Divergences between private and social costs and returns (benefits) are known as externalities, external effects or external economies and diseconomies. Another term is spill-overs or “neighbourhood effects”. “An external effect is assumed to exist whenever the production by a firm or the utility of an individual depends on some activity of another firm or individual through a means which is not bought and sold: such a means is not marketable, at least at present”.

In other words, externalities may run from production to production and from production to consumption. They may also run from consumption to consumption and from consumption to production. There are positive and negative externalities. The beneficial externalities are called positive externalities. The costly externalities are called negative externalities.

In other words, if social benefits exceed private benefits, it is a positive externality or external economy. If social costs exceed private costs, it is a negative externality or external diseconomy. Externalities are, in fact, market imperfections where the market offers no price for service or disservice.

These externalities lead to misallocation of resources and cause production or consumption to fall short of an optimum level. Thus they do not lead to maximum social welfare. Pigou’s major contribution lies in studying the main causes leading to divergences between private and social costs and returns and in suggesting measures for removing these divergences.

Causes of Divergences between Private and Social Costs and Returns:

According to Pigou, it is self-interest that leads to the equality between private and social costs and returns. But certain business practices tend to foster rigidities and create divergences between private and social costs and returns which can be widened by variations in demand, tastes, cyclical fluctuations, war and the rise of new industries.

ADVERTISEMENTS:

The private product diverges from the social product due to the existence of external economies or diseconomies thereby leading to divergences between private and social costs and benefits. We analyse these external economies and diseconomies.

(1) External Economies of Production:

When some firm renders a benefit or cost of a service to other firms without appropriating to itself all the benefit or cost of the service, it is an external economy of production. External economies of production accrue to one or more firms in the form of reduced average costs as a result of the activities of another firm.

External economies of production may arise when the expansion of a firm makes it possible for other firms in the industry to obtain their inputs like rained labour force, raw materials, etc. at low rates. In all such cases, social marginal benefits exceed the private marginal benefits, and the private costs exceed the social costs. For the expanding firm does not receive any remuneration, for the costs incurred by it and the benefits which it has conferred on others.

(2) External Diseconomies of Production:

ADVERTISEMENTS:

External diseconomies of production also lead to divergences between private and social costs and returns when the production of a commodity or service by a firm affects adversely other firms in the industry. Professor Pigou’s example of air pollution explains these divergences. Suppose a factory is situated in a residential or populated area and it emits smoke.

The smoke from the factory soils clothes, household articles, and buildings, and damages the health of the inhabitants of the area. As a result, the maintenance costs of the inhabitants increase in the form of increased expense on washing clothes, cleaning of household articles and rooms, and cleaning and painting of buildings, and enhanced medical expenses.

These are social costs for which the factory does not compensate the inhabitants of the area and in a sense benefits itself. The private costs are thus less than the social costs, and the private benefits to the factory are higher than the social benefits because the factory-owner escapes costs incurred by the inhabitants of the area and thereby gets private benefits.

(3) External Economies of Consumption:

External economies of consumption arise from non-market interdependencies of the satisfactions enjoyed by different consumers. An increase in the consumption of a good or service which affects favorably the consumption patterns and desires of other consumers is an external economy of consumption.

ADVERTISEMENTS:

When an individual installs a TV set, the satisfaction of his neighbours increases when they and their children view the various programmes. This is a case of external economy in consumption in which social benefit is larger and social cost is lower than private benefit and cost, because the TV-owner does not receive any money in return as the neighbours are not asked to pay anything for seeing TV programmes.

(4) External Diseconomies of Consumption:

When the consumption of a good or service by one consumer confers a disadvantage or affects adversely the consumption patterns and desires of other consumers, it is an external diseconomy of consumption. Diseconomies of consumption especially arise in the case of dress fashions and articles of conspicuous consumption. When a rich lady in a particular locality adopts a new style of dress, it leads to the discarding of clothes already in use not only by her but by other women who emulate her.

This results in higher social costs and lower social benefits than private costs and benefits. Individuals who are not in a position to emulate the consumption patterns of their rich neighbours feel dissatisfied and jealous.

As a result, their productive efficiency falls and serious divergences emerge between social and private costs and benefits. Other instances are of noise nuisance from loudspeakers to neighbours for which the individuals using the loudspeaker does not pay anything to neighbours.

(5) The Case of Public Goods:

Another cause of divergence between private and social benefits is the case of public goods which Pigou completely ignored. Prof. Baumol defines a public good as “one whose consumption by one individual does not reduce its utility to any other individual.”

The consumption of public goods is joint and equal. Certain services provided by the government are public goods such, as national defence, public safety, courts for the administration of justice, disease control etc. The benefits of public goods are indivisible.

They are available to everybody whether a person pays for them or not. Thus they are not subject to the exclusion principle. Another characteristic of public goods is that their benefits are provided at zero marginal cost. In other words, their benefits can be provided to an additional user without any additional cost. For example, the cost of providing justice does not increase when one additional person seeks justice from the court.

A third characteristic of public goods is that they create externalities or divergences between social and private benefits. Externalities arise when one individual arranges for a public good; he confers a benefit on some individuals and thereby creates a social benefit that is higher than his own private benefit. When a person manages a municipal street light in front of his house, all the residents of the street benefit from it. The social benefit far exceeds his own private benefit.

Remedial Measures:

To bring about the equality of private and social costs and benefits, Pigou favours state interference rather than self-interest. He, therefore, suggests the use of taxes, subsidies and other social control measures to close the gap between private and social costs and benefits arising from externalities in production and consumption. However, a number of other measures have also been suggested. We discuss the various remedial measures below.

1. Social Control Measures:

ADVERTISEMENTS:

First, Pigou suggest social control measures to attain the “ideal output” or optimum welfare. National dividend would be the maximum, according to Pigou, when the values of the social net product are equal in all possible uses. If the value of the social net product or resources is less in any one use than in any other, the national dividend can be increased by transferring resources to more fruitful modes of production. This can be achieved by social control.

The state can ask the factory-owner to move out of the residential area by providing appropriate facilities to the smoke emitting factory. It can interfere in all cases of external diseconomies of production to remove the divergences between private and social costs and benefits.

In the case of external diseconomies of consumption, the state can put an end to noise-nuisance by banning the use of loud speakers except for special occasions with prior permission. In situations of oligopoly or imperfect competition, Pigou favours state regulation of some type or even nationalisation.

2. Taxes and Subsidies:

Pigou further suggest the use of taxes or subsidies to bridge the gap between private and social costs and benefits. The state can impose taxes in all cases of external diseconomies in production and consumption. For instance, the state can levy a tax on every family and pay the sum so collected to the smoke factory to move away. In the case of external economies of production, the state can give subsidies to producers so that national dividend increases and the ideal output is attained.

ADVERTISEMENTS:

While tax concessions to consumers can help them in maximising their satisfactions by consuming more commodities. Such cases are explained with the help of demand and supply curves. The demand and supply curves of a free competitive market reflect only direct private benefits and costs and not externalities.

If externalities exist, the free competitive market will not provide a socially optimum level. The government can “internalise” externalities by levying taxes and granting subsidies. Suppose social costs exceed private costs which mean that there are negative externalities.

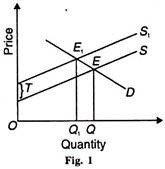

In this case, there is overproduction of the commodity by the industry than is needed by the society. To reduce overproduction, Pigou suggested a Tax on such a commodity. This is illustrated in Figure 1 where D and S curves are the market demand and supply curves respectively. They intersect at point E and OQ output results. The curve S includes only direct °- costs incurred by producers of the commodity.

ADVERTISEMENTS:

It does not include negative externalities. When they are added or internalised in the market supply curve S, the supply curve S1 results. Now the S curve intersects the D curve at point E1, and a smaller output OQ1 is obtained. This is the socially optimum level of output. A tax on the producers equal to T per unit of output will reduce the quantity of commodity produced from OQ to OQ1 which will also reduce the negative externality associated with OQ output.

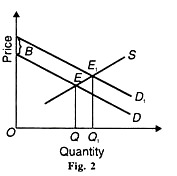

When social benefits exceed private benefits, there are positive externalities. In this case, there is underproduction of the commodity than is needed by the society. To correct this, Pigou suggested the grant of subsidy on per unit of commodity to the producer. This is illustrated in Figure 2 where D and S are the market demand and supply curves respectively.

They intersect at point E and OQ output results. But this is not a social optimum level of output. To encourage the production of the commodity which yields positive externalities, the government gives subsidy to the producer equivalent to В which causes the demand curve to shift upwards from D to D1. This increases the quantity of the g commodity produced from OO to OQ1 which is the socially optimum level. Thus taxes and subsidies are the most effective ways to coincide private costs and benefits with social costs and benefits.

3. Public Goods:

If the number of potential consumers of a public good is very large, it can only be supplied with the help of some public authority. However the benefits of public gods are indivisible. Therefore, the state should make people share the costs of public goods so that everyone is made better-off.