Cost of Production: Money, Real and Opportunity Costs!

The concept of cost of production is very significant in economics because it influences the production, supply, sales and the determination of price in the market.

It means cost of production is a function of total costs in relation to price to guide the firm in deciding whether to expand or contract output and also whether to leave or enter an industry.

Marshall made a distinction between the cost of production and the expenses (expenditures) of production by saying that, “All the efforts and sacrifices made by the producer is the real cost of production while the money paid to other factors of production for these efforts is termed as the expenses of production”.

ADVERTISEMENTS:

The concept of real cost, though of some importance from the social point of view, lacks precision since it is expressed in subjective terms. Watson uses the term ‘cost function’ to denote the general relation between output and cost. It tells that change in output effectively leads to change in cost of production.

According to Prof. Watson, cost function can be expressed as:

C= f (q)

Where:

ADVERTISEMENTS:

C = Cost of Production

q = output

f= functional relationship

However, Prof. Koutsoyiannis states “cost functions are derived functions. They are derived from the production function.”

ADVERTISEMENTS:

For easy and clear understanding, cost of production can be illustrated as:

1. Money Costs:

Money cost is also known as the nominal cost. It is nothing but the expenses incurred by a firm to produce a commodity. For instance, the cost of producing 200 chairs is Rs. 10000, and then it will be called the money cost of producing 200 chairs.

Therefore, money costs include the following expenses:

(i) Depreciation and obsolescence charges.

(ii) Power fuel charges.

(iii) Wages and salaries.

(iv) Cost of machinery, raw material etc.

(v) Expenses on advertising and publicity,

ADVERTISEMENTS:

(vi) Interest on capital.

(vii) Expenses on electricity.

(viii) Insurance charges.

(ix) Transport costs.

ADVERTISEMENTS:

(x) Packing charges.

(xi) All types of taxes viz; property tax, license fees, excise duty.

(xii) Rent on land.

Therefore, money costs relate to money outlays by a firm on factors of production which enable the firm to produce and sell a product. Every producer is interested only in nominal costs. Thus, in the words of Prof. Hanson, “The money cost of producing a certain output of a commodity is the sum of all the payments to the factors of production engaged in the production of that commodity.”

ADVERTISEMENTS:

Moreover, total costs of a firm include both:

(i) Explicit as well as

(ii) Implicit costs.

(a) Explicit Costs:

Explicit costs refer to all those expenses made by a firm to buy goods directly. They include, payments for raw material, taxes and depreciation charges, transportation, power, high fuel, advertising and so on.

According to Leftwitch, “Explicit costs are those cash payments which firms make to outsiders for their services and goods.” He has given stress on the word explicit and it may be called the approach used by the accountant of the firm. The payments are explicit-clear-cut, paid to agents (owners) of factors of production. A contract fixes the rate at which the payments are to be made.

The examples are clear to see. These are wages to workers, money paid for raw materials and semi-finished goods, various fixed costs etc. The producer takes money out of his pocket and pays to others. These are payments to attract resources from other uses to the use made by a particular producer. They are also known as Accounting Costs or Historical Costs.

(b) Implicit Costs:

ADVERTISEMENTS:

Implicit costs are the imputed value of the entrepreneur’s own resources and Services. In fact, these costs refer to the implied or unnoticed costs. They include the interest on his own capital, rent on his land, wages of his own labour etc. Moreover, these costs go to the entrepreneur himself and are not recorded in practice. In the words of Leftwitch, “Implicit costs are the costs of self-owned, self employed resources.”

In short we can say that:

Economic costs = Explicit costs – Implicit costs

There are some resources which are “self-owned” and are self- employed”; the cost is in the shape of income given up rather than payment made. The income forgone is income which could have been earned by allowing the resources to be used by somebody else and the ‘cost’ is at the rate at which income could be earned in the next best use.

Suppose a producer uses his own money in his own business. He does not pay any interest to himself, but he could have earned some money if he had given the money as loan to someone else. Thus for personal capital, self-employed rate of interest would be imputed at the rate at which it could earn interest somewhere else. To make the approach still more realistic, the modern economists prefer to add normal profit to implicit and explicit costs of production.

2. Real Costs:

Another concept of costs is the real costs. It is a philosophical concept which refers to all those efforts and sacrifices undergone by various members of the society to produce a commodity. Like monetary costs, real costs do not tell us anything what lies behind these costs. Prof. Marshall has called these costs as the “Social Costs of Production.”

ADVERTISEMENTS:

According to Marshall, “Real costs are the exertion of all the different kinds of labour that are directly or indirectly involved in making it together with the abstinence rather than the waiting required for saving the capital used in making it, all these efforts and sacrifices together will be called the real cost of production of the commodity.”

In this way, real cost means the trouble, sacrifice of factors in producing a commodity. Though, this concept gained momentum for sometime it has been relegated to the background in modern times due to its impracticability.

3. Opportunity Costs:

The concept of opportunity costs was first systematically developed by Austrian School of Economics. Later on, it was popularized by American economist named Davenport. It is also known as the alternative cost or transfer cost. In simple words, opportunity cost is the cost of production of any unit of commodity for the value of factors of production used in producing other unit.

For instance, a farmer can grow both the potatoes as well as garlic on a farm. On a farm of two hectares, the farmer grows only potatoes and foregoes the production of garlic. Suppose, the price of the quantity of potatoes is Rs. 5000, the opportunity cost of producing the garlic will be Rs. 5000. In this way, the price of garlic which he has to forego to produce is called the opportunity cost of potatoes.

Here, one thing is worth-mentioning that if a factor of production has no alternative use; in that case its opportunity cost will be zero. According to Prof. Benham, “The opportunity cost of anything is the next best alternative that could be produced instead by the same factors or by an equivalent group of factors, costing the same amount of money.”

Assumptions of Opportunity Costs:

1. Perfect competition and full employment prevail in the economy.

ADVERTISEMENTS:

2. Factors of production are fixed.

3. Only-two goods can be produced in the economy.

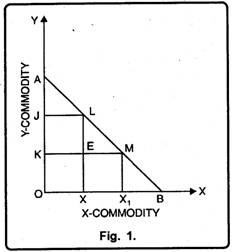

The concept of opportunity cost can be explained with the help of figure 1.

In Figure 1, line AB represents the different combinations of two goods i.e. X and Y which have to be produced in the economy with given resources. At point L on AB line, the producer will produce OX units of goods X and OJ of good-Y.

Now, if the producer wishes to produce more units of good-X than before, in that case he will have to produce less units of good-Y. As given in the fig., at point M, more units of commodity-X (OX1) can be produced, but less units of commodity-Y i.e. OK. In this way, we can say that in order to produce XX 1 units of commodity-X, the producer will have to sacrifice JK units of commodity-Y.

Importance of Opportunity Costs:

ADVERTISEMENTS:

The concept of opportunity cost has a very wide application in economic theory and policy. It is applicable in the determination of factor prices. It can also be applied to consumption and public expenditure.

Opportunity costs also explain the phenomenon of prices. Since, there is scarcity of goods and services they can be put to alternative uses and thus command price.

Limitations:

Although, the concept of opportunity costs is of great importance yet it is not free from limitations.

The main points of its limitations are understated:

1. Wrong Assumption:

The doctrine of opportunity cost is based on perfect competition which is far from reality. The existence of monopoly obstruct the transfer of factors, thereby, nullifies the very transfer price.

2. Homogeneity of Factors:

It assumes that all the factors are homogeneous. But, in fact, they are heterogeneous which falsifies the concept of opportunity cost.

3. Money Cost:

The concept of opportunity cost does not apply to those goods and services which are produced without money cost.

4. Inertia:

These costs fail to take into account the element of inertia. Some factors may be reluctant to leave their occupations and in such cases opportunity costs do not arise at all.

Costs play a very significant role in managerial decisions involving a selection between alternative courses of action. It helps in specifying various alternatives in terms of their quantitative values. The kind of cost to be used in a particular situation depends upon the business decisions to be made.

Costs enter into almost every business decision and it is important to use the right analysis of cost. Hence it is important to understand what these various concepts of costs are, how these can be defined and operationalized.

This requires the under-standing of the two basic things, namely:

(i) That cost estimates produced by conventional financial accounting are not appropriate for all managerial uses, and

(ii) That different business problems call for different kinds of costs.