In this article we will discuss about:- 1. Introduction to Cobweb Theory 2. Assumptions of Cobweb Theory 3. Criticism 4. Conclusion.

Introduction to Cobweb Theory:

The Cobweb Theorem attempts to explain the regularly recurring cycles in the output and prices of farm products. Frankly speaking, it is not a business cycle theory for it relates only to the farming sector of the economy. In 1930 Cobweb Theory was advanced by the three economists in Italy.

Netherlands and the United States, apparently independently of each other almost at the same time. The names of Henery Schultz. (U.S.A.), Jam Tinbergen (Netherland) and Althus Hanau (Italy) are associated with’ the theory, although the term Cobweb Theory was first suggested by Professor Nicholas Kaldor in 1934. It was so named because the pattern traced by the prices and output movements resembled a cobweb. The Cobweb Theory of trade cycle is based upon the foundation of ‘lag’ concept.

It asserts that supply adjusts itself to changing conditions of demand which arc manifested through price changes not instantaneously but after certain period. This time, taken by the supply to adjust itself to changes in demand is known as lag.

ADVERTISEMENTS:

Thus the quantity supplied during any given time period is the function of the price prevailed in earlier time period to while the demand depends upon the price that prevails in period t itself. The core of this theory is that the response of supply to price ranges is not instantaneous.

The Cobweb Theory of trade cycle has its chief application in the case of agricultural products the supply of which can be increased or decreased with certain time-lag. Most crops can be sown and reaped only once a year. For instance, if the price of wheat increases say in September 2007 then supply will not increase instantaneously.

The farmer will, of course, devote larger farm acreage to wheat cultivation in the next crop season and so it will take one year before supply increases in response to increase in wheat price. Thus the supply of wheat in 2008 will depend upon the price of wheat that prevailed in 2007 which offered the farmer inducement to devote more land to wheat cultivation.

Assumptions of Cobweb Theory:

This theorem is based on three assumptions:

ADVERTISEMENTS:

(i) Perfect competition in which each producer assumes that present prices will continue and that his own production plans will not affect the market,

(ii) Price is completely a function of the preceding period’s supply

(iii) The commodity concerned is perishable. These assumptions show that the theory is particularly applicable to agricultural products.

Since the supply in farming is slow to adjust itself to changes in demand and, violent fluctuations in prices and outputs are most likely to occur. For instance, an increase in demand will at once result in a spiral rise in price, since in the short period there can be no increase in supply. This high price may make farmers increase their outputs to a greater degree than is justified by the increase in demand.

ADVERTISEMENTS:

Consequently when this increased supply comes to the market, there will be a sharp fall in price which may then result in a reduction in output in the next period to a greater extent again than is justified. The result is that violent changes in output succeed price longer in farm products.

Professor Tinbergen has extended the application of Cobweb’s analysis to durable goods the supply of which responds to demand changes after a significant time-lag because on account of long “gestation period”, there is a considerable lag between the decision to produce and the actual deliveries of the durable goods.

Cobwebs have been divided into:

(1) Continuous Cobwebs,

(2) Divergent Cobwebs, and

(3) Convergent Cobwebs.

In the case of continuous Cobweb the fluctuations in price and output continues repeating about equilibrium at same level. In the case of diverging Cobweb the amplitude of the fluctuation increases with the passage of time. Once disturbed from position of equilibrium the economy moves cumulatively away from it into the doledrums of disequilibrium.

This happens when the slope of the supply curve is less steep than the slops of demand curve. In the case of converging cobweb the economy, if and when disturbed from its equilibrium position, has a tendency to regain it through a series of oscillations. Each fluctuation is more damped than the one preceding it. This narrowing down of the amplitude of the fluctuations occurs when the slope of the supply curve is steeper than the slope of demand curve.

Case (I) Continuous Cobwebs:

ADVERTISEMENTS:

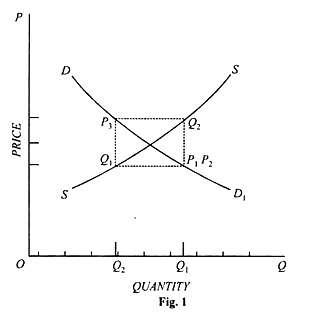

Where the elasticity of supply is equal to the elasticity of demand the series of reactions works out as shown in the Figure 1. The quantity in the initial, period (Q1) is large, producing a relatively low price where it intersects the demand curve at P1 This low price, intersecting the supply curve calls forth in the next period a relatively short supply Q2 .

This short supply gives a high price, P2 where it intersects the supply curve. This high price calls forth a corresponding increased production Q3, in the third, with a corresponding low price, P3. Since this low price in the third period is identical with that in the first, the production and price in the fourth, fifth, and subsequent periods will continue to rotate around the path Q2, P2, Q3, P3 etc.

As long as price is completely determined by the current supply, and supply is completely determined by the preceding price, fluctuation in price and production will continue in this unchanging pattern indefinitely, without an equilibrium being approached or reached. This is true in this particular case because, the demand curve is the exact reverse of the supply curve so that at their overlap each has the same elasticity. This case has been designated the “case of continuous fluctuations.”

ADVERTISEMENTS:

Case (2) Divergent Fluctuation:

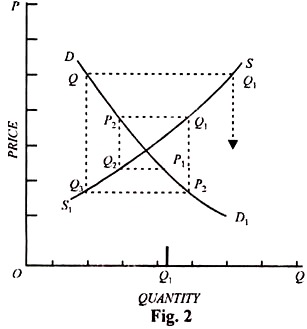

Where the elasticity of supply is greater than the elasticity of demand, the series of reactions works out as shown in Fig. 2. Starting with the moderately large supply, Q1 and the corresponding price P1, the series of reactions is traced by the dotted line.

In the second period, there is a moderately reduced supply, Q2, with the corresponding higher price, P2 . This high price calls forth a considerable increase in supply, Q3 in the third period, with a resulting material reduction in price, to P3.

This is followed by a sharp reduction in quantity produced in the next period to Q4, with a corresponding very high price, P4. This fifth period sees a still greater expansion in supply to Q5 etc. Under these conditions the situation might continue to grow more and more unstable, until price fell to absolute zero, or production was completely abandoned, or a limit was reached to available resources (where the elasticity of supply would change) so that production could no longer expand. The case has been designated the “case of divergent fluctuation.”

ADVERTISEMENTS:

Case (3) Convergent Fluctuation:

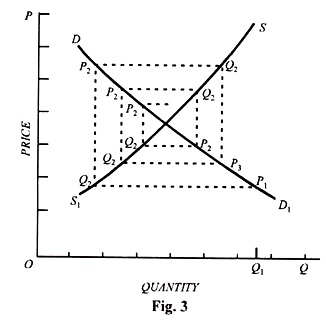

The reverse situation, with supply less elastic than demand, is shown in Fig. 3. Starting with a large supply and low price in the first period, P1 there would be a very short supply and high price, Q2, and P2, in the second period.

Production would expand again in the third period to Q3 but to a smaller production than that in the first period. This would set a moderately low price, P3, in the third period, with a moderate reduction to Q4 in the fourth period; and a moderately high price P4.

Continuing through Q9, P6 and Q6, and P6, production and price approach more and more closely to the equilibrium condition where further changes would occur. Of the three case considered thus so far, only this one behaves in the manner assumed by equilibrium theory ; and even it converges rapidly. If the supply curve is markedly less elastic than the demand curve. The case has been designated “the case of convergent fluctuation.

ADVERTISEMENTS:

The Cobweb theory of trade cycle represents an important forward step in the development of the dynamic explanations of the cyclical fluctuations. The earlier approaches to the study of the cycle problem were static in character. They treated the economy as of a point in time ignoring completely the movements of the economy through time.

To the extent the adjustments between supply and demand were assumed to take place instantaneously and not with a certain degree of time lag, the earlier approaches were static and could not furnish useful tools that could be applied with a fair degree of reliance for solving the problem of economic fluctuations in the dynamic economy where adjustments involved lags. The Cobweb Theorem furnishes us with an illustration of the dynamic process of adjustment movements through time.

Criticism of Cobweb Theory:

Like all other theories of trade cycle, the Cobweb Theory too suffers from some severe limitations:

(1) This is not strictly a trade cycle theorem for it is concerned only with the farming sector. There are a good many others sphere of production where it says nothing.

(2) This theorem assumes that the output is solely governed by price. Thus is unrealistic assumption. The fact is that the output particularly of farm products is determined not only by price, but by several other factors—weather, prices of the factors of production.

(3) It is applicable only where:

ADVERTISEMENTS:

(a) The price is governed by the supply available,

(b) When production is governed only by the considerations of price as wider perfect competition, and

(c) When production cannot vary before the expiry of one full period.

(4) The theory is based upon the unsound assumption that the crop which farmer plants in 2008 depends solely on the prices ruling in 2007. As a matter of fact this is contrary to facts. When 2007 prices undoubtedly influence decisions regarding 2008 crops, producers are also influenced by their expectations.

Producer’s decisions with regard production during any given period depend not only upon the backward look but also on the forward guess. If this year’s price is high, producers are apt to foresee some reaction to the high price and anticipate larger output by their competitors next year.

(5) This theory of trade cycle suffers from another weakness too. If we look at the Fig 2 showing the diverging cobweb cycle, we find that disequilibrium once began continues indefinitely. The curves show that once the equilibrium is upset, the system falls into a series of unending cycles. In practice, however, this is most unlikely to happen. Commonsense tells that it cannot happen. In practice the shape of the curves is such as to make continued divergence impossible.

ADVERTISEMENTS:

(6) It can also be argued that even the constant type of cobweb cycle would not continue indefinitely. This is clear if we look carefully at Fig. 1. Thus in the case of a constant Cobweb Cycle producers experience alternating years of profits and losses but the losses always exceed the profits.

Bankruptcy would ultimately put an end to a cycle of this type. Thus it is in a way correct to assert that in so far as the cycles of the cobweb occur in practice they are either converging cycles that tend towards a new equilibrium position on temporary affairs limited by the ultimate-bankruptcy of people in industry and business.

Conclusion to Cobweb Theory:

We conclude that in spite of its shortcomings the Cobweb Theory is important besides its application as an explanation for the cyclical behaviour of wheat and other agricultural products’ markets. It concentrates attention on the important fact that the present events depend upon the past happenings It furnishes us with a technique to demonstrate the process of change over time.