Deficit financing has played an important role in many LDCs. Given the inability of their governments to mobilise sufficient resources to achieve a desired rate of growth, inadequate flow of foreign investment and lack of tax elasticity, the reliance on deficit financing is unavoidable.

However, for deficit financing to be effective in LDCs the supply of output must be elastic. Otherwise, demand- pull inflation is likely to raise its ugly head. To measure the net benefit of deficit financing, we have to compare the cost of inflation with the possible gains in resource mobilisation.

Among these costs, most important are:

(a) Distortions of real rates of return;

ADVERTISEMENTS:

(b) Inefficiency in allocation;

(c) Inequalities in income distribution; and

(d) An increase in imports and unemployment.

Among the possible benefits are the stimulus to profitability and investment, greater utilisation of capacity because of increased demand and consequent lowering of the costs of production should there be excess capacity, and a larger investment provided that private investment was not forthcoming in any case.

ADVERTISEMENTS:

The other points in favour of deficit financing are, first, if an increase in money supply can stimulate growth, its presence can be tolerated. Here, it is important to find out the ‘optimal’ level of money supply. Secondly, if income distribution becomes more unequal because of deficit financing, then a rise in profit share will stimulate investment.

If, however, profits are not reinvested, then growth is likely to suffer. Also, if private saving is not forthcoming spontaneously, government may resort to deficit financing for generating additional savings.

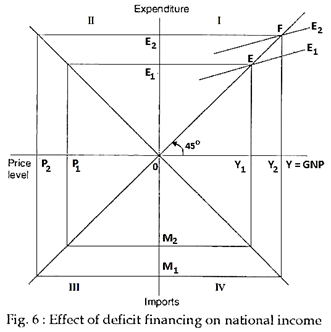

If the aggregate supply is very inelastic, then the different effects of deficit financing can be shown with the help of Fig. 6. In quadrant 1, the Keynesian income-expenditure equilibrium is shown at F. A tax cut or a rise in public expenditure or both will stimulate monetary demand and this is shown by the shift of the expenditure line from E1 to E2.

A rise in aggregate demand raises the price level from P1 to P2 in quadrant II. In quadrant III, the effect of such a rise in domestic prices is shown on the imports and balance of payments. Thus, imports tend to rise from M1 to M2. Quadrant IV shows the relationship between a change in money income and imports and this relationship is assumed to be positive.

ADVERTISEMENTS:

Note that the fall of unemployment is virtually nothing if supply does not respond with changes in demand. Indeed, as the rates of inflation increase with demand stimulation, unemployment may actually rise. This has led some to conclude that in LDCs since a ‘money’ multiplier rather than a ‘real’ multiplier operates, the Keynesian theory has a very limited role to pay.

On the other hand, supporters of the deficit financing theory argue that as long as public expenditure takes place in quick-yielding investment with a short fruition-lag and/or if deficit financing of such investment could reduce the capital-out- put ratio either through the choice of appropriate technology or by greater utilisation of existing excess capacity, then growth rate could indeed rise.

The empirical evidence available so far does not help us to reach any clear conclusion. The deficit financing, generating moderate rate of inflation may help to promote growth, but once again, the evidence seems to weigh against the use of a high rate of inflation.