In this article we will discuss about:- 1. Heckscher-Ohlin Theory of International Trade 2. Superiority of Heckscher-Ohlin Theory over the Classical Theory 3. Criticisms.

The classical comparative costs theory developed by Adam Smith, Ricardo and Mill maintained that comparative cost advantage of the trading countries was based on the differences in the productivity of labour (single factor) but they failed to provide a satisfactory explanation for such differences. It is of course true that the relative cost differences or relative differences in commodity prices between two countries are an evidence of their comparative advantage. But what is the fundamental cause of the commodity price differences remained unanswered in the classical theory.

The theory for analysing the pattern of international trade, developed by Swedish economists Eli Heckscher (1919) and Bertil Ohlin (1933) attempted to deal with this vital question. This theory did not supplant the traditional comparative costs theory but supported it by providing explanation for the relative commodity price differences between the countries and their respective comparative advantages. According to them, the differences in commodity prices arise because of the differences in factor endowments (factor supplies) in these countries.

Introduction to Heckscher-Ohlin Theory:

The structure of the modern theory of international trade rests fundamentally upon the theory developed by Eli Heckscher and Bertil Ohlin. This theory has almost completely replaced the classical and neo-classical theories related to international trade. But it does not mean that there is some real conflict between the Hecksher-Ohlin approach and the comparative costs approach or that the former, in any way, invalidates the latter.

ADVERTISEMENTS:

In fact, the Heckscher-Ohlin approach supplements the traditional approach in a powerful manner. It goes behind the comparative costs doctrine to investigate the basic cause of the relative differences in costs. Heckscher and Ohlin have traced the cause of cost differences to relative factor endowments and relative factor intensities. That is why this theory is also known as Factor- Proportions-Factor-Intensity Theory. According to this theory, countries which are rich in labour will export labour-intensive goods and those rich in capital will export capital-intensive goods.

Assumptions of the Heckscher-Ohlin Theory:

The H.O. theory is based upon the following assumptions:

(i) This theory considers a two-country, two- commodity and two factor (labour and capital) case. It is possible, however, to extend the theory to a multi-factor and multi-commodity case. But such an extension can be done only if the number of factors and number of commodities are equal.

(ii) The factors of production are perfectly mobile within their respective countries but they are immobile between the countries.

ADVERTISEMENTS:

(iii) There is a state of perfect competition both in the product and factor markets.

(iv) There is full employment of the factors of production in both the countries.

(v) Production functions pertaining to both the commodities are linearly homogenous. It implies that the production is governed by constant returns to scale.

(vi) The techniques of production in both the countries remain unchanged. In such a situation, the input-output co-efficient in production functions will remain unchanged.

ADVERTISEMENTS:

(vii) The consumer’s taste pattern and therefore the demand functions for different goods are identical in both the countries.

(viii) The factors endowments, in absolute terms, remain constant in both the countries but the relative endowments of the two factors are disproportionate in the two countries. Suppose country A has an abundance of capital while B has an abundance of labour. In qualitative terms, however, the factors are homogenous in the two countries.

(ix) The production functions are such that the two commodities show different factor intensities—one commodity is capital-intensive and the other is labour-intensive. Although production functions for different commodities are different, yet the production functions for each commodity are the same in both the countries.

(x) The factor intensities are not reversible.

(xi) The trade between two countries is free and unrestricted.

(xii) There is an absence of transport costs so that product prices are related exclusively to factor costs.

(xiii) There is incomplete specialisation in the trading countries.

The whole basis of differences in comparative costs, according to H-O theory, rests upon two crucial elements—factor endowments and factor intensities.

Factor Endowments:

ADVERTISEMENTS:

It is an incontrovertible fact that regions or countries differ from one another in respect of endowments or availability of factors. In country A, there may be an abundance of capital and labour may be scarce. On the opposite, there may be an abundance of labour in country B, while capital may be scarce.

The terms ‘relative factor abundance,’ in H-O model can be defined in terms of two criteria:

(i) The physical criterion of relative factor abundance, and

(ii) The price criterion of relative factor abundance.

ADVERTISEMENTS:

(i) Physical Criterion:

According to this criterion, a country is said to be relatively capital abundant, if and only if, it is endowed with a higher proportion of capital to labour than the other country.

The country A can be called as relatively capital abundant, if the following condition is satisfied:

ADVERTISEMENTS:

where K and L refer to capital and labour respectively. Bars over K and L signify the fixed factor quantities in each country. The subscripts A and B refer to countries A and B.

Similarly the relative scarcity of labour, in physical terms, in country A can be expressed as:

For country B, relative labour-abundance can be indicated by:

And capital-scarcity in this country can be denoted by:

ADVERTISEMENTS:

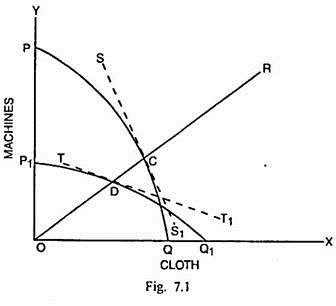

Given the above conditions, H-O theory lays down that country A will produce capital-intensive commodity (say machines) and country B will have a bias in producing labour-intensive commodity (say, cloth). If both the countries produce machines and cloth in the same proportion and production occurs along OR in Fig. 7.1, the country A would be producing at C and country B at D. The points C and D lie on the respective production possibility curves PQ and P1Q1 of these two countries.

Since at point C, the slope of country A’s production possibility curve is more steep than the slope of the production possibility curve of country B at D, this will imply that MC of producing cloth in country A is higher than the MC of producing cloth in country B. So if the production takes place at points C and D, machines can be produced more cheaply in country A and cloth can be produced more cheaply in country B.

Since country A is capital-abundant and the production of machines is capital-intensive, country A will tend to extend the production of machines. Country B, at the same time being labour-abundant, will tend to extend the production of cloth, which is relatively labour- intensive.

The Heckscher-Ohlin theorem can, however, be valid on the basis of this physical criterion and give the above conclusion only if the consumption pattern in both the countries is identical and the income elasticity of demand for each commodity equals unity. If the demand conditions are different in two countries, the conclusion that capital-abundant countries will export capital-intensive commodity and vice-versa cannot be sustained. This can be shown through Fig. 7.2.

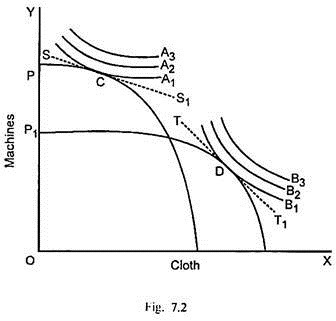

Even in Fig. 7.2, the opportunity cost curves PQ and P1Q1 indicate that country A is capital-abundant and country B is labour-abundant. The pattern of demand is different in the two countries. The community indifference curves A1, A2 and A3 indicate demand pattern in country A and the indifference curves B1, B2 and B3 indicate the demand pattern in country B. The iso-revenue curve SS1 related to country A is less steep than the iso- revenue curve TT1 for country B, therefore-

Now demand conditions indicate that machines are costly in country A while cloth is costly in country B. Therefore, country A may decide to export cloth and country B may export machines. So the pattern of demand may off-set the Heckscher-Ohlin generalisation that capital-abundant country will export capital-intensive commodity and vice-versa.

(ii) Price Criterion:

The alternative criterion for defining relative factor-abundance is the price criterion. The criterion lays down that a country having capital relatively cheap and labour relatively costly is capital-abundant and vice-versa, irrespective of the physical quantities of capital and labour that they have.

Country A can be called as relatively capital-abundant if (PKA/PLA) < (PKB/PLB). Here P denotes prices. K and L signify capital and labour respectively. A and B indicate countries A and B respectively. Similarly country A can be regarded as labour- abundant and capital-scarce, if (PLA/PKA) < (PLB/PKB).

ADVERTISEMENTS:

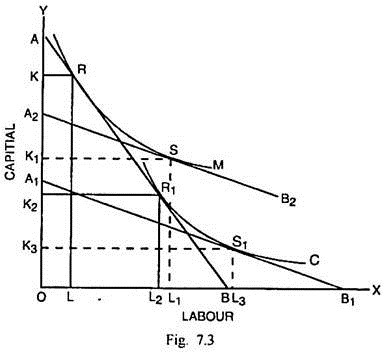

Now suppose country A is capital-abundant and labour-scarce, the interest rates will be relatively low and wage rates will be relatively higher when compared with interest rates and wage rates in country B. Therefore, country A will decide to produce and export capital-intensive commodity (say, machine) and import labour-intensive commodity (say, cloth). Now this generalization can be proved through Fig. 7.3.

AB is the factor-price line for country A and A1B1 is the factor price line for country B. As the slope of AB is greater than that of A1B1, capital is relatively cheap in country A and labour is relatively cheap in country B. It signifies that (PKA/PLA) < (PKB/PLB).

Now the factor price line AB is tangent to the isoquant M of the capital-intensive commodity machine at R. It means country A can produce certain number of units of machine, say 100 machines, by employing OK units of capital and OL units of labour. OL amount of labour is equal to AK amount of capital. In other words, the cost of producing 100 machines in country A in terms of capital is OA.

The factor price line A2B2 of country B is parallel to A1B1. It is tangent to the isoquant M at S. It signifies that country B can produce 100 machines by employing OK1 units of capital and OL1 units of labour. It means A2K1 units of capital are equal to OL1 units of labour and the total cost of producing 100 machines in country B is OA2 in terms of capital. From this, the conclusion can be derived that the production of machine is more capital-intensive in country A than in country B.

Similarly in the production of one unit of cloth (say, 1000 metres) in country A, OL2 units of labour and OK2 units of capital are employed at R1, the point of tangency between country A’s factor price line AB and the isoquant for cloth C representing 1000 meters of cloth. Given this factor combination, OK2 units of capital are equal to BL2 units of labour and the cost of producing 1000 metres of cloth in country A in terms of labour is OB.

ADVERTISEMENTS:

In country B, given the factor price line A1B1, the point of tangency between A1B1 and isoquant C is S1. Country B employs OK3 units of capital and OL3 units of labour for producing 1000 metres of cloth. Now the quantity of capital OK3 equals B1L3 units of labour.

The cost of producing 1000 metres of cloth in labour terms is OB1 in country B. This shows that labour-abundant country B makes more use of labour in producing 1000 metres of cloth than country A. B will specialise in the production and export of cloth while country A will export more capital-intensive commodity machine.

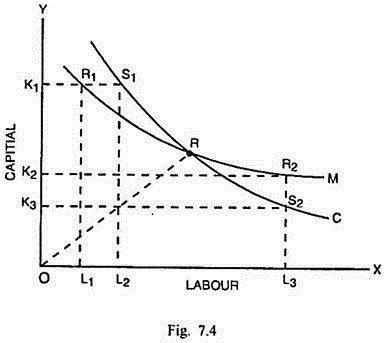

The Heckscher-Ohlin theory attributed the comparative differences in costs also to the factor intensities which have been defined by Ellsworth as “relative use made of each one of the two (or more) factors when combined in production.” Alternatively, factor intensity means the relative proportions in which two factors, say labour and capital, are combined at each point on a given isoquant. This is explained through Fig. 7.4.

C and M in Fig. 7.4 represent the isoquants of cloth and machine respectively. They are not identical otherwise they would have coincided. They intersect each other at R. That indicates equal factor proportions in producing a given number of units of the two commodities. The portion to the left and above R is capital-intensive and the portion below and to the right of R is labour-intensive. Along isoquant M, the quantities of capital and labour used at R1 are OK1 and OL1 respectively. At R2, these inputs are OK2 and OL3 to have the same output of machines.

Thus above and to the left of R, the factor combinations involve larger input of capital than labour. The opposite is true on the combinations below and to the right of R. The same applies even in the case of isoquant C. If OK1 quantity of capital is used, one unit of machine requires the labour input of OL1 but one unit of cloth requires OL2 units of labour along with OK1 units of capital at point S1.

Similarly if OK2 units of capital are employed, one machine can be turned out when labour input is OL3. At S2, one unit of cloth needs OL3 labour input along with a smaller capital input OK3. It clearly shows that machine is a capital- intensive and cloth is a labour-intensive commodity, throughout the length of isoquants M and C except of course at the point of intersection R.

So the relative factor abundance and factor intensity together determine the comparative differences in costs and accordingly the countries will decide about specialisation and export of specific commodities. On the basis of factor proportions, factor intensities and factor prices, Heckscher and Ohlin made the generalisation that capital-abundant countries will export capital-intensive commodities and labour-abundant countries will export labour- intensive commodities.

Superiority of Heckscher-Ohlin Theory over the Classical Theory:

Heckscher- Ohlin theory does not contradict the Ricardian theory. It rather supplements it as it attempts to investigate the basic forces determining the comparative advantage of one country over the other.

However, H-O theory makes some departures from the traditional theory and in the process, effects significant improvements upon the latter in following respects:

(i) Based on General Theory of Value:

While the classical theory is based upon the labour theory of value, Heckscher-Ohlin model, on the other hand, is necessarily based upon a more general theory of value. It takes into amount both demand and supply forces for determining specialisation and pattern of trade. In contrast, Ricardian theory was very deficient and one-sided. It had relied exclusively upon the supply factors and overlooked completely the demand factors.

(ii) No Need for Separate Theory:

Ricardo had made a distinction between internal and international trade. On account of factor immobility among different countries, he felt the need for a separate theory of international trade. Even though Heckscher and Ohlin too believe that there are obstacles to international mobility of factors, yet the greater mobility of products tends to neutralise the factor immobility.

In their opinion, the immobility of factors remains only a matter of degree and not of kind and any distinction between international or inter-regional trade is only superficial. In the words of Ohlin, “International trade is but a special case of inter-local or inter-regional trade and there is not substantial difference between domestic trade and foreign trade. The basis of inter-regional specialisation also follows the principle of comparative cost.”

(iii) Ultimate Cause of Trade:

The classical theory failed to explain the cause of comparative difference in costs. Heckscher and Ohlin provided a highly plausible cause of comparative differences in costs and consequent international specialisation in production.

(iv) Permanent Basis of Trade:

The classical theory implicitly relates the comparative differences in costs to differences in skill and efficiency of labour. Over a long period, there can be international transmission of technical knowledge from one country to another and all differences in costs due to skill, efficiency and technology are likely to be eliminated. It implies that the trade between two countries may come to an end in the long run.

Kelvin Lancaster has, however, pointed out that the trade between countries is not likely to come to an end even if there is perfect transmission of knowledge and techniques because the differences in factor endowments will continue to persist even in the long run. Since the factor movements from one country to the other cannot take place on such a scale that the factor endowment gap can be completely bridged, the comparative cost differences will continue to exist and hence there can be permanent exchange of commodities. It shows that H-O model lays down a permanent basis for international trade.

(v) Two Factors of Production:

In the classical comparative costs theory, it was supposed that production involves only one factor of production—labour. The H-O theory, on the opposite, maintains that in a two-country and two- commodity model, production involves two factors of production—labour and capital.

(vi) Stress on Relative Product or Factor Prices:

A highly significant difference between the classical and H-O theories is that the former approach consists primarily of propositions related to the relative product prices. The latter, on the contrary, deals with propositions related to the relative factor prices.

(vii) Emphasis on Gains vs. Bases of Trade:

The traditional theory emphasises upon the gains accruing to countries from foreign trade. Therefore, the classical theory has useful welfare implication. The Heckscher-Ohlin theory on the opposite, stresses on the analysis of bases of trade between two countries and makes contribution mainly to positive economics.

(viii) Qualitative vs. Quantitative Differences in Factors:

The classical theory takes into account only the single factor, labour, and attributes the comparative differences in costs to qualitative differences in labour. The H-O theory, on the other hand, deals with two factors—labour and capital. It assumes an absence of qualitative differences in them. The international trade and specialisation results on account of quantitative differences in factor proportions and factor intensities.

(ix) Production Function:

The classical trade theory is based on the differences in the production of specified commodities between the two trading countries. In contrast, the H-O theory gives prominence to differences in their production functions.

(x) Product Specialisation:

The comparative costs theory maintains that the comparative advantages of trading countries may or may not lead to complete specialisation in the production and export of respective commodities. On the opposite, the H-O theorem explicitly states that the factor proportions and factor intensities lead to complete specialisation in the production of a specific commodity in the first country and another commodity in the second country. From this viewpoint, the latter theory is more specific and realistic.

(xi) Locational Theory:

Haberler points out that the H-O theory gives prominence to the space factor in the international trade through factor endowments of trading countries. He prefers to call this theory as a locational theory. In contrast, the Ricardian-Mill theory treats different countries as a spaceless market. Even from this angle, the H-O theory is an improvement upon the classical theory.

(xii) Distributions of Income and Welfare:

Since the classical theory takes into account a single factor of production, the distribution of income remains unchanged. It implies that the welfare of every individual unequivocally increases with trade or else no one is worse off than before. The Heckscher-Ohlin theorem does not make such an unqualified, and unrealistic statement about welfare.

(xiii) Integration between the Theory of Value and Theory of International Trade:

The classical theory relies upon the forces of demand and supply in their value theory. But when they come to the trade theory there is a complete neglect of demand factors. So classical approach fails to integrate the theories of value and trade. The Heckscher-Ohlin theory brought about a successful integration between the theories of value and trade.

From the above facts, it becomes clear that the modern theory of international trade does not only make a highly significant break from the traditional analysis but also registers a considerable improvement upon it.

Criticism of Heckscher-Ohlin Theory:

No doubt, the Heckscher-Ohlin theory has been found to be more exact, precise, scientific and analytically superior to the earlier approaches to the theory of international trade, still it has certain deficiencies for which it has been criticized by many a writer.

(i) Partial Equilibrium Analysis:

Haberler although recognized Ohlin’s theory as less abstract, yet it has failed to develop a general equilibrium concept. It remains, by and large, a part of the partial equilibrium analysis. This theory seeks to explain the pattern of trade only on the basis of factor proportions and factor intensities, while ignoring several other influences such as transport costs, economies of scale, external economies etc., which too exert influence on the cost of production.

In such a situation, Ellsworth states that “with several causes operating simultaneously upon costs, it becomes a matter of adding up the influence of all cost-reducing and increasing forces to arrive at a net result.”

(ii) Oversimplifying Assumptions:

This theory is based upon highly over-simplifying assumptions of perfect competition, full employment of resources, identical production function, constant returns to scale, absence of transport costs and absence of product differentiation. Given this set of assumptions, the whole model becomes quite unrealistic.

(iii) Static Analysis:

The Heckscher-Ohlin model assumes fixed quantities of factors of production, given production functions, incomes and costs. It means the theory investigates the pattern of international trade in a static setting. The conclusions drawn from such an analysis are simply not relevant to a dynamic economic system.

(iv) Identical Factors:

This theory maintains that there are no qualitative differences in factors and that these factors are capable of exact measurement so that factor endowment ratios can be calculated. In the real world, however, qualitative factor differences exist. Moreover, there are more than one variety of each factor. This creates serious complications in the measurement and comparison of costs and the determinations of trade pattern.

(v) Neglect of Product Differentiation:

The theory overlooks the role played by product differentiation in international trade. Even when the production agents are identical in two countries, the international trade may still take place due to product differentiation. For instance, the Japanese machines are sold out in the U.S.A. and the American machines are sold in Japan. In this context, Wijanholds opines that factor prices do not determine cost. It is rather the commodity prices that determine factor prices.

Prices of goods are determined by their utility to the buyers (the force of demand) and prices of factors like raw materials, labour etc., are ultimately dependent on the demand and prices of final goods because the demand for them is the derived demand. So Wijanholds states that “prices are the only things we may accept as data. Everything else to be derived therefrom.” He regards both Ricardian theory and Heckscher-Ohlin theory as faulty as they related cost to factor prices and neglected the influence of product differentiation on international trade.

(vi) Factor Proportions and Specialisation:

The H-O theory suggests that the relative factor proportions (or factor endowments) determine the specialisation in exports of different countries. The capital-abundant countries export capital-intensive goods and labour-abundant countries export the labour-intensive goods. It implies that trade will not take place between such countries or regions as have similar relative factor proportions. But this is not true.

A large part of world trade is between the U.S.A. and the countries of Western Europe despite the fact that all of them have a relative greater capital- abundance and scarcity of labour. The H-O theory cannot provide a complete and satisfactory explanation of trade in such cases. In fact, the specialisation is governed not only by factor proportions but also by several other factors like cost and price differences, transport costs, economies of scale, external economies etc. The H-O theory was clearly wrong in overlooking these factors.

(vii) Neglect of Factor Demand:

The H-O theory assumes that the factor prices are determined by the relative factor endowments of a country. It means the rate of interest should be relatively low and wage rates relatively high in a capital-abundant but a labour-scarce country. On this basis, the United States should have a lower structure of interest rate but it is in fact higher because even in that capital-surplus country, the demand for capital too is very strong. In fact, the relative factor prices are influenced not only by their supply but also by the demand for them. The H-O theory failed to take into account the influence of demand for factors on their prices.

(viii) Factor Mobility:

This theory assumes that there is absence of international mobility of factors. This assumption is not valid. The writers like Williams and Levin have pointed out that the international mobility of factors is actually even more than the inter-regional mobility within the same countries. This is evident from international capital flows from advanced countries to such export sectors in the LDC’s as petroleum, minerals, plantations etc.

Similarly the large-scale movement of labour from the Third World countries to the advanced countries has assisted the latter in enlarging their production and export. It is, therefore, clear that H-O theory takes an unrealistic assumption of international immobility of factors.

(ix) Neglect of Technological Change:

The H-O model assumes identical production function. It implies that the technological conditions in a given country remain unchanged. This assumption again is invalid. There has been continuous improvement in techniques of production both in the advanced and the less developed countries. The neglect of technological change in H-O theory makes this model quite inconsistent with actual reality.

(x) Factor-Intensity:

This theory gives much prominence to the concept of factor intensity. It is assumed in this model that one good is capital- intensive and the other is labour-intensive. The capital-intensive good remains capital-intensive in both the counties and the labour-intensive good remains labour-intensive in both the countries. It means there can be no reversal of factor-intensity i.e., the same good is capital-intensive in one country while labour-intensive in the other. The empirical evidence on this issue is conflicting. However, if there is reversal of factor-intensity, the whole structure of H-O theory will collapse.

(xi) Neglect of By-Products:

Sometimes byproducts are even more important than the main final product. The Heckscher-Ohlin theorem, however, provides no explanation how the terms of trade are determined in the case of by-products.

(xii) Possibility of Trade Even under Identical Proportions:

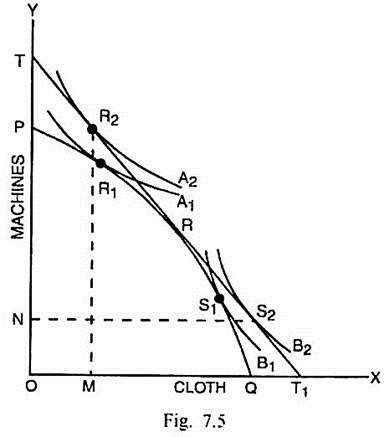

The factor proportions theory implies that there can be no possibility of international trade when factor proportions between two countries are identical. In fact the identical factor proportions may not close the possibility of trade if consumer preferences are not identical due to differences in income distribution in two countries. This can be explained through Fig. 7.5.

Given the identical factor proportions in two countries A and B, there is the same production possibility curve PQ for both the countries. A1 and A2 are the community indifference curves of A. B1 and B2 are the indifference curves of B. In the absence of international trade, consumption points of the two countries are respectively R1 and S1. It shows that country A has a stronger consumer preference for machines and country B has a greater preference for cloth.

As international trade takes place, TT1 is the international exchange ratio line. Now both the countries get superior alternatives at R2 and S2 respectively. At R2, country A consumes R2M of machines and OM of cloth. On the other hand, country B consumes S2N quantity of cloth and ON quantity of machines at S2. The consumption in excess of production is met through mutual imports. Thus even when the factor proportions are identical, the international trade may still occur and that vitiates the Heckscher-Ohlin theory.

(xiii) Vague Theory:

No doubt H-O theorem attempted to explain the basis reason for comparative advantage of the trading countries, yet the theory is vague and conditional. It depends upon several restrictive and unrealistic assumptions. In the words of Haberler, “With many factors of production, some of which are qualitatively incommensurable as between different countries, and with dissimilar production functions in different countries, no sweeping a priori generalisations concerning the composition of trade are possible.”

Undoubtedly, this theory is based upon some unrealistic assumptions, yet Lancaster regards it as of central importance in the theory of international trade because of its objectively and simplicity. According to him, “…model occupies the very centre of international trade theory, for reasons unconnected with its realism, and indeed strengthened by the very properties which have been subject to so much criticism.” He goes on further to comment, “It is in fact, the simple model of international trade …just as two-commodity indifference curve is the simple model of consumer’s behaviour.”