Let us make in-depth study of the meaning, measurement and causes of inflation.

Meaning of Inflation:

By inflation we mean a general rise in prices. To be more correct, inflation is a persistent rise in general price level rather than a once-for-all rise in it.

Rate of inflation is either measured by the percentage change in wholesale price index number (WPI) over a period or by percentage change in consumer price index number (CPI).

Opinion surveys conducted in India and the United States reveal that inflation is the most important concern of the people as it affects their standard of living adversely A high rate of inflation erodes the real incomes of the people. A high rate of inflation makes the life of the poor people miserable. It is therefore described as anti-poor, inflation redistributes income and wealth in favour of the rich.

ADVERTISEMENTS:

Thus, it makes the rich richer and the poor poorer. Above all, a high rate inflation adversely effects output and encourages investment in unproductive channels such as purchase of gold, silver, jewellery and real estate. Therefore, it adversely affects long-run economic growth, especially in developing countries like India. Inflation has therefore been described ‘as enemy number one’.

Measurement of Rate of Inflation:

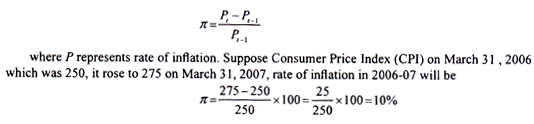

Inflation has been one of the important problems facing the economies of the world. Precisely stated, inflation is the rate of change of general price level during a period of time. And the general price level in a period is the result of inflation in the past. Through rate of inflation economists measures the cost of living in an economy. Let us explain how rate of inflation is measured. Suppose Pi X represents the price level on 31st March 2006 and P represents the price level on 31st March 2007. Then the rate of inflation in year 2006-07 will be equal to

Thus, rate of inflation during 2006-07 will be 10 per cent. This is called point-to-point inflation rate. There are 52 weeks in a year, average of price indexes of 52 weeks of a year (say 2005-06) can be calculated to compare the average of price indexes of 52 weeks of year 2006-07 and find the inflation rate on the basis of average weekly price levels of a year. In both these ways rate of inflation in different years is measured and compared.

ADVERTISEMENTS:

It is evident from above that price level in a period is measured by a price index. There are several commodities in an economy which are produced and consumed by the people. It is through construction of a weighted price index that economists aggregate money prices of several commodities which are assigned different weights.

In India the wholesale price Index (WPI) of all commodities with base year 1993-94 price level at the end of fiscal year is used to measure rate of inflation and is widely reported in the media. Since the wholesale price index does not truly indicate the cost of living, separate Consumer Price Index (CPI) for agricultural labourers and Consumer Price Index (CPI) for industrial workers (with base 1982 = 100) at the end of fiscal year are constructed to measure rate of inflation.

In constructing the Consumer Price Index (CPI) the price of a basket of goods which a typical consumer, industrial worker or agricultural labourer as the case may be are taken into account.

What Causes Inflation?

1. Keynes’s View:

Classical economists thought that it was the quantity of money in the economy that determined the general price level in the economy. According to them, rate of inflation depends on the growth of money supply in the economy. Keynes criticized the ‘ Quantity Theory of Money’ and showed that expansion in money supply did not always lead to inflation or rise in price level.

ADVERTISEMENTS:

Keynes who before the Second World War explained that involuntary unemployment and depression were due to the deficiency of aggregate demand, during the war period when price rose very high he explained that inflation was due to excessive aggregate demand. Thus, Keynes put forward what is now called demand-pull theory of inflation.

Demand – Pull Inflation

Thus, according to Keynes, inflation is caused by a situation whereby the pressure of aggregate demand for goods and services exceeds the available supply of output (both begging counted at the prices ruling at the beginning of a period). In such a situation, rise in price level is the natural consequence.

Now, this imbalance between aggregate demand and supply may be the result of more than one force at work. As we know aggregate demand is the sum of consumers’ spending on consumer goods and services, government spending on consumer goods and services and net investment being planned by the entrepreneurs.

But excess of aggregate demand over aggregate supply does not explain persistent rise in prices, year after year. An important factor which feeds inflation is wage-price spiral. Wage-price spiral operates as follows: A rise in prices reduces the real consumption of the wage earners. They will, therefore, press for higher money wages to compensate them for the higher cost of living. Now, an increase in wages, if granted, will raise the prime cost of production and, therefore, entrepreneurs will raise the prices of their products to recover the increment in cost.

This will add fuel to the inflationary fire. A further rise in prices raises the cost of living still further and the workers ask for still higher wages. In this way, wages and prices chase each other and the process of inflationary rise in prices gathers momentum. If unchecked, this may lead to hyper-inflation which signifies a state of affairs where wages and prices chase each other at a very quick speed.

2. Monetarist View:

The Keynesian explanation of demand-pull inflation is important to note that both the original quantity theorists and the modem monetarists, prominent among whom is Milton Friedman, explain inflation in terms of excess demand for goods and services. But there is an important difference between the monetarist view of demand-pull inflation and the Keynesian view of it. Keynes explained inflation as arising out of real sector forces.

In his model of inflation excess demand comes into being as a result of autonomous increase in expenditure on investment and consumption or increase in government expenditure. That is, the increase in aggregate expenditure or demand occurs independent of any increase in the supply of money.

On the other hand, monetarists explain the emergence of excess demand and the resultant rise in prices on account of the increase in money supply in the economy. To quote Milton Friedman, a Nobel Laureate in economics. “Inflation is always and everywhere a monetary phenomenon…… and can be produced only by a more rapid increase in the quantity of money than in output.”

ADVERTISEMENTS:

Friedman holds that when money supply is increased in the economy, then there emerges an excess supply of real money balances with the public over their demand for money. This disturbs the monetary equilibrium. In order to restore the equilibrium the public will reduce the money balances by increasing expenditure on goods and services.

Thus, according to Friedman and other modern quantity theorists, the excess supply of real monetary balances results in the increase in aggregate demand for goods and services. If there is no proportionate increase in output, then extra money supply leads to excess demand for goods and services. This causes inflation or rise in prices. Thus, according to monetarists let by Prof. Milton Friedman, excess creation of money supply is the main factor responsible for inflation.

Cost-Push Inflation:

Even when there is no increase in aggregate demand, prices may still rise. This may happen if the costs, particularly the wage costs, increase. Now, as the level of employment increases, the demand for workers rises progressively so that the bargaining position of the workers is enhanced. To exploit this situation, they may ask for an increase in wage rates which are not justifiable either on grounds of a prior rise in productivity or cost of living.

ADVERTISEMENTS:

The employers in a situation of high demand and employment are more agreeable to concede to these wage claims because they hope to pass on these rises in costs to the consumers in the form of rise in prices. Therefore, when inflation is caused by rise in wages or hike in other input costs such as rise in prices of raw materials, rise in prices of petroleum products, it is called cost-push inflation. If this happens we have another inflationary factor at work.

Besides the increase in wages of labour without any increase in its productivity, or rise in costs of other inputs there is another factor responsible for cost-push inflation. This is the increase in the profit margins by the firms working under monopolistic or oligopolistic conditions and as a result charging higher prices from the consumers. In the former case when the cause of cost-push inflation is the rise in wages it is called wage-push inflation and in the latter case when the cause of cost-push inflation is the rise in profit margins, it is called profit-push inflation.

In addition to the rise in wage rate of labour and increase in profit margin, in the seventies the other cost-push factors (also called supply shocks) causing increase in marginal cost of production became more prominent in bringing about rise in prices. During the seventies, rise in prices of raw materials, especially energy inputs such a hike in crude oil prices made by OPEC resulted in rise in prices of petroleum products.

For example, sharp rise in world oil prices during 1973-75 and again in 1979-80 produced significant cost-push factor which caused inflation not only in Indian but all over the world. Now, in June-August 2004 again the world oil prices have greatly risen. As a result, in India prices of petrol, diesel, cooking gas were raised by petroleum companies. This is tending to raise the rate of inflation.