Brief outlines of the three approaches to General Theory are (1) Economic Static, (2) Comparative Static, and (3) Economic Dynamic!

1. Economic Statics:

The terms ‘statics’ and ‘dynamics’ though originally borrowed from theoretical mechanics have, by now, become a byword of economic discussions.

It is essential to be very clear about the true nature, scope and the boundary lines between ‘economic dynamics’ and economic statics and then to evaluate the nature of Keynesian General Theory—which has often been misunderstood due to the fundamental confusion about the respective scopes of ‘statics’ and ‘dynamics’. In other words, the scope of economic statics is unduly narrowed during discussions, while that of economic dynamics unduly widened.

Economics statics, is essentially, a state of equilibrium in which we take certain fundamental conditions to be given and known. Suppose we consider a given point of time ‘t’; then, at this point the magnitude of all the variables Xt, Yt, Zt, …. Nt, will be given through the evolution of the system. Thus, by a static theory, we mean a theory where all variables (magnitudes to be explained) relating to a certain point or period of time are explained, by data relating to the same point or period of time. If the system is allowed to evolve, it will go on indefinitely on the same path without a tendency to diverge. Such a situation is then, a situation of static equilibrium.

ADVERTISEMENTS:

The variables that are likely to remain constant in a static analysis are various, for example, tastes, preference of individuals, the size and ability to work of the labour force, quantum of capital, of land, state of technology etc. These variables taken together determine the values of certain unknowns, for instance, the size of national income or the mode of output in an economy.

As these variables do not change in a static state, the unknowns also remain fixed or known and the economic system also remains in equilibrium for there are no signs of growth. This, however, does not mean that no changes take place, certain changes do take place, for example, new persons are born and old die, prices change, etc. But if we consider the economy as a whole the net results of all these changes are cancelled out and the system can be taken in a state of rest.

The static situation, according to Harrod, implies a state in which the rate of output remains constant, i.e., all economic variables like population, resources, techniques, organisation, capital stock, tastes and habits move at constant rate so that the uncertainty in the economic system does not actually exist. The macro-statics aims at the final position of the equilibrium and does not tell us how it is attained.

2. Comparative Statics:

So far the description of static state has been given in terms of older analysis. A line of departure from the older analysis of static stale has been suggested by Prof. R.F. Harrodin the case of a once over change. Let us assume that an economic system is in static equilibrium and a change occurs in any of the variables.

ADVERTISEMENTS:

Now, if the adjustment to the new situation is instantaneous and without time lag, the economy is again restored back to equilibrium and the phenomenon can be explained in static terms. For example, suppose there is a once over fall in the wage rates in an economy and production costs are reduced, new equilibrium is likely to be established at once, if the employers increase the amount of employment without allowing the purchasing power to fall as a result of a fall in the wage rates. Similar is the case when there is no consumption-expenditure lag.

If as a result of an increase in income, consumers at once adjust their expenditures to the changed income then there would be no consumption-expenditure lag. The system would, therefore, again be in equilibrium. All these cases of ‘once-over change’ must be included in economic statics. However, in-so-far as we consider in these cases different equilibrium situations, we may call them ‘comparative statics’. It can. therefore, be defined as the study and comparison of two or more successive equilibrium situations.

It enables us to ascertain the direction and magnitude of changes in the variables when changes in the data have caused a movement from one equilibrium situation to another. Static analysis, whether simple or comparative concentrates only on equilibrium positions. It does not concern itself with the time it takes for an equilibrium position to be achieved, nor with the path by which variables approach their equilibrium states. This is the concern of dynamic analysis. Comparative statics is inadequate for the task when, as a result of changes in underlying economic forces, a system goes into a state of continuous disequilibrium.

Further, even if a new equilibrium does succeed the old, comparative statics is incapable of explaining the path followed by the system over time in getting from the old position of equilibrium to the new. In other words, comparative statics bridges the gap between equilibrium positions in one instantaneous jump, but it tells us nothing about how we got from one position to the other.

ADVERTISEMENTS:

3. Economic Dynamics:

By dynamic theory we mean, “a theory that explains how one situation grows out of the foregoing. We consider under it not only a set of magnitudes in a given point of time and study the interrelations between them, but we consider the magnitudes of certain variables in different points of time.” A theory is dynamic, if there are lags in the causal nexus. The acceleration principle is dynamic relationship—because investment is explained by a previous change in demand for the product. Harrod defines dynamics as the study of an “economy in which the rates of output are changing”.

A more formal and sophisticated definition makes the essence of dynamics to be that it studies systems or models involving relationships which hold over time—i.e., relationships in which the value which obtains new for a variable may depend not only on simultaneous values of other variables, but also or instead on previous values of other variables (or even previous values of the same variable).

Examples are behaviour patterns involving tags (the investment expenditures that make today depend on yesterday’s value of the interest rate); habituation (my consumption expenditures today depend, among other things on my yesterday’s level of consumption); or cumulants (my savings today are the cumulative total of all my past saving and dissaving). A system which involves one or more such relationships is a dynamic system.

Dynamic economic analysis can be classified into:

(i) The period analysis,

(ii) Rates of change analysis.

In the period analysis we split time into periods and study the events of each period in relation to the previous period. This is a study of discrete processes so that instead of talking of a rate of flow at a point of time we consider rates of flow at each and every moment of time—the economic process is treated in this case as continuous through time.

From the period—analysis point of view, dynamics deals with lime lags, lagged adjustments (difference or lag equations) in a process of change. This type of theory is dynamic in that some variables are thought to depend on the lagged values of other variables. From Harrods’s point of view, however, dynamics deals with rate of change (differential equations), and the theory is dynamic in respect (hat the rates of certain variables are thought to depend upon the rates of change of other variables. In the latter case there are no time lags. In certain sections of the ‘General Theory’ the analysis is cast in terms of time rates of change in a moving equilibrium.

ADVERTISEMENTS:

This represents perfect foresight and continuous adjustment to change, so that the actual magnitudes of the different variables always correspond to the desired magnitudes. This is a time rate of change analysis. We here deal with continuous functions, and the system is in a state of moving equilibrium.

Most of the interest in the period analysis arises due to the working of lags. At limes, Keynes did go beyond the method of comparative c, I statics and employed the method of dynamic economics. Here and there the argument in fact proceeds in terms of period analysis, as when he discusses the expenditure lag in the multiplier process. An illustration of period analysis is given by Prof. D. H. Robertson which involves the expenditure lag. Here the consumption of today, Ct, is a function of yesterday’s income Y0 while the income of today is generated out of the consumption and investment expenditures of today.

If represents a particular period, then t – 1 is the preceding period, we get the following difference (lag) equations:

Yt = C, + I1,

ADVERTISEMENTS:

Ct = C(Yt– 1)

Yt = C (Yt– 1) + It

The implication of this, expenditure lag is that a lagged multiplier operates in the generation of incomes over time. Lagged variables may produce mere oscillation, and such a process of change over time fully satisfies Frisch’s definition of dynamics. According to Hansen, mere oscillation represents a relatively unimportant part of economic dynamics. Growth, not oscillation, is the primary subject matter for study in economic dynamics. Growth involves changes in technique and increases in population.

ADVERTISEMENTS:

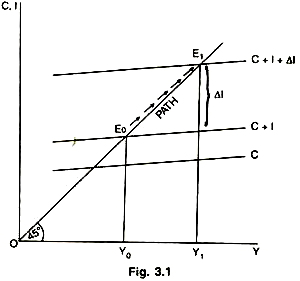

Thus, the ‘General Theory’ is something more than just static theory. Over and over again Keynes is thinking in highly dynamic terms. “Sometimes”, says Hansen, “this involves brief excursions into period analysis (taking account of lags), and sometimes the analysis proceeds in terms of a moving equilibrium (continuous rates of change)”. In the diagram given on the next page macro statics, comparative statics and dynamic situations are explained. The economy is in initial equilibrium at E0, given a certain consumption-income ratio and a fixed level of investment (C + I). It intersects the 45° line at E0 and gives us the initial equilibrium income (OY0).

Suppose, there is an autonomous increase in investment equal to the gap between C + I and C + I + ΔI. The new and final position of equilibrium is shown at E1 and the final income by OY1. The figure indicates how the economic system jumps instantaneously from initial equilibrium En to the final and new equilibrium E1. It does not tell us anything about the adjustment process as to how the new equilibrium at E1 is attained. E0 and E1 taken alone represent two different macro-static equilibrium positions at two different points of time but when we compare the two positions, the new succeeding the old we are entering the field of comparative statics analysis.

However, when we try to study the path or the adjustment process between two points of time period, we are indulging in dynamic analysis. In macro statics we have a ‘still’ picture of the economic system as a whole. In comparative statics analysis, we investigate “the response of a system to changes in given parameters”. In this type of analysis, we don’t study the path during the transition as it skips over the time involved in the transition from one equilibrium position to another equilibrium position. The study of change from one equilibrium position to another equilibrium position falls under the scope of comparative statics.

In other words, two statics positions of the economy are compared under comparative statics. In dynamic analysis or process analysis or period analysis or rates-of-change analysis, we investigate the behaviour of the system which results from the passage of the time. In this type of analysis, we study the path which the economy follows during transition from one equilibrium position to another equilibrium position. The variables found in an economic model are either stocks or flows.

Any given model may include only flow variables or both How and stock variables. Certain functional relationships are postulated amongst these variables, such that the value of one variable is a function of the value of one or more of the other variables in the model. If all the variables are considered in the same period, the relationships are all static; if they cover different time periods, the relationships are dynamic.

The classical approach to dynamics particularly that of Malthus and Ricardo, was the study of the development of progressive economy into a stationary state. The dynamics of Marx and Schumpeter was also an attempt to build a historical dynamic theory. The Marxian “materialist interpretation of history’ was nothing—if not dynamics.

ADVERTISEMENTS:

His prophesy about the future of capitalism, namely chronic unemployment, low wage and concentration of wealth ultimately leading to the destruction of capitalism, was essentially dynamics. Scientific dynamic analysis was, however, evolved only a quarter of a century ago.

J. M. Clark’s ‘Principle of Acceleration’ and the Aftalion theory of business oscillations which described the lagged response of output to previous capital formation opened the way for dynamic process analysis. This task was successfully furthered by a number of economic experts like Frisch, Tinbergen, Kalecki, Robertson, Lange, Meade, Ohlin, Myrdal, Lindahl, Harrod, Domar, Mrs. Joan Robinson etc. As a result, a neat and clear cut picture of the period or process analysis has at last emerged before us.

In statics we are concerned with instantaneous and timeless determination of relationships among economic variables; while dynamics studies the fundamental relationships of economic variables at different points of time. Thus, dynamic analysis proper can be defined as a step by step study of changes in economic data from one period of time to another.