In the general equilibrium analysis, a study is made of the effects of tariff on consumption, production, trade and welfare. When a country imposes a tariff, not only a specific product or sector but practically every sector of the economy gets affected in one way or the other, until the economic system reaches a new equilibrium position.

In this connection, Kindelberger remarked that a tariff is “…likely to alter trade, prices, output and consumption, and to reallocate resources, change in factor proportions, redistribute income, change employment and alter the balance of payments.” The general equilibrium analysis of tariff is made from the viewpoint of a small country and a large country.

General Equilibrium Analysis of Tariff in a Small Country:

When the tariff-imposing country is small, the domestic price of the importable commodity will rise by the full amount of tariff for the individual consumers and producers in that small tariff-imposing country. The international price of the commodity will, however, remain unaffected. The divergence between the price of the importable commodity for individual producers and consumers and the importing country as a whole is of crucial importance in analysing the effect of tariff upon welfare.

Assumptions:

ADVERTISEMENTS:

The general equilibrium analysis of tariff in case of a small country can be attempted on the basis of the following assumptions:

(i) The trade takes place between two countries – A and B.

(ii) The home country A is small.

(iii) There are two commodities, cloth and steel, being exchanged between them.

ADVERTISEMENTS:

(iv) Cloth is exportable and steel is importable commodity.

(v) The imposition of tariff by A upon importable commodity steel raises the import price of steel for domestic producers and consumers upto the full amount of tariff.

(vi) World price of steel remains unaffected.

(vii) The revenues collected by the government through tariff are spent by the government to subsidies public consumption such as schools, health services etc.

ADVERTISEMENTS:

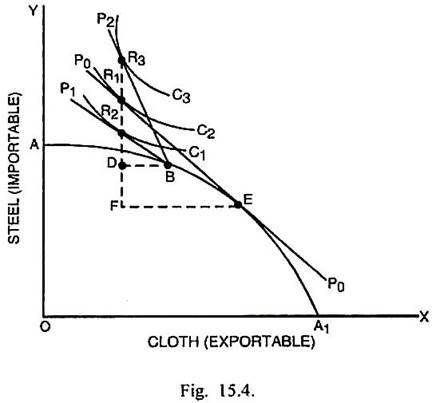

The production and consumption effects of tariff upon country A can be analysed through Fig. 15.4.

In Fig. 15.4., the production possibility curve related to two commodities cloth and steel is AA1. In the absence of international trade, the point of consumption and production equilibrium is B. In the conditions of free international trade, P0P0 is the international exchange ratio line and the production equilibrium point is E.

The consumption equilibrium point is R1 that lies on the community indifference curve C2. In this situation, country A exports FE quantity of cloth and imports R1F quantity of steel. If tariff is imposed but the world prices of commodities remain the same, the international exchange ratio line is P1B which is parallel to the original international exchange ratio line P0P0.

Now production equilibrium shifts to B where country A produces a large quantity of steel (importable good) domestically. This is the production or protective effect of tariff. The consumption equilibrium shifts from R1 to R2 where the international exchange ratio line P1B becomes tangent to a lower community indifference curve C1.

It shows that tariff has caused a reduction in the welfare of tariff-imposing small country. The shift in consumption point from R1 to R2 signifies the consumption effect of tariff. After tariff, country exports BD quantity of cloth and imports R2D quantity of steel.

Thus in the case of a small tariff-imposing country, the import tariff has adverse effects. Firstly, since world prices of exchanged commodities remain unchanged, tariff fails to bring about an improvement in the terms of trade for the home country A.

Secondly, although there is an increased production of import-substitutes within the home country yet the diversion of resources from the production of cloth, in case of which the country was enjoying comparative advantage and was having specialisation, shows the misallocation of resources and consequent loss to country A.

Thirdly, the shift of consumption equilibrium to a lower community indifference curve indicates loss in welfare for the tariff-imposing country.

ADVERTISEMENTS:

Fourthly, tariff not only reduces imports but also the exports of the tariff-imposing country. The reduction in the volume of trade is not only a loss to the tariff- imposing country but also for the rest of the world.

General Equilibrium Analysis of Tariff in a Large Country:

If the tariff-imposing country is large, the reduced demand for imports subsequent upon the imposition of tariff may reduce the world demand for the product to such a great extent that the price of importable good falls. In such a situation, the fall in import price relative to export price causes a change in the international price ratio and brings about an improvement in the terms of trade of the tariff-imposing large country.

The production effect, consumption effect and terms of trade effect due to tariff can be explained through Fig. 15.4. If tariff causes a fall in the price of importable commodity steel relative to the price of exportable commodity, the international exchange ratio line shifts to P2B, which is more steep than the exchange ratio line P0P0 or P1B.

In this case, the production equilibrium takes place at B and consumption equilibrium occurs at R3 where P2B becomes tangent to the higher community indifference curve C3. The large tariff-imposing country A imports R3D quantity of steel and exports BD quantity of cloth. A higher ratio of imports to exports indicates that the terms of trade have become favourable for the tariff imposing-country A.

ADVERTISEMENTS:

The production or protective effect is in the form of increased domestic production of importable commodity steel owing to shift in the production equilibrium from E to B. No doubt, lesser production of cloth involves misallocation of resources and reduced specialisation in production, yet the country A is better off because of positive consumption and terms of trade effects.

The shift of consumption equilibrium to the highest community indifference curve C3 signifies a gain in welfare despite reduction in specialisation and diversion of resources towards the production of import-substitute. This is the positive consumption effect. In the case of a large tariff-imposing country, since there is a fall in price of imports relative to export prices, there is an improvement in the terms of trade. This is the positive terms of trade effect.

Hence the imposition of tariff by a large country, despite the reduction in the volume of international trade, leaves it a net beneficiary from the policy of tariffs.