In this essay we will discuss about the National Income of India. After reading this essay you will learn about: 1. Meaning of National Income 2. Trends in National Income in India 3. Rates of Growth 4. Sectoral Contribution 5. Difficulties or Limitations in Estimation 6. Inter-State Variation.

Content:

- Essay on the Meaning of National Income

- Essay on the Trends in National Income in India

- Essay on the Rates of Growth of National Income in India

- Essay on the Sectoral Contribution or Distribution of National Income by the Industrial Origin

- Essay on the Difficulties or Limitations in the Estimation of National Income in India

- Essay on the Inter-State or Inter-Regional Variation of National Income in India

Essay # 1. Meaning of National Income:

National income of India constitutes total amount of income earned by the whole nation of our country and originated both within and outside its territory during a particular year. The National Income Committee in its first report wrote, “A national income estimate measures the volume of commodities and services turned out during a given period, without duplication.”

The estimates of national income depict a clear picture about the standard of living of the community. The national income statistics diagnose the economic ills of the country and at the same time suggest remedies. The rate of savings and investment in an economy also depends on the national income of the country.

ADVERTISEMENTS:

Moreover, the national income measures the flow of all commodities and services produced in an economy.

Thus the national income is not a stock but a flow. It measures the total productive power of the community during given period. Further, the National Income Committee has rightly observed, “National income statistics enable an overall view to be taken of the whole economy and of the relative positions and inter-relations among its various parts”.

Thus the computation of national income and its analysis has been considered an important exercise on economic literature.

A. Estimates of National Income during Pre-Independence Period:

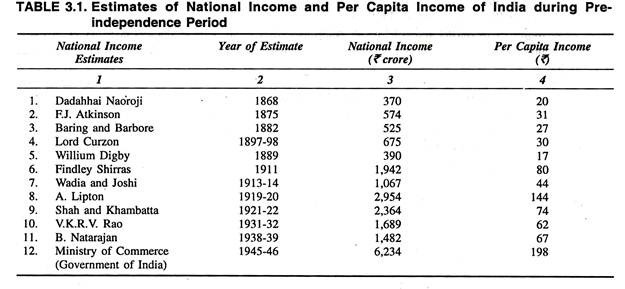

During the British period, several estimates of national income were made by Dadabhai Naoroji (1868), Willium Digby (1899), Findlay Shirras (1911, 1922 and 1934), Shah and Khambatta (1921), V.K.R.V. Rao (1925-29) and R.C. Desai (1931-40).

ADVERTISEMENTS:

Among all these pre-independence estimates of national income in India, the estimates of Naoroji, Findlay Shirras and Shaw and Khambatta have computed the value of the output raised by the agricultural sector and then added some portion of the income earned by the non-agricultural sector. But these estimates were having no scientific basis of its own.

After that Dr. V.K.R.V. Rao applied a combination of census of output and census of income methods. While dividing the whole economy into two separate categories he included agriculture, pastures, forests, fishing, hunting and mines in the first category and applied output method to derive the value of output of these sectors.

The other activities like industry, trade, transport, administrative and public services, professions, liberal arts and domestic services were included in second category and applied income method to derive the amount of income raised from all these services.

He also added income from house property and other internal incomes along-with the total income earned from abroad to these two sub-totals mentioned above. Just to derive the net aggregate income he excluded those values of goods and services which we consumed in the process of production.

ADVERTISEMENTS:

Table 3.1 reveals various estimates of national income and per capita income of India as prepared by different dignitaries before independence.

All these estimates of national income were conducted out of individual effort and were subjected to serious limitations due to some of its arbitrary assumptions.

Difficulties and Limitations:

Following are some of the important difficulties and limitations of the estimates of national income in India during pre-independence period:

1. In the absence of any government agency for estimation of national income, no such estimates were prepared in India at the official level. Rather all those estimates were prepared at the personal level and, therefore, suffered from personal bias of the individuals.

2. Different personal estimates of national income were based on different methods.

3. All these estimates were not prepared as per the standard definitions and concepts of national income.

4. All these estimates were prepared on the basis of incomplete and unreliable data.

ADVERTISEMENTS:

5. These estimates of national income were not of much relevance as these covered different geographical areas.

6. These estimates of national income were prepared at current prices only and also for a particular year and therefore could not be compared between themselves.

7. In the estimation of national income during the pre-independence period, different methods were adopted in the same sector as per personal choice, leading to distortion of these estimates.

Although pre-independence estimates of national income in India suffered from various difficulties and limitations but it provided considerable light and insight about the economic conditions of the country prevailing during those period.

B. Estimates of National Income during the Post-Independence Period:

After independence, the Government of India appointed the National Income Committee in August, 1949 with Prof. P.C. Mahalnobis as its chairman and Prof. D.R. Gadgil and Dr. V.K.R.V. Rao as its two members so as to compile a national income estimates rationally on scientific basis. The first report of this committee was prepared in 1951.

In its report, the total national income of the year 1948-49 was estimated at Rs. 8,830 crore and the per capita income of the year was calculated at Rs. 265 per annum. The committee continued its estimation works for another three years and the final report was published in 1954.

ADVERTISEMENTS:

The report of this National Income Committee provided complete statistics on the national income of the whole country.

The following were the main features of the National Income Committee report:

1. Agriculture including forestry, animal husbandry and fishery contributed about one half of the national income of the country during 1950-51.

2. Mining, manufacturing and hand trades contributed nearly one-sixth of the national income India.

ADVERTISEMENTS:

3. Commerce, transport and communication also contributed a little more than one-sixth of the total national income of the country.

4. Income earned from other services such as professions and liberal arts, house property, administrative and domestic services contributed nearly 15 per cent of the total national income of the country.

5. Commodity production constituted nearly two-thirds share of the national income whereas services contributed the remaining one-third of the national income of India.

6. In 1950-51, the share of the Government sector contributed about 7.6 per cent of net domestic product.

7. In the computation of national income estimates, the margin of error was estimated at about 10 per cent.

National Income Committee and C.S.O. Estimates:

ADVERTISEMENTS:

During the post-independence period, the estimate of national income was primarily conducted by the National Income Committee. Later on, it was carried over by the Central Statistical Organisation.

For the estimation of national income in India the National Income Committee applied a mixture of both ‘Product Method’ and the ‘Income Method’. This Committee divided the entire economy into 13 sectors. Income from the six sectors, viz., agriculture, animal husbandry, forestry, Fishery, mining and factory establishments was estimated by the output method.

But the income from the remaining seven sectors consisting of small enterprises, commerce, transport and communications, banking and insurance, professions, liberal arts, domestic services, house property, public authorities and rest of the world was estimated by the income methods.

The National Income Unit of the Central Statistical Organisation (C.S.O.) is now-a-days entrusted with the measurement of national income. Here this unit of C.S.O. estimated the major part of national income from the various sectors like agriculture, forestry, animal husbandry, fishing, mining and factory establishments with the help of product method.

The unit of C.S.O. is also applying the income method for the estimation of the remaining part of national income raised from the other sectors. Till now we have three different series in the national income estimates of India.

These include:

ADVERTISEMENTS:

(i) Conventional Series,

(ii) Revised Series and

(iii) New Series.

(i) Conventional Series:

The Conventional series revealed national income data both at current prices and at 1948-49 prices covering the period from 1948-49 to 1964-65. Here the contribution of all the 13 sectors was added for obtaining an estimate of the net domestic product at factor cost through the application of both net output method and net income method.

To arrive at the estimate of net national income, the net income from abroad and net indirect taxes were added to the estimate of net domestic product at factor cost. Moreover, for obtaining a series of national income at constant prices, this estimate was deflated at the prices of base year chosen.

ADVERTISEMENTS:

(ii) The Revised Series:

The revised series revealed national income data for both at current prices and at 1960-61 prices for the period 1960-61 to 1975-76. Later on, a new series was also started with 1970-71 as base year. Due to this difference in the base year and differences in weights used for the two series, estimates of national income revealed differences in its magnitudes.

(iii) C.S.O’s New Series:

The National Income Unit of Central Statistical Organisation (C.S.O.) prepared a new series on national income with 1980-81 as base year as against the existing series with 1970-71 as the base year. These national income estimates have also been projected backwards to prepare a total series of national income from 1950-51 onwards for the sake of comparison.

Taking this new series into consideration, the estimates of national income aggregates have registered an increase in the new series as against 1970-71 series. Again the CSO prepared another new series on national income with 1993-94 as base year as against the existing series with 1980-81 as base year.

Although the total national income has registered an increase in this new series but the estimates of gross domestic, savings have been revised downwards.

C. Methodology of National Income Estimation in India:

ADVERTISEMENTS:

In India, the estimation of national income is being done by two methods, i.e., product method and income method.

1. Net Product Method:

While estimating the gross domestic product of the country, the contribution to GDP from various sectors like agriculture, livestock, fishery, forestry and logging, mining and quarrying is estimated with the adoption of product method.

In this method, it is important to estimate the gross value of product, bi-products and ancillary activities and then steps are taken to deduct the value of inputs, raw materials and services from such gross value.

In respect of other sub-sectors like animal husbandry, fishery, forestry, mining and factory establishments, the gross value of their output is obtained by multiplying the estimated output with their market price. From such gross value of output, deductions are made for cost of materials used and depreciation charges so as to obtain net value added in each sector.

In respect of secondary activities, the computation of gross domestic product is done by the production approach only for the manufacturing industrial units (both registered and unregistered). In respect of constructions activity, the estimates of the value of pucca construction is made by the commodity flow approach and that of the kachcha construction is made by the expenditure method.

2. Net Income Method:

In India, the income from rest of the sectors, i.e., small enterprises, commerce, transport and communications, banking and insurance professions, liberal arts, domestic activities, house property, public authorities and rest of the world is estimated by the income method.

Here, the income approach is adopted to estimate the value added from these aforesaid remaining sectors. Here, the process involves the measurement of aggregate factor incomes in the shape of compensation of employees (wages and salaries) and operating surpluses in the form of rent, interest, profits and dividends.

In order to measure the contribution of small enterprises, it is essential to make an estimation of total number of workers employed in different occupations under small enterprises through sample surveys and also to estimate the per capita average earnings of such workers.

After multiplying the total number of such workers employed by their average earning, the contribution of small enterprises to national product is estimated. In order to obtain the contribution of banking and insurance sector, necessary information are collected from their balance sheets so as to add the wages, salaries, directors’ fees and dividends.

In order to derive the contributions of transport and communication, trade and commerce, professions and liberal arts, the same procedure as adopted by the small enterprises is followed. Regarding the contribution of the public sector, the amounts related to wages, salaries, pensions, other benefits, dividend or surpluses etc. are all added up to derive the same.

Again the contribution of house property to the national income is obtained by estimating the imputed value of net rental of all houses situated both in urban and rural areas.

Finally, by adding up the contribution of all different sectors to national income of the country, it is necessary to obtain net domestic product at factor cost. In order to derive the net national income at current prices, it is necessary to add the net income from abroad and net indirect taxes with the net domestic product at factor cost.

This same estimate is then deflated at the prices of the base year selected to derive a series of national income at constant prices.

Essay # 2. Trends in National Income in India:

A study, of the trend of the national income in India over the last 60 years, in detail, is very much essential for attaining a clear understanding about the impact of planning on the Indian economy. Both the national income and per capita income are first collected at current prices and then at constant prices for eliminating the effect of any change of price level during that period.

This trend in national income also reflects on the standard of living of the people of India. Thus the national income at current prices is influenced by both the increase in production of goods and services and the rise in prices. In order to make the national income figures comparable, these figures are deflated at constant prices just for eliminating the effect of any change in the price level of the country.

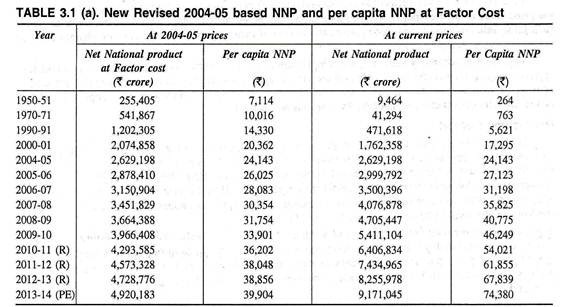

Let us now look into the trends in the national income figures and per capita income figures of India both at current prices and at constant prices obtained through CSO’s new series with 2004-05 as base year.

A. CSO’s Revised 2004-05 Based Net National Product (NNP) Series:

The Central Statistical Organisation (CSO) has released the new 2004-05 based NNP series. Let us now look into the trends in the national income figures and per capita income figures of India both at current and constant prices obtained through CSO’s new series with 2004-05 as base year.

Table 3.1(a) reveals the estimates of new 2004-05 based net national product (NNP) series of last 64 years since 1950-51 both at 2004-05 prices and at current prices. It is observed that NNP of India at 2004- 05 prices increased from Rs 255,405 crore in 1950-51 to Rs 2,629,198 crore in 2004-05 and then to Rs 4,920,183 crore in 2013-14 (P) registering a growth rate of 1926 per cent during the last 64 years.

Again the national income (NNP) of India at current prices increased from Rs 9,464 crore in 1950-51 to Rs 2,629,198 crore in 2004-05 and then to Rs 9,171,045 crore in 2013-14 (P) registering a growth of nearly 969 times during the last 64 years.

Again the per capita income figure at constant (2004-05) prices increased from 7,114 in 1950-51 to Rs 24,143 in 2004-05 and then to Rs 39,904 in 2013-14 (P) registering a growth rate of 560 per cent during the last 64 years. Moreover, the per capita income at current prices also increased from Rs 264 in 1950- 51 to Rs 24,143 in 2004-05 and then to Rs 74,380 in 2013-14 registering growth of 281 times during the last 64 years.

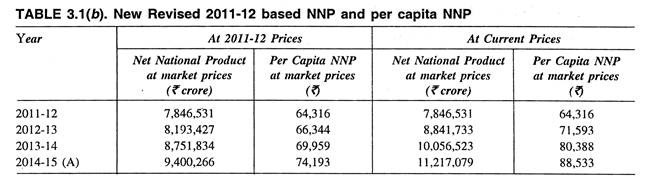

B. CSO’s Revised 2011-12 Based NNP Series:

The Central Statistical Organisation (CSO) has released the new 2011-12 based NNP series. Let us now look into the trends of national income figures and per capita income figures of India both at current and constant prices obtained through CSO’s new series with 2011-12 as base year. This new estimate is prepared as Net National Income at market prices instead of Net National Income at factor cost.

Table 3.1(b) reveals the estimates of new 2011-12 based net national product (NNP) series of last 4 years since 2011 -12 both at 2011-12 prices and at current prices. It is observed that NNP of India at 2011-12 prices increased from Rs 7,846,531 crore in 2011-12 to Rs 8,751,834 crore in 2013-14 and then to Rs 9,400,266 crore in 2014-15 (A) registering a growth rate of 19.8 per cent over the last 4 years.

Again the national income (NNP) of India at current prices increased from Rs 7,846,531 crore in 2011-12 to Rs 10,056,523 crore in 2013-14 and then to Rs 11,217,079 crore in 2014-15(A) registering growth of 42.9 per cent during the last 4 years.

Again, the per capita income figure at constant (2011-12) prices increased from Rs 64,316 in 2011-12 to Rs 69,959 in 2013-14 and then to Rs 74,193 in 2014-15(A) registering a growth rate of 15.3 per cent during the last 4 years.

Moreover, the per capita income at current prices also increased from Rs 64,316 in 2011-12 to Rs 80,388 in 2013-14 and then to Rs 88,533 in 2014-15(A) registering a growth of 37.6 per cent during the last 4 years.

Essay # 3. Rates of Growth of National Income in India:

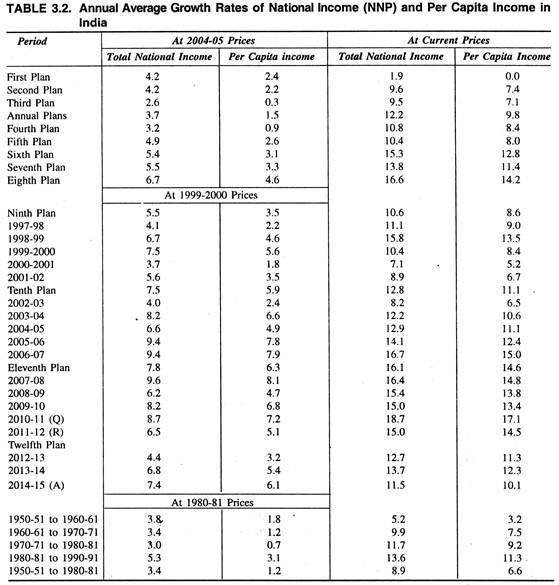

In order to study the extent of changes in the national income during different periods it is quite essential to study the annual average growth rate of national income and per capita income in India. Table 3.2 reveals a clear picture about the annual average rates of growth of both national income and per capita income in India during different plan periods as well as during different decades.

Table 3.2 reveals that the annual average growth rate of NNP at 2004-05 prices increased from 4.2 per cent during the First Plan to 4.2 per cent during the Second Plan and then declined to 2.6 per cent during the Third Plan due to severe drought.

This growth during the Third Plan was just sufficient to neutralise the growth of population indicated by the zero rate of growth of per capita income during the same period. But during the First Plan and the Second Plan, the annual growth rates of per capita income were 2.4 per cent and 2.2 per cent respectively.

During the three Ad-hoc Annual Plans, the economy of the country gradually started to pick up resulting in increase in the growth rates of national income and per capita income to 3.7 per cent and 1.5 per cent respectively.

During the Fourth Plan, the annual average growth rate, of both national income and per capita income gradually declined to 3.2 per cent and 0.9 per cent respectively and the same rates again gradually increased to 4.9 per cent and 2.6 per cent respectively during the Fifth Plan showing an improvement in its performance.

During the Sixth Plan Period, the national income and per capita income in India again recorded a growth rate of 5.4 per cent and 3.1 per cent respectively. Again during the Seventh Plan at 2004-05 prices, the national income and per capita income in India recorded a growth rate of 5.5 per cent and 3.3 per cent respectively.

Again during the Eighth Plan at 2004-05 prices, the national income and per capita income in India recorded a growth rate of 6.7 per cent and 4.6 per cent respectively and in 1993-94 the same rate reached the level of 6.1 per cent and 3.7 per cent respectively.

Again as per the CSO’s new series of estimates of national income with 1993-94 as base year, it is found that the national income and per capita income in India at 2004-2005 prices recorded a growth rate of 5.5 per cent and 3.5 per cent respectively during the Ninth Plan. But the same growth rate declined significantly to 4.0 per cent and 2.4 per cent respectively in 2002-03.

The same growth rate again increased to 8.2 per cent and 6.6 per cent in 2003-04 and then again increased to 9.4 per cent and 7.8 per cent in 2005-06 and then again increased to 9.4 per cent and 7.9 per cent in 2006-07. However, during the Tenth Plan at 2004-2005 prices, the national income and per capita income in India recorded a growth rate of 7.5 per cent and 5.9 per cent respectively.

In 2007-08, the same growth rate increased to 9.6 per cent and 8.1 per cent respectively. In 2011-12, the same growth rate declined to 6.5 per cent and 5.1 per cent respectively facing the impact of global recession. Thus, during the Eleventh Plan at 2004-05 prices, the national income and per capita income recorded a growth rate of 7.8 per cent and 6.0 per cent respectively.

However, during the Twelfth Plan, the growth rate of national income and per capita income is likely to face a setback facing the impact of global recession again. Accordingly, the CSO has estimated a growth rate of 4.4 per cent only for the year 2012-13. The CSO data released so far shows that the growth rate of GDP attained by India in 2012-13 was 4.4 per cent compared with 6.5 per cent in the same period a year ago.

Again the report of Economic Outlook for the year 2014-15 released by Chairman of the Prime Minister’s Economic Advisory Council (PMEAC) shows that the country’s gross domestic product (GDP) is estimated to attain a growth rate of 7.2 per cent in 2014-15. But the CSO has pegged the growth rate for 2014-15 at 7.4 per cent.

Table 3.2 further reveals that during the 30 years period, i.e., from 1950-51 to 1980-81, the annual average growth rates of both national income and per capita income at 1980-81 prices were 3.4 per cent and 1.2 per cent respectively.

But at current prices, the same rates of growth were of the order of 8.9 per cent and 6.6 per cent respectively. This increase in the growth rates of NNP and per capita income at current prices during the above mentioned period was mainly due to sharp rise in the price level of the country more particularly after the Third Plan.

Moreover, a further break-up of the same data into three periods shows that during the decade of planning (1950-51 to 1960-61), the NNP and the per capita income increased at the average annual rate of 3.8 per cent and 1.8 per cent respectively. After that the performance of the economy started to decline.

During the second decade of planning (1960-61 to 1970-71) the annual rate of growth NNP gradually declined to 3.4 per cent and that of per capita NNP to 1.2 per cent. In the next 10 years period of our planning (1970-71 to 1980-81), the annual average growth rate of NNP and per capita NNP gradually declined further to 3.0 per cent and 0.7 per cent respectively.

But during the 1980s, the economy registered a spectacular improvement in achieving its growth rate. During the period 1980-81 to 1990-91, the net national product at 1980-81 prices registered a growth rate of 5.3 per cent per annum and that of per capita income to 3.1 percent per annum.

The same growth rates of NNP and per capita NNP at current prices showed a perceptible increase to 13.6 per cent and 11.3 per cent respectively per annum in comparison to that of 8.9 per cent and 6.6 per cent respectively per annum during the period of 30 years (1950-51 to 1980-81).

A. Causes for Slow Growth of National Income in India:

The growth rate of national income in India remained all along poor particularly in the first half of our planning process. Between First plans to Fourth Plan, the annual average growth rate of national income varied between 2.6 per cent to 4.1 per cent. During the Fifth, Sixth and Eighth Plan, the annual average growth rate of national income also ranges between 4.9 per cent, 5.4 per cent and 6.7 per cent respectively.

It is only during the Ninth Plan, the annual rate of growth of national income in India touched the level of 5.5 per cent. Again in 2004-05, the rate of growth of national income plunged down to 6.6 per cent after reaching 8.2 per cent in 2003-04 and then increased to 9,4 per cent in 2006-07 and then declined to 7,4 per cent in 2014-15.

Thus we have seen that the rate of growth of national income in India is very poor. Targets of growth rate of national income remain all long unfulfilled.

In this connection, Richard T. Gill has observed that, “India’s rate of progress is pity-fully meagre as against her actual needs. At her present pace, India would remain a very poor nation at the end of the century and many segments of her population would undoubtedly still be living in conditions of desperate poverty.”

The following are some of the important causes of slow growth of national income in India:

1. High Growth Rate of Population:

Rate of growth of population being an important determinant of economic growth, is also responsible for slow growth of national income in India. Whatever increase in national income has been taking place, all these are eaten away by the growing population. Thus high rate of growth of population in India is retarding the growth process and is responsible for slow growth of national income in India.

2. Excessive Dependence on Agriculture:

Indian economy is characterised by too much dependence on agriculture and thus it is primary producing. The major share of national income that is usually coming from the agriculture, which is contributing nearly 34 per cent of the total national income and engaged about 66 per cent of the total working population of the country.

Such excessive dependence on agriculture prevents quick rise in the level of national income as well as per capita income as the agriculture is not organised on commercial basis rather it is accepted as way of life.

Excessive dependence on agriculture and low land-man ratio, inferior soils, poor ratio of capital equipment, problems of land holding and tenures, tenancy rights etc. are also responsible for slow growth of agricultural productivity which, in turn, is also responsible for slow growth of national income.

3.Occupational Structure:

The peculiar occupational structure is also responsible for slow growth of national income in the country. At present about 66 per cent of the working force are engaged in agriculture and allied activities, 3 per cent in industry and mining and the remaining 31 per cent in the tertiary sector.

Moreover, prevalence of high degree of under-employment among the agricultural labourers and also among the work force engaged in other sectors is also responsible for this slow growth of national income.

4. Low Level of Technology and its Poor Adoption:

In India low level of technology is also mostly responsible for its slow growth of national income. Moreover, whatever technology that has been developed in the country, is not properly utilised in its production process leading to slow growth of national income in the country.

5. Poor Industrial Development:

Another important reason behind the slow growth of national income in India is the poor rate of development of its industrial sector. The industrial sector in India has failed to maintain a consistent and sustainable growth rate during the planned development period and more particularly in recent years.

Moreover, the development of basic industry is also lacking in the country. All these have resulted a poor growth in the national income of the country.

6. Poor Development of Infrastructural Facilities:

In India, the infrastructural facilities viz., transport, communication, power, irrigation etc. have not yet been developed satisfactorily as per its requirement throughout the country. This has been creating major hurdles in the path of development of agriculture and industrial sector of the country leading to poor growth of national income.

7. Poor Rate of Saving and Investment:

The rate of savings and investment in India is also quite poor as compared to that of developed countries of the world. In recent times, i.e., in 2008-09, the rate of gross domestic savings was restricted to 32.5 per cent of GDP and that of investment was 33.0 per cent of GDP in the same year. Such low rate of saving and investment has resulted in a poor growth of national income in the country.

8. Socio-Political Conditions:

Socio-political conditions prevailing in the country is also not very much conducive towards rapid development. Peculiar social institutions like caste system, joint family system, fatalism, illiteracy, unstable political scenario etc. are all responsible for slow growth of national income in the country.

In the mean time, the Government has taken various steps to attain a higher rate of growth in its national income by introducing various measures of economic reforms and structural measures. All these measures have started to create some impact on raising growth of national income of the country.

B. Suggestions to Raise the Level and Growth Rate of National Income in India:

In order to raise the level and growth rate of National income in India, the following suggestions are worth mentioning:

1. Development of Agricultural Sector:

As the agricultural sector is contributing the major portion of our national income, therefore, concrete steps be taken for all round development of the agricultural sector throughout the country at the earliest.

New agricultural strategy be adopted widely throughout the country to raise its agricultural productivity by adopting better HYV seeds, fertilizers, pesticides, belter tools and equipment’s and scientific rotation of crops and other scientific methods of cultivation. Immediate steps be taken to enhance the coverage of irrigation facilities along with reclamation of waste land.

2. Development of Industrial Sector:

In order to diversify the sectoral contribution of national income, industrial sector of the country should be developed to a considerable extent. Accordingly the small, medium and large scale industries should be developed simultaneously which will pave the way for attaining higher level of income and employment.

3. Raising the Rate of Savings and Investment:

For raising the level of national income in the country, the rate of savings and investment should be raised and maintained to a considerable extent. The capital output ratio should be brought down within the manageable limit.

In this respect, the Ninth Plan document set its objectives to achieve 7 per cent rate of economic growth, to enhance the rate of investment from 27 per cent to 28.3 per cent and to reduce the capital output ratio from 4.2 per cent to about 4.0 per cent.

4. Development of Infrastructure:

In order to raise the level of national income to a considerable height, the infrastructural facilities of the country should be adequately developed. These include transport and communication network, banking and insurance facilities and better education and health facilities so as to improve the quality of human capital.

5. Utilisation of Natural Resources:

In order to raise the size and rate of growth of national income in India, the country should try to utilize the natural resources of the country in a most rational manner to the maximum extent.

6. Removal of Inequality:

The country should try to remove the inequality in the distribution of income and wealth by imposing progressive rates of taxation, on the richer sections and also by redistribution of wealth through welfare and poverty eradication programmes. Moreover, imposing higher rates of taxation on the richer sections can also collect sufficient revenue for implementation of the plan.

7. Containing the Growth of Population:

As the higher rate of growth of population has been creating a negative impact on level of national income and per capita income of the country, positive steps be taken to contain the growth rate of population by adopting a rational population policy and also by popularising the family planning programmes among the people in general.

8. Balanced Growth:

In order to attain a higher rate of economic growth, different sectors of the country should grow simultaneously so as to attain an inter-sectoral balance in the country.

9. Higher Growth of Foreign Trade:

Foreign trade can also contribute positively towards the growth of national income in the country. Therefore, positive steps be taken to attain a higher rate of growth in foreign trade of the country. Higher volume of export can also pave the way for the import of improved and latest technologies required for the development of country.

10. Economic Liberalisation:

In order to develop the different sectors of the country, the Government should liberalise the economy to a considerable extent by removing the unnecessary hurdles and obstacles in the path of development. This would improve the productivity of different productive sectors.

Under the liberalised regime, the entry of right kind of foreign capital and technical know-how will become possible to a considerable extent leading to modernisation of industrial, infrastructural and other sectors of the country. This economic liberalisation of the country in the right direction will ultimately lead the economy towards attaining higher level of national income within reasonable time frame.

Therefore, in order to raise the size and growth rate of national income of the country, a rigorous and sincere attempt be made by both public and private sector to undertake developmental activities in a most realistic path and also to liberalize and globalize the economy for the best interest of the nation as a whole.

C. Major Features of National Income in India:

Trends and composition of national income estimates of India during post-independence period shows the following major features:

1. Excessive Dependence on Agriculture:

One striking feature of India’s national income is that a considerable proportion, i.e., 27.8 per cent of the national income is now being contributed by the agricultural sector. Naturally development of this sector is very important considering its employment potential, marketable surplus and necessary support to industry sector.

2. Poor Growth Rate of GDP and Per Capita Income:

Poor growth rate of GDP and per capita income is another important feature of national income of the country. The annual average growth rate of GDP in India was 5.2 per cent during 1980-92 as compared to 9.1 per cent for China and 5.7 per cent of Indonesia. Again the annual average growth rate of per capita GNP in India was only 3.1 per cent during 1980-92 as compared to 7.6 per cent for China.

In 1994, the per capita income figure in Switzerland was nearly 119 times, in USA about 81 times, in Japan about 105 times the per capita income in India. This low per capita income is also resulted from lower growth rate of national income and higher growth rate of population. The growth rate of GDP at constant price was 6.8 per cent in 2013-14.

3. Unequal Distribution and Poor Standard of Living:

The distribution of national income in India is most unequal. Human Development Report, 1994 shows that in 1993, richest 20 per cent of total population shared 84.7 per cent of the total income and the poorest 20 per cent of the total population shared only 1.4 per cent of the total income of the country. Due to highly skewed pattern of distribution of income, the standard of living of the majority of population of our country is very poor.

4. Growing Contribution of Tertiary Sector:

Another striking feature of India’s national income is that the contribution of tertiary sector has been increasing continuously over the years, i.e. from 28.5 per cent of total national income in 1950-51 to 52.6 per cent in 2014-15.

5. Unequal Growth of Different Sectors:

In India different sectors are growing at unequal rates. During the period 1951-97, while the primary sector has recorded a growth rate of 2.9 per cent but the secondary and tertiary sector recorded a growth rate of 6.3 per cent and 7.1 per cent respectively and in 2013-14, the same growth rates were 3.9 per cent, 4.4 per cent and 11.1 per cent respectively.

6. Regional Disparity:

Another striking feature of India’s national income is its regional disparity. Among all the states, only six states of the country have recorded a higher per capita income over the national figure. Out of this six states Punjab ranks highest and Bihar ranks lowest. In 2013-14, the per capita income of Bihar at the bottom was Rs 31,229 as compared to that of Rs 92,638 of Punjab at the top, reflecting the ratio at 1: 2.96.

7. Urban and Rural Disparity:

Urban and rural disparity of income is another important feature of our national income. The All India Rural Household Survey shows that the level of income in urban areas is just twice that of the rural areas depicting a poor progress of rural economy.

8. Public and Private Sector:

Another important feature of India’s national income is that the major portion of it is generated by the private sector (75.8 per cent) and the remaining 24.2 per cent of the national income is contributed by the public sector.

Essay # 4. Sectoral Contribution or Distribution of National Income by the Industrial Origin:

Sectoral contribution of national income depicts a clear picture about the composition or distribution of national income by industrial origin. Thus it shows the contribution made by different sectors towards the national income of the country.

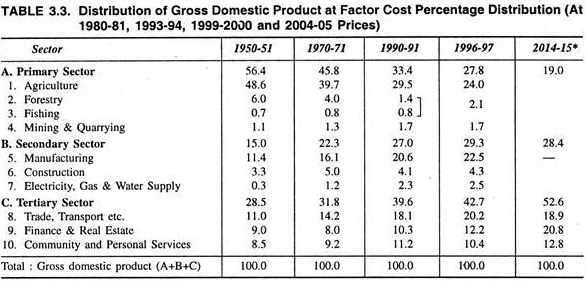

In India, among the different sectors, the primary sector and more particularly agriculture still plays a dominant role in contributing the major portion of the national income of the country. Table 3.3 shows the changes in the sectoral contribution towards the national income of the country since 1950-51.

Table 3.3 shows the following trends:

1. Primary Sector:

The contribution of primary sector which is composed of agriculture, forestry, fishery and mining gradually declined from 56.4 per cent of GDP in 1950-51 to 45.8 per cent in 1970-71 and then finally to 19.0 per cent in 2014-15. It is also interesting to look at the trend in the contribution of agriculture which is contributing the major share (nearly above 90 per cent) to the primary sector.

Thus agriculture contributed about 48.6 per cent of GDP in 1950-51 and then its share however declined to 39.7 per cent in 1970-71 and then to 29.5 per cent in 1990-91 and then finally to around 24.0 per cent in 1996-97.

The share of forestry has also considerably declined from 6.0 per cent in 1950-51 to nearly 1.4 per cent in 1990-91. But the contribution of fishing and mining remained more or less stable varying between 1 to 2 per cent of GDP during this entire period of 60 years.

2. Secondary Sector:

The secondary sector which is composed of manufacturing industries, construction, electricity, gas and water supply increased its share of GDP from 15.0 per cent in 1950-51 to 22.3 per cent in 1970-71 and then to 28.4 per cent in 2014-15.

Among the major constituents of the secondary sector, the share of manufacturing industries to GDP also increased from 11.4 per cent in 1950-51 to 15.1 per cent in 2012-13. But the share of construction to GDP marginally improved from 3.3 per cent in 1950-51 to 5.0 per cent in 1980-81 and then slightly declined to 4.3 per cent in 1996-97.

3. Tertiary Sector:

The share of tertiary sector which is constituted by trade, transport, storage, communications, banking, insurance, real estate, community and personal services gradually increased from 28.5 per cent in 1950-51 to 31.8 per cent in 1970-71 and then finally to 52.6 per cent in 2014-2015.

Among the major components of tertiary sector, the share of transport, communication and trade also increased from 11.0 per cent in 1950-51 to 18.9 per cent in 2014-15. The share of community and personal services to GDP marginally increased from 8.5 per cent in 1950-51 to 12.80 per cent in 2014-15.

Thus due to the developmental strategy followed in economic planning of the country, structural changes occur in the composition of its national income by industrial origin. With the rapid expansion of manufacturing’ industries, the share of manufacturing sector recorded a sharp increase.

But the agriculture could not record a faster rate of growth. But the services sector has improved its position and became the major contributor to the growth process attaining a faster and higher rate of growth in the later stage. Thus growth scenario in India is termed as services-led growth.

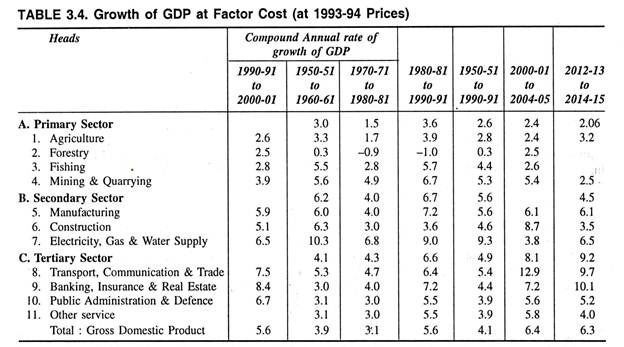

Growth of GDP at Factor Cost:

Table 3.4 reveals that the annual average rate of growth of the primary sector which was 3.0 per cent during 1950-51 to 1960-61, gradually declined to 1.5 per cent during 1970-71 to 1980-81 and then the same rate increased to 3.6 per cent during 1980-81 to 1990-91.

Similarly, the annual average growth rate of agricultural output alone gradually declined from 3.3 per cent during 1950-51 to 1960-61 to 1.7 per cent during 1970-71 to 1980-81 and then the same rate increased to 3.9 per cent during 1980-81 to 1990-91.

Thus the agricultural sector did not experience any faster rate of growth. Again during the 40 year period (1950- 51 to 1990-91), the average rates of growth of the primary sector as well as of the agricultural sector were 2.6 per cent and 2.8 per cent respectively.

Again the process of transformation of the Indian economy from an agricultural economy to an industrial economy has also remained slow.

The annual average growth rate of the secondary sector and the manufacturing industry which were 6.2 per cent and 6.0 per cent respectively during 1950-51 to 1960-61 gradually declined to 4.0 per cent each during 1970-71 to 1980-81 and then it rose to 6.7 per cent and 7.2 per cent respectively during 1980-81 to 1990-91.

Again during the last 40 year period (1950-51 to 1990-91), the average rate of growth of both the secondary sector and the manufacturing sector was 5.6 per cent only. Moreover, the annual average growth rate of the tertiary sector gradually increased from 4.1 per cent during 1950-51 to 1960-61 to 6.6 per cent during 1980-81 to 1990-91.

During the 40 year period (1950-51 to 1990-91) the annual average growth rate of the tertiary sector was 4.9 per cent and that of transport and communication and trade was 5.4 per cent and that of banking, insurance and real estate was 4.4 per cent.

Moreover during 1990-91 to 2000-01 these rates of growth were 2.6 per cent in the primary sector, 6.0 per cent in the secondary sector and 7.9 per cent in the tertiary sector.

Again during 2000-01 to 2004-05, the rate of growth of agriculture, industry and tertiary sector were 2.4 per cent, 6.1 per cent and 8.1 per cent respectively. Again during 2012-13 to 2014-15, the rate of growth for primary, secondary and tertiary sector was 2.06 per cent, 4.5 per cent and 9.2 per cent respectively.

Thus with the growing industrialisation in the country, Indian economy has gradually transformed from an agricultural one to an industrialised one. All this has resulted structural change in the composition of the national income of the country.

Thus there is a special need for the enhancement of growth process both in agriculture and industry with special emphasis on the development of agro-based industries in different parts of the country.

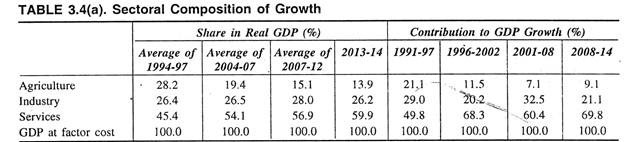

Service Led Growth:

The growth scenario in India shows that the services sector has become the most dominant in the later part of its growth process. The share of services sector in GDP increased from 28.5 per cent in 1950-51 to 39.6 per cent in 1990-91 and then to 52.6 per cent in 2014-15 while the share of primary sector declined from 56.4 per cent in 1950-51 to 33.4 per cent in 1990-91 and then to only 19.0 per cent in 2014-15.

During the Ninth Plan, in spite of slowdown in overall growth process, the services sector grew at a rate of 7.9 per cent per annum as compared to that of 2.5 per cent and per annum as compared to that of 2.5 per cent and 4.3 per cent attained by agriculture and industry sector respectively.

Moreover, expansion of services sector accelerated further since 2002-03, propelled considerably by high rates of growth attained by communications (especially telecom), business services (especially information technology) and finance. Table 3.4(a) shows the excellent performance of services sector since 1991.

Table 3.4(a) reveals that during the period 1991-97 services sector contributed about half (49.8 per cent) of total growth of GDP. But in the subsequent five years, i.e. during 1996-2002, the contribution of services sector to GDP growth increased significantly to 68.3 per cent and continued to grow at 60.4 per cent over the next six years, i.e. during 2001-08.

Again, during 2008-14 periods, the contribution of services sector to GDP growth in India was as high as 69.8 per cent as shown in the study made by Shankar Acharya. Sri Acharya also observed that “these shares would “be even higher if the construction sub-sector were included under services instead of industry”.

Thus the above analysis clearly, shows a ‘services-led’ pattern of economic growth attained by India in the later part of its economic transformation realising a structural transformation of the economy.

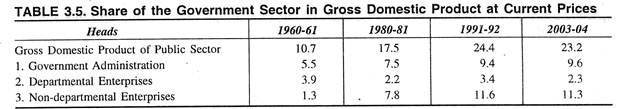

Share of Government Sector in Net Domestic Product (NDP):

The share of government sector in the net domestic product of India has been gradually increasing with the increasing participation of the government in various economic activities connected with enlargement of administrative services and expansion of public sector.

The share of the government sector in net domestic product gradually increased from 7.6 per cent in 1950-51 to 10.7 per cent in 1960-61 and then again increased to 24.9 per cent in 19.87-88. This can be seen from the Table 3.5.

Table 3.5 reveals that the share of government administration in NDP gradually increased from 5.5 per cent in 1960-61 to 9.6 per cent in 2003-04. Again the share of non-departmental enterprises in NDP substantially increased from 1.3 per cent in 1960-61 10 11.3 percent in 2003-04 although the share of departmental enterprises in NDP slightly declined from 3.9 per cent in 1960-61 to 2.3 per cent in 2003-04.

The factors which were responsible for increase in the share of non-departmental enterprises included setting up of new industries, expansion of existing enterprises, nationalisation of banks, insurance companies and coal mines and amalgamation of private electricity companies into state electricity boards.

Essay # 5. Difficulties or Limitations in the Estimation of National Income in India:

National income estimation in India is subjected to various conceptual and practical difficulties. These conceptual; difficulties arise mostly in connection with personal and government administrative services. In this connection the first report of the national Income Committee mentioned,

“Which part of the government’s general administration is services to the people as individuals and consumers and should be counted……. Likewise, in considering what is consumption in the process of production and what is net product, the estimators merely, follows the judgement of society- which views net product as what is available either for consumption of individuals, personally or collectively or for additions to capital stock.”

In addition to the conceptual difficulties, the estimation of national income in India is facing number of limitations or practical difficulties.

These difficulties or limitations are as follows:

(i) Non-Monetised Output and Its Transactions:

In the estimation of national income or output, only those goods and services which are exchanged against money are normally included.

But in an underdeveloped country like India, a huge portion of our total output is still either being consumed at home or being bartered away by the producers in exchange of other goods and services leading to the non-inclusion of huge non-monetised output in the national income estimates of the country.

This problem of non-monetised transactions is very much in the rural areas whose inclusion in NDP is really difficult. Till now, no proper method has been developed to find out the total output of this farm output consumed at home and also to derive the imputed value of this huge non-monetised output.

(ii) Non-Availability of Information about Petty Income:

The national incomes estimates in India are also facing another problem of non-availability of information about the income of small producers and household enterprises. In India a very large number of producers are still carrying on production at a family level or are running household enterprises on a very small scale.

Being illiterate this small producers have no idea of maintaining accounts and do not feel it necessary to maintain regular accounts as well.

Under such a situation it is really a difficult task to collect data. In this connection the National Income Committee wrote, “An element of guess-work, therefore, invariably enters into the assessment of output especially in the large sectors of the economy which are dominated by the small producer or the household enterprise”.

(iii) Lack of Differentiation in Economic Functions:

In India the occupational classification is incomplete and thus there is lack of differentiation in economic functions. As National Income Statistics are collected by industrial origin thus classification of producers and workers into various occupational categories is very much essential.

(iv) Unreported Illegal Income:

In India the parallel economy is fully operational as hidden or subterranean economy. Thus there is huge unreported illegal income earned by those people engaged into those parallel economies which is not included in the national income estimates of our country.

In 1983-84, the National Institute of Public Finance and Policy made an estimate of black income which was to the extent of 18 to 21 per cent of our national income. Obviously, non-inclusion of such a huge illegal income makes the national income estimates of the country as under-estimates.

(v) Lack of Reliable Statistical Data:

The most important difficulty facing the national income estimation in India is the non-availability of reliable statistical information. In India national income data are collected by untrained and semiliterate persons like gram sevaks and thus the statistics are mostly unreliable.

Although some statistical organisations like National Sample Survey (NSS) are organised by the Government for this purpose but these are considered as inadequate. Thus due to the dearth of the reliable adequate statistical data, the national income estimates in India is still subjected to high degree of error.

Essay # 6. Inter-State or Inter-Regional Variation of National Income in India:

For computing aggregate income of respective states in India, State Domestic Products (SDP) of various states are estimated regularly for every year by its government agencies.

The data related to SDP estimates are widely in use by various agencies like Planning Commission, Finance Commission and other research organisations for assessing the degree of regional disparities and also for formulating necessary policies in connection with transfer of resources from the Centre to states.

The estimates of SDP can be successfully utilised for measuring the degree of development attained by a state. Accordingly the level of development attained by a state can also be measured by its per capita income which can again be compared with the all India average of per capita income.

The SDP estimates also work as useful indicators to show structural transformation, if any, among the constituent sectors of these states. Let us now look at the CSO estimates of per capita income of 15 major states of India to have a look at the dynamics of growth and the ratio of disparity between various states.

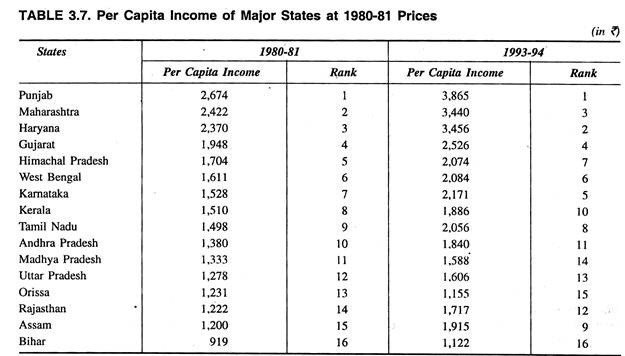

Table 3.7 reveals that during the 14-year period, i.e. from 1980-81 to 1993-94, the per capita income figures of most of the states, excepting a few rich states like, Punjab, Haryana and Maharashtra have gone for a little change.

Moreover, the relative ranking of the most of the states by per capita income has not shown any significant change excepting Himachal Pradesh, Karnataka, Kerala, Madhya Pradesh, Rajasthan, Assam and Orissa whose relative ranking has shown a change to some extent.

During this period, the five top ranking states in respect of per capita income were Punjab, Haryana, Maharashtra, Gujarat and Himachal Pradesh.

But the five poorest states in respect of per capita income during the same period were Bihar, Orissa, Madhya Pradesh, Uttar Pradesh and Rajasthan. In 1993-94, Karanataka, Assam and Rajasthan have improved its relative position. The per capita income figure of Bihar was lowest among all the 16 states.

The table further reveals that the inter-state disparity in respect of per capita income has been widened during the 14 year period as a result of the strategy followed in planning for economic development in India. As a result of this, the disparity ratio between the richest state—Punjab and the poorest state—Bihar which was 2.91: 1 in 1980-81 gradually increased to 3.44: 1 in 1993-94.

Thus the planning process followed in India has totally failed in fulfilling one of its basic objectives of removing regional imbalances and maintaining balanced regional development throughout the country. The following table shows the disparity ratio in respect of per capita income of different states at constant prices during the recent years.

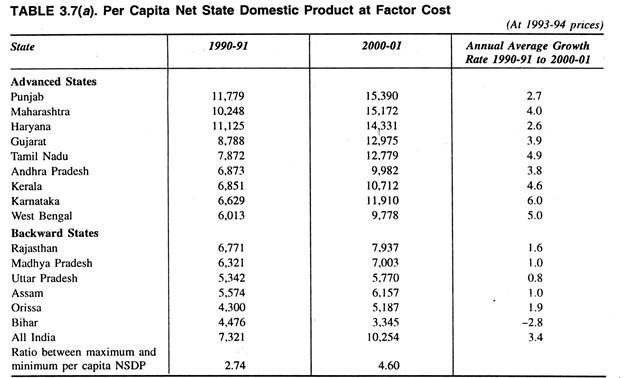

Table 3.7(a) reveals that the per capita NSDP of nine advanced states has been increasing at moderate rates (annual average) between 6.0 per cent to 2.6 per cent during 1990-91 to 2000-01. But the per capita NSDP of the backward states recorded a slow growth between 1.9 per cent to 1.0 per cent and Bihar recorded a negative growth rate of (-) 2.8 per cent during the same period.

Again, the ratio between the maximum per capita income of Punjab and the minimum per capita income of Bihar has increased from 2.74 in 1990-91 to 4.60 in 2000-01.

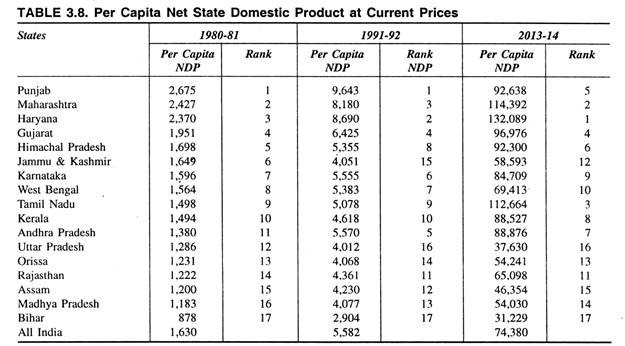

Table 3.8 depicts a clear picture about the per capita net state domestic product (NDP) at current prices for 17 major states along with their relative ranking. In 1980-81, the per capita state NDP of only six states, viz., Punjab, Haryana, Maharashtra, Gujarat.

Himachal Pradesh and Jammu & Kashmir were lying above the national average NDP whereas in 1991-92 only the first four above mentioned states were above the national average.

The disparity ratio between the richest state—Punjab and the poorest state—-Bihar which was 1 : 3.04 in 1980-81 gradually increased slightly to 1 : 4.90 in 2000-01. Thus it proves again that the planning process in India has failed to reduce regional disparities to a considerable extent.

Moreover, the table shows that the relative ranking of Andhra Pradesh, Madhya Pradesh, Rajasthan, Tamil Nadu, Kerala and Assam has improved considerably.

But the same ranking remained low for Uttar Pradesh, Jammu & Kashmir, Bihar. Further, the relative ranking of Uttar Pradesh, Orissa, West Bengal and J &K have even deteriorated considerably in 1995-96.

Thus the regional disparity is very much acute among the various states of India. This has been reflected by the per capita income gap between the very rich states (viz., Punjab, Haryana, Maharashtra and Gujarat) and the very poor states (viz., Bihar, Madhya Pradesh, Assam, Uttar Pradesh and Orissa).

The per capita income gap at 1980-81 prices between the richest state (Punjab) and the poorest state (Bihar) has increased from Rs 1755 in 1980-81 to Rs 2473 in 1993-94. Again the same gap at current prices has increased from Rs 1797 in 1980-81 to Rs 19940 in 2000-01 and then to Rs 30,957 in 2005-06.

Again the per capita income figure of different states in 2013-14 at current prices reveals a wide disparity among the states. The per capita income gap at current prices between the richest state Haryana (Rs 1, 32,089) and the poorest state Bihar (Rs 31,229) reached the level of Rs 1, 00, 86 in 2013-14 which can be considered as very high.

It would be better to look into this regional disparity from a different angle, i.e., through comparative rates of growth.

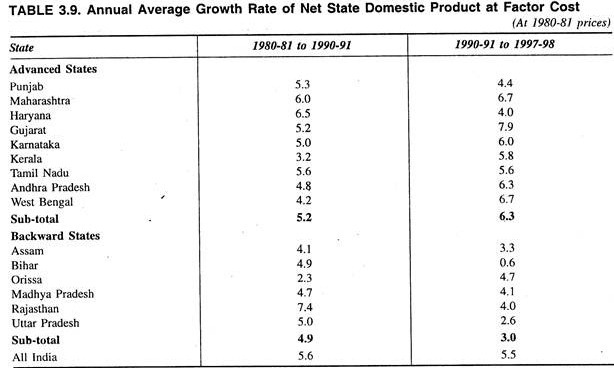

The growth rates of NSDP during the current period also show the trend of growing regional disparity among different states of the country. Table 3.9 reveals that the annual average growth rate of NSDP of advanced states during the pre-reform period, i.e., during 1980-81 to 1990-91 was 5.2 per cent.

But the same rate for the advanced states increased to 6.3 per cent during the post-reform period, i.e., during 1990-91 to 1997-98.

As compared to that, the annual average growth rate of NSDP of backward states in general has declined from 4.9 per cent during the pre-reform period (1980-81 to 1990-91) to 3.0 per cent during the post- reform period (1990-91 to 1997-98).

It is further observed that the annual average growth rates of NSDP of three major states Uttar Pradesh, Madhya Pradesh and Bihar declined to 2.6 per cent, 4.1 per cent and 0.6 per cent respectively during the post-reform period as compared to that of all India growth rates of 5.5 per cent during the same period.

Table 3.9 thus clarifies the position:

Overall growth rate of SDP of these above mentioned states has improved fairly due to their steady growth in either agriculture or industry or both. But the states like Kerala and Orissa had all along maintained a very poor overall growth rate of SDP during the 1970s and the first half of 1980s due to their attainment of very low growth rate in agricultural production.

Again during the first half of 1980s only six states, viz., Punjab, Haryana, West Bengal, Tamil Nadu, Rajasthan and Madhya Pradesh had been able to maintain their overall growth rate of SDP above the 5 per cent all India average growth rate of NDP.

Whereas, the other states had attained a very poor overall growth rate of SDP even to the extent of 1.1 per cent only, which were far below the all India average growth rate of NDP.

Thus it has been revealed that in most of the states excepting a few industrially developed states, agriculture is still playing the role of major determinants of their overall growth rates in SDP. Further, it is found that much disparity still prevails in the overall growth rates of SDP of the various states leading to aggressive regional imbalance or inequalities creating serious discontent and chaos in social fabric of our country.

Although historical experience shows that regional inequalities tend to increase in the early part of development and it tend to get narrowed down after attaining some level of development but the high degree of poverty and backwardness prevailing in some of the backward states of India is aggravating the situation to the worst level.

Thus unlike the developed countries of the world, India should try to reduce this degree of regional disparity or imbalances as early as possible for the interest of integrity of the country even if it is considered too early from the angle of economic development.