturing sector of food processing industries during the period 2001-04. Domestic product from manufacturing food products and beverages in registered sector has grown from Rs 15,472 crore in 2000-01 to Rs 19,086 crore in 2003-04 and that in unregistered sector it has grown from Rs 12,075 crore to Rs 15,540 crore during the same period.

Presently, food processing is one of the most heterogeneous sectors of manufacturing covering marine products, dairy products, grain, meat products, fruits and vegetables, sugar, edible oils and beverages. This sector has proved itself as one of the fastest-growing segments in manufacturing in the current year (2011- 12) contributing 27 per cent to average industrial growth, more than three times its weight in the IIP.

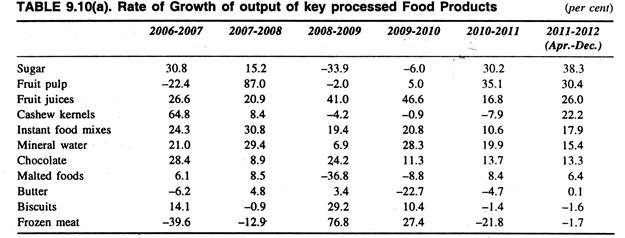

The following Table 9.10(a) shows the growth rate of some of the important products in this group.

Table 9.10(a) reveals that rate of growth of output of some of the key processed food products like sugar, fruit pulp, fruit juices, and instant food mixes mineral water, chocolates etc. are quite encouraging.

In a country like India, a vibrant agrarian and rural economy requires establishing forward linkages in the form of food processing industries. Establishment of such linkages can improve the income levels of the producers and help reduce wastages, which are very much crucial for food and livelihood security.

Recently, a study made by the Central Institute for Post Harvest Engineering Technology (CIPHET) in 2010 reveals that the post harvest losses of agricultural products in India amount to around Rs 44,000 crore annually.

Thus the Ministry of Food Processing Industries formulated appropriate policies and implements targeted schemes to reduce wastage and increase value addition in the food chain.

By catalysing adequate investment in this sector, the Ministry has helped in creating employment opportunities and upgraded human capital formation in the rural sector. Besides, consumers are also largely benefitted by availing a wider and healthier choice of food products at affordable prices.

Considering the growing prospect of the industry, the Food Processing Ministry of India has been considering to provide financial assistance for setting up and upgradation of about 100 laboratories at national, state and district level during the Eleventh Plan Period.

The Ministry has been providing financial assistance for setting up and upgradation of food testing laboratories and has approved assistance to 36 organisations so far under its plan scheme.

These laboratory facilities have been extended in the country so as to ensure compliance with existing and future standards of processed food items produced for domestic as well as export purposes. Till December 2006, about 300 food testing laboratories were functioning in the country both under public and private sector.

Moreover, the Government has recently enacted Food Safety and Standards Act, 2006, which provides adequate thrust on ensuring quality of food products.

The food processing industry attracted over Rs 9000 crore foreign direct investment (FDI) during April- November 2011 period, which is the highest ever so far the food processing industry is in its infancy in India at present, but sensing the huge untapped potential, overseas firms are increasing by showing their interest to participate in this sunrise sector. Thus the prospect of this industry is quite bright.

Large Scale Industry # 8. Information Technology and Electronics Industry:

Among all the industries, the Information Technology and Electronics industry is the most recently developed industry of the country. This industry is popularly known as InfoTech industry. India is now playing a major role in the promotion and development of InfoTech industry throughout the world. In the first millennia, India led the world on the basis of knowledge. Today history is repeating itself.

Young Indian entrepreneurs are at the forefront of InfoTech revolution, whether in Silicon Valley, Bangalore or Hyderabad. They have shown how ideas, knowledge, entrepreneurship and technology can combine to yield unprecedented growth of incomes, employment and wealth.

Companies which were unknown 5 years ago have now become world leaders. It is now very important that all possible steps should be taken to promote this flowering of knowledge based enterprise and job creation.

Severe shortage of IT professionals, along with recent advances in telecommunications had led to the increasing acceptance and use of off shore IT service providers, like India. The low cost high skill resources in India will continue to receive attention from the US, IT Companies as they will be increasingly focusing on costs in the coming years.

The average annual wage of software professionals in India was 15 per cent of the average rate in the U.S.A.

Contribution of IT Sector:

Accordingly, IT has bloomed itself into a full fledged industry along with its own flavour. Taking the history into its background, probably no industry has recorded such a high growth rate with overwhelming opportunities of employment and other related avenues.

Recognising the huge potential of IT and IT-enabled services (ITES), top priority has been given for its promotion and development. Contrary to some popular misconceptions, the growth of IT and ITES sector has had a salutary effect on the employment generation scenario and accordingly, total number of professional employed in this sector increased from 2, 84,000 in 1999-2000 to 2.2 million in 2008-09.

The increase in the number of employed persons in the sector was as high as 4, 00,000 in 2007-08 itself. In addition, Indian IT- ITES is estimated to have helped create an additional 30 lakh job opportunities. Through indirect and induced employment in telecom, power, construction, facility management, IT-transportation, catering and other services.

The different services lines in IT enabled services off-shored to India include customer care, finance, human resources, billing and payment services, administration and content development etc.

The Indian ITES and Business Processing Outsourcing (ITES-BPO) has demonstrated its superiority, sustained cost advantage and fundamentally—powered value proposition in the international market. This sector is growing with Indian companies expanding their service offerings, enabling customers to deepen their offshore engagements and shifting from low end business processes to high value ones.

The volume of software and ITES exports from India grew—from Rs 28,350 crore in 2000-01 to Rs 58,240 crore in 2003-04 and then to Rs 103,200 crore in 2005-06, showing a growth of 32 per cent over the previous year. The same software and ITES export increased recently from $31.1 billion in 2006-07 to $ 46.3 billion in 2008-09.’

As per NASSCOM study, IT-BPO export reached US $ 49.7 billion in 2009-10 and is expected to grow at least 18 per cent in 2010-11 to reach US $ 58.7 billion. Thus in ITES BPO, India has built up valuable brand equity in the global markets. In ITES, India has emerged as the most preferred destination for BPO, a key driver of growth for the software industry.

On the demand side of the software section of the industry, export markets continue to dominate the domestic segment. The size of domestic market in software relative to export markets for Indian software, which was 45.2 per cent in 1998-99, after declining rapidly to 29.8 per cent in 2001-02, fell only to 29.1 per cent and 27.7 per cent in two subsequent years.

Thus IT and ITes sectors would emerge as the major contributors to the country’s GDP, providing over 4.8 per cent in 2005-06, as compared to that of 3.5 per cent recorded in 2003-04 and a meagre 1.2 per cent in 1997-98. Again, the IT-ITES industry’s contribution to national GDP is estimated to increase from 6.0 per cent in 2008-09 to 6.1 per cent in 2009-10.

In 2007-08, the performance of the Information Technology Enabled Services—Business Process Outsourcing (ITES—BPO) industry was marked by high revenue growth, steady expansion into newer service lines and increased geographic penetration and an unprecedented rise in investments by multi-national corporations (MNCs). Total export revenues of IT-ITES—industry have grown from US$ 40.4 billion in 2007- 08 to US$ 46.3 billion in 2008-09 registering a growth rate of 14.6 per cent.

On the employment of IT professional, it would cross 10 lakh in 2004-05, with software exports sector recruiting around 3.45 lakh (2.70 lakh in 2003-04), software domestic sector employing 30,000 personnel and software in house captive staff recruitment increasing to 3.22 lakh (2.90 lakh in 2003-04).

ITES sector would be the largest employment generator, staffing around 3.48 lakh in 2004-05 as compared to that of 2.54 lakh job generated in 2003-04 and is likely to employ 4.7 lakh in 2005-06 (NASSCOM). Total number of professionals employed in India by IT and ITes sectors is estimated at 16.21 lakh as on 31st March, 2007.

Again total IT software and services employed has reached 2.28 million in 2009-10 (excluding employment in the hardware sector) as against 2.20 million in 2008-09. As per a NASSCOM survey, 2.3 million people are employed in India’s IT and BPO sector at the end of December 2010.

The year 2007-08 was marked by substantial growth in the revenue of IT-ITES industry, BPO, software and services exports and software and services employment. Total revenue earned from IT and ITES industry increased from $ 47.8 billion in 2006-07 to $ 64.0 billion in 2007-08 and expected to be $ 71.7 billion in 2008-09. Total revenue earned from software and services industry increased from $ 39.3 billion in 2006-07 to $ 52.0 billion in 2007-08 and expected to be $ 60.0 billion.

Total software and services exports increased from $31.1 billion in 2006-07 to $ 40.4 billion in 2007-08. Again IT-BPO revenue from domestic market also increased from $ 8.2 billion in 2006-07 to $ 11.7 billion in 2007-08. Total employment generated by IT software and services also increased from 1.6 million in 2006-07 to 2.0 million in 2007-08 and then to 2.2 million in 2008-09 and then finally to 2.28 million in 2009-10.

Growth of IT Sector:

Although IT sector in India has faced considerable expansion but the sector is of recent origin. The growth of this sector picked up only in the nineties, i.e., only after the international treaty of 1994. Huge size of middle class population (more than 400 million) along with a huge stock of English knowing population facilitated fast expansion of IT sector in India.

The country has been experiencing a gradual increase in the use of IT in the activities of government, public sector, private sector, school, colleges universities and technical institutes.

After the setting up of the National Association of Software and Services Companies (NASSCOM) the data related to the growth of IT sector has been made available. As on 31st March, 2002, the NASSCOM study observed, that the total number of personal computers (PCs) in India was 7.4 million and the figure in expected to rise at 20 million by 2009.

Total number of Internet users constituted 16.9 million in 2002 which in expected to increase at 100 million by 2009. Total number of Internet subscribers in India was 1.6 million (5 million users) in March 2002 and the figure rose to 8 million subscribers (18 million users) by March 2003. Moreover, with supportive policies, internet/broadband subscribers grew from 8.77 million as in March 2010 to about 10.71 million upto November 2010.

Growth of Revenue from IT Sector:

Total amount of revenue earned by the IT industry in India has been increasing considerably from Rs 6,345 crore in 1994-95 to Rs 56,592 crore in 2000-01 and then to Rs 79,337 crore in 2002-03 showing the CAGR at 33.6 per cent.

Again total revenue earning of IT industry in terms of dollar also increased from $ 2041 in 1994-95 to $ 16,494 in 2002-03 showing the annual average growth rate of 26.8 per cent. As a proportion of GDP, the revenue earned from IT industry stood at 1.22 per cent in 1997- 98 and the same increased to 6.1 per cent of GDP in 2009-10.

Moreover, the revenue aggregate of the information technology (IT) – business process outsourcing (BPO) industry has grown by 5.4 per cent to reach US $ 73.1 billion in 2009-10 as compared to US $ 69.4 billion in 2008-09.

Share of IT Software Exports in Total Exports:

In India, the share of IT software exports in total exports has been increasing gradually. The share of IT export in total export earning of the country increased from 5.0 per cent in 1997-98 to 14.0 per cent in 2000-01 and then to 21.8 per cent in 2004-05. Thus the IT exports have become very much significant for a country like India.

In 2009-10, IT services, exports were US $ 27.3 billion as compared to US $ 25.8 billion in 2008-09, showing a growth of 5.8 per cent. Information Technology Enabled Services (ITES)- BPO export have increased from US $ 11.7 billion in 2008-09 to US $ 12.4 billion in 2009-10, registering a year on year (y-o-y) growth of 6 per cent.

Moreover revenue from the domestic market (IT services and ITES-BPO) has grown to US $ 14 billion in the year 2009-10 as compared to US $ 12.8 billion in 2008-09 showing a growth of about 9 per cent. NASSCOM expects IT- BPO exports to grow by at least 18 per cent in 2010-11 to reach US $ 58.2 billion as against US $ 49.7 billion in 2009-10.’

In the mean time, Indian Companies are enhancing their global services delivery capabilities by undertaking combination of Greenfield initiatives, cross-border mergers and acquisitions, partnership and alliances with local players. This strategy is enabling them to execute end-to-end delivery of new services. Global Software giants like Microsoft, Oracle and SAP have already established their captive development centres in India.

Majority of the Indian companies have already aligned their internal processes and practices to international standards such as ISO, CMM and Six Sigma. All these have helped India to establish a credible sourcing destination. As on December 2006, more than 400 Indian companies have acquired quality certifications with 82 companies certified at SEI, CMM level 5, which is higher than any other country in the world.

In 2011, the global management consultancy firm AT Kearney has identified India as the best outsourcing destinations because of its “first mover advantage” and deep skill base.

The top three slots in AT Kearney’s 2011 Global Services Location Index (GSLI) are occupied by three Asian countries: India, China and Malaysia and the same trend is maintained since the inception of the GLSI in 2003 because of their deep talent pools and cost advantages.

National Task Force on Information Technology and Software Development:

Recognising the impressive growth achieved by the country since the mid-1980s in Information Technology which is only a fraction of the potential, a National Task Force on Information Technology and Software Development was set up on May 22, 1998 under the chairmanship of the Deputy Chairman, Planning Commission.

The Task Force submitted the Information Technology (IT) Action Plan comprising 108 recommendations on July 4, 1998. The recommendations have since been notified in the Gazette of India, dated July 25th, 1998. While making recommendations, the Task Force has kept in view the objective that by 2008, the annual export of Computer Software will be US $ 50 billion and the export of computer and telecom hardware will be US $ 10 billion.

The major recommendations of the Task Force are as follows:

(i) The compound annual growth rate of around 55 per cent observed between 1992-97 in the IT sector should increase to 80 per cent by 2008.

(ii) Schools, polytechnics, colleges and public hospitals in the country shall have access to Computer and Internet by 2003.

(iii) A new paradigm in setting up IT software and hardware manufacturing units will be created for making them viable for meeting both local demands as well as exports by creating a policy framework and investment climate in the country comparable to that in Taiwan, Malaysia and Singapore.

(iv) A policy framework and industrial strategy is to be designed for making the Indian IT industry strong enough to meet the demands of a zero duty regime under the WTO-ITA by the year 2003.

(v) Steps be taken to spread IT culture to all walks of economic and social life of the country.

(vi) The 108-point Action Plan also includes: Opening of Internet Gateway access; encourage private STPs : zero customs and excise duty on IT software; income tax exemption to software and services exports; encouragement to set up venture capital funds; a fund to handle Y2K problem; gift tax exemption on computers; allocation to the tune of 1-3 per cent of Budget of every Ministry/ Development for IT applications; networking of all universities and research institutions; allowing US dollar linked stock options to employees of Indian software Companies; Sweat equity; and new schemes for students including attractive package for buying computers etc.

The Government has accepted the Task Force recommendations and has directed all concerned departments to implement the recommendations. On the basis of IT Action Plan, the internal policy as well as licensing terms and conditions were modified and a large number of Internet service providers have been licensed.

Moreover, an ‘Operation Knowledge’ has been launched for universalising IT education and IT based education in a phased manner. The second report on “Information Technology Action Plan Part II: Development. Manufacture and Export of IT Hardwares” was submitted on November 3, 1998.

I.T. Bill:

The Information Technology Bill was introduced in the winter session of Parliament in 1999. The Bill provided legal framework for electronic contracts, prevention of computer crimes, electronic filing/ documents etc. Amendments were later proposed in the Indian Evidence Act, Indian Penal Code and the RBI Act. also. The mechanism of digital signature was proposed for addressing jurisdiction, authentication and origination.

The new legislation will recognise electronic mail, text files, web pages and audio/video clippings as valid evidence in the court of law. IT Act, 2000 gives legal recognition to electronic records or any transactions that may be carried out through electronic means. Moreover, acceptance of a contract may also be expressed electronically.

In the new environment, digital signature certificates can be produced or public keys be used to verify a document. A certifying authority can be cross examined on the authentication of the digital signature. Electronic records can be verified by using the public key of the subscriber.

Thus, the resultant IT Act would eliminate barriers resulting from uncertainties over writing and signature requirements and also promote legal and business infrastructure necessary to implement e-commerce.

MIT:

In October 1999, the Government of India has set up a new Ministry of Information and Technology as the nodal agency for facilitating all the initiatives in the Central Government, the State Governments, academia, the private sector and the successful Indian IT professionals abroad.

The ministry will implement a comprehensive action plan to make India an IT super power in the twenty first century and achieve a target of US $ 50 billion in software exports, by 2008.

It will emphasise upon internet revolution, particularly on the creation of useful contents in Indian languages. IT-enabled services, IT education, electronics and computer hardware manufacturing and exports, silicon facility, e-commerce and Internet based enterprise, will be actively promoted. The ministry will also implement IT enabled distance education programme in collaboration with leading academic institutions.

The Government is taking all necessary steps to make India a global information technology superpower. It has been recommended that each ministry must allocate 2-3 per cent of its budget on IT promotion. This is a step towards the development of domestic software industry and a conscious move towards electronic governance.

The Ministry of Information Technology has initiated institutional mechanisms for facilitating initiatives towards greater utilisation of IT as an enabling tool for efficiency and effectiveness in Government. Three test beds in electronic governance have been initiated in close association with the Government of Andhra Pradesh.

Moreover, a series of measures have been taken to develop a road map for India in e-commerce. These measures are in information and communication technology infrastructure, legal and regulatory framework, technology for e-commerce including test beds, issues related to international domain names etc.

To set up the mechanism and infrastructure for implementation of Cyber laws, Department of Electronics has initiated efforts for developing technology for issue of digital signature certificate, procedure for certification authorities and other security guidelines. Efforts are also being made to develop image water marking technology for an electronic copyright system.

The Government has also approved setting up of an IT venture Capital Fund of Rs 100 crore for software companies. This will have contributions from the Ministry of Information Technology, SIDBI, Financial institutions, private companies and NRIs.

Large Scale Industry # 9. Software Industry:

The software industry has emerged as one of the fastest growing sectors in the economy, having a great potential for its expansion. In software, the strength of the country with its abundant technical manpower skills is well recognised.

To further harness this potential, the Government has taken several important initiatives to make India a global information technology super power and a frontrunner in the era of information revolution. As a result, software industry has emerged as one of the standout sectors of the economy, recording a growth of 24.4 per cent in production and an increase in exports by 31.5 per cent in 2008-09.

The software industry has achieved a compound annual growth rate exceeding 50 per cent in the last five years and a likely turnover of US $ 6 billion and exports worth US $ 4.0 billion during 1999-2000. The Government has targeted an export of US $ 50 billion by the year 2008 for the Indian software industry and attained export of US $46.3 billion in 2008-09.

Indian software professionals have created a brand image in the global market. As per the NASSOCAM (National Association of Software and Service Companies) Survey, more than 185 of the Fortune 500 Companies, i.e., almost two out of every five global giants outsource their software requirements from India.

The capability of Indian Software Industry is reflected in the very high capitalisation with a Market Cap of listed software companies in India estimated at US$ 55 billion as on 30th June 2000. There is also an increasing demand of Indian IT professionals from other countries like USA, Germany, Japan and Australia.

Moreover, India’s software industry has earned the distinction for providing quality services. As on December 1999, 170 Indian software companies have acquired international quality certification. 15 out of 23 companies in the world which have acquired SEICMM (Software Engineering Institute Capability Maturity Model) Level, 5 maturities (the highest quality standard for software practices) are located in India.

Majority of the Multinational Companies operating in the area of information technology have either Software Development Centres or Research and Development Centres located in India. Further, 30 per cent of the E-commerce starts up during the year 1999 in Silicon Valley, USA were initiated by Indians. Around 500 portals are being launched in India every month.

In export as well as domestic sector, Computer Software is a thrust area and its fastest growing sector. Software exports from India jumped from 7 10,940 crore in 1998-99 to Rs 2, 16,300 crore in 2008-2009 showing a growth rate of about 1,877 per cent. The domestic software industry has also increased its business from Rs 29,600 crore in 2005-06 to Rs 57,230. crore in 2008-2009.’

Thus, software development and IT enabled services emerged as a niche opportunity for India in the global context. The software industry emerged as one of the fastest growing sectors in the economy with a CAGR exceeding 50 per cent over the last decade and with a turnover of US $ 58.7 billion and exports of US $ 46.3 billion during 2008-09.

The consistent growth in export of software can be largely attributed to the comparative cost advantage enjoyed by India.

Today, more than 260 of the Fortune 1,000 companies, i.e., almost one out of every four global giants outsources their software requirements to India. In export as well as in the domestic sector, computer software remains a thrust area and the fastest growing sector. The domestic software industry is likely to go up to Rs 57,230 crore during 2008-09 as compared to that of Rs 2,600 crore in 1996-97.

Thus it is observed that the prospect of the Information Technology industry in India is quite bright.

Electronics and IT:

Electronics and IT is the fastest growing sub-sector of the Indian industry. This industry is having a huge potential considering a wide market for its product. It achieved a growth rate of 20 per cent in production in 1997-98. Production of electronic items is likely to register a growth rate of 30 per cent per annum during the Eleventh Plan period.

With de-licensing of consumer electronics industry, liberalisation in foreign investment and Export- Import policies, all renowned global giants have either established production facilities in the country or are present in the market through technical/financial collaborations, thus giving the consumer a wider choice in terms of product features, technology quality and competitive prices.

The Indian electronics industry is estimated to have had production worth Rs 3,68,220 crore during 2008- 2009 as compared to that of Rs 2,95,820 crore during 2007-08 registering a growth of 24.4 per cent. Consumer electronics, with colour TV industry in particular, continued to witness phenomenal growth. The industry (excepting aerospace and reference electronics) is now fully de-licensed.

Fiscal, investment and trade policies related to electronics industry have also been liberalised. All renowned global brands of companies have either established production facilities in the country or are present in the market through technical/financial collaborations, thus giving the consumer a wider choice in terms of product features, technology quality and competitive prices.

Again, consumer electronics sector continues to consolidate its production base and has achieved a production level of Rs15, 200 crore during 2003-2004, achieving a growth rate of 65 per cent. The Colour TV industry has witnessed phenomenal growth during the year 1999 and has crossed a production level of 57 lakh units during the year.

Prices of Colour TVs and Computers have also come down in consonance with worldwide trends. The component industry, especially related to Colour TV improved their performance during the year. The sale of personal computers increased substantially as the demand for PCs was estimated to be around 14 lakh in numbers during the year 1999.

In the mean time, Indian electronic industry attained considerable progress. Indian electronics hardware production increased from Rs 1,10,720 crore in 2009-10 to Rs 1,21,760 crore in 2010-11 (estimated) registering a growth of 10 per cent. During 2010-11, the exports of electronics hardware are estimated to have registered a growth of 56 per cent in rupee terms (62.42 per cent in US dollars) over the preceding year.

In value terms, exports of electronics hardware are estimated to be Rs 40,000 crore (US$ 8.9 billion) during the year 2010- 11 as compared to that of Rs 25.900 crore (US$ 5.5 billion) in 2009-10. Electronics hardware production is expected to be US$ 33 billion in 2011-12.

It is already projected that electronics hardware exports will cross US$ 10 billion in the year 2011-12 as compared to that to US$ 8.86 billion worth exports in 2010-11, showing an expected growth of nearly 12.8 per cent.

Thus, the Information Technology and Electronics .industry is having a wide prospect for its future development in a country like India.

Draft National Policy on Electronics 2011 (NPE 2011):

On 3rd October, 2011, the draft National Policy of Electronics was released. This policy provides a road map for the development of the sector in the country. The vision of the draft policy is to create a globally competitive Electronics System Design and Manufacturing (ESDM) industry including Nano electronics to meet the country’s needs and serve the international market.

Following are some of the salient points of draft NPE 2011:

1. Multi-fold growth in production, investment and employment:

In order to achieve a turnover of about US$ 400 billion by 2020 involving an investment of about US$ 100 billion and employment opportunities to around 28 million people in the ESDM sector, the following specific initiatives are proposed:

2. Setting up of semiconductor wafer fabs for manufacture of semiconductor chips:

a. A Modified Special Incentive Package Scheme providing for the disabilities in manufacturing in the sector.

b. An Electronic Manufacturing Clusters Scheme for about 200 clusters with world class infrastructure.

c. Preferential market access for domestically manufactured electronic goods to address strategic and security concerns and consistent with international commitments.

d. Provide for 10-year stable tax regime.

3. Semiconductor chip design industry:

Building on the emerging chip design and embedded software industry to achieve global leadership and a turnover of US$ 55 billion by 2020.

4. Multi-fold growth in Export:

To increase export from US$ 5.5 billion to US$ 80 billion by 2020.

5. Human resource development:

Significantly enhancing availability of skilled manpower, in scale and scope, including in emerging technology areas, by active participation of the private sector and thrust on higher education. It includes creation of about 2,500 PhDs annually by 2020.

6. Standards:

Developing and mandating standards for electronic products.

7. Security Eco-system:

Creating a completely secure cyber eco-system in the strategic use of electronics.

8. Sourcing for strategic sectors:

Creating long-term partnerships between the ESDM industry and strategic sectors like defence, space and atomic energy.

9. Research and Development (R&D) and Innovation:

To become a global leader in creating intellectual property in the ESDM sector by increasing fund flow for R&D seed capital and venture capital for start-ups in the ESDM and Nano electronics sectors.

10. To develop core competencies in identified sectors:

To develop core competencies in identified sectors such as automotive electronics, avionics, LED, industrial electronics, medical electronics, solar photovoltaic and information and broadcasting through use of ESDM.

11. National Electronic Mission (NEM):

A NEM will be set up with industry participation, as an institutional mechanism to formulate policy, implement approved policy, and promote ‘Brand India in electronics. Thus the draft National Policy on Electronics (NPE), 2011 in designed to bring dynamism, growth and international competitiveness in the electronics manufacturing industry sector.

Large Scale Industry # 10. Automobile Industry:

In recent year, the automobile industry attained considerable growth especially during the post liberalisation period. Initially, there were very few number of automobile producing unit in India. But during the post liberalisation period, with the entry of new manufacturers including multi-national into the automobile sector along with state-of-the-art technology, a huge expansion of the automobile industry has taken place in our country.

Some of the leading Indian automobile companies like Tata Motors, Maruti Udyog etc. have already gone for collaboration with leading multi-national of the automobile sector for technology transfer. As a result some of the Indian automobile companies has become very much successful in attaining best of the updated technology so as to face international competition.

This has also provided confidence to automobile manufacturers of the country for facing international competition. Such steep competition in the global automobile market along with importation of safety regulations of emissions have resulted improvement in the quality and standard of the product along with attainment of its cost-effectiveness.

In the mean time, the automobile industry has diversified its product spectrum by setting up production units for producing various categories of vehicles. The product spectrum of automobile industry in India is consisting of passenger cars, multi-utility vehicles, commercial vehicles, two wheelers and three-wheelers.

During the pre-reform period, Indian automobile industry was dominated by a few monopoly producers. But after the introduction of economic reforms since 1991, the policy of liberalisation and globalisation have resulted progressive growth of in the number of and size of manufacturers of automobiles putting an end to the earlier monopoly position held by a few manufacturers.

Presently, there are 15 manufacturers of passenger cars and multi-utility vehicles, 1 manufacturer of commercial vehicles and 15 manufacturers of two/three wheelers.

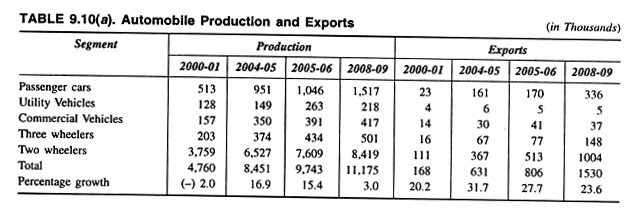

Total volume of production and export of the automobile industry of India is also increasing considerably in recent years. During the last 9 years, the automobile industry experienced a steady growth and annual average growth rate during the same period is estimated at 15 per cent, Table 9.10(a) reveals a clear picture of the rapid growth of this industry during the last 9 years.

Table 9.10(a) reveals that the automobile industry attained a overall growth in the production of vehicles i.e., from 4.76 million in 2000-01 to 8.45 million in 2004-05 and then to 11.17 million in 2008-09 showing a growth of 135 per cent during this 9-year period. However, the production of automotive industry grew at a CAGR of 11.5 per cent over last five years ending 2008-09.

The industry has a strong multiplier effect on the economy due to deep forward and backward linkages with several key segments of the economy. Although the industry has been witnessing impressive growth during the last two decades, the performance after 2006-07 has not been encouraging.

The automobile sector recorded growth of 13.6 per cent in 2006-07. In 2007-08, the industry registered negative growth rate of (-) 2.3 per cent. However, in 2008-09, the industry has witnessed a modest growth of 3.0 per cent. Among the various segments of the industry, the production passenger cars increased from 513 thousand in 2000-01 to 1517 thousand in 2008-09.

Total production of commercial vehicles increased from 157 thousand in 2000-01 to 417 thousand in 2008-09.

Total production of two wheeler segment Increased considerably from 3.76 million in 2000-01 to 8.41 million in 2008-09. In recent years, the growth of automobile industry has been affected by global recession.

Accordingly, while the passenger vehicle, two-wheeler and three-wheeler registered a growth of 3.4 per cent, 4.9 per cent and 0.1 per cent respectively, the utility vehicles and commercial vehicles request registered negative growth of (-) 11.9 per cent and (-) 24.0 per cent respectively.

Moreover, the export of automobiles in recent years has also attained a considerable growth. The export of all segment of automobiles increased from 1.68 lakh in 2000-01 to 15.30 lakh in 2008-09, showing a growth of 810 per cent. In 2008-09, India exported 3.36 lakh passenger cars, 5 thousand utility vehicles, 37 thousand commercial vehicles, 148 thousand three wheelers and 10.04 lakh two wheelers.

This reflects the competitive capability of automobile industry of the country. Moreover, the quantum of exports of automobiles as percentage of total production increased from 3.5 per cent in 2000-01 to 13.7 per cent in 2008-09.

Among the various segments, the export of passenger cars has increased from 4.5 per cent to 22.1 per cent of its total production and exports of two-wheelers also increased from 2.95 per cent to 11.9 per cent of total production during the same 9-year period.

Thus the automobile industry of India had been able to earn its place in the international market and has become successful in increasing its penetration in the foreign market.

The turnover of the automobile sector in 2008-09 was Rs 2, 18,966 crore and exports were around Rs 31,782 crore. The turnover and the exports of the automobile vehicle industry in 2008-09 was at Rs 1, 42,646 crore and Rs 16,782 crore whereas for the automobile component industry this was at Rs 76,320 crore and Rs 15,000 crore respectively.

The percentage of exports to the total turnover for the automobile industry and the automobile components sector in value terms was 12 per cent and 19.7 per cent respectively.

The total investment of automobile industry was around Rs 50,000 crore in 2002-03 which was increased to about Rs 1, 00,000 crore by the year 2010. It is estimated that the automobile industry generated direct and indirect employment of 10.5 million people, of which direct employment is estimated at 5 lakhs and indirect employment of nearly 10 million people.