Union (Central) Budget of India: it’s Meaning and Components!

Meaning of Union (Central) Budget of India:

According to Constitution of India, there is three-tier system of government, namely. Central (or Union) government.

State government and Local government (like Municipal Corporation, Municipal Committee, Zila Parishad, etc.). Accordingly, these governments prepare their own respective budgets (called Union Budget, State Budget and Municipal Budget) containing estimates of expected revenue and proposed expenditure.

ADVERTISEMENTS:

The basic structure of government budget is almost the same at all levels of government but items of expenditure and sources of revenue differ from budget to budget. Again, there is no clash with regard to sources of revenue because functions of Central, State and local government have been clearly demarcated and laid down in the Indian Constitution. However, we shall discuss here the budget of the Central Government.

Let it be noted that Central Government is constitutionally required to lay an “annual financial statement” before both the houses of Parliament. This statement is conventionally called Government Budget. Accordingly, in India, every year Central (or Union) Budget for the coming financial year is presented by the Union Finance Minister in the Lok Sabha normally on the last working day of the month of February.

It gives item wise details of government receipts and expenditure for three consecutive years, i.e., Actuals for the preceding year. Budget estimates for the current year. Revised estimates for the current year and Budget estimates for the ensuing (coming) year .For Instance, Union Budget for the financial year 2009-2010 as presented in the Parliament reflects this approach.

It contains details of government Receipts and Expenditure under the following four heads:

ADVERTISEMENTS:

(i) Actual for the year 2008-09 Hi) Budget estimates for the year 2009-10

(iii) Revised estimates for the year 2009-10

(iv) Budget estimates for the year 2010-11

Components of the Union (Central) Budget of India:

The budget is divided into two parts:

ADVERTISEMENTS:

(i) Revenue Budget and

(ii) Capital Budget.

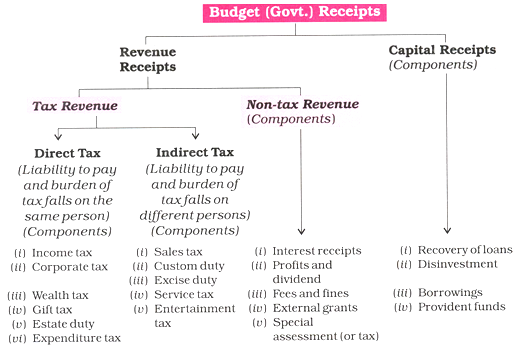

The Revenue Budget comprises revenue receipts and expenditure met from these revenues. The revenue receipts include both tax revenue (like income tax, excise duty) and non-tax revenue (like interest receipts, profits). Capital Budget consists of capital receipts {like borrowing, disinvestment) and long period capital expenditure (creation of assets, investment).

Capital receipts are receipts of the government which create liabilities or reduce financial assets, e.g., market borrowing, recovery of loan, etc. Capital expenditure is the expenditure of the government which either creates assets or reduces liability. Capital budget is an account of assets and liabilities of the government which takes into consideration changes in capital.

Structure or components of a government budget broadly consists of two parts—Budget Receipts and Budget Expenditure as shown in the following chart with their classification.