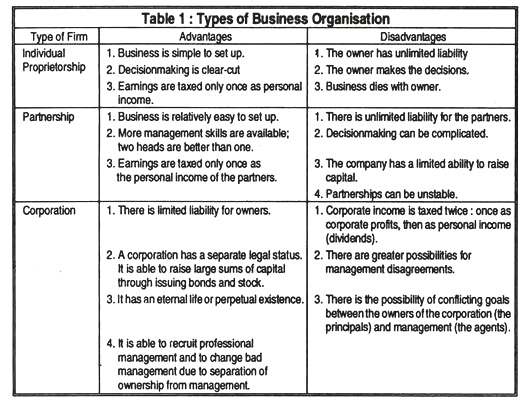

The following points highlight the top three forms of organisations. The forms are: 1. The Sole Proprietorship Concern 2. Partnership 3. Corporation.

Form # 1. The Sole Proprietorship Concern:

The sole proprietorship is the least complex form of business enterprise. This form of business is owned by one individual who makes all the business decisions receives the profits that the business earns, and bears the financial responsibility for losses.

From this description, the simplicity of the individual proprietorship is apparent. Barring legal restrictions any individual can simply decide to go into business except in areas of enterprise where business licences are required. Such restrictions aside, the individual who has accumulated or borrowed sufficient funds to set up a business can do so. No legal work is required to set up a sole proprietorship, although the individual proprietor will often seek legal and accounting advice.

Once in business, the proprietor is responsible for all business decisions. The owner determines how many employees to hire, when they should be rewarded or penalised, what products to produce, how they are to be marketed. The owner need not seek any one’s permission to make such decisions. The basic limitation upon decision-making is that the owner must observe the law and honour contracts. Otherwise, the owner is free to make wise or foolish decisions.

Advantages:

The first advantage of the sole proprietorship is that, decision-making authority is clear-cut; it resides with the owner who need not consult anyone.

The second advantage of the sole proprietorship is that the profits of the business enterprise are taxed only once. The individual proprietor will receive any profits that the business earns after meeting its expenses. The proprietor has to pay personal income taxes on these profits.

Disadvantages:

There are three basic disadvantages of the sole proprietorship:

ADVERTISEMENTS:

1. Unlimited liability:

The first is that the owner must assume unlimited liability (responsibility) for the debts of the company. The owner enjoys the profit of the business if it is successful, but if the business suffers a loss, the owner is personally liable. If the company borrows money, purchases materials, and incurs other bills that it cannot cover out of its revenues, the owner must personally cover the losses. The owner stands to lose personal wealth accumulated over the years in paying off the debts of the company.

2. Limited capital:

The second disadvantage of the sole proprietorship is its limited ability to raise financial capital. This limitation makes it difficult for sole proprietorships are small businesses. Financial capital for the expansion of the company can be raised in several ways in the case of the sole proprietorship. The owner can choose to flow profits back into business.

ADVERTISEMENTS:

The owner can use the personal wealth to invest in the company, or the owner can borrow money from relatives, friends, and lending institutions. The ability of the owner to borrow is determined by the owner’s earning capacity (which will depend upon the success of the business) and personal wealth.

Lending money to an individual proprietorship can be risky because the success of the business depends very much on one person, and if that person dies or becomes incapacitated, the lender will have to stand in the line with other creditors.

3. Non-permanence:

The third disadvantage is that the business will typically die with the owner. Since the firm does not have a permanent existence, it may be difficult to find reliable employees. In fact, most employees prefer to work in firms that will exist for long and thus offer employees bright carrier prospects.

Form # 2. Partnership:

A partnership is much like an individual proprietorship but with more than one owner.

A partnership is a business enterprise that is owned by two or more people (called partners) who make all the business decisions, who share the profits of the business, and who bear the financial responsibility for any losses.

Like the individual proprietorship, partnerships are easy to establish. Most partnerships are based upon an agreement that spells out the ownership of shares and duties of each partner. The partners may contribute different amounts of financial capital to the organisation; there may be an agreement on the division of responsibility for running the business.

One partner may make all the business decisions, while the other partner (a “silent partner”) may simply provide financial capital. A partnership can be a corner petrol pump owned by three friends or brothers or a nationally known law firm or brokerage house.

Advantages:

The advantages of partnerships are much like those of the sole proprietorship. Partnerships are easy to set up. The profits of the company accrue to the partners and are taxed only once as personal income.

ADVERTISEMENTS:

1. Specialisation:

Unlike the sole proprietorship, however, there is a greater opportunity to specialise and divide managerial responsibility because the partnership consists of two or more individuals. The partner who is the better salesperson will be in charge of the sales department. The partner who is a talented mechanical engineer will be in charge of production. “Two heads are better than one”, when each has different talents that are useful to the business enterprise.

2. Large capital base:

Second a partnership can raise more financial capital than a sole proprietorship because the wealth and borrowing ability of more than one person can be mobilised. In fact, if a large number of wealthy partners can be assembled, such partnership can indeed raise huge sums of capital.

Disadvantages:

ADVERTISEMENTS:

1. Limited capital:

The ability of the partnership to raise financial capital is limited by the amount of money the partners can raise out of their personal wealth or from borrowing.

2. Unlimited liability:

The partners have unlimited liability for the debts of the partnership. A business debt incurred by any of the partners is the responsibility of the partnership. Each partner stands to lose personal wealth if the company is a commercial failure. Clearly, a conflict in goals can arise because the richer partner may be more risk-averse than the poorer partner.

ADVERTISEMENTS:

3. Complicated decision-making process:

“Two heads are better than one” if the two heads agree. But, if partners fail to agree, decision-making can become quite complicated. In a partnership where all partners are responsible for management decisions, there is no longer one single person who is in charge. Partnerships can be immobilised when partners disagree on a fundamental policy. Partnerships involve a more complicated decision-making process that can become more complicated as the number of partners grows.

4. Instability:

Partnerships can also be unstable. If disagreement over policy causes one partner to withdraw from the partnership, the partnership must be reorganised. When one partner dies, again the partnership agreement must be renegotiated.

5. Great risk:

Finally, partnerships can involve a considerable risk for the individual partners. The sole proprietor does bear unlimited liability for the debts of the company, but at least the owner is the one who makes the business decision that may turn out to be bad. In case of partnership, each partner is responsible for business debts incurred by another partner even if that partner acted without the consent of the other partners.

ADVERTISEMENTS:

For this reason partnerships are often made up of family members, close relatives, and close personal friends, who have come to trust one another over the years Partnership with more partners would have a greater ability to raise capital. However, because additional partners complicate decision-making and increase the like-hood of an irresponsible act being committed by a partner, many partnerships have a limited number of partners.

Form # 3. Corporation:

The corporation or the corporate form of business was set up to overcome some of the disadvantages of the proprietorship and partnership.

A corporation is a form of business enterprise that is owned by a large number of shareholders. The corporation has the legal status of a fictional individual and is authorised by law to act as a single person. The shareholders elect a board of directors that appoints the management of the corporation, usually headed by a president. Management is charged with the actual operation of the corporation.

Unlike the sole proprietorship and partnerships that can be established with minimal paperwork, a corporate charter is required to set up a corporation. The laws of each state are different, but typically, for a fee, corporations can be established (incorporated) and can become legal “persons” subject to the laws of that state.

According to state and Central laws, the corporation has the legal status of a fictional individual. Officers of the corporation can act in the name of the corporation without being personally liable for its debts. If corporate officers commit criminal acts, however, they can be prosecuted.

The corporation is owned by individuals (shareholders) who have purchased equity shares of stock in the corporation. A shareholder’s share of ownership of the corporation will equal the number of shares owned by that individual divided by the total number of shares outstanding (owned by shareholders).

ADVERTISEMENTS:

If a person owns 1,00,000 shares of PAL stock and there are 630 million PAL shares outstanding, then the person would own only 0.016 per cent of PAL. Owners of shares of stock have the right to vote for the board of directors and to vote on special referenda at the annual meeting of the corporation.

The management of the corporation is required by law to issue periodic reports to its shareholders describing the financial and business activities of the corporation during the reporting period. The shareholders may cast their votes in person at the annual meeting (the greater is the number of shares owned, the greater is the weight of the individual’s vote) or can vote by proxy (that is, turn over voting privileges to the current management or to some other group).

The shareholder who owns 1 percent of the stock of PAL will receive 1 per cent of the dividends; the PAL management choose to pay to its shareholders out of profits. In the case of the sole proprietorship and partnership, the owners decide what to do with the profits.

In the case of the corporate stockholder, the management determines what to do with the profits of the corporation. The shareholder who does not approve of the way these profits are handled can vote to change the current board of directors or sell the stock and buy some other asset. Ordinary shares preference shares and convertible bonds are three types of corporate stock!

Ordinary shares confers voting privileges but no prior claim on dividends. Common stock dividends are paid only if they are declared by the board of directors in any given year.

Preference shares confer a prior claim on dividends but no voting privileges. Dividends on preference shares must be paid before paying dividends on ordinary shares but after meeting interest obligations.

ADVERTISEMENTS:

Convertible stock is a hybrid between a stock and a bond. The owner of convertible stock receives fixed interest payments but has the privilege of converting the convertible stock into ordinary share at a fixed rate of exchange.

Corporations often have thousands or millions of shares are typically owned by a large number of stockholders. In the case of closely held corporations, the number of shareholders is limited and each shareholder owns a substantial share of the corporation’s stock.

Unlike the sole proprietor or the partner, shareholders do not participate directly in the running of the corporation unless they happen to own a substantial share of the outstanding stock. Moreover, even if an effort was made to involve shareholders in corporate decision-making, there would be too many of them they would be graphically dispersed, and they would be too involved in their own business affairs.

For these reasons, there is usually a separation of ownership and management in the modern corporation. The board of directors appoints a professional management team that makes decisions for the corporation. The professional management team serves as agents for the corporation.

As long as the corporation is run successfully, the management team is allowed to continue. If the corporation falls on hard times, then the shareholders may vote out the current board of directors or the board of directors itself may decide to bring in a new management team.

Statistical studies of modern corporations have demonstrated the magnitude of the separation of ownership and management. Shareholders, however, can exercise substantial indirect control over management by simply selling their shares. The sale of shares by a large number of unhappy stockholders will depress the price of each share and invite possible takeovers by other corporate teams.

Advantages:

ADVERTISEMENTS:

1. Limited liability:

The first advantage of the corporation is limited liability. The owners of the corporation (the shareholders) are not personally liable for the debts of the corporation. If a corporation incurs debts that it cannot meet, its creditors will have claim to the assets of the corporation (its bank accounts, equipment, supplies, buildings and real-estate holdings), but they cannot file claims against the shareholders. The worst thing that can happen to shareholders is that the value of their stock will decline (in extreme circumstances, it can become worthless).

2. Large capital base:

Limited liability contributes to a second advantage of the corporation. Corporation can raise large sums of financial capital by selling corporate bonds, by issuing stock, and by borrowing from public financial institutions.

3. Separate legal status:

The third advantage of the corporation follows from its status as a legal individual distinct from the officers of the corporation. A change in the board of directors, the death or resignation of the current president, or a transfer ownership could destroy a partnership or sole proprietorship, but these events do not alter the legal status of the corporation.

The continuity of the corporation is a distinct advantage. Many major US corporations are more than a century old. Few corporations have the same owners and officers that they had when the corporations started their operations.

New shareholders can also be brought into the operation because they know that the existence of the corporation is not dependent upon the individuals that currently run the corporation. Continuity also makes it easier for the firm to hire a carrier-minded and talented labour force.

4. Separation of ownership from management:

The fourth advantage of the corporation follows from the separation of ownership and management.

Because, the two functions are separated, professional managers who specialise in running different parts of the corporation’s operations can be hired. Experience shows that the owners of businesses (those individuals with money to invest) do not always make the best managers. In the modern corporation, talented officers can be brought into the business who own little (or no) capital to invest.

Disadvantages:

1. Double taxation:

The major disadvantage of the corporation is the double taxation of corporate income. The profits (earnings) of the corporation can either be distributed to shareholders as dividends or kept as retained earnings to be reinvested (ploughed back) in the corporation. The profits of the corporation are subject to a Central income tax.

If the corporation chooses to plough back all profits into the company, corporate profits will be taxed only once, but if it distributes some of its profits to shareholders in the form of dividends, shareholders must pay personal income tax on these dividends. Corporate profits can, therefore, be taxed twice, first by the corporate income tax and second by the personal income tax on dividends.

The double taxation of corporate earnings is indeed a disadvantage, but the prevalence of the corporate form of business enterprise suggests that the advantages of corporations (more specifically limited liability) can compensate for double taxation.

2. Complexity:

A second disadvantage of the corporation is its complexity. A modern corporation can have thousands or even millions of different owners (shareholders). Often ownership is so dispersed that it is difficult to get the owners to agree (or even assemble), even when important issues are at stake. Power struggles among shareholding groups can break out and paralyse decision-making.

It is difficult to mobilise widely dispersed stockholders to get rid of incompetent management. The costs of gathering information about the complex dealings of the corporation are high to individual shareholders, who are often poorly informed about the corporation.

3. Conflicting objectives:

A third disadvantages of the corporation is the possibility of conflicting objectives between the principals (the shareholders) and the agents (the corporation’s professional management team). Share-holders are interested in maximising the long-run profits of the corporation (thereby getting the best return from their shares of stock.) The professional management team may be more interested in preserving their jobs or in maximising their personal income or perquisites than in profit maximisation.