India’s tax structure exhibits the following characteristics:

1. Heavily-Biased towards Tax Revenue:

First, tax revenue is the predominant source of revenue of the Union Government.

Though, over time, non-tax revenue is yielding larger revenue, the importance of tax revenue in the tax structure is undeniable.

For instance, out of the total revenue receipts in the revenue account of Rs. 12,830 crore in 1980-81, total tax revenue yielded as much as Rs. 9,390 crores (i.e., 78.8 p.c. of the total revenue) while nontax revenue earning stood at Rs. 3,061 crores (i.e., 21.2 p.c.) However, though tax-revenue has been rising over time, in terms of percentages, it has risen.

ADVERTISEMENTS:

In 1990-91, net contribution of tax revenue towards total revenue remained stationary at 78.20 p.c. In 2008-09 (budget estimates), net contribution of tax revenue to total revenue rose to 84 p.c. while that of nontax revenue declined to 16 p.c.

In 1988-89, tax revenue as a percentage of GDP was 8.5 but it declined to6.5 p.c. in 2002-03. It then increased consistently to 8.6 p.c. of GDP in 2007-08. As against this, non-tax revenue as a percentage of GDP declined from 2.9 p.c. in 2002-03 to 1.8 p.c. in 2007-08 (Table 8.1).

2. Rising Tax-GDP Ratio:

Secondly, because of the increase in tax revenue, tax-GDP ratio has been rising. In 1980-81, tax-GDP ratio stood at 14.9 p.c. It rose to 15.4 p.c. in 1990-91 and then declined to 14.58 p.c. in 2001-02. It again rose to 18.3 p.c. in 2007-08 (BE). However, compared to other countries, India still lags far behind. In Western countries, tax-GDP ratio moves around 30-40 p.c. This means that the amount of tax collection in India in relation to GDP is miserably low.

3. Predominance of Indirect Taxes:

Thirdly, India’s tax structure before 1991 reflected the predominance of indirect taxes. Between 1990- 91 and 2002-03, direct tax-GDP ratio increased from 1.9 p.c. to 2.8 p.c. and to 5.1 p.c. in 2007- 08. Indirect tax-GDP ratio declined from 7.8 p.c. to 6.4 p.c. and to 5.9 p.c. on the other, during the same time period.

ADVERTISEMENTS:

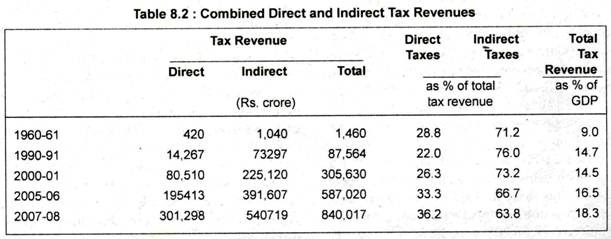

The amount of revenue collected from direct taxes in 1990-91 increased from Rs. 14,267 crores (or 16.3 p.c. of the total tax revenue) to Rs. 80,510 crore in 2000-01 (or 26.3 p.c. of the total tax revenue). By 2007-08, it rose to Rs. 307,298 crore (i.e., 36.2 p.c. of the total tax revenue).

On the other hand, the amount of revenue collected from indirect taxes rose from Rs. 73,297 crore (83.7 p.c. of the total tax revenue) to Rs. 2,25,120 crore (or 85.7 p.c. of the total tax revenue). Though it increased to Rs. 540,719 crore, in percentage terms it fell to 63.8 p.c. in 2007-08.

In the last couple of years (1990-91 —2007-08), this ratio has changed to 36: 64 as against 16:84 in 1990-91. This ratio was 40:60 in 1950- 51. Thus, over the last 40 years or so, India’s tax structure was heavily tilted in favour of indirect taxes. Now it is heading in the right direction.

4. Corporate Tax, the Largest Direct Tax:

Fourthly, among the direct taxes, corporate tax yields the largest revenue. It yielded 4 p.c. of GDP in 2007-08 as against 1.9 p.c. in 2000-04. The bulk of corporate taxes is collected from public sector undertakings, mainly petroleum- producing companies. Contribution of personal income taxes has also increased from 1.5 p.c. in 2000-04 to 2.5 p.c. in 2007-08.

ADVERTISEMENTS:

Finally, the importance of agricultural income tax is negligible in India:

Service tax—a great source of indirect tax:

Finally, in the Union Budget a buoyant source of tax revenue—service tax (1994-95)— was imposed. This means some services are taxable. There are more than 100 services now that are subject to service tax.

5. Defects of the Tax Structure:

From these features, one can point out the major defect—in India the tax rate is very high but the contribution to the total tax revenue is very low.

i. Greater dominance of indirect taxes:

In the 1950s, the rate of income tax in India was the highest in the world but the revenue earned was insignificant. This is because high tax rates encouraged tax evasion and avoidance on a large scale. So the government has been gradually reducing the tax rate as soon as the tax reforms era began. In spite of this, the rate of income tax in India is one of the highest in the world even today.

Although the rate of income tax is the highest in India, the contribution from such is very low. Tax evasion seems to be the proximate reason. Another reason is the high exemption limit in a country where per capita income is very low. In India, the exemption limit has been raised from time to time, but the levels of national and per capita incomes have failed to increase proportionately.

Consequently, more and more people have managed to come out of the tax net. It is a pity that the percentage of people paying income tax in India at present is less three—and naturally the major reliance is on indirect taxes. In fact, an undue reliance on indirect taxes is a common feature of the fiscal system of LDCs.

We know that successful mobilisation of tax revenue depends on the degree of elasticity and buoyancy of tax revenue. Tax structure is said to be an elastic one if increase in tax revenue exceeds that of the national income growth. Unfortunately, India’s tax structure exhibits tax revenue as an inelastic one. However, tax reform measures introduced since July 1991 have helped in correcting the imbalances in the structure of revenue resources.

ADVERTISEMENTS:

In the 1980s, supply side economics came to the limelight. This school of thought, headed by Prof. Laffer, argued that lower the rate of taxes greater is the tax compliance. This argument is presented by a curve popularly known as the “Laffer curve”. Current tax reform measures in India are surely a reflection of the Laffer curve. The recent trend in direct tax collection indicates this. Prior to reform, high rates of direct taxes did not yield high collections.

The reduction in personal and corporate tax rates over the past years have brought a substantial increase in tax collections. As a result of all these, primary deficit, revenue deficit and fiscal deficit as a percentage of GDP are declining.

In India, the importance of indirect taxes has increased over the years which implies that the importance of direct taxes has diminished. In absolute terms (i.e., in terms of rupee) the contribution of direct taxes has increased but the percentage contribution of such taxes in total tax revenue has declined.

ADVERTISEMENTS:

It is observed that combined tax revenue as a percentage of GDP has increased from 9.0 p.c. in 1960-61 to 18.3 p.c. in 2007-08. During the same period, the percentage contribution of direct taxes has increased from 28.8 to 36.2 p.c., while that of indirect taxes has decreased from 71.2 to 63.8 p.c. Rising tax-GDP ratio is another area where one gets some sort of satisfaction. The tax-GDP ratio for 2007-08 rose to 12.5 p.c. from 8.2. p.c. in 2001-02. These increasing trends can be attributed to the rationalisation of the country’s direct tax structure.

Reasons for predominance of indirect taxes prior to economic reforms introduced in 1991 and thereafter were: (i) narrow base of direct taxes, (ii) virtual absence of agricultural income tax, and (iii) massive increase in government expenditure over the years. In addition, public sector enterprises contributed very little toward mobilising resources.

All these forced government to rely on excise duty, customs duty and sales tax as important sources of revenue. However, after 1991, the situation has changed and the contribution of direct taxes vis-a-vis indirect taxes has been rising. Direct-indirect tax ratio has moved from 23.8: 76.2 in 1990-91 to 36.2: 63.8 in 2007-08. This is a healthy sign as far as the country’s tax structure is concerned.

ii. High collection cost of taxes:

ADVERTISEMENTS:

Thirdly, India’s tax structure is characterised by rising cost of collection. This means that the tax structure in some cases is unproductive. For instance, the cost of collection of income tax of rupee one was Rs 3.45 in 1991. It declined to Rs. 2.59 for the collection of one rupee income tax in 2007-08.

iii. Change in commodity tax structure:

Fourthly, there has been a rational change in commodity tax structure only after 1991. First, MODVAT was introduced in 1986 and was extended in 2000-01 when it was renamed as CENVAT. There had been a proposal for the introduction of VAT in place of union excise duties and other commodity taxes. VAT was introduced in 2005 in 20 states of India. Now it is in vogue in all the states.