To understand the dynamics of economic reforms one must know the economic policies that India pursued during 1951-1990.

Development goals of the country consisted of higher economic growth, self-reliance, poverty eradication, social justice, etc.

Developmental strategy of the time came to be known as ‘inward-looking strategy’ that consisted of controls and regulations of the economy through industrial licences and import controls. That is to say, state intervention was essentially inevitable.

As we proceed, we will picturise the inefficiencies of the Indian economy, the consequences arising out of such, and, finally, the changes in economic policies since July 1991 consequent upon grave economic crisis that erupted in the late 1980s and culminated in mid-1991. It is often argued that the origins of the severe macroeconomic crisis of the late 1980s and early years of the 1990s could be traced to the inward-oriented strategy of development.

1. 1951-1981:

ADVERTISEMENTS:

The Indian economy started its journey in 1951 when the First Five Year Plan was launched. This first phase of development could be characterised as the ‘decade of crisis’ when the country faced the problem of Partition (1947-48) and the consequent food crisis and foreign exchange crisis. It was because of the crisis of such grave nature that the country could not overcome the ‘teething troubles’ associated with the early development of the country after independence.

During the 1960s, a higher growth was achieved and ‘pre-conditions for take off’ became visible.

But the country experienced three twos during 1960s:

(i) deaths of two prime ministers (Jawaharlal Nehru and Lalbahadur Sashtri)

ADVERTISEMENTS:

(ii) two wars with China (1962) and Pakistan (1965), and

(iii) two droughts in 1965 and 1966.

The crisis was so grave that the country had to import large amount of foodgrains from other countries— a condition known as ‘ship to mouth’. The Indian economy then made a retrograde journey.

The 1970s was called the ‘decade of change’ or ‘reform by stealth’. In the 1970s, Indira Gandhi found that the brand of socialism initiated by her father had resulted in some social conflicts. During her initial stewardship, we saw some conflicts between government and private industrialists.

ADVERTISEMENTS:

She took up some anti-rich policies like, abolition of princely states, bank nationalisation, and implementation of MRTP (Monopolies and Restrictive Trade Practices) provisions to curb the growth of large monopoly houses, nationalisation of coal industry, and many anti-poverty measures. Signs of pitfalls in our economic policies were raising their ugly heads and the need for reforms became uppermost in the minds of the policymakers’. However, the economic and political climate was not propitious for reforms since the mindset of the Indian leaders and policymakers was still pro-government.

The growth scenario that we saw during 1951-1979 was rather discouraging. As real GDP grew at an annual rate of around 3.5 p.c. during 1951 and until 1980, Raj Krishna christened this economic performance as ‘Hindu rate of growth’ a syndrome that continued for almost 30 years. During 1980, China and India had been ranked as the 19th and the 20th largest economic power in the world. And, it was believed that such growth rate was ‘inevitable’. But why?

2. 1980s and Structural Problems:

During her last phase of life in the early 1980s, Indira Gandhi continued her tirade against private sector banks. She nationalised 6 more banks and attempted to further liberalise the Indian economy more. One could see then raising of the exemption limit from licensing, relaxations to MRTP (Monopolies and Restrictive Trade Practices) and FERA (Foreign Exchange Regulation Act) companies, delicensing, etc., to woo private investors. Meanwhile, her assassination in 1984 upset all economic calculations.

One thing clear from such economic policies pursued then is that the country had been moving more towards capitalist path of development—a deviation from Nehru’s so- called socialistic path of development often called Nehruvian socialism.

In this connection, Sukhamoy Chakravarty’s comment in 1987 is worth reading. “…as of now, there is no evidence that despite the growth of a large public sector, India has moved to any significant extent closer to a ‘socialist society’, in any meaningful sense of the term. If the present trends are not going to be reversed, it is possible that India will witness in the closing decade of this century a considerably enlarged private sector with further erosion of the role of planning in the traditional sense of the term.”

As soon as Rajiv Gandhi came to power in 1985, he experimented with liberalisation on a grand scale hitherto unknown in the Indian economy. He had a different vision to put the Indian economy in the 21st century. His experiment with liberalisation put the Indian economy in a different gear.

He said that his primary objective was to ‘rationalise’ controls and regulations so as to remove inefficiencies of the Indian economy. Several industries were delicensed; imports of capital goods and intermediate goods as well as technologies were liberalised. Earlier, license-permit-quota raj affected industrial growth adversely.

With the slackening of such controls, i.e., with the growing liberalisation of the Indian economy, a higher growth rate was struck 5.5 p.c. the syndrome of Hindu rate of growth (3.5 p.c.) was, thus, broken. With the emergence of the Bofors scandal involving Rajiv Gandhi resulting in political turmoil, piecemeal reforms were abandoned.

(iii) Outcomes of Faulty Economic Policies:

To understand the dynamics of economic reforms, one must have some knowledge about the economic policies pursued during 1951- 1991. Development goals of the country consisted of higher economic growth, social justice, poverty eradication, self-reliance.

ADVERTISEMENTS:

To achieve these goals, our institutional structure centred on the mixed economy principle where both public and private sectors functioned with their distinctive roles. Economic activities were carried through planning mechanism with less emphasis on market mechanism. Development strategy of this time came to be known as ‘inward-looking strategy’. This strategy consisted of controls and regulations of the economy through industrial licenses and import controls.

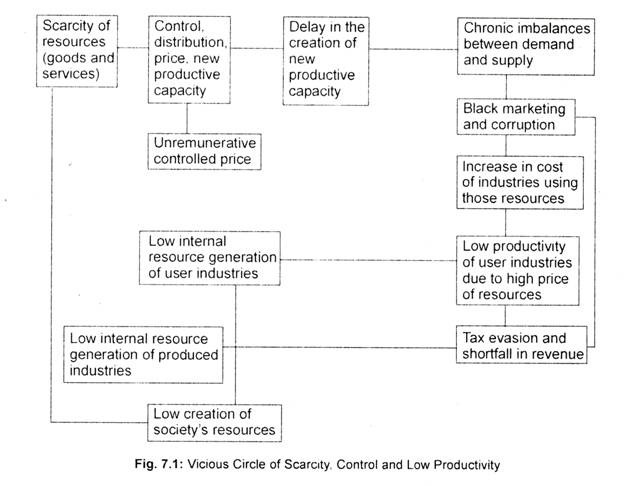

The outcomes of control-ridden economy were the emergence of inefficiencies of the economy. It is said that control and scarcity create a vicious circle of low productivity (Fig. 7.1.) Scarcity demands control that brings in rationing in distribution line. This creates delays in the creation of new productive capacity and, hence, lower output. This results in demand-supply imbalances. Imbalances, in turn, cause corruption, black marketing, etc., thereby raising costs of industrial goods and hence, low productivity. Tax evasion becomes rampant leading to a shortfall in revenue. Further, controlled price is often set at an un-remunerative level. This makes lower internal revenue generation. This demands distribution of commodities with more controls and regulations.

As a result of this vicious cycle, Indian industries could not become efficient and competitive.

ADVERTISEMENTS:

Since experiment with liberalisation was launched rather haltingly and without bothering for the economic fallouts of such measures, Indian economy landed in a new crisis, hitherto unknown. All along, the country rather fairly succeeded in maintaining the some sort of financial discipline despite odds (like oil crisis in 1973 and 1979, high rate of inflation of around 23 p.c. p.a etc.). The country then experienced huge fiscal deficit. Truly speaking, in the ‘decade of growth and expansion’ of 1980s, we saw a change in the underlying philosophy.

Epoch-making changes were brought out in economic policies and perceptions. Perceptions changed. No longer market is bad. It is said that planning is dead, government or state is bad and market is good. Socialism now became a dirty word, particularly after the collapse of the Soviet Union.

A journey towards deregulation, privatisation, debureaucratisation started with a great bang. Earlier, reforms could not be initiated on this scale because the Government was not serious enough to go against the public mood. Opposition from vested interests like bureaucrats who amassed huge benefits from the controlled economy was another reason for not introducing reforms in the Indian economy.

During the 1980s, as industrialisation became heavily import-dependent, BOP difficulties rearer up its ugly head. In fact, liberalisation measures introduced by Rajiv Gandhi encouraged import of ‘screw-driver technology’, palpably visible in electronic industries. Industrial structure exhibited dominance of durable consumer goods industries. Growth in employment during 1988-91 hovered around 1.4 p.c. p.a. Number of people living below the poverty lines increased, though poverty ratio declined from 54.9 p.c. in 1973-74 to 39 p.c. in 1987-88.

ADVERTISEMENTS:

All these resulted in serious fiscal imbalances. Budgetary deficit mounted up. This fuelled the inflationary pressures (15-16 p.c. p.a.). BOP deficit in current account that stood at 3.7 p.c. of GDP brought tremendous miserly to the people. Liberalisation of the economy caused the imports bill to shoot.

To tide over the unprecedented BOP crisis, necessity was felt for borrowing from abroad. Foreign debt rose to a higher magnitude at that time. To reduce such burden of debt, borrowings were needed. Repayment of loans required further borrowing—thereby triggering debt-service ratio to 30 p.c.

No country dared to give loans to India as her financial credibility went down to a staggering level. Finding no other alternative, the country pledged 20 tonnes of confiscated gold in May 1991 and another 47 tonnes in July 1991 for 6 month in banks of foreign countries to finance her import bill. Foreign exchange reserves were down to about 2 weeks’ imports. Financial credibility of the Government reached its nadir. No country risked giving loans to India as she might default.

All these compelled the Indian Government to initiate dialogue with the IMF and the World Bank, though it was overdue during the Gulf War. The country also saw political instability and frequent changes of the Government. This caused the postponement of taking such loans from the IMF. Meanwhile, a Minority Government headed by P.V. Narasimha Rao came to power in June 1991 and announced several short term and long term measures beyond the typical stabilisation package so that the country does not sink further.

What is important now is that the days of Nehruvian socialism characterised by state- sponsored development in an environment of rigid controls, bureaucracy and inward-looking development of the Indian economy have gone. As the development experience of the 1980s and early 1990s was terrible, it called for immediate changes in economic policies.

However, crisis and changes in economic policies were not peculiar to India alone at that time. Demise of the Soviet planning system in 1989 and increasing globalisation and marketisation of the Chinese economy launched in 1978 accompanied by remarkable growth performance of the Chinese economy and, above all, India’s home-made domestic crisis created over the years brought changes in her economic policies in mid-1991 as a part of the overall global process.

ADVERTISEMENTS:

Marketisation, liberalisation, privatisation, debureaucratisation and outward orientation of economy were the principal ingredients of the New Economic Policy (NEP) introduced in July 1991. The World Bank propagated that aid, but not trade, is the engine of growth. It recommended market-friendly development strategies (See Table 7.1).

(iv) Reforms of the 1990s and Onwards:

To repeat, the three macroeconomic crisis that below out of proportions in the early years of 1990s were: (i) acceleration of inflation (16.3 p.c. in August 1991); (ii) unsustainable fiscal deficit (6.6 p.c. in 1991, 30 p.c. debt-service burden, and hence, debt trap); (iii) fragile balance of payments situation (current account deficit of 3.69 p.c. of GDP in 1991).

Against the backdrop of these major, unprecedented, unsustainable economic crisis, new economic policy reforms were required to be initiated without any doubts to avert further deterioration.

The diagnosis and the solution of the crisis could then be addressed in terms of neo-classical theory that says that a liberalised economy or more specifically, market economy, is more efficient than a controlled-regulated economy. State intervention and state planning is ‘costly’ now to the Indian economy, as was suggested by the IMF-World Bank.

The two important planks of NEP were: (i) macroeconomic adjustment and balances (called structural adjustment programmes), and (ii) reconstruction of the Indian economy through macroeconomic stabilisation. To bring macroeconomic adjustments and macroeconomic stabilisation, measures were taken to reduce fiscal deficit, maintenance of BOP equilibrium and containment of inflation. For these purposes, loans from the IMF and the World Bank were sought.

ADVERTISEMENTS:

Former policy measures i.e., structural adjustments are taken to improve the supply of the economy through reforms in industrial sector (like deregulation and delicensing, disinvestment of public sector enterprises), reforms in trade and capital flows, reforms in the financial sector, etc. These policies are called supply side management policies.

On the other hand, macroeconomic stabilisation policy—or the so-called demand management policy—centres around inflation control, improvement of the BOP situation and fiscal adjustment to correct fiscal imbalances. It suggested that imports were to be liberalised; import duties were to be reduced; quotas and quantitative restrictions were to be removed; Indian currency was to be devalued by at least 22 p.c.; privatisation of Public sector enterprises (PSEs) were to be made; budgetary deficit and fiscal deficit were to be reduced. Thus, the Indian Economy entered a phase what is euphemistically called the LPG (Liberalisation-Privatisation-Globalisation) strategy of development.