In this essay we will discuss about World Bank Group. After reading this essay you will learn about: 1. Meaning of World Bank 2. The International Bank for Reconstruction and Development 3. International Development Association 4. International Finance Corporation 5.The Multilateral Investment Guarantee Agency 6. The International Centre for Settlement of Investment Disputes.

Contents:

- Essay on the Meaning of World Bank

- Essay on The International Bank for Reconstruction and Development

- Essay on the International Development Association

- Essay on the International Finance Corporation

- Essay on the The Multilateral Investment Guarantee Agency

- Essay on the The International Centre for Settlement of Investment Disputes

Essay # 1. Meaning of World Bank:

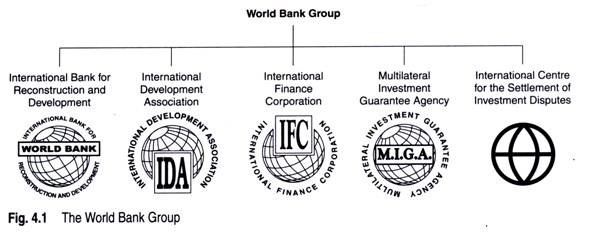

The World Bank Group consists of five closely associated institutions (Fig. 4.1), all owned by member countries that carry the ultimate decision-making power. Each institution plays a distinct role in the mission to fight poverty and improve living standards for people in the developing world.

The term ‘World Bank Group’ encompasses all the five institutions, while the term ‘World Bank’ refers specifically to IBRD and IDA out of the five.

The World Bank is a vital source of financial and technical assistance to developing countries around the world. It is made up of two unique development institutions-the IBRD and the IDA, owned by 185 member countries. Each institution plays a different but supportive role in its mission of reducing global poverty and improving living standards.

The IBRD focuses on middle-income and creditworthy poor countries, while IDA focuses on the poorest countries in the world. Together these institutions provide low-interest loans, interest-free credit, and grants to developing countries for education, health, infrastructure, communication, and many other purposes.

The World Bank is run like a co-operative, with member countries as its shareholders. The number of shares a country has is based roughly on the size of its economy. The US is the single largest shareholder with 16.41 per cent of votes, followed by Japan (7.87%), Germany (4.49o/o), the UK (4.31%), and France (4.31%). The rest of the share is divided among its other member countries.

The IBRD and IDA are run on the same lines. They share the same staff and headquarters, report to the same president, and evaluate projects with the same rigorous standards. But the IBRD and IDA draw on different resources for their lending. A country must be a member of the IBRD before it can join the IDA.

Essay # 2. The International Bank for Reconstruction and Development:

The International Bank for Reconstruction and Development (IBRD) is the oldest of the World Bank Group institutions established in 1944 to help Europe recover from the devastation of World War II. Subsequently, it shifted its attention to developing countries.

ADVERTISEMENTS:

It aims to reduce poverty in middle-income and creditworthy poor countries by promoting sustainable development through loans, guarantees, risk management products, and (non-lending) analytic and advisory services.

The income that IBRD has generated over the years has allowed it to fund developmental activities and ensure its financial strength, enabling it to borrow in capital markets at low cost and offer good borrowing terms to clients. IBRD’s 24-member board is made up of five appointed and 19 elected executive directors who represent the institution’s 185 member countries.

IBRD helps clients gain access to capital and financial risk management tools in larger volumes, on better terms, at longer maturities, and in a more sustainable manner than they could receive from other sources. However, unlike commercial banks, IBRD is driven by development impact rather than profit maximization.

Essay # 3. International Development Association:

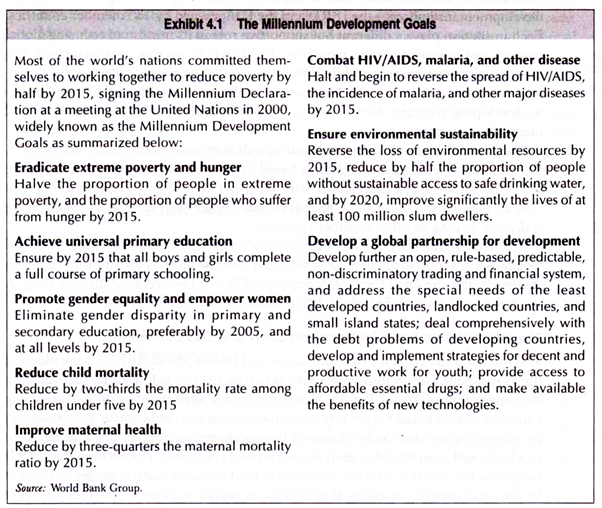

Established in 1960, the International Development Association (IDA) provides interest-free credits and grants to the poorest developing countries in order to boost their economic growth and improve people’s living conditions. IDA funds help these countries deal with due complex challenges they face in striving to meet the Millennium Development Goals (MDGs), as given in Exhibit 4.1.

ADVERTISEMENTS:

It helps to reduce inequalities both across and within countries by allowing more people to participate in the mainstream economy, reducing poverty, and promoting more equal access to the opportunities created by economic growth. IDA complements the World Bank’s other lending arm, the IBRD. Presently it has 167 members.

The IDA depends on contributions from its wealthier member countries for most of its financial resources. The other important source is from repayment of outstanding credits, including by countries that received IDA assistance in the past but have since ‘graduated’ (reached the ‘completion point’) from the IDA. Since its inception, IDA credits and grants have directed the largest share, about 50 per cent to Africa.

At the July 2005 G8 Summit in Gleneagles, Scotland, G8 leaders agreed to write off completely the debt provided by IMF and World Bank to the world’s 18 most indebted countries, 14 of which are located in Africa. Debt cancellation will be provided by IDA, the IMF, and the African Development Fund to countries that have graduated from the Enhanced Heavily Indebted Poor Countries (HIPC) Initiative.

This effort, known as the Multilateral Debt Relief Initiative (MDRI), became effective on 1 July 2006, and is expected to provide about US$37 billion in debt relief over 40 years.

IDA provides highly concessional financing to the world’s 81 poorest countries comprising about 2.5 billion people. IDA’s resources help support country-led poverty reduction strategies in key policy areas, including raising productivity, providing accountable governance, building a healthy investment climate, and improving access to basic services, such as education and health care.

Essay # 4. International Finance Corporation:

The private sector arm of the World Bank Group, the International Finance Corporation (IFC), was founded in 1956. It promotes sustainable private sector investment in developing countries, helping to reduce poverty and improve people’s lives.

Corporate powers are vested in its board of governors, which meets annually and delegates many of its powers to a board of directors. Working at the headquarters, the board of directors reviews all investment projects and major policy decisions.

The IFC coordinates its activities with other institutions of the World Bank Group but is legally and financially independent. Its share-capital is provided by its member countries, who vote in proportion to the number of shares held. The IFC is owned by its 179 member countries with an authorized capital of US$2.45 billion.

ADVERTISEMENTS:

The IFC promotes private businesses in developing countries by providing loans and making equity investments, helping companies mobilize financing in the international financial markets, and providing advice and technical assistance to businesses and governments. It charges market rates for its products and does not accept government guarantees.

Financial products and services to client companies include:

i. Long-term loans in major currencies, at fixed or variable rates

ii. Equity investments

ADVERTISEMENTS:

iii. Quasi-equity instruments (subordinated loans, preferred stock, income notes)

iv. Guarantees and standby financing

v. Risk management tools

vi. Structured finance products

ADVERTISEMENTS:

The IFC seeks to reach businesses in regions and countries that have limited access to capital. It also provides financing in markets deemed too risky by commercial investors in the absence of IFC participation and adds value to projects.

It finances through its corporate governance and environmental and social expertise. To be eligible for IFC financing, projects must be profitable for investors, benefit the economy of the host country, and comply with stringent social and environmental guidelines.

IFC emphasizes five strategic priorities for maximizing its sustainable development impact:

i. Strengthening its focus on frontier markets, particularly the SME sector

ii. Building long-term partnerships with emerging global players in developing countries

iii. Differentiating IFC from its competitors through sustainability

ADVERTISEMENTS:

iv. Addressing constraints to private sector investment in infrastructure, health, and education

v. Developing domestic financial markets through institution-building and the use of innovative financial products

The IFC’s investments are funded out of its net worth, the total of paid-in capital and retained earnings. To ensure participation of investors and lenders from the private sector, IFC limits the finance provided of a project to 25 per cent of total estimated costs; it does not normally hold more than a 35 per cent stake or be the largest shareholder.

For all new investments, the IFC articulates the expected impact on sustainable development, and, as the projects mature, the IFC assesses the quality of the development benefits realized.

Essay # 5. The Multilateral Investment Guarantee Agency:

The Multilateral Investment Guarantee Agency (MIGA) provides non-commercial guarantees (insurance) for foreign direct investment in developing countries (Fig. 4.2). It addresses concerns about investment environments and perceptions of risk, which often inhibit investment, by providing political risk insurance. It was established in 1988 and presently has 172 members.

The MIGA’s guarantees offer investors protection against non-commercial risks, such as expropriation, currency inconvertibility, breach of contract, war, and civil disturbance.

ADVERTISEMENTS:

MIGA also provides advisory services to help countries attract and retain foreign investment, mediates investment disputes to keep current investments intact and to remove possible obstacles to future investment, and disseminates information on investment opportunities to the international business community.

The MIGA provides private investors the confidence and comfort they need to make sustainable investments in developing countries. As part of the World Bank Group, and having shareholders of both host countries and investor countries, the MIGA brings security and credibility to an investment that is unmatched.

The MIGA’s presence in a potential investment can literally transform a ‘no-go’ into a ‘go’. The MIGA acts as a potent deterrent against government actions that may adversely affect investments. And even if disputes do arise, leverage with host governments frequently enables resolving differences to the mutual satisfaction of all parties.

The MIGA’s operational strategy, which plays to its foremost strength in the marketplace, attracting investors and private insurers into difficult operating environments, is as follows:

i. Infrastructure development is an important priority to deal with rapidly growing urban centres and underserved rural populations in developing countries.

ADVERTISEMENTS:

ii. Frontier markets—high-risk and low-income countries and markets—represent both a challenge and an opportunity. These markets typically have the most need and stand to benefit the most from foreign investment, but are not well served by the private market.

iii. Investment into conflict-affected countries is one of the operational priorities of MIGA. While these countries tend to attract considerable donor goodwill, once the conflict ends, aid flows eventually start to decline, making private investment critical for reconstruction and growth. With many investors wary of potential risks, political risk insurance becomes essential to additional investments.

iv. South-south investments (investment between developing countries) are contributing a greater proportion of FDI flows. But the private insurance market in these countries is not always sufficiently developed and national export credit agencies often lack the ability and capacity to offer political risk insurance.

The MIGA offers comparative advantages in areas ranging from unique packaging of products and ability to restore the business community’s confidence to on-going collaboration with the public and private insurance market to increase the amount of insurance available to investors.

The MIGA’s guarantee programme complements national and private investment insurance schemes through co-insurance and reinsurance arrangements to provide investors more comprehensive investment insurance coverage worldwide.

Essay # 6. The International Centre for Settlement of Investment Disputes:

Founded in 1966, the International Centre for Settlement of Investment Disputes (ICSID) was designed to facilitate the settlement of investment disputes between foreign investors and host states. It is headquartered at Washington DC and its administrative council is chaired by the World Bank’s president.

ADVERTISEMENTS:

It encourages foreign investment by providing neutral international facilities for conciliation and arbitration of investment disputes, thereby helping foster an atmosphere of mutual confidence between states and foreign investors.

Many international agreements concerning investment refer to the ICSID’s arbitration facilities. The ICSID also conducts research and carries on publishing activities in the areas of arbitration law and foreign investment law.

Recourse to ICSID conciliation and arbitration is entirely voluntary. However, once the parties have consented to arbitration under the ICSID convention, neither can unilaterally withdraw its consent. Moreover, all ICSID contracting states, whether or not parties to the dispute, are required by the convention to recognize and enforce ICSID arbitral awards.

Since 1978, for providing conciliation and arbitration, the centre has a set of additional facility rules authorizing the ICSID secretariat to administer certain types of proceedings between states and foreign nationals which fall outside the scope of convention. These include conciliation and arbitration proceedings where either the state party or the home state of the foreign national is not a member of the ICSID.

Arbitration under the auspices of the ICSID is one of the main mechanisms for the settlement of investment disputes under four recent multilateral trade and investment treaties, such as the North American Free Trade Agreement, the Energy Charter Treaty, the Cartagena Free Trade Agreement, and the Colonia Investment Protocol of Mercosur.

During recent years, the caseload of the ICSID has increased considerably, mainly due to the proliferation of international investment treaties.