In this article we will discuss about the modern the theory of rent.

The modern economists have generalised the term ‘rent’. In truth, there exists rent in the earning of the every factor of production and it is identified with surplus income.

Transfer Earnings and Economic Rent:

The amount that a factor must earn in its present use to prevent it from transferring to another use is called its transfer earnings: any excess that it earns over this amount is called its economic rent. The distinct is crucial in predicting what changes in earnings will cause factors of production to enter or leave a particular employment.

ADVERTISEMENTS:

The concept of economic rent, a surplus over transfer earnings, is analogous to the notion of economic profit as a surplus over opportunity cost.

The definition of rent has been extended in two directions by Joan Robinson and Vilfredo Pareto.

According to Robinson:

“The essence of the concept of rent is one of surplus earned by a part of a factor of production over and above the minimum earning necessary to induce it to do work.” A slightly different definition is associated with the name of Pareto. “Economic rent is the excess payment to a factor in its present occupation.”

ADVERTISEMENTS:

So, in short, rent is the excess earning to a factor over and above its true supply price.

For Ricardo and other classical economists, both the definitions are useless. Ricardo assumed that supply of land is fixed for the economy as a whole. Therefore, even when price falls to zero, supply remains unchanged.

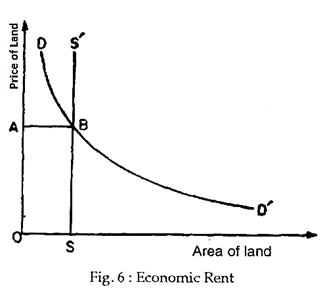

Let us measure demand for and supply of land on the horizontal axis and price of land (rent) on the vertical axis (Fig. 6). The downward sloping demand curve intersects the vertical supply curve at the point B and the whole earning OABS represents economic rent in the Ricardian sense.

But, according to modern economists, land has multiple uses and accordingly, its supply for a particular use is not perfectly inelastic. The minimum amount that has to be paid to a factor in order to retain its supply price or opportunity cost. If a higher price is offered for apple growing, more land will come forth from other uses and vice versa for a decrease in offer-price.

ADVERTISEMENTS:

Suppose, an acre of land has two alternative uses, wheat and potato production. Then for its employment into wheat production the owner of the plot must be offered Rs.400 which is the basic minimum. Ibis amount then becomes the transfer price of the plot. If now the actual pay turn out to be Rs.500, then the economic rent will be Rs.100.

Let us again measure demand for and supply of land along the vertical axis. The supply curve is upward sloping quite simply for the reason cited above. The equilibrium point is B and the equilibrium price is BC leading to a total earning of OABC (Fig. 6).

Since different units of land are equally fertile, they must be given the same remuneration. Again, the minimum supply price of a particular unit of factor of production is given by the distance BC Thus, while the area OCBS is total amount of transfer earning the area ABS is the amount of economic rent.

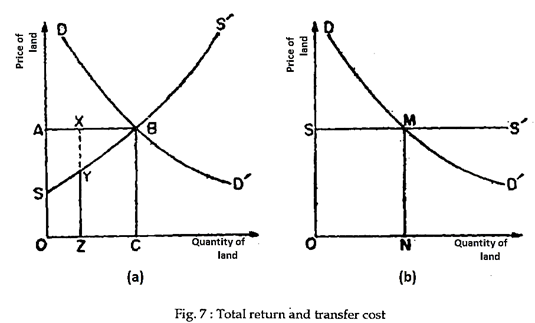

Suppose now the supply curve of land is perfectly elastic, i.e., a straight line parallel to the horizontal axis (Fig. 7). The equilibrium point is M and thus the total earning is OSMN with price OS per unit. However, since the minimum supply price is also OS per unit, no economic rent results in this situation.

Again, the various alternative uses which are open to the factor-owner tends to vary directly with time. If we define the short run as a period within which a unit of a productive service cannot move from one use to another, then its supply price to its present use will be zero and the whole current earning will be economic rent.

In the long run, however, units of a productive service may move from one use to another and thus only a part of actual earning becomes economic rent. Hence, the notion of planning horizon is highly connected with the determination of economic rent.