The following points highlight the four main factors which affect economic rent.

1. Economic Rent and Land:

In the case of land which is completely specific, i.e., what has only one use, the whole of its income is economic rent. Since it has no alternative use it cannot be transferred to another use.

In other words, it will remain in that use for an indefinite period even when its earnings are zero. In reality, however, we observe that most land has alternative uses. Suppose a plot of land has alternative uses. It will be earning economic rent if—and only if—its income in its present use exceeds what it could earn in its next best use.

A simple example will make the point clear. Suppose a small plot of land is being used for growing wheat and the farmer is paying a rent of Rs. 90 per acre for it. Its next best (or most profitable) use would be for growing jute. But another farmer who is willing to the land for jute cultivation is just ready to pay Rs. 75 per acre. Thus, according to modern theory, payment for the land in its present use (i.e., wheat cultivation) contains as rent element of Rs. 15 per acre.

ADVERTISEMENTS:

Now, it is quite obvious that any price greater than Rs. 75 per acre will cause this plot of land being transferred from jute to wheat. It is a matter of relative demand and relative supply. If it is really profitable to produce wheat, farmers will bid against each other for suitable and available land and this very fact could cause the rent per acre to rise well above the transfer earnings of the plot of land.

2. Economic Rent and Labour:

Economic rent is a payment to a factor of production which is in excess of the supply price of that factor. Take the example of a person in Civil Service job earning Rs. 60,000 a year. If he had not joined the Civil Service he would have gone to teach in college where he would have been earning Rs. 40,000 a year.

Thus Rs. 40,000 represents the person’s transfer earnings. If the Civil Service cut his earnings to below Rs. 40,000 he would leave and go to work in a college instead, but provided that he receives Rs. 40,000 he will stay in the Civil Service. Therefore he would be prepared to work in his present job for Rs. 40,000, yet he is being paid Rs. 60,000. The extra Rs. 20,000 is economic rent—a payment in excess of the supply price or transfer cost.

One may consider the phenomenal amounts being earned by some of the top singers today. If they had not taken up singing, they would most probably be in jobs where their earnings would be much less. There is therefore a high element of economic rent in the earning which they now receive. They are given these high payments because of the particular skills which they possess and such rent is known as the ‘rent of ability’.

ADVERTISEMENTS:

Further examples are found in other sports, films, etc. The high earnings in such cases contain a large element of economic rent and this occurs because the supply of such talent is limited in relation to the demand for it. Once the demand for a particular star, whether in sport or music, falls, the earnings also fall drastically and quickly.

The amount of rent in wages obviously depends upon the elasticity of supply and the level of demand. Elasticity of supply, in turn, depends largely on mobility. The higher the mobility of labour, the more elastic will be the supply of labour and the smaller will be the element of economic rent.

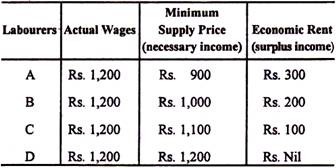

Economic rent in wages of the different labourers is shown in Table 13.2:

Table 13.2: Rent Element in Wages

Highly specialised labour is in very inelastic supply. This is true of film stars, cricketers and singers. A superstar has, it seems, some unique characteristic and supply of his (her) particular talent is perfectly inelastic (because it cannot be duplicated overnight). The earning of such a person probably contains a huge amount of economic rent.

His relatively high rewards are due to the fact that his service is in much higher demand relative to its supply. His transfer earnings will be very much less than his current remuneration because his market value outside his own specialised profession is probably very low. One wonders whether Sachin Tendulkar could earn more than Rs. 5,000 per month outside cricket!

It may be added that earnings of superstars can reach very high figures in a very short time period and transfer earnings constitute a very small proportion of their incomes. But we often observe that the popularity of many superstars does not last for long. So their earnings fell as quickly as they rose.

3. Economic Rent and Capital:

Economic rent can also be found in relation to capital. Consider a machine which has only one use —often being installed in a factory. It cannot be transferred to any other use. So any revenue it makes above its operating costs is surplus income or economic rent, because the only alternative is to keep the machine idle, in which case revenue would be zero. (This is true only in the short run.In the long run the machine will wear out and a decision will have to be made as to whether or not to replace it. Therefore, in the long run some of the revenue of the machine will be transfer earnings, because if a certain level of revenue has not been achieved, no such machine will be purchased.)

Much of a nation’s capital stock consists of highly specialised equipment. Each machine is designed for a particular purpose and cannot be transferred to another use easily and quickly. Once an equipment (such as a blast furnace) is installed, it cannot be transferred to any other use except steel production. So it will be used so long as the operating cost (i.e., variable cost) is covered.

Therefore, any return from the equipment which is greater than variable cost is to be treated as surplus income or economic rent. In other words, the transfer cost of the equipment is its current operating cost. If this cannot be covered the machine will not be used. It will be kept idle. So one is going to lose more than its fixed costs.

However, in the long-run the machine will be replaced if the revenue derived from it is sufficient to cover, both variable costs and depreciation. These two together constitute its transfer cost (earnings). Unless this transfer cost is covered the supply of this equipment to the iron and steel industry will gradually cease.

4. Economic Rent and Organisation (Entrepreneurship):

Economists make use of the concept of normal profit to refer to the maximum rate of return which is necessary to keep an entrepreneur in his existing line of business. Thus, normal profits might well be regarded as the entrepreneur’s transfer earnings. And any super-normal or excess profit (excess of TR over TC) has to be treated as surplus income or economic rent. It is to be noted that normal profit varies from industry to industry depending on the degree of risk involved.

The minimum expected rate of profit required to induce a firm to go for oil exploration will obviously be much greater than that needed to keep a firm in the transport business. Since even (abnormal) profits can only be maintained in the long run only where there is a monopoly situation, such abnormal profits go by the name monopoly rent.