Some of the major importance of liquidity preference theory in interest rate are as follows:

1. Liquidity Trap:

By liquidity trap, we mean a situation where the rate of interest cannot fall below a particular minimum level. It means rate of interest is always positive.

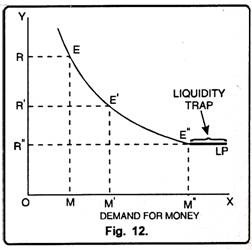

It cannot be zero or negative. It can be shown with the help of Fig. 12.

Along the X-axis is represented the speculative demand for money and along the Y-axis the rate of interest. The liquidity preference curve LP is downward sloping towards the right. It signifies that the higher the rate of interest, the lower the demand for speculative motive, and vice-versa. Thus, at the high current rate of interest OR, a very small amount OM is held for speculative motive. This is because at a high current rate of interest much money would have been lent out or used for Buying bonds and therefore less money will be kept as inactive balances.

ADVERTISEMENTS:

If the rate of interest rises to OR1 then less amount OM1 will be held under speculative motive. With the further fall in the rate of interest to OR2, money held under speculative motive increases to OM2. It will be seen in Fig. 12 that the liquidity preference curve LP becomes quite flat i.e., perfectly’ elastic at a very low rate of interest. It is horizontal line beyond point EE1 towards the right. This perfectly elastic portion of liquidity preference curve indicates the position of absolute liquidity preference of the people.

That is, at a very low rate of interest people will hold with them as inactive balances any amount of money they come to have. This portion of liquidity preference curve with absolute liquidity preference is called liquidity trap by some economists.

M1, = L1, (Y)

2. Interest is Monetary Phenomenon:

ADVERTISEMENTS:

According to Keynes, interest is a purely monetary phenomenon. His theory has focused on the role of money in determining the rate of interest.

3. More Generalized:

The classical theory was a special theory applicable only to a full- employment situation. Keynes theory is more general in that it is applicable both to full as well as under employment situations.

4. Integrated Theory:

A great merit of Keynes theory is that it has integrated the theory of interest with the general theory of output and employment. Employment depends on the level of investment and inducement to invest is influenced apart from marginal efficiency of capital, by the rate of interest.

5. Integration with Price:

Keynes has integrated the theory of interest with the theory of price. The classical writers had unduly emphasized such real factors as abstinence and time preference. According to Keynes, interest is the price of money, and like the price of any commodity, it is determined by the demand for and supply of money.

6. More Practical:

ADVERTISEMENTS:

The theory is of great practical significance also. The rate of interest depends on the demand for and supply of money. The supply of money is regulated by the government or the monetary authority of the country. Therefore, the government can greatly influence the rate of interest by regulating money-supply. Also through its liquidity trap hypothesis, the theory stresses the limitation of monetary authority in lowering the rate of interest beyond a certain level.

7. Inverse Relation between Interest and Price:

Another importance of Keynes liquidity preference is that bond prices are inversely related to interest rate. It means, interest rate and bond prices move in opposite direction.

8. Long Term Vs. Short Term Interest Rates:

According to Keynes, interest is a reward for parting with liquidity. The interest rate differs on debts of different lengths and maturities. The interest rate on daily loans will be different from the rates of interest on weekly, monthly and yearly loans. Debts of longer maturity’ like three, five or ten years will have different interest rates.