Here is a term paper on the ‘Derivative Markets’. Find paragraphs, long and short term papers on the ‘Derivative Markets’ especially written for school and college students.

Term Paper on Derivative Markets

Term Paper Contents:

- Term Paper on the Introduction to Derivative Markets

- Term Paper on the Role of Regulator in Derivative Markets

- Term Paper on Trading in Derivatives Markets

- Term Paper on the Types of Derivatives

- Term Paper on the Growth of Derivative Markets

- Term Paper on the Advantages of Derivative Markets

- Term Paper on the Problems in Derivatives Markets

- Term Paper on Report on Derivatives

- Term Paper on the Derivative Market Risk Management in India

Term Paper # 1. Introduction to Derivative Markets:

ADVERTISEMENTS:

The derivative markets are for those assets or instruments, which are synthetic financial products derived from the real assets or stocks or commodities. These new financial products have combinations of features of the existing real products and can be traded separately independent of the instruments or stocks, from which they are derived.

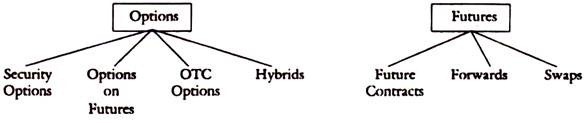

The major derivative products have been classified as options, futures and hybrids, which are all widely used in developed countries and in some developing counties. These products are increasingly becoming popular and traded volumes in these products are increasing, year after year.

In emerging markets, there is a greater need for these markets for risk reduction from the high volatility of financial markets. Portfolio managers, particularly FFIs may face market risks, commodity price risks and foreign exchange risks that can be properly controlled through the prudent use of these derivatives for hedging. Increasing globalisation and operations of foreigners in domestic markets make it necessary to develop certain facilities like hedging which in developed countries, they are used to.

The domestic markets will improve asset diversification, deepen the financial structure and promote the sophistication of the markets through the route of the derivative markets, offshore markets etc. These new financial products deepen the structure and promote the superior allocation of resources so as to maximise return and minimise risk and ultimately to better capital formation and higher economic growth.

ADVERTISEMENTS:

Absence of derivative markets make the domestic firms less competitive locally and globally and the domestic markets less attractive and imperfect. There will be unfilled gaps in the financial structure. Increased inter linkages of markets due to globalisation make it necessary to promote the derivatives, which lead to sophistication of these markets by filling up the gaps.

Term Paper # 2.

Role of Regulator in Derivative Markets:

Too much regulation and too little regulation are both bad in respect of these markets. Too much regulation will have a throttling effect and prevent the entry and growth of the market. Too little regulation will lead to lack of enough protection to investors and fear of failures in the market.

The role of regulator has many objectives. The purpose of regulation is to protect the interests of investors, infuse confidence in the market and prevent unfair trade practices. Next regulatory objective is to promote smooth functioning of the market and prevent undue speculation and trade defaults.

ADVERTISEMENTS:

Regulatory role on the market has its impact in many ways, namely, through the throttling effect on growth, minimising incentive to gaming and abuse, and promoting a healthy growth. It is now well accepted that only optimal level of regulation promotes a healthy market. This is particularly relevant to developing countries and emerging markets. The control effect operates through imposition of margins and prevention of over speculation and leading to gaming failures of the dealers and traders.

Term Paper # 3.

Trading in Derivatives Markets:

Trading on healthy lines necessitate adequate disclosures of open positions of traders, and trading by companies, and proper reporting. Disclosure of the covered positions, open positions, volume of trade and net losses and gains etc. would help the market to grow in right directions.

The disclosures are to the investors by all the players in the market and the companies and to the regulators for enforcing proper controls, and margins and by imposing trade restrictions. All the trading firms should have their own internal controls and by observing standards of capital adequacy and prudential norms, real hedging purpose can be served. A well capitalised clearing house improves the confidence in the market. The regulators and the Exchange authorities have to impose and implement an optimal level of controls.

Term Paper # 4. Types of Derivatives:

The security or asset classes on which the derivatives depend are:

(1) Debt or Bonds,

(2) Equities,

ADVERTISEMENTS:

(3) Indexes,

(4) Commodities,

(5) Currencies.

ADVERTISEMENTS:

Categories of Derivatives:

Derivatives can be divided into two general categories:

I. Why Options for Corporations/Government?

ADVERTISEMENTS:

(a) Hedging Inventory

(b) Hedging Currency Rate

(c) Hedging Interest Rate

(d) Lowering Borrowing Costs

ADVERTISEMENTS:

II. Why Options for Individuals?

(a) For Speculation

(b) For Hedging

(c) Yield/Return Enhancement

(d) Asset Relocation or Allocation

ADVERTISEMENTS:

(e) Arbitrage Operations

Investors and Dealers:

Investors are individuals, mutual funds, pension funds, trusts, endowments, portfolio managers, companies, etc.

The dealers in these markets are security firms, banks, financial institutions, market makers etc.

ADVERTISEMENTS:

Term Paper # 5. Growth of Derivative Markets:

Derivative markets in the US, UK and Europe have been started in the seventies. In 1988 Japan has started its Topix Options and in 1993 Hong Kong had its first options contracts. The European style options are based on the principle that the buyer can only exercise the right on the expiry date but not before.

But in the US style of options, it can be exercised on any of the specific times before the expiry date. The rapid growth of derivatives was due to need for hedging in trade, increased volatility in cash markets, improved technology and deregulation in the markets. In India, options are now permitted by a change in law and NSE and BSE are expected to start any time.

ADVERTISEMENTS:

Market Structure:

The options markets may have three different types of structures:

(a) Auction market with jobbers or market makers (as the present one).

(b) Order matching electronic trading.

(c) Dealer markets as in government security.

Auction markets require a trading floor which the present system of stock exchange can adopt. Even dealer markets can also be developed as in the gilt edged market or money markets in India. It is based on telephonic, telex and fax systems of communications.

Only in the case of order driven marketing system, computer aided trading is needed as in the OTC. There can be order driven and quote driven markets.

Globalisation and World Market Integration:

The derivative markets also help the process of globalisation and spread of technology across the markets. The available supply of capital will increase at a given level of risk due to the provision of hedge in this market for the investments in the cash markets.

The competition will increase among the world markets encourage openness of the economies and spread of capital across the borders in the world. The growth of technology and the revolution in the informatics will provide the avenue for such capital flows across borders and this is aided by the available options markets.

Term Paper # 6. Advantages of Derivative Markets:

1. Diversion of speculative instinct from the cash market to the derivatives.

2. Increased hedge for investors in cash market.

3. Reduced risk of holding underlying assets.

4. Lower transactions costs.

4. Enhance price discovery process.

6. Increased liquidity for investors and growth of savings flowing into these markets.

7. It increases the volume of transactions.

8. It leads to faster execution of trades and arbitrage and hedge against risk.

Term Paper # 7. Problems in Derivatives Markets:

The experience of developed countries with the derivative markets was not all that rosy. Without adequate safeguards trading has been taking place, in these markets with a speculative objective, with the result that there are instances of spectacular debacles in the derivative markets.

There were failures of Barings Bank, and Metall Gesclschaft due to speculative over exposures and financial difficulties of Orange County and Bankers’ Trust due to operations in these markets for lack of proper comprehension of the risks involved.

In view of such failures or difficulties, what is wanted is education of the pitfalls of trading in derivative markets and provision of training facilities for traders and investors alike.

One of the major problems of these derivative markets is over speculation which has to be controlled by a right degree of regulation. Developing countries like to promote them in a meticulous manner, through education training and with all necessary infrastructure.

A right degree of regulation with a fair degree of self-regulation of the exchange authority and trading and dealer members. Derivative market depends on the observance of the rules of the game, like disclosures and transparency, maintenance of capital adequacy standards and avoidance of monopoly positions (undue long positions) and unfair trading practices.

The regulation of these markets is an important factor, as the confidence of investors is to be built in these markets. Market integrity and investor confidence are the major issues to be dealt with in earnest for promotion of the market.

This confidence is dependent on the right degree of regulatory rules, exchange procedures and by member actions. Trades in the derivative markets unlike in the primary markets or cash markets have zero sum consequences which mean that for every deal the gain of one is the loss of another. The losses are therefore Inherent in the market operations itself.

Although some degree of speculation is necessary and tolerated in any of these markets, a strict control through margins on these deals is necessary. This market is also sensitive to rumours and trading positions of numbers. It has to be nebulously protected from these problems to promote its growth.

Term Paper # 8.

Report on Derivatives:

Derivatives Market:

As part of financial market reforms, new instruments and financial reengineering have been introduced in India. One area where the growth and innovation is slow is in the introduction of derivatives. What are the factors which hinders the introduction and growth of derivative markets in India? Infrastructural difficulties, poor clearing and settlement procedures, differences in practices among Stock Exchanges and low level of expertise among brokers, sub-brokers and investors in absorbing new technologies and low level of electronic trading network.

Although National Securities Clearing Corporation (NSCC) was created by NSE in 1996, not much headway was made in the introduction of NSE 50 Index limited futures market, mainly due to unpreparedness of member brokers, insufficient funds with brokers and inadequate infrastructural support. The Government also wanted to go slow in this process.

The L.C. Gupta Committee on Derivatives (1998) reportedly favoured the introduction of derivative market in a phased manner in India. As a first step, Index futures are recommended and trading in derivatives is to be strictly regulated by the Exchange authorities, as per the Rules to be made by the SEBI. But the scope and the need for such derivative market is undoubtedly accepted by the committee. Index futures can be followed by other derivative markets like those in Interest Rates and Foreign Exchange rates, in a phased manner.

Experience in Developed Countries:

The committee has drawn heavily on the experience of derivative markets in the Developed Countries. In India, the experience of this type of trading will be found to be riddled with hurdles of poor regulatory enforcement, malpractices and failures of the system. The experience in badla trading is felt to be completely different from that of derivative markets although the intent and purpose are the same. The separation of cash market from speculative market and provision of a different venue for the operation of speculative forces is no doubt laudable.

But the fact that it is closely linked to the cash market cannot guarantee the separation of these markets and the inter-linkages are bound to create problems and the effect of one on the other. In the context, when badla is already providing a venue for speculative instinct, the need for futures and options is felt less impending. But, the Government is determined to replace the badla system by a more modern and sophisticated electronic trading system in the derivatives in India for the benefit of trading by FIIs and FFIs, who are more used to these markets.

The government is only biding the time for the broker members and investors to get ready for the introduction of the futures trading in India. Even now, the BSE members being used to Badla trading wanted a phased introduction of futures, while NSE is more willing and ready for the trading in the futures. The experience of developed countries succinctly proved that the success of future trading depends on how effectively the rules are enforced, dematerialization of physical certificates and effective and efficient system of clearing and settlement.

Experience in Emerging Countries:

China, Singapore and Hongkong have successfully introduced the Derivative markets. Countries, which introduced derivatives after 1990 among the developing countries are Brazil, Korea, Philippines, Malaysia, Argentina, and Spain, in addition to China, Singapore and Hong Kong. Many other developing countries are working towards setting up derivative markets as in the case of Turnkey, Colombia, Greece, Poland, Thailand, Indonesia etc. In this category, mention may be of India, whose efforts in this direction are in a formative stage.

The SEBI has decided on the introduction of derivatives in a phased manner and L.C. Gupta report on the subject is being implemented. The greatest hurdle in India as per this Report is regulation in which all the regulatory bodies like SEBI, RBI and Ministry of finance are seriously concerned. The derivative markets open up the gates of greater competition, globalisation and speculation.

The areas of concern are the possible manipulation, inadequate expertise and concern with the efficiency of clearing house and settlement procedures. The securities industry derivatives start with equity and go to debt instruments and spread, to all markets like foreign exchange, commodities and real estate and make these markets exposed to global forces where efficiency and manipulation are both forces to react on with.

Gupta’s Report on Derivatives:

L.C. Gupta Committee Report on Derivatives was submitted to SEBI in March 1998. The panel took a year to complete the drafting of the Report. The committee is of the view that introduction of Derivatives trading is an important component of modernising the capital markets. The trading in derivatives will provide a much needed hedge mechanism to the big players and institutional investors in the Market. The derivative segment should have a minimum of 50 Members.

The committee wanted a phased introduction of derivative trading in India under strict controls and rules. The committee has also set out a set of Rules and guidelines. Models of derivative trading as existing in some well-developed markets have been set out by the committee. The capital or networth requirements for the trading members and clearing members are set out.

The future capital market should be sophisticated with well-developed segments of all types, namely, cash market, forward market, options and futures etc. These segments will attract more foreign funds to come in through the FFIs and FIIs in particular who are familiar with this type of trading in developed countries and will be at home in these markets and make them popular with the Indian counterparts as well. The individuals and small investors may be out of this market due to strict capital adequacy norms and high margins.

Section 2 (H) of S.C. (R) Act has been amended by a notification of the Government to give recognition to derivatives as a security and promote trade in this segment of the Market.

Term Paper # 9. Derivative Market Risk Management in India:

RBI has announced its intention of developing interest rate swaps and forward markets for currencies. Forward rate agreements are also being provided by banks. Strips and asset backed securities have a greater role to play and a beginning has been made in India for residential mortgages and auto loans.

Credit swaps offers advantage of hedging risk and some institutions like IDFC can take over credit risks and banks can lend against guarantee of other banks.

Active use of derivatives requires the existence of term money market for 6 months to one year, which the RBI is trying to promote. Freeing of interest rates, in the money market, deregulation of Term deposit rates and lending rates, freedom given to banks to determine their own rates of penalty for premature withdrawals, exemption of inter-bank liabilities from the CRR and SLR requirements are some of the steps that the RBI has taken for banks to develop their own methods of risk management.

Banks have to develop the system of ALM or asset liability management by identifying mismatches for various periods of time. Some banks can quote bid and offer rates for various periods of Time Money to initiate the growth of this market. FRAs (Forward Rate Agreements) and Interest Rate Swaps (IRS) would provide good hedges against interest rate Risk. The development of forward currency market would also provide hedge against currency fluctuations. Derivative markets, short selling options and futures etc. are the next steps which the banks should be encouraged to adopt as techniques of risk management as much as corporate in India.

Methods of meeting these risks:

(1) Insurance for credit risks.

(2) Asset liability matching or exposure liability to be matched by asset changes.

(3) Matching the inflows with outflows for liquidity risk management or use of Repos.

(4) Hedging the risk such as interest rate risk or currency risk.

(5) Use of Derivative Products like options, futures, forwards, swaps, switches etc.

Repos:

Currently banks, and primary dealers (PDs) can create liquidity through Repos. Repos in the PSU bonds and corporate bonds have not grown but only in Government securities. Repos are used by RBI to control liquidity in the economy.

Short Positions:

Short positions are prohibited or restricted by the RBI and SEBI, in the debt market. But once the short sale is allowed atleast by PDs they can hedge the position without having to offload the securities in the market.

P. L. R.:

Banks fix PLRs — one for short-term advances and the other for term loans. Now the banks are free to fix their own rates. Suppose there are no fixed PLR and banks offer floating deposit rates and accordingly change the P L R as per the deposit rate changes, then the asset liability mismatches will be less.

R. U. F.:

Revolving underwriting facilities is to be provided by banks to corporate. This will increase the fee based income and allow corporate to raise short-term funds through commercial paper and other methods.