Let us make an in-depth study of deficit financing and its effect on LDCs.

If the usual sources of finance are inadequate for meeting public expenditure, a government may take resort to deficit financing — particularly in an underdeveloped country like our own. It refers to the creation of new money for filling up the gap between planned expenditure and estimated receipts. It implies deliberate budgeting for a deficit.

The government budget is said to be in deficit when its current expenditure exceeds its current revenue. Keynes suggested that, during deep depression and severe unemployment, a budgetary deficit should be deliberately incurred, taxes being reduced in order to make more purchasing power available as a stimulus to demand.

A budget deficit arises when the expenditure planned for the current year exceeds the revenues expected to be obtained during the same period. The deficit may be met by raising the rates of taxation or by charging higher prices for goods and services supplied by the government (e.g., railway fares).

ADVERTISEMENTS:

The deficit may also be met from the accumulated cash balances of the government or by borrowing from the banking system. If the last two methods (expenditure from cash balances or borrowing) are followed, there is said to be deficit financing.

If the government sells bonds to finance the deficit, the result will generally be less expansionary than if it had printed new money. By increasing its purchase of goods and services, the government puts additional funds into the income stream by the same amount, which, ultimately, causes the change in the money supply to be greater than the increase in expenditures.

By selling bonds to finance this increase in expenditures, it then takes an equal amount of funds out of the income stream. If the funds are borrowed simultaneously with the expenditures, the monetary base and, therefore, the money supply, remains constant.

Deficit financing in India is made in the two ways mentioned above either by drawing down the cash balances of the government or by borrowing from the Reserve Bank of India. When the government draws down its cash balances, they become active and come into circulation.

ADVERTISEMENTS:

Again, when government borrows from the Reserve Bank, the latter gives this loan by printing additional notes. Thus, in both cases, ‘new money’ comes into circulation. As a result, inflation may occur, because the supply of goods does not simultaneously increase with the increase in money supply.

Deficit financing occupies a pivotal position in any programme of planned economic development. But it has one major defect. It creates excess purchasing power. Hence it is inherently inflationary, unless accompanied by a corresponding and proportionate fall in the income velocity of money. In other words, it inflates the money value of the national income through the price effect.

On the positive side it increases effective demand which, if there exists unemployed labour and other factors of production, may raise employment and output and, to some extent, undo the price effect.

To quote Prof. Alak Ghosh; “Deficit financing, undertaken for the purpose of building up useful capital during a short period of time, is likely to improve productivity and ultimately increase the elasticity of supply curves.” And the increase in productivity can act as an antidote against price inflation.

ADVERTISEMENTS:

The most important thing to secure from deficit financing is the generation of economic surplus during the process of development. If this saving is productively employed, it will lead to a substantial amount of capital generation and growth.

The essence of the matter is whether additional public expenditure on development projects is equal to the saving generated in the process. If there is an exact balancing between the two and public investment is made on productive projects — which give a steady rate of return year by year — there is likely to be a mild dose of inflation — which is conducive to the whole process of development.

In developing countries like India the root cause of inflation lies in inelasticity of supply of essential goods. If such supply can be stepped up pari passu with money creation, there is no danger of inflation. But, in reality, this does not happen and some amount of inflation is inevitable.

However, everything depends upon the magnitude of deficit financing undertaken by the government and its phasing over the time horizon of the development plan. If there is continuous deficit in the budget, this must be accompanied by additional taxation so as to reduce the excess purchasing power that is likely to be created through printing of paper money. There is also need for price control- cum-rationing in such periods.

Deficit Financing (DF) and LDCs [Optional]:

Deficit financing (DF) has played an important role in many LDCs. Given the inability of their governments to mobilise enough resources to achieve a desired rate of growth, unreliability of foreign investment and lack of tax elasticity, the temptation to adopt DF is understandable.

It remains to be pointed out that, for DF to be effective in the LDCs, the supply of output must be elastic with respect to demand. Otherwise, inflation is bound to occur.

To count the net benefit of DF, it is necessary to examine the costs of inflation against the possible gains in resource mobilisation.

Among these costs, most important are:

ADVERTISEMENTS:

(a) distortions of real rates of return;

(b) inefficiency in allocation;

(c) inequalities in income distribution; and

(d) an increase in imports and unemployment.

ADVERTISEMENTS:

Among the possible benefits are the stimulus to profitability and investment, greater utilisation of capacity because of increased demand and consequent lowering of the costs of production and a larger investment.

The other points in its favour are, first, if an increase in money supply can stimulate growth, its presence can be tolerated. Here it is important to find out the ‘optimal’ level of money supply. Second, if income distribution becomes more unequal because of DF, then a rise in profit share will stimulate investment. If, however, profits are not reinvested, then growth is likely to suffer.

Also, if private saving is not forthcoming spontaneously, the government may resort to DF for generating more savings.

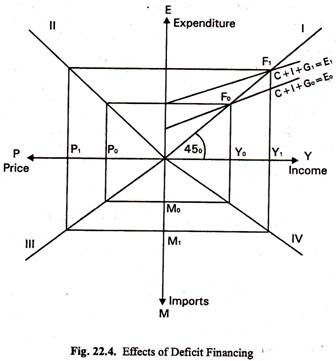

If the aggregate supply is very inelastic, then the different effects of DF can be shown with the help of Fig. 22.4. In quadrant I, the Keynesian income-expenditure equilibrium is shown by point F. A tax cut or a rise in public expenditure — or both — will stimulate monetary demand and this is shown by the shift of the expenditure line from E0 to E1.

ADVERTISEMENTS:

A rise in aggregate demand raises the price level from P to P in quadrant II. In quadrant III, the effect of such a rise in domestic prices is shown on the imports and balance of payments. Thus, imports tend to rise from M0 to M1. Quadrant IV shows the relationship between a change in money income and imports and this relationship to be positive.

Note that the fall of unemployment is virtually nothing if supply does not respond with changes in demand. Indeed, as the rates of inflation increase with demand stimulation, unemployment may actually rise. This implies that in LDCs, since a ‘money’ multiplier rather than a ‘real’ multiplier operates, the Keynesian theory has a very limited role to play.

On the other hand, supporters of DF argue that as long as public expenditure takes place in quick-yielding investment with a short gestation period and/or if DF of such investment could reduce the capital-output ratio (either through the choice of appropriate technology or by greater utilisation of existing excess capacity) then growth rate could indeed rise.

The empirical evidence available so far does not help much to say anything very conclusively. In fact, DF, by generating moderate rate of inflation, may help to promote growth, but, once again, the evidence seems to go against the use of a high rate of inflation. To what extent there is a direct and significant correlation among DF, inflation and growth in the LDCs is not yet clear.