In this essay we will discuss about Globalization and Business. After reading this essay you will learn about: 1. Introduction to Globalization and International Business 2. Globalization of Business – A Historical Perspective 3. Concept 4. Dimensions 5. Factors Influencing 6. Factors that are Used for Restraining 7. Methods to Measure 8. Reality or Myth 9. Major Arguments in Support and Others Details.

Contents:

- Introduction to Globalization and International Business

- Globalization of Business – A Historical Perspective

- Concept of Globalization

- Dimensions of Economic Globalization

- Factors Influencing Globalization

- Factors that are Used for Restraining Globalization

- Methods to Measure Globalization

- Globalization – Reality or Myth

- Major Arguments in Support of Globalization

- Major Grounds where Globalization is Criticised

- Response Strategies to Globalization Forces for Emerging Market Companies

- Managing Business in the Globalization Era

Essay # 1. Introduction to Globalization and International Business:

The forces of globalization have hardly been as intense before as to be explicitly evident as influencing our daily lives. The advents in information and communication technology (ICT) and the rapid economic liberalization of trade and investment in most countries have accelerated the process of globalization. Markets are getting flooded with not only industrial goods but also with items of daily consumption.

Each day, an average person makes use of goods and services of multiple origins—for instance, the Finnish mobile Nokia and the US toy-maker’s Barbie doll made in China but used across the world; a software from the US-based Microsoft, developed by an Indian software engineer based in Singapore, used in Japan; the Thailand-manufactured US sports shoe Nike used by a Saudi consumer.

ADVERTISEMENTS:

The increased integration of markets—goods and financial—the mobility of people with transnational travels for jobs and vacations, and the global reach of satellite channels, the Internet, and the telephone all have virtually transformed the world into a ‘global village’.

‘Globalization’, one of the most complex terms used in international business, has wide connotations. Interestingly, ‘globalization’ is a term not only used and heard frequently, but also as often misused and misinterpreted. Globalization is used to refer to the increasing influence exerted by economic, political, socio-cultural, and financial processes across the globe.

Globalization not only offers numerous challenges to business enterprises but also opens up new opportunities. In the earlier era of restrictive trade and investment regimes with much lower degree of interconnectedness among countries, companies solely operating in their home markets were generally protected and isolated from the vagaries of upheavals in the international business environment.

Therefore, developing a thorough conceptual understanding of international business has become inevitable not only for the managers who operate in international markets, but also for those who operate only domestically.

ADVERTISEMENTS:

Economic restrictions became pervasive around the world after World War I, leading to de-facto de-globalization. Besides, the import substitution strategies followed by most developing countries, which gained independence from colonial rule in the post-World War II era, considerably restricted international trade and investment.

A number of multilateral organizations set up after World War II under the aegis of the United Nations, such as the World Bank (WB), the International Monetary Fund (IMF), the General Agreement on Tariffs and Trade (GATT), and the World Trade Organization (WTO), facilitated international trade and investment.

Elucidating the conceptual framework of globalization, encompassing financial, cultural, and political aspects, besides the economic. Movers and restraining factors of globalization have also been examined at length.

The arguments both for support and criticism of globalization have also been critically evaluated. Globalization offers challenges and opportunities for business enterprises and firms are required to adopt the most effective response strategy.

Essay # 2. Globalization of Business – A Historical Perspective:

Globalization is not a new phenomenon. In the initial years of human history, people remained confined to their communities, villages, or local regions. There were hardly any formal barriers, such as tariffs or non-tariff restrictions, for the movement of goods or visa requirements for people. The concept of globalization can be traced back to the phenomenon of a nation-state.

ADVERTISEMENTS:

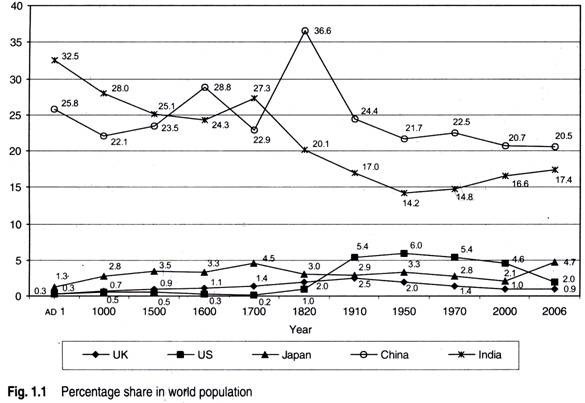

In the beginning of the Christian era, India was the most populated country with 75 million people constituting 32.5 per cent of the world population (Fig. 1.1), followed by China (25.8%) with 59.6 million, Italy (3%) with 7 million, France (2.2%),with 5 million, Spain (1.9%) with 4.5 million, Germany (1.3%) and Japan (1.3%) each with 3 million people, whereas the UK (0.34%) and the US (0.29%) inhabited merely 0.8 million and 0.7 million people, respectively, out of the total world population of 230 million.

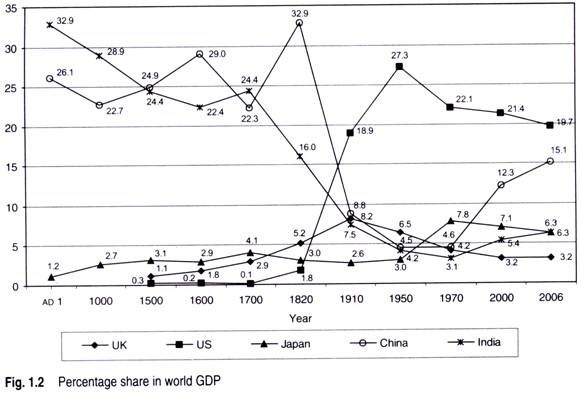

Moreover, during this period, India was the world’s largest economy with 32.9 per cent share of the world’s GDP, followed by China (26.1%), the former USSR (1.5%), and Japan (1.2%).

It was only after AD 1500 that some western economies, such as Italy, France, and Germany emerged with 4.7 per cent, 4.4 per cent, and 3.3 per cent share, respectively, in the world GDP whereas the UK and the US merely contributed 1.1 per cent and 0.3 per cent, respectively, of the world GDP (see Fig. 1.2). India and China continued to remain the two most dominant economies till the early nineteenth century.

Portugal played the key role in opening up European trade, in navigation and settlement in the Atlantic islands, and in developing trade routes around Africa, into the Indian Ocean, and to China and Japan. Portugal became the major shipper of spices to Europe for the whole of the sixteenth century, usurping this role from Venice.

Right up to the eighteenth century, the ‘Indian methods of production and of industrial and commercial organization could stand in comparison with those in vogue in any other part of the world’ as written by Vera Anstey. India was a highly developed manufacturing country and exported her manufactured products to Europe and other nations.

Her banking system was efficient and well organized throughout the country, and the bills of exchange (hundis) issued by the great business or financial houses were honoured everywhere in India, as well as in Iran, Kabul, Herat, Tashkent, and other places in Central Asia. Merchant capital had emerged and there was an elaborate network of agents, jobbers, brokers, and middlemen.

ADVERTISEMENTS:

The ship-building industry was flourishing and one of the flagships of an English admiral during the Napoleon wars was built in India by an Indian firm. India was, in fact, as advanced industrially, commercially, and financially as any country prior to the industrial revolution.

No such development could have taken place unless the country had enjoyed long periods of stable and peaceful government and the highways been safe for traffic and trade.

Foreign adventurers originally came to India because of the excellence of her manufacturers, who had a big market in Europe. The British East India Company was started with the objective of carrying manufactured goods, textiles, etc., as well as spices and the like from the East to Europe, where there was a great demand for these articles. Such trading was highly profitable, yielding enormous dividends.

So efficient and highly organized were the Indian methods of production, and such were the skills of India’s artisans and craftsmen, that India could compete successfully even with the higher techniques of production that were being established in England.

ADVERTISEMENTS:

Even when the big machine age began in England, Indian goods continued to pour in and had to be stopped by very heavy duties and, in some cases, by outright prohibitions.

By the middle of the eighteenth century, the main exports into Europe were textiles and raw silk from India and tea from China. The purchases of European products into India were financed mainly by the exports of bullion and raw cotton from Bengal, whereas the purchases into China were financed by the exports of opium.

Until the eighteenth century, the British generally maintained peaceable relations with the Indian Mughal empire, whose authority and military power were too great to be challenged by the British.

It was only after the development of new industrial techniques that a new class of industrial capitalists emerged in Britain and under their influence, the British government began to take greater interest in the affairs of the East India Company.

ADVERTISEMENTS:

The British government now adopted the strategy to close the British market for Indian goods and get the Indian market opened for British manufacturers. To begin with, Indian goods were excluded by legislation in Britain. Since the East India Company had the monopoly in the Indian export business, the exclusion influenced other foreign markets as well.

During the pre-World War I period from 1870 to 1914, there took place a rapid integration of economies in terms of trade flows, movement of capital, and migration of people. The pre-World War I period witnessed the growth of globalization, mainly led by technological forces in the field of transport and communication.

However, between the first and second world wars, the pace of globalization decelerated. Various barriers were erected to restrict free movement of goods and services during the inter-war period. Under high protective walls, most economies perceived higher growths. It was resolved by all leading countries after World War II that the earlier mistakes committed by them to isolate themselves should not be repeated.

Although, after 1945, there was a drive to increased integration, it took a long time to reach pre-World War I levels. In terms of percentage of imports and exports to total output, the US could reach the pre-World War level of 11 per cent only around 1970.

Most developing countries that gained independence from colonial rule in the immediate post-World War II period followed imports substitution strategies to promote local industrialization. The East European countries shielded themselves from the process of global economic integration.

Multilateral organizations, especially the World Bank, the IMF, and the GATT, set up in the post-war era contributed considerably to the economic integration of countries. Setting up of the WTO in 1995 provided an effective institutional mechanism for multilateral trade negotiations, integration of trade policies under the WTO framework, and even the settlement of trade disputes among the member countries.

ADVERTISEMENTS:

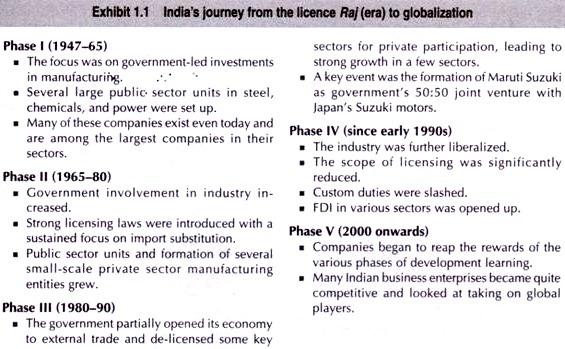

During the recent decades, most developing countries made a strategic shift from their restrictive trade and investment policies to economic liberalization. The transformation of the Indian economy from one following the import substitution strategy with a highly complex system of licenses and multiple procedures to an economy open to globalization is summarized in Exhibit 1.1.

The breakthroughs in information, communication, and transportation technologies and the growing economic liberalization have accelerated the process of global economic integration. The major concerns about present-day globalization are significantly higher than ever before because of the nature and speed of transformation.

What is striking about the current globalization is not only its rapid pace but also the enormous impact of new information and communication technologies on market integration, efficiency, and industrial organization.

Essay # 3. Concept of Globalization:

‘Globalization’ has become the buzzword that has changed human lives around the world in a variety of ways. The growing integration of societies and national economies has been among the most fervently discussed topics during recent years.

Globalization refers to the free cross-border movement of goods, services, capital, information, and people. It is the process of creating networks of connections among actors at multi- continental distances, mediated through a variety of flows including people, information and ideas, capital, and goods.

ADVERTISEMENTS:

The breakthroughs in the means of transport and communication technology in the last few decades have also made international communication, transport, and travel much cheaper, faster, and more frequent.

Globalization is the closer integration of the countries and peoples of the world, brought about by the enormous reduction in the costs of transportation and communications and the breaking down of artificial barriers to the flow of goods and services, capital, knowledge, and (to a lesser extent) people across the borders.

With the arrival of the Internet, the transaction costs of transferring ideas and information have declined enormously. ‘Global village’ is the term used to describe the collapse of space and time barriers in human communication, especially by using the World Wide Web, enabling people to interact on a global scale.

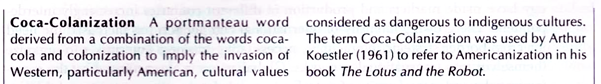

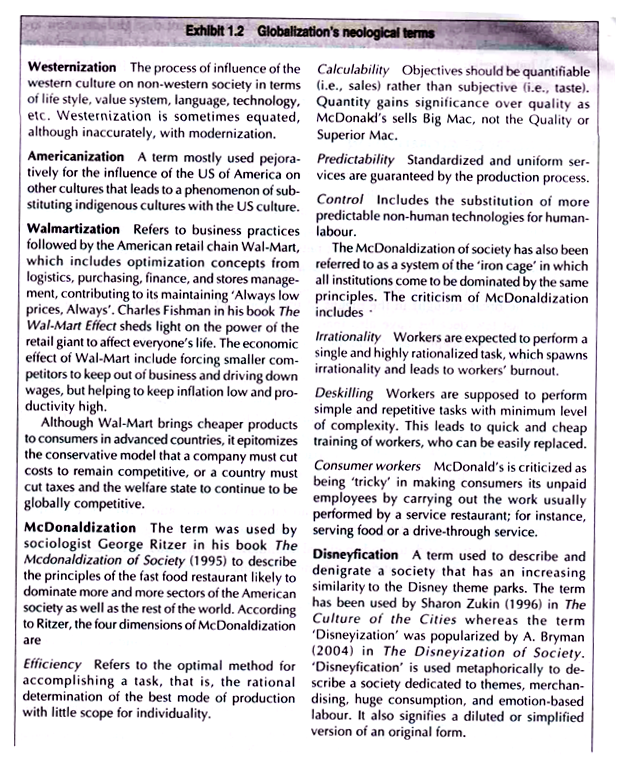

Moreover, a number of interesting terms to signify the various aspects of globalization, such as Westernization, Americanization, Walmartization, McDonaldization, Disneyfication, Coca-Colanization, etc., have also emerged, as given in Exhibit 1.2.

Globalization tends to erode national boundaries and integrate national economies, cultures, technologies, and governance, leading to complex relations of mutual interdependence.

Globalization refers to the intensification of cross-national economic, political, cultural, social, and technological interactions that leads to the establishment of transnational structures and the integration of economic, political, and social processes on a global scale.

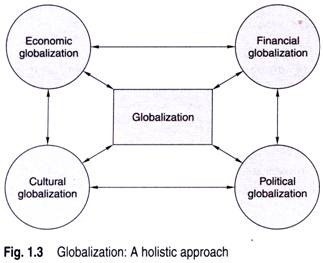

Further, globalization is widely understood to imply economic globalization by way of free movement of factor inputs (both labour and capital) as well as output between countries. It is not only the economic integration of countries but also various other aspects such as financial, cultural, and political integration across the world, as depicted in Fig. 1.3.

Therefore, globalization may be defined as the process of integration and convergence of economic, financial, cultural, and political systems across the world.

(i) Economic Globalization:

The term ‘globalization’ is widely used in business circles and economics to describe the increasing internationalization of markets for goods and services, the financial system, corporations and industries, technology, and competition.

In the globalized economy, distances and national boundaries have substantially diminished with the removal of obstacles to market access. Besides, there have been reductions in transaction costs and compression of time and distance in international transactions.

The changes induced by the dynamics of trade, capital flows, and transfer of technology have made markets and production in different countries increasingly interdependent. The growing intensity of international competition has increased the need for cross-border strategic interactions, necessitating business enterprises to organize themselves into transnational networks.

ADVERTISEMENTS:

Globalization is characterized by the growing interdependence of various facets. For instance, foreign direct investment (FDI) is accompanied by transfer of technology and know-how, along with the movement of capital (equity, international loans, repatriation of profits, interest, royalties, etc.) generating exports of goods and services from the investor countries.

The growth in global economic integration is evident from the increase in the percentage share of world merchandise trade in the world GDP from 32.3 per cent in 1990 to 47.3 per cent in 2005, whereas trade in services grew from 7.8 per cent to 11 per cent during the same period.

The gross private capital flows rapidly rose from 10.3 per cent of the world GDP in 1990 to 32.4 per cent in 2005. Here are some definitions of economic globalization.

The increasing integration of national economic systems through growth in international trade, investment and capital flows. – Dictionary of Trade Policy Terms, WTO.

A dynamic and multidimensional process of economic integration whereby national resources become more and more internationally mobile while national economies become increasingly interdependent. -OECD

Economic globalization constitutes integration of national economies into international economy through trade, direct foreign investment (by corporations and multinationals), short-term capital flows, international flows of workers and humanity generally, and flows of technology? – Jagdish Bhagwati

The activities of multinational enterprises engaged in foreign direct investment and the development of business networks to create value across national borders.- Alan Rugman

For the purposes of this book, globalization is defined as ‘the increasing economic integration and interdependence of national economies across the world through a rapid increase in cross-border movement of goods, service, technology, and capital’.

(ii) Financial Globalization:

The liberalization of capital movements and deregulations, especially of financial services, led to a spurt in cross-border capital flows. The globalization of financial markets has triggered a rapid growth in investment portfolio and a large movement of short-term capital borrowers and investors interacting through an increasingly unified market.

The growing integration of financial markets has greatly influenced the conduct of business and even the performance of the industrial sector. This has significantly enhanced the vulnerability of stocks that were hitherto considered impervious.

A liquidity crunch in the US makes stock markets across the world go berserk. Globalization of financial markets makes them inherently volatile with few options to control left with the national governments.

(iii) Cultural Globalization:

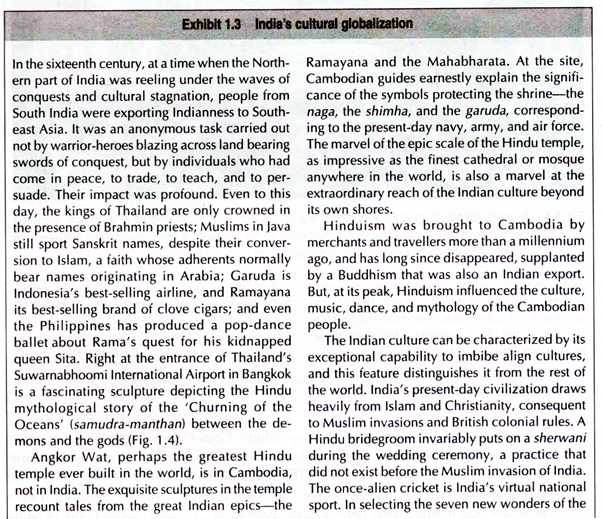

The convergence of cultures across the world may be termed as cultural globalization. India’s rich cultural heritage has a glorious history of globalization (Exhibit 1.3), which is evident even today by its profound impact on people and their lives. Globalization has led to the development of global pop culture.

Coca-Cola is sold in more countries than the United Nations has as members. ‘Coke’ is claimed to be the second-most universally understood word after OK. McDonald’s has more than 30,000 local restaurants serving 52 million people every day in more than 100 countries. Levi’s jeans are sold in more than 110 countries. Ronald McDonald is second only to Santa Claus in name recognition for most school children.

(iv) Political Globalization:

The convergence of political systems and processes around the world is referred to as political globalization. International business is increasingly conducted across the juridical, socio-cultural, and physical borders of sovereign states. After World War II, there has been a proliferation of sovereign states. In 1914 there were 62 separate states, 74 in 1946, 149 in 1978, 193 in 1991, and 209 in 2007.

The administrative set-ups and the decision-making processes in multilateral organizations and UN forums have considerably influenced the governance within sovereign states. Democratic processes of decision making and governance to a varying extent are increasingly receiving wider acceptance in most countries.

Essay # 4. Dimensions of Economic Globalization:

The rapid growth in integration and interdependence of economies can be explained by the interconnectedness of the various dimensions of economic globalization, as depicted in Fig. 1.5, such as the globalization of production, markets, competition, technology, and corporations and industries.

(i) Globalization of Production:

The increased mobility of the factors of production, especially the movement of capital, has changed countries’ traditional specialization roles significantly. Consequently, many firms in developing countries seek to strengthen their competitive advantage by specializing in differentiated products with an increasingly large technological content.

Such specialization has given rise to intra-industry trade between developing countries.

Abandoned activities are often acquired by other firms in the same industry to strengthen their positions. As a result, many firms, in all industries and different countries, establish co-operative agreements or adopt strategies of mergers and acquisitions and network organizations, which has contributed to a surge in FDI during recent decades.

Moreover, the privatization of public enterprises across the world has also accelerated cross-border investments.

The globalization of production has led to multinational origin of product components, services, and capital as a result of transnational collaborations among business enterprises. Firms evaluate various locations world-wide for manufacturing activities so as to take advantage of local resources and optimize manufacturing competitiveness.

Companies from the US, the EU, and Japan manufacture at overseas locations more than three times of their exports produced in the home country. Intra- firm export-import transactions constitute about one-third of their international trade.

(ii) Globalization of Markets:

Marketing gurus in the last two decades have extensively argued over customized marketing strategies in the globalization of markets. Theodore Levitt, in his path- breaking paper ‘Globalization of Markets’, views the recent emergence of global markets on a previously unimagined scale of magnitude. Technology as the most powerful force has driven the world towards converging commonality.

Technological strides in telecommunication, transport, and travel have created new consumer segments in the isolated places of the world. Kenichi Ohmae also advocates the concept of a borderless world and the need for universal products for global markets. Standardized products are increasingly finding markets across the globe.

Such globalization of markets has on one hand increased the opportunity for marketing internationally while on the other has increased the competitive intensity of global brands in the market.

The simultaneous competition in markets between the numerous new competitors across the world is intensifying. This offers tremendous challenge to the existing business competitiveness of firms, compelling them to globalize and make rapid structural changes.

(iii) Globalization of Competition:

This refers to the intensification of competition among business enterprises on a global scale. Such globalization of competition has resulted in the emergence of new strategic transnational alliances among companies across the world. Increasingly, more firms need to compete with new players from around the globe in their own markets as well as foreign ones.

To cope with global competition, firms need to simultaneously harness their skills and generate synergy by a broad range of specialized skills, such as technological, financial, industrial, commercial, cultural, and administrative skills, located in different countries or even different continents.

(iv) Globalization of Technology:

The rapid pace of innovations with international networks and convergence of standards across countries has contributed to the globalization of technology. This rapid dissemination of technology internationally and the simultaneous shortening of the cycles of production has led to the globalization of technology.

Countries with advanced technologies are best placed to innovate further. Moreover, unlike in the past when inventions and innovations were considered breakthroughs, today they are a regular occurrence. This implies that the transformation process is continuous and thus has important consequences both for the overall organization of firms and for policy making.

Global firms rely on technological innovations to enhance their capabilities. Thus, technology is both driven by and is a driver of globalization. Moreover, it has led to the emergence of new ‘technologically driven character’ of the global economy.

(v) Globalization of Corporations and Industries:

The worldwide economic liberalization led to the rapid growth in FDIs and the relocation of business enterprises heavily driven by the various forms of international strategic alliances and mergers and acquisitions across the world. As a result, there has been widespread rise in the fragmentation of production processes, whereby different stages of production for a given product are carried out in different countries.

Essay # 5. Factors Influencing Globalization:

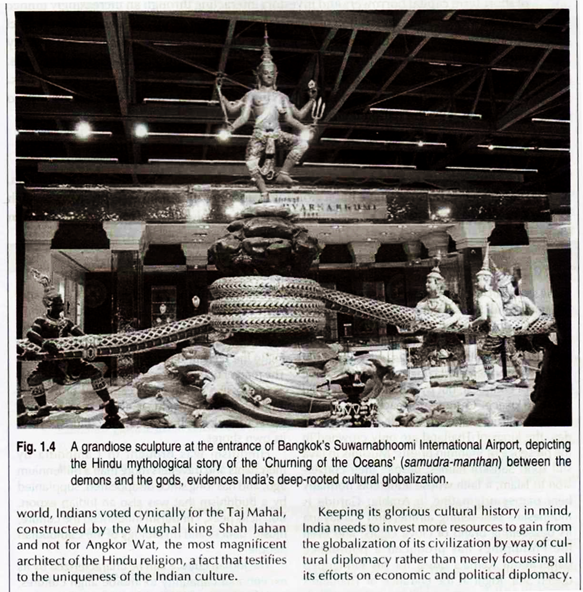

The process of globalization is characterized by the interplay of dynamic forces that act as movers and restraining factors, as shown in Fig. 1.6, which offers significant challenges to traditionally established ways of doing businesses. Since the driving forces of globalization are considerably stronger than the restraining factors, globalization of business assumes much higher significance.

(i) Economic Liberalization:

Economic liberalization, both in terms of regulations and tariff structure, has greatly contributed to the globalization of trade and investment. The emergence of the multilateral trade regime under the WTO has facilitated the reduction of tariffs and non-tariff trade barriers. In the coming years, the tariffs are expected to decline considerably further.

(ii) Technological Breakthroughs:

The breakthroughs in science and technology have transformed the world virtually into a global village, especially manufacturing, transportation, and information and communication technologies.

(a) Manufacturing technology:

Technological advancements transformed manufacturing processes and made mass production possible, which led to the industrial revolution. The production efficiency resulted in cost-effective production of uniform goods on a large scale. In order to achieve the scale economies to sustain large-scale production, markets beyond national boundaries need to be explored.

(b) Transportation technology:

The advents in all means of transports by roads, railways, air, and sea have considerably increased the speed and brought down the costs incurred. Air travel has become not only speedier but cheaper. This has boosted the movement of people and goods across countries.

(c) Information and communication technology:

The advent of information and communication technology and the fast developments in the means of transport have considerably undermined the significance of distance in country selection for expanding business. There has been a considerable reduction in international telecommunication costs due to improved technology and increased competition.

This has given rise to new business models, such as the off-shore delivery of services to global locations and electronic business transactions.

(iii) Multilateral Institutions:

A number of multilateral institutions under the UN framework, set up during the post-World War II era, have facilitated exchanges among countries and became prominent forces in present-day globalization.

Multilateral organizations such as the GATT and WTO contributed to the process of globalization and the opening up of markets by consistently reducing tariffs and increasing market access through various rounds of multilateral trade negotiations.

The evolving multilateral framework under the WTO regime, such as Trade-Related Investment Measures (TRIMS), Trade-Related Aspects of Intellectual Property Rights (TRIPS), General Agreement on Trade in Services (GATS), dispute settlement mechanism, anti-dumping measures, etc., has facilitated international trade and investment.

Besides, the International Monetary Fund has contributed to ensuring the smooth functioning of the international monetary system.

(iv) International Economic Integrations:

Consequent to World War II, a number of countries across the world collaborated to form economic groupings so as to promote trade and investment among the members. The Treaty of Rome in 1957 led to the creation of the European Economic Community (EEC) that graduated to the European Union (EU) so as to form a stronger Economic Union.

The US, Canada, and Mexico collaborated to form the North American Free Trade Agreement (NAFTA) in 1994. The reduction of trade barriers among the member countries under the various economic integrations around the world has not only contributed to the accelerated growth in trade and investment but also affected the international trade patterns considerably.

(v) Move Towards Free Marketing Systems:

The demise of centrally planned economies in Eastern Europe, the former USSR, and China has also contributed to the process of globalization as these countries gradually integrated themselves with the world economy.

The Commonwealth of Independent States (CIS) countries—all former Soviet Republics—and China have opened up and are moving towards market-driven economic systems at a fast pace. However, the exceptions to free market systems are the autocratic countries, such as North Korea and Cuba.

(vi) Rising Research and Development Costs:

The rapid growth in market competition and the ever-increasing insatiable consumer demand for newer and increasingly sophisticated goods and services compel businesses to invest huge amounts on research and development (R&D). In order to recover the costs of massive investments in R&D and achieve economic viability, it becomes necessary to globalize the business operations.

For instance, software companies such as Microsoft, Novel, and Oracle, commercial aircraft manufacturers like Boeing and Airbus, pharmaceutical giants such as Pfizer, Glaxo SmithKline, Johnson & Johnson, Merck, and Novartis, etc., can hardly be commercially viable unless global scale of operations are adopted.

(vii) Global Expansion of Business Operations:

Growing market access and movement of capital across countries have facilitated the rapid expansion of business operations globally. Since the comparative advantages of countries strongly influence the location strategies of multinational corporations, companies tend to expand their businesses overseas with the growing economic liberalization.

As a result, multinational corporations constitute the main vectors of economic globalization.

(viii) Advents in Logistics Management:

Besides these, the greater availability of speedier and increasingly cost-effective means of transport, breakthroughs in logistics management such as multimodal transport technology, and third-party logistics management contributed to the faster and efficient movement of goods internationally.

(ix) Emergence of the Global Customer Segment:

Customers around the world are fast exhibiting convergence of tastes and preferences in terms of their product likings and buying habits. Automobiles, fast-food outlets, music systems, and even fashion goods are becoming amazingly similar across countries. The proliferation of transnational satellite television and telecommunication has accelerated the process of cultural convergence.

Traditionally, cultural values were transmitted through generations by parents or grandparents or other family members. However, with the emergence of unit families that have both parents working, television has become the prominent source of acculturation not only in Western countries but in oriental countries as well.

Besides, advances in the modes of transport and increased international travel have greatly contributed to the growing similarity of customer preferences across countries. Thus, the process of globalization has encouraged firms to tap the global markets with increased product standardization. This has also given rise to rapid increase in global brands.

Essay # 6. Factors that are Used for Restraining Globalization:

(i) Regulatory Controls:

The restrictions imposed by national governments by way of regulatory measures in their trade, industrial, monetary, and fiscal policies restrain companies from global expansion. Restrictions on portfolio and foreign direct investment considerably influence monetary and capital flows across borders.

The high incidence of import duties makes imported goods uncompetitive and deters them from entering domestic markets.

(ii) Emerging Trade Barriers:

The integration of national economies under the WTO framework has restrained countries from increasing tariffs and imposing explicit non-tariff trade barriers. However, countries are consistently evolving innovative marketing barriers that are WTO compatible.

Such barriers include quality and technical specifications, environmental issues, regulations related to human exploitation, such as child labour, etc. Innovative technical jargons and justifications are often evolved by developed countries to impose such restrictions over goods from developing countries, who find it very hard to defend against such measures.

(iii) Cultural Factors:

Cultural factors can restrain the benefits of globalization. For instance, France’s collective nationalism favours home-grown agriculture and the US fear of terrorism has made foreign management of its ports difficult and restrained the entry of the Dubai Port World.

(iv) Nationalism:

The feeling of nationalism often aroused by local trade and industry, trade unions, political parties, and other nationalistic interest groups exerts considerable pressure against globalization. The increased availability of quality goods at comparatively lower prices generally benefits the mass consumers in the importing country but hurts the interests of the domestic industry.

On one hand, consumers in general are hardly organized to exert any influence on policy making, while on the other, trade and industry have considerable clout through their associations and unions to use pressure tactics on national governments against economic liberalization.

(v) War and Civil Disturbances:

The inability to maintain conducive business environment with sufficient freedom of operations restricts foreign companies from investing. Companies often prefer to expand their business operations in countries that offer peace and security. Countries engaged in prolonged war and civil disturbances are generally avoided for international trade and investment.

(vi) Management Myopia:

A number of well-established business enterprises operating indigenously exhibit little interest in expanding their business overseas. Besides, several other factors such as resource availability, risks, and the attitude of top management play a significant role in the internationalization of business activities.

Essay # 7. Methods to Measure Globalization:

Although quantifying globalization is difficult, a number of approaches have been used to measure globalization. As international managers are especially concerned about economic globalization that affects businesses the most, it can be measured based on the trade openness of a country, FDI inflows and outflows, capital account restrictions, trade barriers, etc.

(i) Trade Openness:

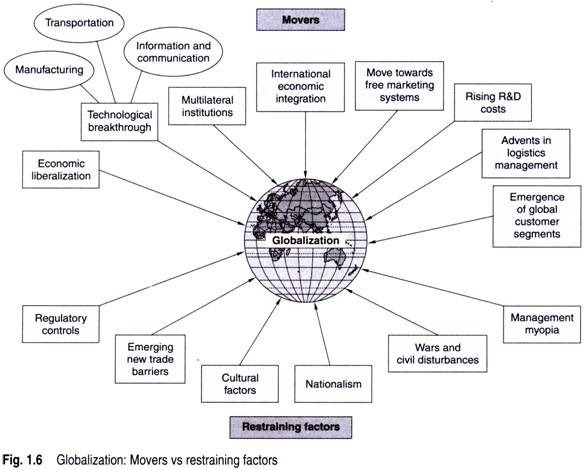

The trade openness of a country can be measured as the percentage share of total trade in the total GDP. The total trade is arrived by summing up exports and imports of goods and credit and debits of services. The cross-country comparison reveals (see Fig. 1.7) that Singapore is the most open economy with 474 per cent share of total trade to GDP in 2007, followed by Hong Kong (409%), Malaysia (210%), Netherlands (137%), Switzerland (115%), China (76%), Canada (68%), and South Africa (67%), whereas Brazil is the least open economy with the share of total trade to GDP as 26 per cent followed by the US (29%), Japan (35%), Australia (39%), India (45%), Russian Federation (51%), France (54%), and the UK (56%).

The percentage share of total trade in GDP increased only marginally for the US and the UK from 23.1 per cent and 54.3 per cent in 1998 to 29 per cent and 56 per cent, respectively, in 2007 whereas the percentage share of India and China increased remarkably from 25.7 per cent and 39.2 per cent in 1998 to 45 per cent and 76 per cent, respectively, in 2007.

Countries with a higher degree of trade openness generally grew relatively faster compared to those with low trade openness. Switzerland is home to the largest number of the world’s top global companies in relation to its population, followed by the US, Scandinavia, Britain, Belgium, Netherlands, and France.

(ii) KOF Index of Globalization:

A holistic approach to assess globalization is adopted under the KOF overall Index of Globalization based on three sub-indices, which are:

Economic globalization:

This refers to the long distance flows of goods, capital, and services as well as information and perceptions that accompany market exchanges.

Social globalization:

This is characterized by the spread of ideas, information, images, and people.

Political globalization:

This is expressed as a diffusion of government policies. Each of the above indices is allocated different weights: economic globalization (36%), social globalization (38%), and political globalization (25%).

In constructing the indices of globalization, each of the variables introduced above is transformed to an index on a scale of one to hundred, where hundred is the maximum value for a specific variable over the period 1970 to 2005, and one is the minimum value. The higher values denote a higher degree of globalization.

The availability of the indices for 122 countries consistently since 1970 enables the empirical comparison of globalization trends during the period.

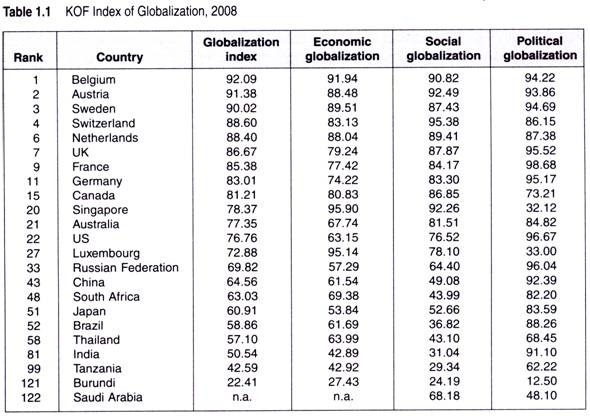

Belgium tops in overall globalization with a score of 92.09 under the KOF Index of Globalization, as shown in Table 1.1, followed by Austria (91.38), Sweden (90.02), and Switzerland (88.60), whereas the UK ranks seventh with a score of 86.67, the US 22nd (76.76), China 43rd (64.56), India 81st (50.54), and Burundi and Saudi Arabia rank the last.

(iii) A.T. Kearney/Foreign Policy Globalization Index:

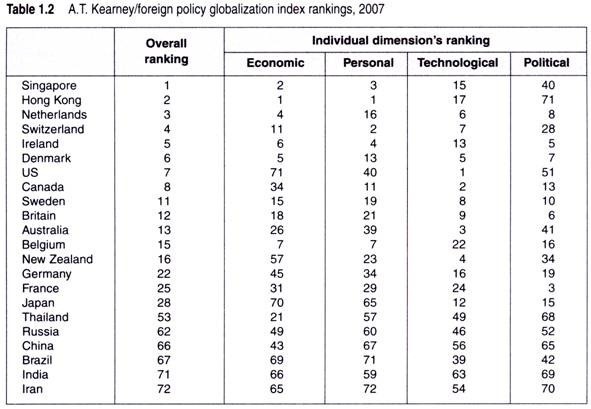

A.T. Kearney/Foreign Policy Globalization Index (2007) measures 72 countries that account for 97 per cent of the world’s GDP and 88 per cent of population. A comprehensive framework to measure globalization is provided by the globalization index brought out by A.T. Kearney/Foreign Policy, based on 12 variables grouped into four ‘baskets’, as shown in Table 1.2, is discussed below.

Economic integration:

Trade, portfolio, and foreign direct investments

Personal integration:

International travel and tourism, international telephone calls, cross-boarder remittances, and personal fund transfers

Technological integration:

Number of Internet users, Internet hosts, and secured Internet servers

Political integration:

Country memberships in international organizations, personal and financial contributions to UN peacekeeping missions, ratification of selected multilateral treaties, and amounts of government transfer payments and receipts.

The A.T. Kearney Index ranks Singapore as the most globalized country in the world, followed by Hong Kong, Netherlands, Switzerland, Ireland, Denmark, the US, Canada, Jordan, and Estonia. Iran is the least globalized country in the index followed by India, Algeria, Indonesia, Venezuela, Brazil, China, Turkey, Bangladesh, and Pakistan.

It may be observed that most globalized countries are smaller in size. Eight of the index’s top ten countries have land areas smaller than the US state of Indiana, and seven have fewer than 8 million citizens. Canada and the US are the only large countries that consistently rank in the top ten.

In fact, globalization is a matter of necessity when a country is a fly-weight. Reaching out beyond national borders is the only way to find new opportunities for tiny countries. Countries like Singapore and Netherlands lack natural resources.

Small countries, such as Ireland and Denmark, can hardly rely upon their domestic markets to sustain large-scale production the way the US, India, and China can. Thus, these countries hardly have an option other than to open up their economies and attract trade and investment to be globally competitive.

Essay # 8. Globalization – Reality or Myth:

Rugman argues that globalization is a myth that never occurred anyway. The riots in Seattle in December 1999 during the WTO ministerial and subsequent protests, sometimes violent, were interpreted as defeat of free trade and globalization. It is also interesting to learn that 43 per cent (i.e., 107) of the world’s top 250 retailers have not yet ventured beyond their own borders.

An additional 35 companies operate in just two—typically contiguous—countries, such as the US and Canada, Spain and Portugal, or Australia and New Zealand. Foreign operations of the world’s top 250 retail companies, on average, still account for only 14.4 per cent of their total retail sales.

A country-wise analysis of the world’s top 250 retailers reveals the following astonishing facts:

i. Over half of the US-based companies (i.e., 49 of 93 retailers) operate only in a single country.

ii. Japan remains the most insular as two-thirds of the top 250 Japanese retailers operate only in Japan.

iii. Asian, Latin American, and North American retailers are the least likely to have foreign operations, although globalization is slowly accelerating.

iv. European and African retailers dominate in terms of the degree to which they operate internationally.

v. On an average, the top 250 European firms did business in 9.9 countries in 2005, generating 28.1 per cent of their sales from foreign operations.

vi. The five South African retailers in the top 250 list operated in an average of 8.8 countries, primarily throughout the African continent.

vii. French and German retailers are the most international in scope, primarily due to low consumer spending, fierce market competition, and the tough regulatory environment in home markets.

The sales analysis of the world’s largest 500 firms astonishingly reveals that 70 per cent or more of their sales takes place in their home triad rather than global sales. It leads to infer that the world’s largest companies hardly bother to be global; rather they act local (see Exhibit 1.4) to harness their core competencies.

Essay # 9. Major Arguments in Support of Globalization:

Globalization means different things to different people and is considered to have both positive and negative impacts. Opinions vary widely on its influence on national economies.

(i) Maximization of Economic Efficiencies:

The global integration of economies has prompted a rapid rise in the movement of products, capital, and labour across the borders. It contributes to the maximization of economic efficiencies, including the efficient utilization and allocation of resources, such as natural resources, labour, and capital on a global scale, resulting in a sharp increase in global output and economic growth.

(ii) Enhanced Trade:

Besides rapid trade growth, new patterns on international trade are fast evolving. The creation of foreign-based affiliates by national firms and of host-country affiliates by foreign parent companies has led to a rise in intra-firm trade.

(iii) Increased Cross-border Capital Movement:

The economic liberalization across the world has paved way for FDIs even in a large number of developing countries that had a restrictive regulatory framework. This has opened up business opportunities for transnational corporations to expand their operations by way of ownership on one hand and benefited developing countries from increased flow of capital and other forms of finance on the other.

Direct investment is increasingly becoming crucial to companies’ international expansion strategies. This has led to the globalization of manufacturing and fragmentation of the production process into its sub-component parts in multiple countries.

(iv) Improved Efficiency of Local Firms:

The heightened competition by multinationals compels local businesses to adopt measures to cut down costs and improve quality for survival. On one hand, competition makes the survival of inefficient businesses difficult; on the other, it encourages firms to evolve innovative methods to improve productivity. As a result, business enterprises become more competitive not only domestically but also internationally at times.

(v) Increase in Consumer Welfare:

Consumers benefit by increased access to products and services from manufactures across the world. An import restriction in a large number of developing countries has deprived consumers of global brands and the quality thereof.

Besides the intensification of market, competition has also compelled domestic producers to reduce prices. As all domestic and multinational companies compete with each other to woo the customer, the consumer became the ultimate gainer.

Essay # 10. Major Grounds where Globalization is Criticised:

Globalization is often denounced by social organizations, NGOs, politicians, consumers, and even the general public on multiple grounds as the sole cause of all ills. It is often decried as just another term for Americanization and US global imperialism.

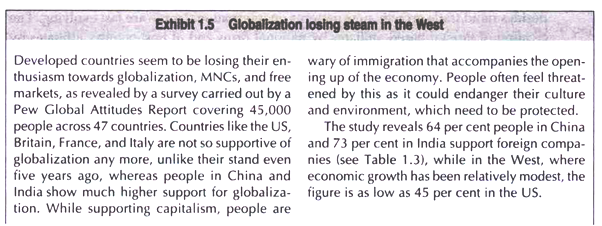

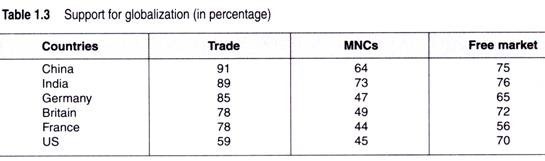

There have been numerous protests against globalization in various parts of the world. Contrary to general belief, the support for globalization is the lowest in the US and even in certain other developed countries, including France, Britain, and (Germany, whereas it is much higher in developing countries such as India and China (see Exhibit 1.5).

Globalization is frequently criticized on several grounds as discussed below:

(i) Developed versus Developing Countries: Unequal Players in Globalization:

The dynamics of the globalization process reveals that developed and developing countries participate on unequal footings. Developed countries along with their mighty multinational corporations exert a very strong force globally while developing country governments and civil society organizations hold much less sway.

Developed country governments often reserve and exercise the right to take unilateral and bilateral actions that have global scope and implications concurrently with their participation in debates and negotiations.

According to the neo-classical economic theories of equilibria, capital will flow towards areas of cheap labour but labour will flow towards the areas of expensive labour—thereby raising the cost of labour where it was once cheap by reducing the available numbers and bringing down the cost of labour where it was once expensive.

Although there have to be some bottlenecks in the theoretical framework, it seems that the ‘powerful’ countries, the ‘superpowers’ themselves, use their power to create such bottlenecks.

In the developed world, quotas, controls, and oppressive legislation curtailing the movement of people, derogatorily called ‘economic refugees’, are justified in the name of protecting ‘national’ principle but similar measures are seldom applied against the movement of capital.

Economic efficiency is often one of the strong reasons for advocating globalization in that allowing free movement of goods and capital across borders would lead to the lowest costs and thus the lowest prices. But this argument ignores the real social consequences of the search for economic efficiency.

For instance, farmers in developing countries commit suicides as the commodity prices crash, workers are thrown out of jobs as factories close, unique and specialized businesses are driven out of the market because they do not have the advantage of economies of scale, etc.

Developing countries are continually preached about on the need to reduce tariffs by multilateral organizations. Ironically, the West and the European Union impose such rigid non-tariff barriers that firms from developing countries hardly have any chance to break into their markets. Global phannaceutical companies often gang up against drug companies from developing countries.

For most Europeans and Americans, globalization only means two types of fear: fear of cheap Chinese goods and fear of Islamic immigrants. Business process outsourcing (BPO) still remains a big political issue in the US. Getting ‘Bangalored’ is often used in a pejorative way in the US to refer to the loss of a job because it has been exported to India.

(ii) Widening Gap between the Rich and the Poor:

The gains of globalization are not evenly distributed. Under globalization, those who possess capital and skills are better off, but the middle class is reported to get more and more squeezed. Noble laureate Joseph Stiglitz observes that globalization is creating rich countries with poor people.

The benefits of globalization have failed to reach the poorest citizens of the world’s wealthiest country and this was evident when Hurricane Katrina hit the US province of New Orleans. Globalization has applied intense downward pressure on the wages of the unskilled and the less skilled of the labour force even in advanced countries.

Globalization is often accused of contributing to the rise in poverty in developing countries, while in the developed world it is associated with growing economic inequality, unemployment, and fears about job security, which fuels demand for trade, protection, and more restrictive trade policies.

Globalization, often characterized by connectedness among countries, has bypassed a huge swathe of territory from Africa, the Balkans, the Caucasus, Central and Southwest Asia to South Asia, parts of Southeast Asia, and parts of the Caribbean. Poorer countries’ share in world trade has fallen over the past 20 years.

Income inequality as measured by the Gini coefficient has risen over the past decades in most regions, such as in developing Asia, emerging Europe, Latin America, and the newly industrialized economies of Asia as well as in advanced economies. In contrast, it has declined in sub-Saharan Africa and the Commonwealth of Independent States (CIS).

The failure of the WTO’s Doha round—because of the tenacity of both the US and Europe’s persistent refusal to reduce trade-distorting subsidies and of the developing countries to open up their market access—was bad news for poor farmers in Africa, Asia, and Latin America.

Rich countries spend US$300 billion a year on agriculture subsidies—more than six times the amount they give away as foreign aid. The subsidies depress world prices for such agricultural commodities as cotton, peanuts, and poultry, making it harder for farmers in developing nations to make a living.

Despite tall claims of welfare in the globalized era, more than a billion people in the world still live on less than a dollar a day. To the policy makers of rich countries, they are simply considered as forces of threats ranging from illegal immigration to drug smuggling to crime and as vectors of diseases.

Economic failure in countries in the ‘non-integrating gap’ has resulted in a global job crisis leading to migration problems. As the per capita GDP of the high-income countries grows at a rate of about 66 times that of the low-income countries, the lure of better-paid jobs has become stronger than ever.

Tens of thousands of people from the hopeless economies of sub-Saharan Africa make desperate attempts to enter Europe. Unable to compete with cheaper imported grains, many Mexican farmers have abandoned their rural occupations for a hazardous journey to the US as illegal immigrants.

Immigration laws in developed countries have been tightening against a rising tide of poor migrants, and the planned erection of a 700-mile long fence along the US- Mexican border has become a symbol of the anti-immigrant sentiment across the Western world. ‘Globalization’ has become a dirty word in Latin America, the continent described as ‘the most inequitable’ on the planet.

On an average, developed countries impose tariffs on developing countries four times higher than those on developed ones. Rich countries have cost poor countries three times more in trade restrictions than they give in development aid.

(iii) Wipe-out of Domestic Industry:

Opening up of countries for trade and investment for foreign corporations often leads to buying up of local industry by Western conglomerates. As a result, a few ‘global brands’ dominate the markets, no matter which country you are in.

The clusters of smaller firms in Italy and Germany that were once successful exporters have suffered as commoditized textiles, footwear, and toys from China have swamped the market. To cope up with the competition from cheap imports, companies keep the production of core parts of their output at their home base and send components for assembly in low-wage countries such as China.

(iv) Unemployment and Mass Lay-offs:

Globalization is reported to have pushed workers from the organized to the unorganized sector, where they enjoy much less job security and sometimes lower wages as well. This has aggravated the problems of unemployment, shifting labour from secured to casual or part-time jobs with little security and lower wages for tasks requiring lower skills.

The process of cost-cutting has raised the share of capital in value addition. Higher business profits are often attributed to exploitative efficiency rather than increased opportunities. The bargaining power of trade unions has considerably declined.

In order to save the workers from job losses, trade unions are often forced to accept cuts in wages and salaries, freezing of numerous monetary and non-monetary benefits, increase in share of temporary workforce, and curbing of union activities and even lay-offs.

(v) Balance of Payments Problems:

The liberalization of foreign investment policies results in an increase in foreign capital inflows that leads to the appreciation of local currency. This adversely impacts the export competitiveness and in turns the export-intensive manufacturing industry in the country.

Consequently, imports become relatively cheaper and the viability of indigenous industry even for the domestic market is adversely affected. This has led to mass lay-offs of the workforce besides exerting pressure on the country’s balance of payments, especially in developing countries.

(vi) Increased Volatility of Markets:

The global integration of economies has made markets highly vulnerable to external upheavals. For instance, the soaring popularity of the film Titanic in the US created a boom in the worldwide demand for the gem tanzanite whereas its subsequent association with a terrorist outfit drastically brought down its prices (see Exhibit 1.6).

Use of lead to paint toys by Chinese manufacturers evokes serious concerns among consumers around the world, compelling children in several countries to abandon their favourite toys, including the Barbie doll. Stock markets have become highly interconnected to global happenings. Any plunge in the US stock market sends tremors to shareholders across the world.

(vii) Diminishing Power of Nation States:

The global forces, the increasingly transnational character of capital, the erosion and sometimes the voluntary surrender of state sovereignty have all made countries less powerful, for instance the transnational alliances such as the European Union.

As a result, less powerful countries find it difficult to control their own destinies and become victims of forces beyond their control. Diminishing sovereignty is reported to be the source of many of the ills of the contemporary world. Its citizens lose control of their day-to-day lives.

(viii) Loss of Cultural Identity:

The proliferation of satellite channels, the Internet, and the means of transportation and communication have immensely affected the social and cultural values of masses across the world. Most people agree that globalization is changing our values and making lives too fast and impersonal.

The forces of globalization have led to cultural convergence across countries, and individuals tend to lose their country-specific cultural values and national identity.

(ix) Shift of Power to Multinationals:

As a result of the globalization of markets and production, a number of transnational companies, such as Microsoft, General Electric, Unilever, Procter & Gamble, Sony, Ford, Toyota, etc., have emerged to operate across the globe.

The total sales revenue of these MNCs is greater than the total national income of a large number of midsized and small countries. The global scale operations of multinationals empower them with enormous financial and political muscle to monopolize the markets and influence government decision making.

Nations often fear losing their sovereignty due to the shift of power to MNCs and super-national organizations. Multinationals are often accused of exploiting resources and abusing the environment. Consequent to economic liberalization, India’s best- selling soft-drink brands, i.e., Parle’s Thumps Up and Limca, were bought by the global giant Coke.

Essay # 11. Response Strategies to Globalization Forces for Emerging Market Companies:

Most books and business literature on the subject often discuss at length the global strategies of mammoth multinationals, such as Coke/Pepsi, Sony/LG, or Unilever/Nestle, but very little is known or written about local firms, especially from the emerging economies.

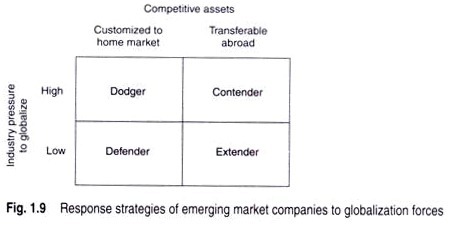

Since local firms in the emerging markets can hardly match the resources, expertise, and experience of large multinationals, it becomes crucial to understand their strategic perspective to respond to the forces of globalization. Depending upon the industry pressure to globalize and the transferability of assets, the emerging market companies can adopt four strategic options (Fig. 1.9) as follows.

(i) Defender:

In some industries, where the pressure to globalize is low and the local companies’ primary competitive strength lies in their deep understanding of the markets or their competitive assets are customized to the local markets, companies should adopt a defensive strategy that focuses on leveraging local assets in market segments where multinationals are weak.

For instance, in order to successfully counter the multinational enterprise (MNE) competition from fully automatic washing machines in India, Videocon developed semi-automatic machines, targeting value-conscious Indian consumers by focusing on this segment.

Similarly, when Western cosmetic multinationals entered China, the local cosmetic company Shanghai Jahwa did not compete with them head-on by targeting global range products; rather it responded by developing products to suit the local complexion and appeal to the local people.

The Mexican food company Bimbo responded to global competition by defending their deep penetrating distribution system that reached far-off rural areas with 420,000 deliveries daily through 350,000 stores, thus creating a huge barrier to the entry of PepsiCo, whose reach was largely big supermarkets in urban areas.

Thus, under the defender strategy, local firms concede some markets to multinationals while building strongholds on the other market segments.

(ii) Extender:

When industry pressure to globalize is low and companies possess competitive skills and assets that can be transferred abroad, companies can focus on expanding to markets similar to the home base, using competencies developed at home.

Faced with intense competition from Western fast food chains, such as McDonald’s and Pizza Hut in the Indian market, the Indian Foodmaker Haldiram focused on traditional Indian vegetarian food and expanded overseas primarily to cater to ethnic Indians.

Similarly, Jolibee foods, a Philippines fast food chain, countered McDonald’s by developing spicier products better suited to the Filipino palate. The company then followed the Filipino population across the world.

The Mexican media company Televisa globalized by marketing its Spanish language products to Spanish-speaking populations across the world.

Asian Paints developed strong capability tailored to the unique Indian environment, characterized by the extensive network of thousands of small retailers and numerous low income customers whose primary requirement is confined to small quantities of paints that can be diluted to save money.

The aggressive business model of multinational paint companies that largely focuses upon affluent customers in developed countries had a tough time cracking the markets with low-income customers, whereas Asian Paints leveraged such capabilities not only in India but also in other countries with similar requirements for low-end products, such as Asia, Pacific, and Africa.

(iii) Dodger:

To compete in industries with high globalization pressures is a highly difficult situation for local companies. The situation becomes highly vulnerable when the competitive assets based on the superior understanding of local markets are neither adequate to face the competition from multinationals in the home country nor transferable overseas.

Under such circumstances, local companies have no other option but to dodge the competition.

Such strategy may include cooperating through a joint venture with the MNE, selling off to the MNE, or become a supplier or service provider to the MNE. For instance, faced with MNC competition, Kwality, a dominant player in the Indian ice-cream market, sold its manufacturing assets and brand to Unilever.

This paved way for Kwality Walls to become the market leader in the ice-cream market in India. Consequent to the changes in the economic policies in Russia after the iron curtain came down, Vist, the Russian manufacturer of personal computers, focused itself on distribution rather than on competing with American and Japanese multinationals.

As the distribution system in Russia was ridden with corruption and inefficiency the foreign companies faced formidable difficulties.

As a result, Vist is a vital link in supporting MNC distribution of personal computers in Russia. Skoda, the leading state-owned automaker in the Czech Republic, was sold by the government to Volkswagen much as the selling of government stake in Maruti-Suzuki to Suzuki by the Indian Government.

In situations, when local firms find it difficult to compete head-on with the multinationals, such co-operation becomes necessary. If you cannot beat them, join them.

(iv) Contender:

Companies that have high pressure to globalize and competitive advantages that can be leveraged overseas can aggressively compete in the global market by focusing on upgrading their capabilities and resources in the niche segment to match multinationals globally. A large number of Indian companies have achieved global competitiveness in their niche segment.

For instance, Bharat Forge, the second largest forging company in the world, is a global supplier of specialized engine and chassis components for trucks and passenger cars. One out of every two trucks in the US uses front axles made by Bharat Forge.

Similarly, Sundram Fasteners competes in niche auto components, such as high tensile fasteners, radiator caps, precision forced differentiated gears etc., and supplies to leading auto manufactures across the world.

The company has also received a number of international quality recognitions, including the prestigious TPM Excellence and Consistency Award from the Japan Institute of Plant Maintenance. The Chinese company TCL not only rapidly caught up with global cellular phone companies such as Nokia and Motorola, but also emerged as a significant player in a number of consumer electronics.

Competition from multinationals in the home markets has driven a number of local firms in the emerging markets to become globally competitive. Some of the local firms, especially in India and China, have not only challenged supremacy of giant multinationals in their home markets, but leveraged their competitive advantage internationally.

Indian companies’ global expansion, such as Tata’s buying Corns Birla’s buying Novelis, Ranbaxy acquiring Terapia, has not only affirmed their global competitiveness but also earned them global respect. This has convinced a number of Indian and Chinese companies of their global strengths in terms of quality, cutting edge technology, cost competitiveness, and human capital.

As a result, these companies are undoubtedly much better prepared and equipped to face competition in the global arena.

Essay # 12. Managing Business in the Globalization Era:

Globalization is essentially a macroeconomic phenomenon driven by the strategies and behaviour of the firms that have responded to environmental changes. The high degree of economic integration among the countries has also posed considerable risks of contagion following economic and financial upheavals in foreign countries, even if a firm is not directly involved.

Globalization offers both challenges and opportunities for business enterprises, including the following:

Challenges:

i. Opening up of domestic market to foreign companies increases competition even for the firms solely operating in domestic markets.

ii. Liberal investment regime facilitates international competitors in establishing business operations, giving rise to increased competition to firms that have been accustomed to operate in protected economies.

Opportunities:

i. Increased market access and reduced tariffs make foreign markets not only accessible, but increases competitiveness as well.

ii. Liberalization of regulatory framework for investment in target countries enables companies to invest and expand their business operations abroad.

iii. It offers opportunities for integration of business operations on a global scale.

iv. Provides increased opportunity to establish foreign collaborations and ownership.

v. Facilitates consolidation of business operations in various countries and developing global capabilities.

Firms, whose output was previously significantly more limited by the size of the domestic market, now have the chance to reap greater advantages from economies of scale by ‘being global’. Global companies are differentiated by their strong global position in terms of global assets, capabilities, brands, and their relative resilience to shocks and even to the business cycles.

The abilities to become globally competitive and leverage global opportunities are what make a firm global. Global companies can attract stronger talent, can enable cross-learning across markets, have greater opportunities to service and develop capabilities for global customers, and can invest more in R&D that can be spread over larger markets.

Further, global companies can act in multiple markets to retaliate against increased competition from other large companies in any given market.

The global strategies adopted by business enterprises may include:

i. Global conception of markets

ii. Multi-regional integration strategy

iii. Changes in external organization of multinational firms—Mergers and acquisitions, rather than Greenfield operations, strategic alliances, international subcontracting, worldwide network structure, etc.

iv. Changes in internal organization—just-in time inventories, global outsourcing, reduced emphasis on hierarchical relationships, need for greater transparency and for corporate governance regulations, etc.

The book is conceptualized to facilitate both practitioners and beginners to develop a thorough understanding of international business for effective decision making. Although in precise theoretical terms, a company should follow a single business strategy for its operations in various countries in ‘global business’, the strategy adopted in ‘international business’ may vary to some extent.

Since the differences in ‘global’ and ‘international’ business appear to be too semantic and obscure, the term ‘international business’ is used throughout this book. Explicating the concept of globalization, the book equips the readers to manage business in the globalization era.