The doctrine of comparative advantage originated as an improvement and development of the 18th century criticism of mercantilist policy. It has continued to command attention mainly because of its use as the basic “scientific” argument of free trade economists in their attack on protective tariffs.

Rejecting Smith’s principle of absolute advantage, Ricardo asserted that international trade depends en a difference in the comparative, not in the absolute cost of producing goods.

The doctrine of comparative costs maintains that if trade is lot free, each country in the long-run tends to specialize in the product in of and to export those commodities in whose production it enjoys a comparative advantage in terms of real costs, and to obtain by importation those commodities which could be produced at home only at a comparative disadvantage in terms of real costs.

Such specialization will be to the mutual advantage of the countries participating in the foreign trade. In the explanation of the doctrine the “real “costs are expressed as a rule in terms of quantities of labour-time.

ADVERTISEMENTS:

In the beginning, of the free trade doctrine in the 18th century the usual economic arguments for free trade were based on the advantage to the country in exchange for native products, those commodities which either could not be produced at home at all or could be produced at home only at costs absolutely greater than those at which they could be produced abroad. Thus under free trade, all products would be produced in those countries where their real costs were lowest. The case for free trade as presented by Adam Smith did not advance beyond this point.

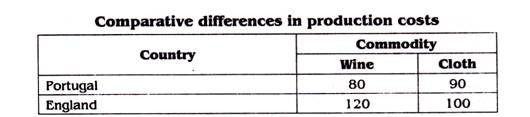

Ricardo in his Principles first published in 1817, presented the doctrine of comparative costs by means of what was to become a famous illustration. Suppose there are two countries Portugal and England and they are producing two commodities wine and cloth. In Portugal a unit of wine costs 80 and a unit of cloth 90 hours of labour; in England a unit of wine costs 120 hours and a unit of cloth 100 hours of labour. In the above example, Portugal has an absolute superiority in both branches of production.

This superiority, however, is greater in wine than in cloth. She has a comparative advantage in the production of wine, since here her cost-difference is relatively greater than in the case of cloth. For 80/120 is less than 90/100. We have to compare the ratios of the costs of production of one good in both countries, 80/120 with the ratios of the costs of production of the other good in both countries 90/100.

ADVERTISEMENTS:

Expressed in words:

Portugal has a comparative advantage over England in wine relatively to cloth. Conversely, the disadvantage of England is greater in wine than in cloth. Stated in another way, England has an absolute disadvantage in cloth but at the same time she has a comparative advantage in cloth.

In the absence of trade, the domestic ratio of exchange in England will be; 1 unit of wine exchanged against 1.2 units of cloth and in Portugal, 1 unit of wine exchanged against 0.88 units of cloth. The main task of the labour-cost hypothesis was to determine these exchange-ratios or relative prices.

Let us now assume that trade takes place between the two countries. It is clearly advantageous for Portugal to send wine to England where a unit of it command 1.2 units of cloth. Now Portugal will take to producing wine instead of cloth. England, on the other hand can obtain wine at much less expense by specializing upon the manufacture of cloth and exchanging the cloth with Portugal against wine. For Portugal, there is sufficient inducement to participate in International trade if 1 unit of wine commands a little more than 0.88 units of cloth; for England, if a little less than 1.2 units of cloth must be given for 1 unit of wine.

ADVERTISEMENTS:

Hence any exchange ratio between 0.88 and 1.2 units of cloth against 1 unit of wine represents a gain to both countries. Let us assume that the exchange ratio is established at 1 unit of wine exchanged for 1 unit of cloth. Then for every 100 labour-units which England sends to Portugal embodied in the form of cloth, she receives 1 unit of wine which in the absence of international division of labour, would have cost her 120 labour-units to produce for herself and Portugal obtains cloth at a cost of 80 per unit; whereas to produce in for herself would cost 90. Thus, each country specializes upon that branch of production in which it enjoys a comparative advantage, thereby obtaining a greater total product from its given factors of production.

Generally, the credit for the first publication of the principle of comparative costs is given to David Ricardo. Leser, however, in 1881 assigned to Torrens the credit of discovery of the doctrine. In 1815, Torrens published his “An Essay on the External Corn Trade” giving a satisfactory formulation of the doctrine and first using the term “comparative cost”. Leser’s comment attracted no notice, but some year later credit for priority in formulating the doctrine of comparative cost was again claimed for Torrens by Professor Seligman. Professor Hollander has replied in defense of Ricardo’s claims that much of the evidence in support of Torrens presented by Seligman was of questionable weight. Even after the appearance of Ricardo’s Principles, Torrens never realized the full significance of the comparative cost doctrine and never made explicit use to it.

That Ricardo’s claim to priority could never be overcome merely by the fact that Torrens in a single paragraph had correctly stated the doctrine “in outline” before Ricardo had published his Principles. It is unquestionable, however, that Ricardo is entitled to the credit for the first giving due emphasis to the doctrine, for first placing it in an appropriate setting and for obtaining general acceptance of it by economists.

Ricardo based his analysis on the following assumptions:

(i) Ample time for long-run adjustments;

(ii) Free competition;

(iii) Only two countries and only two commodities;

(iv) Constant labour costs as output is varied; and

(v) Proportionality of both aggregate real costs and supply prices within each country to labour time costs within that country.

ADVERTISEMENTS:

Ricardo’s emphasis on comparative advantage as opposed to absolute advantage marks his great advance over Adam Smith. Ricardo was the true author of comparative advantage doctrine. As Alfred Marshall wrote: “Professor Hollander has shown that nearly every part of Ricardo’s doctrine was anticipated by some of his predecessors; but his masterly genius, like that of Adam Smith, was largely occupied with the supreme task of building up a number of fragmentary truths into coherent doctrine such a doctrine; has constructive force because it is an organic whole.”

The doctrine of comparative advantage is no doubt a brilliant and Intellectual discovery in the realm of international trade and an explanation for international specialization. The doctrine remained supreme in the realm of international trade for more than a century (1817-1933). It served as a tool of analysis of international specialization. But later on it was vehemently criticized.

Critics of the doctrine of comparative advantage point out that it is valid only under the simple assumptions upon which it was originally formulated. But Haberler and Viner have asserted that this is not so and that the simplifications merely help the exposition without affecting the essentials of the matter. Both the economists have demonstrated that even if we give up some of these assumptions still the doctrine holds true but the scope of the trade may be narrowed down.

Another criticism leveled against the theory is that it failed to explain the basis of international specialization. Bertil Ohlin, the most outstanding and vigorous of the critics of the doctrine of comparative costs, bases his criticism on the interpretation of the doctrine as representing the attempt of the classical school to explain the forces which determine the specific nature of the course of trade and of international specialization.

ADVERTISEMENTS:

Ricardo assumed the differences in the comparative costs and then went on analyzing how trade would be mutually advantageous to participating countries. He did not explain as to why Portugal has comparative advantage in the production of wine and England in cloth. Ricardo started from the hypothesis that nations differ in their productive performance and has expressed rather than explained the differing labour time used in the production of different commodities.

The doctrine is primarily concerned with the gains from trade and the critics hold that the theory is simply a demonstration of gains from trade. G.H. Williams had vehemently criticized the doctrine. His criticism is based on an article. “The Theory of International Trade Reconsidered.” His Criticism is directed against the assumptions which are claimed to be highly unrealistic, lay also points out the illogicality of the doctrine as the conclusion of the theory does not follow from its premises.

To quote Williams, “Logically followed though the classical doctrine contradicts itself its conclusions contradict its premises. It is a theory of benefit from the territorial division of labour. If before trade England and Portugal produced both cloth and wine, after trade is opened England will produce cloth for both and Portugal wine. This means national specialization for world market. But such specialization is antithesis of mobility, in this case of domestic movement of productive factors.”

Again, the doctrine was built up in a static analytical framework. The theory was based on an outdated and antiquated labour cost theory of value. “Despite all these difficulties, the supporters of real-cost doctrine have often argued that the deficiency of the theory of value employed in stating the comparative positions of various countries does not detract from its importance and usefulness as an instrument of welfare analysis which is what the theory intended to be. But if the analytic value of the theory is limited in the sense that it holds goods only under very heroic assumptions, then the same limitation applies to the welfare conclusions derived from the heroics.”