In our daily lives, almost everything, such as the petrol we use for transportation, food we eat, clothes we wear, and movie we watch has a price.

Every organization whether it aims to gain profit or not has to fix price for its products. An organization follows various pricing strategies to attract the customers.

A pricing strategy can be defined as an action, task, or approach to achieve the pricing objectives of the organization.

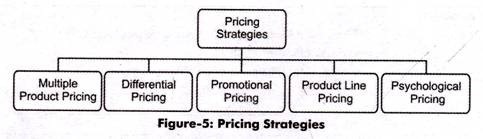

Figure-5 shows various pricing strategies adopted by organizations:

These pricing strategies (as shown in Figure-5) are discussed in detail below:

Multiple Product Pricing:

Generally, organizations produce more than one product in their line of production. Even a single product of an organization can differ in styles and sizes. For example, a refrigerator manufacturing organization produces refrigerators in different colors, sizes, and features. Similarly, an automobile organization manufactures vehicles in different colors, sizes, and mileage. The pricing in case of multiple products is called multiple product pricing.

The demand curve for multiple products would be different. However, the MC curve of these products is same as these are produced under interchangeable production facilities. Therefore, AR and MR curves are different for each product. On the other hand, AC and MC are inseparable. Therefore, the condition of MR=MC cannot be applied directly to fix the prices of each product.

ADVERTISEMENTS:

The solution of this problem was provided by E.W. Clemens who stated how the multi-product organizations fix prices of their products. Suppose there are four differentiated products. A, B, C, and D produced by an organization.

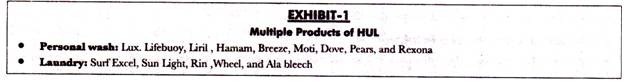

Figure-6 shows multiple product pricing:

As shown in Figure-6, the AR (price) and MR curves for four products are shown as four different curves and MC curve is shown as the total of MC of all the products. Suppose the aggregate MR curve, which is the total of all individual MR curves, passes through point E on the MC curve.

ADVERTISEMENTS:

From point E, a parallel line, equal marginal revenue (EMR) is drawn towards Y- axis (parallel to X-axis). This parallel line passes through the M Rs of A, B, C, and D. The output and prices of these four products are determined at the points where their respective MC and MR curves intersect each other.

As shown in Figure-6, OQa, QaQb, QbQc, QcQd are the output levels of products A, B, C, and D and PaQa, PbQb, PcQc, PdQd are the prices of the products respectively. These are the maximum price and output levels of an organization.

Differential Pricing:

Differential pricing implies charging different prices from different customers for same products. This type of pricing strategy is used in the market where the multiple customer segments exist to avoid confusion regarding the different prices of products. In these types of markets, customers purchasing the product at the lower prices cannot resell the product at higher price in another market. An example of differentiated pricing can be selling Coca-Cola at Rs. 10 in supermarkets, Rs. 15 in theatres, and Rs .20 in restaurants.

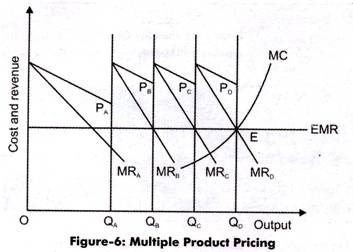

Figure-7 shows the four types of differential pricing:

The discussion of the types of differential pricing (as shown in Figure-7) is as follows:

i. Negotiated Pricing:

Implies pricing strategy in which a price is decided through bargaining between the customer and seller.

ii. Secondary Market Pricing:

ADVERTISEMENTS:

Implies setting different prices for different markets. The price for a primary market is different from the price in the secondary market. The primary market is the target market where the product is introduced for the first time; whereas, the secondary market is the target market where the product is introduced after it has gained success in the primary market.

The price in the primary market is generally higher than the secondary market. However, if the cost of serving the secondary market is higher as compared to the cost of primary market then the price charged in the secondary market is higher. The example of secondary market can be an isolated area in the domestic and foreign country markets.

A secondary market also involves a segment that buys the product during off-peak rimes. For instance, the restaurants give several discount options to early customers of the day during the off-peak season. The customers are offered early bird menus that offer food items at lower prices.

iii. Periodic Discounting:

ADVERTISEMENTS:

Refers to the type of pricing strategy that involves a temporary reduction in the prices of products. This reduction is done on a systematic basis. For instance, many clothing outlets offer discounts in festive seasons or on a seasonal basis. The main problem with periodic discounting is that the customers easily predict the reduction in the prices; therefore, they delay their purchases. For example, Big Bazaar has introduced a famous Wednesday bazaar concept, in which it provides discount on almost all of its products on every Wednesday. It has declared Wednesday as Hafte Ka Sabse Sasta Din.

iv. Random Discounting:

Implies giving discounts on an unsystematic basis so that customers cannot predict the discount easily. When the prices are reduced randomly, then the customers cannot predict the reduction in prices. The random discounting is mainly used to attract new customers.

Promotional Pricing:

ADVERTISEMENTS:

Promotional pricing refers to a pricing strategy that helps in promoting the product. It is defined as a policy of reducing the prices to attract customers towards a product.

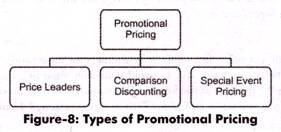

Figure-8 shows the types of promotional pricing:

Now, let us discuss the types of promotional pricing (as shown in Figure-8) in brief:

i. Price Leaders:

Refer to a policy that involves setting the prices of a product less or equal to its cost. This type of pricing is generally used in supermarkets. The marketers believe that this strategy helps in increasing sales. However, this type of pricing is also called loss leader pricing as sometimes the product is sold at loss.

ADVERTISEMENTS:

ii. Special Event Pricing:

Involves reduction in the prices of a product according to special events, such as festivals or seasons. The organizations follow this strategy to gain revenue. The sales gap in organizations is filled by this type of pricing.

iii. Comparison Discounting:

Involves setting the price of a product at a specific level and simultaneously comparing it with the higher price. The higher price can be the product’s last price, price of competitor’s brand, or price of the same brand at the other retail outlet. For example, marketer while demonstrating his/her product to the customer tells the competitor’s high price of the same product to induce sale of his/her product. Comparison discounting is a kind of informative pricing method as it helps customers to make purchase decisions.

Product Line Pricing:

Product line pricing can be defined as the setting of prices of all the high priced and low priced products in a way that maximizes the profit on whole product line. It is a pricing method that studies price determination of those products that are identical to each other or used for the same purpose. For instance, Hindustan Unilever Limited offers a wide price range for its hair care product line that include oil, shampoo, and conditioner to optimize the profit on its hair care product line.

Setting prices in product fine pricing requires a relationship between the products in the product line. For instance, computer hardware and software are complementary products. The increase in demand for one leads to the increase in the demand for the other. If both the products are in the same product line then the high price of software will lead to low demand for software as well as hardware. Thus, a marketer should carefully set the prices in the product fine.

ADVERTISEMENTS:

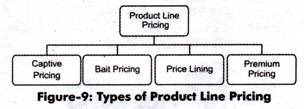

Figure-9 shows the different types of product line pricing:

The types of product line pricing (as shown in Figure-9) are discussed as follows:

i. Captive Pricing:

Refers to a pricing where the price of the basic product is kept at a lower level; whereas, the price of the items that are required with the basic product is high. For instance, a marketer may set the low price of a video camera; whereas, the price of film used to operate camera is high.

ii. Premium Pricing:

ADVERTISEMENTS:

Implies pricing for the different versions of same products. The product with enhanced feature is priced high than the product with basic features. For instance, a simple vanilla ice-cream costs less than the ice-cream enriched with dry fruits. Similarly, in the hospitality industry, the rooms with luxurious facilities are priced high than ordinary’ rooms with basic facilities.

iii. Bait Pricing:

Refers to a tactic that involves luring customers by setting low prices of some of the items in the product line with the intention of selling high priced products. This type of pricing strategy is adopted when there is high competition in the market. Thus, organizations advertise low-price products to attract the customers. Sometimes, advertisements show the low prices of products with attached terms and conditions, which force customers to visit the shop.

iv. Price Lining:

Implies setting a single price for all the products in the store. For example, a store can set Rs. 100 for all the items. This type of pricing was started in North America’s Five & Dime General stores where everything costs 5 or 10 cents. Price lining helps customers in making the easy selection of products as prices of all the products are same.

Psychological Pricing:

Psychological pricing tries to influence the perception of customers about the price of a product. It is used when a marketer wants customers to respond emotionally rather than rationally. Psychological pricing is based on the fact that some prices have psychological impact on customers. Some customers believe that high price is an indicator of the good quality of a product. For example, products, such as high quality perfumes are more costly than normal perfumes. The price becomes a good factor to judge the quality of a product if no other information is available regarding a product.

ADVERTISEMENTS:

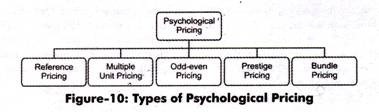

There are five types of psychological pricing, which are shown in Figure-10:

The discussion of the types of psychological pricing (as shown in Figure-10) is as follows:

i. Reference Pricing:

Refers to a pricing in which the marketer sells the product at the price lower than the price of competitor’s product. The competitor’s product seems less attractive to the customers. The price of the competitor s product is called reference price. While buying a product, the customers compare the price of a product with the reference price.

ii.Bundle Pricing:

Refers to packaging two or more complementary products together and selling them at a single price. The bundle pricing is seen as a profitable option by the customers as the price of the bundled products is less than the total price of the products taken individually. This type of pricing helps in saving the packaging cost of the organization.

iii. Multiple Unit Pricing:

Implies packaging two or more products together at a single price. It involves lower price per unit, thus, customers benefit from this pricing as it leads to cost saving. Selling a pack of two potato chips and six soft drinks are the examples of multiple unit pricing. This type of pricing is used to attract new customers and increase the consumption of the product. It allows customers to buy in large quantity that in turn increases the sales volume of the organization.

iv. Odd-even Pricing:

Implies a type of psychological pricing, which assumes that customers are sensitive to the prices. The prices ending in 1,3,5,7 and 9 are odd prices; whereas, the prices ending in 0, 2,4,6,8 are even prices. According to a research, setting odd prices imply low prices. For instance, a customer has to select between two brands of the same product where one product costs Rs. 30 and the other costs Rs. 29.93. The customer will prefer the product for Rs. 29.93 as it is considered to be less expensive though there is only a difference of 7 paisa. Setting even prices generally indicate the high quality of products. For example, a pen-maker sets the price of its pen to Rs. 40 instead of Rs. 38.95 to lay emphasis on the good quality of the product.

v. Prestige Pricing:

Implies a pricing strategy where the prices of products are kept at higher level to express the quality of the product. This is used for customers who think that high prices denote high quality. The products whose prices are set as per the prestige pricing are perfumes, jewellery, cars, and liquor.