Distribution and Theories of Distribution!

Introduction and Definition:

‘Distribution’ refers to the sharing of the wealth that is produced among the different factors of production.

In the modern time, the production of goods and services is a joint operation. All the different factors of production i.e., land, labour, capital and enterprise are combined together in productive activity.

Productive activity is thus the result of the joint effort of these four factors of production which work collectively to produce more wealth. These factors need to be paid or rewarded for their services for producing the wealth.

ADVERTISEMENTS:

Definition:

Some important definitions of ‘Distribution’ are as follows:

1. According to Prof. Nicholson – “Distribution refers to the sharing of wealth of a nation among the different classes.”

2. Prof. Chapman has said that – “The Economics of Distribution accounts for the sharing of the wealth produced by a community among the agents or the owners of agents which have been active in its production.”

ADVERTISEMENTS:

3. According to Prof. Cannon – “Distribution like production is a social phenomenon. In production we study the creation of social income and in distribution we study its distribution in one case we regard it as national output and in the other as national dividend.”

4. According to Prof. Seligman – “All wealth that is created in society finds its way to the final disposition of the individual, through certain channels or sources of income, this process is called distribution.” Thus, the theory of distribution deals with the distribution of income. It seeks to explain the principles governing the determination of factor like rewards—rent, wages, interest and profits—i.e., how prices of the factors of production are set. The theory of distribution thus states how the product is functionally distributed among the co-operating factors in the process of production.

Personal Distribution and Functional Distribution:

In economics, the term ‘distribution’ has two components:

(i) Functional distribution,

ADVERTISEMENTS:

(ii) Personal distribution.

1. Functional Distribution:

Functional distribution refers to the distinct share of the national income received by the people, as agents of production per Unit of time, as a reward for the unique functions rendered by them through their productive services. These shares are commonly described as wages, rent, interest and profits in the aggregate production. It implies factor price determination of a class of factors. It has been called as “Macro” concept.

2. Personal Distribution:

Personal distribution on the other-hand, is a ‘Micro Concept’ which refers to the given amount of wealth and income received by individuals in society through their economics efforts, i.e., individual’s personal earnings of income through various sources.

The concept of equality and inequality of income distribution and social justice is basically concerned with the personal distribution of income. Taxation measures are designed to influence personal distribution of income and wealth in a community.

The theory of distribution deals with functional distribution and not with personal distribution of income. It seeks to explain the principles governing the determination of factor rewards like—rent, wages, interest and profits, i.e., how prices of the factors of production are set.

Importance of Distribution:

At present under the study of economics the study of ‘Distribution’ has occupied a very important place. The methods and systems of distribution has high effect on the economic life of the nation. Therefore, where the work of distribution is done with equity and justice the various channels of distribution are satisfied with its workings.

The satisfied workers increases their efficiency and they increase the quality and quantity of production. Contrary to this if the methods of distribution are improper and a particular class is being exploited then there will be dis-satisfaction feeling will crop up among people. Therefore, with the study of the distribution, it is clear that in the country with scientific system of production, equity and scientific way of distribution method is also very essential.

Main Problems of Distribution:

Main problems of Distribution are as follows:

1. How much property be distributed?

ADVERTISEMENTS:

2. Among what factors it should be distributed?

3. What should be the theory of distribution?

1. How much Property be Distributed?

Distribution is made of national income.

But national income is of two types:

ADVERTISEMENTS:

(i) Gross National Income and

(ii) Net National Income.

In any country in one year whatever is earned in connection with goods and service, their value interns of money is called Gross National Income. But it should be remembered that Gross National Income is never distributed. Distribution is always done of Net National Income.

To earn total income one has to incur certain expenses. Therefore, in the total national income, after the deduction of the expenses whatever is left out that is known as net national income and the balance of the remaining money is distributed among the various factors of production.

ADVERTISEMENTS:

Therefore, Net National Income = (Gross National Income) – (minus) Cost of raw-materials + Replacement cost of fixed and circulating capital + depreciation and repairs of fixed capital + Taxes and insurance charges

2. Among What Factors to be Distributed?

National income is distributed among the various factors of production like—land, labour, capital and enterprise. From national income the rent of land, wages of labourers, interest on capital and risk part of money to entrepreneur will be deducted and the balance left will be net profit which will be distributed.

3. What should be the Theory of Distribution?

Regarding the distribution of net national income the following two principles are being adopted.

They are as follows:

(i) Marginal Productivity Theory of Distribution.

(ii) Modern Theory of Distribution.

ADVERTISEMENTS:

(i) Marginal Productivity Theory of Distribution:

Marginal productivity theory of distribution is the most celebrated theory of distribution. It is the neo-classical theory of distribution and is derived from Ricardo’s “Marginal principle”. J.B. Clark, Marshall and Hicks are the main pro-pounders of this theory. Initially, the theory was propounded as an explanation for the determination of wages (i.e., the reward for labour) but, later on, it was generalized as a theory of factor pricing for all the factors of production.

“The theory states that the price of a factor of production is governed by its marginal productivity. To support this hypothesis, it analyses the process of equilibrium pertaining to the employment of input of various factors by an individual firm under perfect competition. In a perfectly competitive factor market, a firm can buy any number of units of factors of production, at the prevailing market price. Now, the question is: given the price of a factor, how much of each factor will he employ.”

According to this theory, an entrepreneur or a firm will employ a factor at a given price till its marginal productivity tends to be equal to its price. It thus follows that the reward (price) of a factor tends to be equal to its marginal productivity.

The summary of the marginal productivity theory may thus be laid down in terms of the following propositions:

“The marginal productivity of a factor determines its price. In the long-run, the price or reward of a factor tends to be equal to its marginal as well as average products. When the reward of each factor in the economy tends to be equal to its marginal productivity, there is optimum allocation of resources (factors) in different uses. Further, when all factors receive their shares according to their respective marginal products, the total product will be exhausted.”

Assumptions of Marginal Productivity Theory:

The Marginal Productivity Theory of distribution is based on the following implicit and explicit assumptions:

ADVERTISEMENTS:

(i) There is perfect competition, both in the product market as well as in the factor market.

(ii) There should not be any technological change. Therefore, the techniques of production should remain the same, though the scales and proportions of factors may change.

(iii) All units of a factor should be perfectly homogeneous i.e., they should be of equal efficiency. This means that all units of a factor should receive the same price. The homogeneity of factors of units should imply that they are perfectly substitutes of each other.

(iv) The firm aims at maximisation of profit. Therefore, it should seek and observe the most efficient allocation of resources.

(v) The economy as a whole, should operate at the full employment level.

ADVERTISEMENTS:

(vi) There should be perfect mobility of factors of production.

(vii) The bargaining power of the seller and the buyers of a factor of production should be equal.

(viii) The marginal productivity of an individual should be measurable.

(ix) There should not be any government intervention in the fixation of factor price, such as minimum wage legislation or price control etc.

(x) The theory essentially considers long-run analysis in order to prove that the price of a factor will tend to be equal to both average and marginal productivity.

The Concepts of Productivity:

Productivity means the quantity of the output turned out by the use of factor or factors of production.

ADVERTISEMENTS:

For example:

How much wheat can be produced on 5 hectares of land under certain conditions or how much earth-digging can be done by 10 labourers.

Productivity of a factor may be viewed in two senses:

(i) Physical productivity, and

(ii) Revenue productivity.

(i) Physical Productivity:

Physical productivity of a factor is measured, in terms of physical units of output of a commodity produced by it per unit of time. When physical productivity is expressed in terms of money it is called revenue productivity.

Again physical productivity has two concepts:

(a) Average Physical product, and

(b) Marginal Physical product.

(a) Average Physical Product:

The average physical product or the average product of a factor is the total product dividend by the number of units of the factor employed in the process of production. To put this in symbolic terms

(b) Marginal Physical Product:

The marginal physical product of a factor is the increase in total product resulting from the employment of an additional unit of that factor, other factors remaining constant. The physical product or the marginal product of a particular factor is thus measured as MP = TPn – TPn-1.

Once the average and marginal products are calculated it is easy to measure the respective revenue productivity of the factor concerned. Here, we measure the quantity of the product in physical terms.

For example:

We may express in terms of quintals of wheat or the number of chairs produced. But we are not concerned here with the total quantity of wheat or the average yield. We are concerned here with the marginal product which means an addition made to the total output of the commodity by the addition of one unit of a factor of production.

Suppose 3 hectares of land yield 30 quintals of wheat and 4 hectares, 40 quintals. The use of the third hectare has added 10 quintals. This is the marginal physical product. The total product has been increased by 10 quintals by the employment of the third or the marginal hectare. That is why it is called marginal product. But it is the physical product and not product in terms of value.

Value of Marginal Product (VMP):

This is also called Value of Marginal Physical Product (VMPP) and is usually referred to as the marginal productivity of a factor, and is obtained by multiplying the marginal physical product of the factor by the price of output.

To put it symbolically:

Marginal Productivity of VMPP = MPP x P where, MPP stands for the marginal physical product of the factor, and P for the price of output. The marginal value product means the value of additional product obtained by the employment of another unit of a factor of production. We can get value product by multiplying the physical product i.e., the quantity of the commodity by its price in the market.

For example:

When we say that it is an addition to the total product by the addition of one more unit of a factor of production, say one hectare or one worker, or a unit of Rs. 1,000 in capital. When this marginal product is expressed not in physical terms but in terms of its value in the market, it is called Marginal Value Product.

Marginal Revenue Productivity:

The marginal revenue at any level of firm’s output is the net revenue earned by selling another (additional) unit of the product. Algebraically, it is the addition to total revenue earned by selling n units of product. In other-words, Marginal Revenue Product (MRP) of a factor is the net addition to total revenue made by the employment of an additional unit of that factor, assuming other factors to be fixed under a given state of technology. Thus, marginal revenue product is obtained by multiplying the marginal revenue.

To put it symbolically:

MRP = MPP x MR

where, MRP indicates marginal revenue product,

MPP stands for the marginal physical product

and MR stands for the marginal revenue.

Thus, there is a conceptual difference between marginal revenue product (MRP) and value of marginal physical product (VMPP). In the former, we consider marginal revenue to be multiplied by the MPP and, in latter, we take price to multiply it by the MPP.

In perfectly competitive market conditions for the product, however, MPP = VPP. This is because under Perfect Competition—Price = MR. But if the commodity-market has imperfect competition price or AR tends to be greater than the marginal revenue, then VMPP will be higher than MRP.

Marginal Productivity Theory of Distribution:

Marginal Productivity Theory of Distribution is the reward of a factor equals its marginal product. Marginal product, also known as marginal physical product, is the increment made to the total output by employing an additional unit of a factor, keeping all other factors constant. If the increase in the output is multiplied by the prevailing price of the product, the result is the marginal value product of that factor. But it is better to measure marginal product of a factor in terms of its marginal revenue product (MRP) which may be defined as the addition made to total revenue resulting from the employment of one more unit of a factor of production, other factors remaining unchanged.

In other words, by the marginal productivity of a factor of production we mean the addition made to total output by the employment of the marginal unit i.e., the unit which the employer thinks just worth-while employing. At the margin of employment, the payment made to the factor concerned is just equal to the value of the addition made to the total output on account of the employment of the additional unit of a factor.

For example:

If the prevailing wage is less than the marginal productivity, then more labour will be employed. Competition among employers will raise the wage to the level of marginal productivity. If on the other-hand, the marginal productivity is less than the wage, the employers are losing and they will reduce their demand for labour. As a result, the wage rate will come down to the level of marginal productivity. In this way by competition, wage tends to equal the marginal productivity. This applies also to the other factors of production and their rewards.

Thus, it must be noted that in a position of competitive equilibrium:

(a) The marginal productivity of a factor of production is the same in all employments,

(b) The marginal productivity of a factor of production is measured by the price of the factor of production; and

(c) Marginal productivities of various factors are proportional to their respective prices.

Further, over the whole field of employment, therefore, each factor of production tends to be paid in proportion to its marginal productivity. Thus, the distribution of national income or the total aggregate output of an economy is not a scramble as the strikes or lock-outs make it appear to be. It is governed by a definite economic principle viz. marginal productivity.

Criticisms of the Marginal Productivity Theory:

Most of the economists are of this opinion that though the marginal productivity theory is logically sound and perfect, it has many inherent shortcomings and they have criticised the theory on the following grounds:

1. The Basic Assumption Underlying the Theory is Unrealistic:

The theory is based on the assumption of perfect competition in the product as well as factor markets. Modern economists, like—Mrs. Robinson and Chamberlin have rightly pointed out that perfect competition is not a very large relative phenomenon. In reality, there is imperfect competition in the market. Further, other assumptions of the theory have also been criticised and they are as such:

2. All Units of Factor are not Homogeneous:

The theory assumes that all units of a factor are homogeneous. In reality, however, all factor units can never be alike. Especially, the different labour units differ in efficiency and skill. Similarly, plots of land differ in fertility and so on.

3. Factors are not fully Employed:

The theory assumes that all factors are fully employed. But, as Keynes pointed out, in reality there is a likelihood of under-employment rather than full employment.

4. Factors are not Perfectly Mobile:

Next, the theory assumes perfect mobility of factors. But in reality, factors are imperfectly mobile between regions and occupations. There is no automatic movement of factors units from one place to another. The greater the degree of specialisation in an industry, the less is the factor mobility from one industry to another.

5. All Factors are not Divisible:

The theory assumes the divisibility of factors. But lumpy factors like factory plant, machines and the manager are indivisible. In a large factory the addition or subs-traction of one factor units will have practically no effect on the total productivity. It may be true in domestic production. Thus, the equality between marginal productivity and price of a factor cannot be brought about by varying its quantities a little less or more.

6. This Theory not Applicable in the Short-run:

The theory is applicable only in the long-run, when the reward of a factor service tends to equal its marginal revenue product. But in reality, we are concerned with short-run problems. As said by Prof. Keynes—”In the long-run we are all dead.” This assumption makes the problem of pricing the factor-services unrealistic.

7. This Theory is a Static Theory:

The marginal productivity theory is applicable only to a static economy as it regards no change in technology. Since the modern economy is dynamic and there are technological advances from time to time, the theory becomes inapplicable to modern conditions.

8. This Theory has been considered as One-sided:

Because it considers only demand for factors in terms of its Marginal Revenue Product but it fails to analyse the conditions of supply in the factor market. The factor price may be high when the factor is relatively scarce.

9. Marginal Productivity of all Factors cannot be Measured Separately:

In this theory it has been assumed that the marginal physical product of an individual factor can be measured by keeping other factors unchanged. Critics have said that one cannot consider the specific marginal productivity of a factor in isolation, when production is not the result of only one factor. It is the outcome of collective efforts of all factors at a time. Therefore, it is difficult to measure the marginal productivity of each factor separately. Since variation in output cannot be attributed to a single factor alone, marginal productivity appears to be a make-believe concept.

10. The Theory is based on the Law of Diminishing Returns as Applied to the Organisation of a Business:

This means that a factor like capital with improved technology has increasing returns and it also enhances the productivity of other factors like labour. This theory misses this vital point of practical consideration.

11. Wage Determination Theory:

This Theory has been Criticised by Keynes and he is of this Opinion that theory is Basically Explained for Wage Determination and is Loosely Extended for Pricing of the Other Factors of Production. But other factors like rent and capital have their distinctive factors like—rent and capital have their distinctive characteristics, so their rewards are also fixed distinctly. Again, the entrepreneur earns profit which is a residual income, which can be negative as well. Then, is it not ridiculous to lack of negative marginal product of an entrepreneur to explain loss in the business, which is improper.

12. The Theory cannot apply to Personal Distribution:

The theory only explains functional distribution. It does not deal or explains anything of personal distribution of income and inequalities of earnings.

13. The Theory Lacks Normative Aspect of the Dealings:

This theory contains only the positive aspect of the analysis. It does not consider anything or it does not have any ethical justification or social norm in determining the reward factor.

Modern Theory of Distribution Demand and Supply Theory:

We have seen earlier that the marginal productivity theory only tells us that how many workers will an employer engage at a given level in order to earn maximum of profit. It does not tells us how that wage-level is determined. Further, the marginal productivity theory describes the problem of the determination of the reward of a factor of production from the side of demand only. It has not said anything from the supply side.

Therefore, the marginal productivity theory cannot be said to be an adequate explanation of the determination of the factor prices. The modern theory of pricing which gives us a satisfactory explanation of factor prices in the Demand and Supply Theory. As we are aware that the price of a commodity is determined by the demand for and supply of, a commodity, similarly the price of a productive service also is determined by demand for and supply of that particular factor.

Demand for a Factor:

First we are going to consider the demand side of the factor. Here, we should remember that the demand for a factor of production is not a direct demand. It is on indirect or derived demand, It is derived from the demand for the product that, the factor produces. For example, we can say that labour does not satisfy our w ants directly. The demand for labour entirely depends upon the demand for goods. If the demand for goods increases, the demand for the factors which help to produce those goods will also increase.

The demand for a factor of production will also depend on the quantity of the other factors required for the process. The demand price for a given quantity of a factor of production will be higher, the greater the quantities of the co-operating productive services. If in production more of a factor of production is employed, the marginal productivity of the factor will fall and the demand price will be lower of the unit of a productive service.

Further, the demand price of a factor of production also depends upon the value of the finished product in the production of which the factor is used. The demand price of a commodity is normally higher, if more valuable is the finished product in which the factor is used. Next, the more productive the factor is, the higher will be the demand price of a given quantity of the factor.

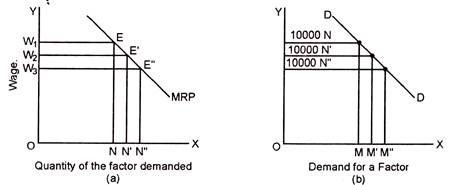

From the following diagramme the given explanation given can be explained:

In the diagramme given the wage is OW, the firm is in equilibrium at the point E and the demand for the factor is ON. Similarly at OW’ wage the demand is ON’ and at OW “the demand is ON “. MRP (Marginal Revenue Productivity) curve is the demand curve for a factor of production by an individual firm.

For determining the price of a factor, it is not the demand of the individual firm that matters but it is the total demand, i.e., the sum-total of the demands of all firms in the industry. The total demand curve is derived by the total summation of the marginal revenue productivity curves all the firms. This curve DD is shown in the figure. Thus, from this figure it can be ascertained that-according to the law of diminishing marginal productivity, the more a factor is employed, the lower is the marginal productivity.

Supply Side:

The supply curve of a factor depends on the various conditions of its supply.

For example:

The supply of labour entirely depends upon the size and composition of population, the occupational and geographical distribution, labour efficiency their training, expected income, relative preference for work and leisure etc. By considering all these relevant factors, it is possible to construct the supply curve of a productive service.

Further, the supply of labour does not depend only on economic factors but many non-economic considerations also. Therefore, we can say that if the price of a factor increases, it supply will also increase and vice-versa. Hence, the supply curve of a factor rises from left to right upwards.

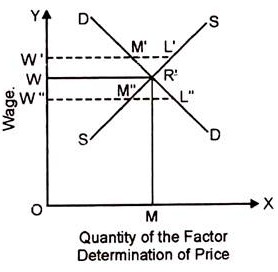

This can be shown by the figure given below:

Interaction of Demand and Supply:

Interaction of Demand and Supply:

We have studied up to this stage the demand curve and the supply curve of the factor of production while in price fixation both curves are needed. Therefore, the price will tend to prevail in the market at which the demand and supply are in equilibrium. This equilibrium is at the point of intersection of the demand and supply curves.

In the diagram above the demand and supply curves intersect at the point R and the price of the factor will be OW at OW’ demand W’ M’ is less than the supply W L’. In this case competition among the sellers of the service will tend to bring down the price to OW. On the other hand, at OW “price the demand W “L” is greater than the supply W “M “, hence price will tend to go up to OW at which the demand and supply will be equal.

To conclude, this is how that the price of a factor of production in the factor market is determined by the interaction of the forces of demand and supply in connection with the factor of production. Thus eminent economists are of this opinion that this is the proper, correct and satisfactory theory of distribution.