Here is a term on the ‘Supply of Money’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on the ‘Supply of Money’ especially written for school and college students.

Term Paper on the Supply of Money

Term Paper Contents:

- Term Paper on the Meaning and Definition of Supply of Money

- Term Paper on Who Supplies Money?

- Term Paper on the Measures & Components of Money Supply in India

- Term Paper on the Money Stock and Flow of Money

- Term Paper on the Relative Importance of Measures of Money Supply

- Term Paper on the Factors Affecting Money Supply

Term Paper # 1. Meaning and Definition of Supply of Money:

ADVERTISEMENTS:

Supply of money means the total amount of money available in the economy on a particular time. But supply of money includes only that stock of money which is with the public of a country. It is to be noted that government of the country and financial institutions are the suppliers of money. So stock of money available with the suppliers is not included in it.

There are three opinions regarding the definition of the supply of money:

They are as follows:

(1) Under Traditional or Narrow Approach:

ADVERTISEMENTS:

This is the most traditional and narrow definition of money. According to this approach, supply of money means cash with the people and that portion of cash deposited with the commercial banks, which is demand deposit. According to this, meaning, for the medium of exchange, both the money which is available with the people in terms of currency and money deposited with the bank which can be withdrawn by cheque.

Thus:

Supply of Money (M1) = Currency held by public (Currency + Coins) + Demand Deposits in commercial banks.

This approach of supply of money is supposed to be a narrow approach.

ADVERTISEMENTS:

(2) Under Broad Approach:

While defining the supply of money under this approach, Prof. Friedman said, “The supply of money in a specific time is that money in dollars which is with the public or in the form of time deposits with commercial banks.” Here any other currency for respective country can be taken in place of dollar.

Thus, according to this definition medium of exchange and store of money, both are considered as the importance of money. This is known as ‘M2‘ in America and ‘M3‘ in Britain and India. Thus M3 = Currency + Demand deposits with commercial Banks + Time deposit.

Or

M3 = M1 + Time Deposits

(3) Gurley and Shaw Approach:

This is the broadest approach for the measurement of the supply of money. This has been produced by Gurley and Shaw. According to them, in the supply of money the above stated ‘M2‘ the deposit of the savings bank and other deposits are considered.

While discussing all three approaches of the supply of money, the definition of money should be based on the enforcement of the monetary policy of a particular country. The first definition gives stress on the exchange of money where as the second definition is appropriate for the enforcement of the monetary policy. As regards the third definition, it is impractical as it is extremely widespread.

Term Paper # 2. Who Supplies Money?

ADVERTISEMENTS:

At present government, central bank as well as commercial banks supplies the money. In India the central bank is the Reserve Bank of India, in India one rupee coins are issued by the finance ministry of the Government of India. Reserve Bank of India is the central bank of India. Currencies are issued by Reserve Bank of India on the bases of Minimum Reserve System.

Reserve Bank has to keep gold and foreign securities worth Rs. 200 crores in Reserve Fund. Out of this gold must be valued of Rs. 115 crores. Commercial bank creates credit or supply or supply of money on the bases of demand deposit. Expansion or contraction of supply of money depends upon the monetary policy of the Reserve Bank of India.

Term Paper # 3. Measures & Components of Money Supply in India:

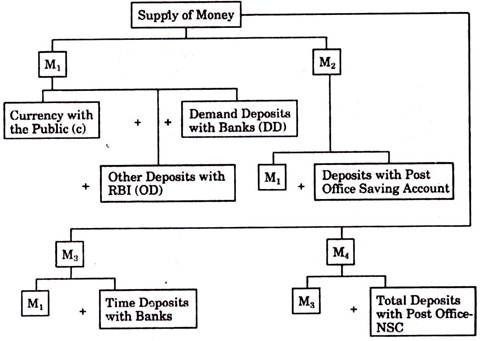

Till April 1977, the traditional approach was adopted in India for the measurement of money, in which only currency with people and demand deposit were included. But after April 1977, Reserve Bank has adopted the new method to measure the supply of money. These four methods are the components of the measurement of supply of money, which have been defined as M1, M2, M3 and M4.

ADVERTISEMENTS:

(1) M1, Measurement:

According to this measurement M1 = Currency with public (c) + Demand Deposit (DD) + other deposit with RBI (OD)

Here, C = currency with public (Paper money & coins)

DD = Demand Deposit, deposited with the commercial bank, which can be withdrawn by cheques.

ADVERTISEMENTS:

OD = other deposit, which includes:

(i) Time deposits of Public sector financial institutions such as IDBI with RBI

(ii) Demand Deposits of foreign central banks and foreign government with RBI

(iii) Demand Deposits of International Financial Institutions such as IMF and World Bank. But OD certainly does not include the deposits of RBI and the deposits of the banking system of the country under RBI.

(2) M2 Measurement:

As compared to M1, this one is broader measurement of the supply of money. In this approach the savings with the post office are also included along with all the components of M1. Thus, M2 = M1 + Savings deposits with post office saving banks.

ADVERTISEMENTS:

(3) M3 Measurement:

As compared of M1, M3 is also broader approach of the supply of money. In this approach along with all the components of M1 the term deposit of people with the commercial banks are included.

M3 = M1 + Term deposits with commercial banks.

(4) M4 Measurement:

This is the broadest concept of the supply of money. In this approach along with all the components of M3 all the deposits with the post offices (excluding NSC) are included.

M4 = M3 + Total deposits with post office (excluding NSC)

ADVERTISEMENTS:

= M3 + all deposits with post office-NSC

Thus among the above concepts, M1, and M2 are the narrow approach of the supply of money, whereas M3 and M4 are broader concept but there is less liquidity of money in this concept also.

M3 has a great importance among the above four measurement. On the bases of this measurement Reserve Bank publishes the data. In these days Reserve Bank gives priority to M3 measurement, because it includes currency with the public and deposits with bank, which helps to prepare the credit budget for credit policy. Chakrabarti Committee had also recommended this measurement. Thus, M3 is a standard measurement in India like the developed country.

Different components of supply of money can be shown by the following chart:

Term Paper # 4. Money Stock and Flow of Money:

ADVERTISEMENTS:

In common language stock of money and flow of money are considered as synonyms of each other; but this concept is not true. Because in economy, at any specific time the amount of money in circulation is a called, stock of money. Secondly, the amount of supply money on a particular date is known as stock of money.

On the other hand, the supply of money is considered for a particular period of time involved is regarded as flow of money. If stock of money is multiplied by average velocity of money, then we can know the flow of money. For example, if the stock of money is Rs. 1000 crore and in a particular time period its velocity is 20, then the supply of money will be Rs. 20, 000.

In a country the stock of money is controlled by central bank, but velocity is not controlled by central bank. Velocity depends on public. Basically velocity refers to using a single unit of money by the public for exchange over a specific period of time.

Term Paper # 5. Relative Importance of Measures of Money Supply:

There are four approaches of supply of money in India, which are defined in context of M1, M2, M3 and M4. Among these four approaches, Reserve Bank gives more attention to and M3 and among these two more emphasis is laid on M3.

As regards M2, and M4, less attention is paid on them. Because in these two measurements, the deposits of post offices, are also included. It is assumed that the amount deposited with post office is the nominal portion of total deposits of the economy. A part of this, there is no control of Reserve Bank on the deposits with post offices. In spite of them; Reserve Bank is continuously publishing data of above four measurements since April 1977.

ADVERTISEMENTS:

According to new measurement of Reserve Bank Reserve Money [MB]:

Currency in circulation + Banker’s deposits with the RBI + Other deposits with the RBI = Net RBI credit to government + RBI credit to commercial Sector + RBI’s Claim on Bank + RBI’s net Foreign assets + Government’s currency liabilities to public – RBI’s net non-monetary liabilities.

Term Paper # 6. Factors Affecting Money Supply:

In any economy the supply of money is affected by various factors.

Some of them are as follows:

(1) Monetary Policy of the Central Bank:

Monetary policy of Central bank plays an important role in the supply of money. When central bank of a country adopts cheap monetary policy then the public can avail loan at a lower rate of interest. As a result supply of money will increase. On the contrary, if the central bank of the country increases rate of interest or CRR [Cash Reserve ratio] or purchases the securities in open market then it means expensive money policy is adopted. In such a way supply of money will decrease.

(2) Commercial Bank’s Capacity and Policy of Credit Creation:

Bank creates credit policies on the bases of their deposits. In banking system credit depends on quantity of money available in the fund. If, number of credits will increase it will lead to an increase in supply of money. On the contrary, quantity of credit will decrease if deposits decrease. Apart from this, expansion or contraction of credit also depends on the CRR of Reserve Bank.

(3) Government’s Fiscal Policy:

If the government follows the policy of deficit budget, it increases the supply of money. On the other hand if the government follows the policy of surplus budget it decreases the supply of money.

(4) Public Desire:

Credit Creation Capacity of commercial banks also depends on whether the public wants to keep maximum money in the form of currency with them or deposit them in banks. If the public desires to keep maximum money in commercial banks the capacity of credit creation of banks will increase along with an increase in the supply of money.

On the other hand if the public desires to keep currency with them, maximum money in the form of currency then the credit creation capacity of bank will decrease and this will also lead to decrease in the supply of money.