The following points highlight the eight major defects in the tax structure of India.

Defect # 1. High Rate and Low Yield of Direct Taxes:

In India, as in other LDCs, the rate of direct tax is very high but the contribution to the total tax revenue is very low.

In the 1950s, the rate of income tax in India was one of the highest in the world but the revenue was very insignificant. This is because high tax rates encouraged tax evasion and avoidance on a large scale. It may be noted in this context that tax avoidance refers to arranging one’s financial affairs within the law so as to minimise taxation liabilities, as opposed to tax-evasion which is failing to meet actual tax liabilities through, e.g., not declaring income or profit. So the Government gradually reduced the tax rate over the years. In spite of this, the rate of income tax in India is one of the highest in the world even today. The higher tax rate (including surcharge) at present is 30% (plus surcharge of 2%).

Defect # 2. Low Contribution of Income Tax:

Although the rate of income tax is the highest in India, the contribution from such is very low. Tax evasion seems to be the primary reason. Another reason is the high exemption limit in a country where per capita income is very low. In India, the exemption limit has been raised from time to time, but the levels of national and per capita incomes have failed to increase proportionately.

ADVERTISEMENTS:

Consequently, more and more people have managed to come out of the tax net. India’s per capita income in 1999-2000 was Rs. 16,047 at current prices but the exemption limit in case of personal income tax was Rs. 50,000. If other deductions are brought into consideration (such as investment in approved Government securities such as NSCs, units of UTI, of public provident fund, or insurance policies), the exemption limit would be even more. It is a pity that the percentage of people paying income tax in India at present is less than one. Naturally, the major reliance is on indirect taxes. In fact, an undue reliance on indirect taxes is a common feature of the system of LDCs.

Defect # 3. Double Taxation of Dividends:

Moreover, due to double taxation of dividend, the rate of domestic saving and capital formation has failed to increase appreciably. Companies pay corporation and other taxes (such as excess profit tax or surtax) to the Government. A portion of net profit after tax is usually distributed among shareholders in the form of dividend. A portion of such dividend income is again taxed away in the form of personal income tax.

Consequently, those who pay tax on dividend income cannot save much and companies find it increasingly difficult to raise financial resources on a large scale. It is often alleged that one of the cause of industrial stagnation in India has been the high rate of taxation and slow growth of corporate capital. The problem has assumed serious proportions in recent years.

Defect # 4. Absence of Agricultural Income Tax:

Another feature of India’s tax system is that there is no tax on agricultural income. Agriculture is the dominant sector of the Indian economy. The contribution of agriculture and related activities to India’s GDP was 29.3% in 1999-00. Planned investment on agriculture has also increased over the years. But agriculture has failed to make any contribution to the introduction of the Government’s tax revenue. Since agriculture is a State subject, the introduction of the agricultural income tax system at the Central level has not been possible. This is another reason for undue reliance on indirect taxes.

Defect # 5. Importance of Indirect Taxes:

ADVERTISEMENTS:

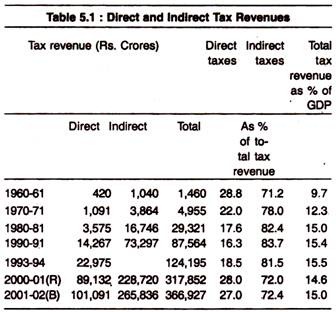

In India, importance of indirect taxes has increased over the years which implies that the importance of direct taxes has diminished. In absolute terms (i.e., in terms of rupee) the contribution of direct taxes has increased but the percentage contribution of such taxes in total tax revenue has declined as Table 5.1 shows.

It is observed that tax revenue as a percentage of GDP has increased from 9 in 1960-61 to 15 in 2001-02. During the same period, the percentage contribution of direct taxes has declined and that of indirect taxes increased. However, with the introduction of tax reforms in recent years, the ratio of indirect to direct taxes has come to about 27.6:72.4 in 2001-02. This is the most significant change that has occurred in India’s tax structure in the whole plan period. It seems that substantial reliance on indirect taxes is unavoidable in our country in the foreseeable future.

Defect # 6. Progressive Taxes on Income:

The Government has made the system of direct tax progressive and progressiveness is considered desirable in the interest of equity and for reducing the disparities in the distribution of income and wealth. But progressive taxes encouraged tax evasion and avoidance and have failed to reduce inequalities of income and wealth.

Defect # 7. Widening the Indirect of Tax Net:

ADVERTISEMENTS:

Over the years, the indirect tax net has been spread wide. Almost all the commodities that we buy bear high indirect taxes as sales tax, excise duty, customs duty, octroi, cess and so on. At present, Central Government revenue from two main taxes, viz., union excise duties and customs accounts for about 80% of the total revenue.

The collection from these two taxes amounted to Rs. 81,720 crores and Rs. 54,822 crores, respectively, in 2001-02. However, the major defect of the present system of indirect taxes is the cascading effect (i.e., the cumulative burden) of such taxes. In India we find a multiplicity of levies. The same commodity or factor of production (such as raw material or purchased component) is taxed more than once as it passes through different stages of production and distribution.

There is tax such as State sales tax on an item on which union excise duties has already been paid. There is, for instance, not only excise duty or sales tax on finished cars but also on tyres, tubes and other components. Due to the multiplicity of levies the cascading effect cannot be avoided. Thus, indirect taxes have caused cost-push inflation in India.

Defect # 8. Regressive Nature:

Moreover, indirect taxes have become more and more regressive over the years. Such taxes are usually imposed on consumption goods. In general, poor people have a high propensity to consume than the rich people. In fact, the marginal propensity to consume gradually decreases with an increase in income.

Thus poor people, who spend the major portion of their small income on consumption goods, pay the maximum amount of indirect taxes. Thus, over the years, the direct tax system has become less and less progressive due to gradual reduction in the personal income tax rate, while indirect taxes have become more and more regressive due to the inclusion of more and more items in the excise net.

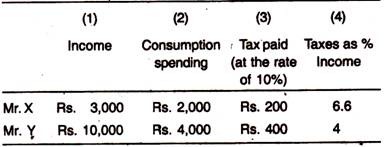

A simple example will classify the point. Suppose we consider two individuals—Mr. X and Mr. Y. Their monthly incomes are Rs. 3,000 and Rs. 10,000, respectively. Mr. X spends Rs. 2,000 per month on consumption goods and Mr. Y Rs. 4,000. Suppose there is 10% excise duty on all items of consumption.

So the tax burden of the two individuals may now be calculated as follows:

Table 5.2: Regressiveness of Indirect taxes

Thus, in absolute terms, Mr. Y pays Rs. 400 to the Government in the form of indirect taxes. But Mr. X pays only Rs. 200. But the tax on Mr. X is much higher than that of Mr. Y, as Table 5.2 shows. Mr. X pays 6.6% of his monthly income in the form of tax, while Mr. Y pays only 4%.

ADVERTISEMENTS:

This example makes it clear that indirect taxes are highly regressive in nature. They fall more heavily on people who have a strong propensity to consume and less heavily on the rich people who have a strong propensity to save. This is another important change that has occurred in India’s tax structure during the plan period.

However, the taxation measures undertaken in the recent years intend to achieve reforms in the structure of all types of taxes and are designed to further the basic objectives of economic growth, equity, simplicity and built-in revenue-raising capacity. Accordingly, personal income tax has been restructured with lower taxes, fewer slabs and higher exemption limit.

The system of taxation of firms by eliminating the distinction between registered and unregistered firms has been re-valued to widen the tax net; a scheme of presumptive taxation has been introduced for petty traders, and small transport operators. To plug the loopholes and leakage of revenue, minors’ income has been clubbed with that of their parents.

ADVERTISEMENTS:

Taxation of capital gains has been completely restructured, so that only capital gains net of price increases, would be taxed. Several measures aiming at improving tax compliance—such as voluntary disclosure reliance and simplifying tax administration—have been introduced. Still more reforms are due and the Government will have to adopt some more effective measures.

Trends in tax revenue in the post-reform period:

In the post-reform period (1991-92 to 2000-01) total tax revenue has a proportion of GDP has fallen by about 1% due to a fall in the indirect tax component. This is due to the rationalisation of custom and excise duties in 1990. Direct tax revenue as a proportion of GDP has risen from 2% in 1991-92 to 2.8% in 2000-01. This compositional changes in the structure of tax revenue has been in the desired direction as direct taxes are generally less distortionary in impact than indirect taxes, i.e., direct tax do not have excess burden.