Deficit Financing: Meaning, Effects and Advantages!

Meaning of Deficit Financing:

Deficit financing in advanced countries is used to mean an excess of expenditure over revenue—the gap being covered by borrowing from the public by the sale of bonds and by creating new money. In India, and in other developing countries, the term deficit financing is interpreted in a restricted sense.

The National Planning Commission of India has defined deficit financing in the following way. The term ‘deficit financing’ is used to denote the direct addition to gross national expenditure through budget deficits, whether the deficits are on revenue or on capital account.

The essence of such policy lies in government spending in excess of the revenue it receives. The government may cover this deficit either by running down its accumulated balances or by borrowing from the banking system (mainly from the central bank of the country).

ADVERTISEMENTS:

The ‘Why’ of Deficit Financing:

There are some situations when deficit financing becomes absolutely essential. In other words, there are various purposes of deficit financing.

To finance war-cost during the Second World War, massive deficit financing was made. Being war expenditure, it was construed as an unproductive expenditure during 1939-45. However, Keynesian economists do not like to use deficit financing to meet defence expenditures during war period. It can be used for developmental purposes too.

Developing countries aim at achieving higher economic growth. A higher economic growth requires finances. But private sector is shy of making huge expenditure. Therefore, the responsibility of drawing financial resources to finance economic development rests on the government. Taxes are one of such instruments of raising resources.

ADVERTISEMENTS:

Being poor, these countries fail to mobilize large resources through taxes. Thus, taxation has a narrow coverage due to mass poverty. A very little is saved by people because of poverty. In order to collect financial resources, government relies on profits of public sector enterprises. But these enterprises yield almost negative profit. Further, there is a limit to public borrowing.

In view of this, the easy as well as the short-cut method of marshalling resources is the deficit financing. Since the launching of the Five Year Plans in India, the government has been utilizing seriously this method of financing to obtain additional resources for plans. It occupies an important position in any programme of our planned economic development.

What is important is that low incomes coupled with the rising expenditures of the government have forced the authorities to rely on this method of financing for various purposes. There are some situations when deficit financing becomes absolutely essential. In other words, there are various purposes of deficit financing.

These are:

ADVERTISEMENTS:

i. To finance defence expenditures during war

ii. To lift the economy out of depression so that incomes, employment, investment, etc., all rise

iii. To activate idle resources as well as divert resources from unproductive sectors to productive sectors with the objective of increasing national income and, hence, higher economic growth

iv. To raise capital formation by mobilizing forced savings made through deficit financing

v. To mobilize resources to finance massive plan expenditure

If the usual sources of finance are, thus, inadequate for meeting public expenditure, a government may resort to deficit financing.

The ‘How’ of Deficit Financing:

A budget deficit arises when the estimated expenditure exceeds estimated revenue. Such deficit may be met by raising the rates of taxation or by the charging of higher prices for goods and public utility services. The deficit may also be met out of the accumulated cash balances of the government or by borrowing from the banking system.

Deficit financing in India is said to occur when the Union Government’s current budget deficit is covered by the withdrawal of cash balances of the government and by borrowing money from the Reserve Bank of India. When the government draws its cash balances, these become active and come into circulation.

Again, when the government borrows from the RBI, the latter gives loan by printing additional currency. Thus, in both cases, ‘new money’ comes into circulation. It is to be remembered here that government borrowing from the public by selling bonds is not to be considered as deficit financing.

Effects of Deficit Financing:

Deficit financing has several economic effects which are interrelated in many ways:

ADVERTISEMENTS:

i. Deficit financing and inflation

ii. Deficit financing and capital formation and economic development

iii. Deficit financing and income distribution.

i. Deficit Financing and Inflation:

ADVERTISEMENTS:

It is said that deficit financing is inherently inflationary. Since deficit financing raises aggregate expenditure and, hence, increases aggregate demand, the danger of inflation looms large. This is particularly true when deficit financing is made for the persecution of war.

This method of financing during wartime is totally unproductive since it neither adds to society’s stock of wealth nor enable a society to enlarge its production capacity. The end result is hyperinflation. On the contrary, resources mobilized through deficit financing get diverted from civil to military production, thereby leading to a shortage of consumer goods. Anyway, additional money thus created fuels the inflationary fire.

However, whether deficit financing is inflationary or not depends on the nature of deficit financing. Being unproductive in character, war expenditure made through deficit financing is definitely inflationary. But if a developmental expenditure is made, deficit financing may not be inflationary although it results in an increase in money supply.

To quote an expert view: “Deficit financing, undertaken for the purpose of building up useful capital during a short period of time, is likely to improve productivity and ultimately increase the elasticity of supply curves.” And the increase in productivity can act as an antidote against price inflation. In other words, inflation arising out of inflation is temporary in nature.

ADVERTISEMENTS:

The most important thing about deficit financing is that it generates economic surplus during the process of development. That is to say, the multiplier effects of deficit financing will be larger if total output exceeds the volume of money supply. As a result, inflationary effect will be neutralized. Again, in LDCs, developmental expenditure is often pruned due to the shortage of financial resources.

It is the deficit financing that meets the liquidity requirements of these growing economies. Above all, a mild dose of inflation following deficit financing is conducive to the whole process of development. In other words, deficit financing is not anti- developmental provided the rate of price rise is slight.

However, the end result of deficit financing is inflation and economic instability. Though painless, it is very much inflation-prone compared to other sources of financing.

Some amount of inflation is inevitable under the following circumstances:

(a) When the economy is fully employed, increased money supply increases aggregate money income through multiplier effect. As there is no excess capacity in the economy, such increased money income results in an increased aggregate expenditure— thereby fuelling inflationary rise in prices.

Again, a persistent deficit financing policy would soon directly lead to inflationary price rise. It is true that the gestation period of capital goods is long. Thus, the effect of increased output can only be felt after a long time gap. But deficit financing immediately releases monetary resources leading to excessive monetary aggregate demand which creates demand-pull inflation.

ADVERTISEMENTS:

(b) One cannot escape from the vicious circle of deficit financing once this popular method of financing is adopted. Governments usually resort to this technique since public hardly opposes it. The inflationary impact becomes stronger once the continuous deficit financing is adopted.

If the government fails to stabilize the price level, rising prices lead to increased costs which compel the government to mobilize additional revenues through deficit financing. This surely threatens the price stability. Thus a vicious circle of rising price level and increased cost sets in.

Thus, deficit financing has a great potentiality of fanning out demand- pull and cost-push inflationary forces.

(c) We have already said that some amount of inflation is inevitable in LDCs. In these countries, not all aggregate demand can be met because of the low production. It is due to lack of complementary resources and various types of bottlenecks that actual production falls short of potential output.

The low elasticity in the supply of essential goods and the rising aggregate expenditures result in high propensities to consume and low propensities to save. Thus, the real problem of LDCs is not the deficiency of effective demand but low rate of capital formation, market imperfections, etc.

Above all, pattern of consumption fuels inflationary price rise in these countries. For instance, demand for food grains is comparatively higher in these countries. When there is an increase in aggregate demand consequent upon deficit financing, demand for food grains rise.

ADVERTISEMENTS:

But its price rises due to the inelasticity in supply. Consequently, prices of non-agricultural goods rise. Thus, deficit financing is inflationary in LDCs—whether the economies remain at the state of full employment or not.

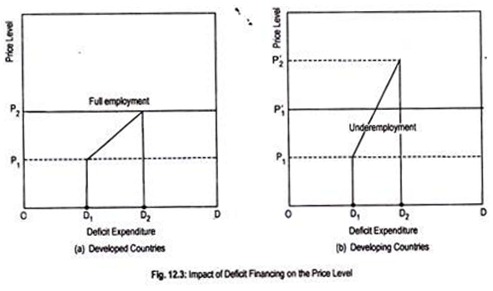

The impact of deficit financing on the price level in both developed and underdeveloped countries can be demonstrated in terms of the Fig. 12.3.

On the horizontal axis the volume of deficit financing and on the vertical axis price level is measured. In developed countries, a rise in deficit financing from OD1 to OD2 causes price level to rise towards full employment price OP2.

But a smaller dose of deficit financing in developing countries leads to a rise in price level from OP1 to OP2. Thus, deficit financing and, hence, increased money supply is always associated with a high degree of inflation in developing countries like India.

One estimate suggests that a deficit budget covered by deficit financing of one per cent leads to a rise in the price level by approximately 1.75 per cent.

ADVERTISEMENTS:

ii. Deficit Financing and Capital Formation and Economic Development:

The technique of deficit financing may be used to promote economic development in several ways. Nobody denies the role of deficit financing in garnering resources required for economic development, though the method is an inflationary one.

Economic development largely depends on capital formation. The basic source of capital formation is savings. But, LDCs are characterized by low saving-income ratio. In these low-saving countries, deficit finance- led inflation becomes an important source of capital accumulation.

During inflation, producers are largely benefited compared to the poor fixed-income earners. Saving propensities of the former are considerably higher. As a result, aggregate savings of the community becomes larger which can be used for capital formation to accelerate the level of economic development.

Further, deficit-led inflation tends to reduce consumption propensities of the public. Such is called ‘forced savings’ which can be utilized for the production of capital goods. Consequently, a rapid economic development will take place in these countries.

ADVERTISEMENTS:

In developed countries, deficit financing is made to boost effective demand. But in LDCs, deficit financing is made for mobilization of savings. Savings thus collected encourages to increase capital. The technique of deficit financing results in an increase in government expenditure which produces a favourable multiplier effect on national income, saving, employment, etc.

However, the multiplier effect of deficit financing in poor countries must be weaker even if these countries exhibit underemployment of resources.

In other words, national income does not rise enough due to deficit financing since these countries suffer from shortage of capital equipment and other complementary resources, lack of technical knowledge and entrepreneurship, lack of communications, market imperfections, etc.

Due to all these obstacles these countries suffer from deficiency in effective supply rather than deficiency in effective demand. This causes low productivity and low output. Thus, deficit financing becomes anti-developmental in the long run.

However, this conclusion is too hard to digest. It helps economic development, although not in a great way. It is true that deficit financing is self-defeating in nature as it tends to generate inflationary forces in the economy. But it must not be forgotten that it is self-destructive in nature since it has the potentiality of raising output level to counter the inflationary threat.

To the underdeveloped countries, there is no escape route to bypass the technique of deficit financing. Everyone admits that it is inflationary in character. But at the same time it helps economic development. Hence the dilemma to the policy makers. However, everything depends on the magnitude of deficit financing and its phasing over the time horizon of development plan.

It has to be kept within the ‘safe’ limit so that inflationary forces do not appear in the economy. But nobody knows the ‘safe’ limit. In view of all these, it is said that deficit financing is an ‘evil’ but a ‘necessary evil’. Much of the success of deficit financing will be available to the economy if anti-inflationary policies are employed in a just and right manner.

iii. Deficit Financing and Income Distribution:

It is said that deficit financing tends to widen income inequality. This is because of the fact that it creates excess purchasing power. But due to inelasticity in the supply of essential goods, excess purchasing power of the general public acts as an incentive to price rise. During inflation, it is said that rich becomes richer and the poor becomes poorer. Thus, social injustice becomes prominent.

However, all types of deficit expenditure, not necessarily tend to disturb existing social justice.

If money collected through deficit financing is spent on public good or in public welfare programmes, some sort of favourable distribution of income and wealth may be made. Ultimately, excess dose of deficit financing leading to inflationary rise in prices will exacerbate income inequality. Anyway, much depends on the volume of deficit financing.

Advantages and Disadvantages of Deficit Financing:

The most easiest and the popular method of financing is the technique of deficit financing. That is why it is the most popular method of financing in developing countries.

Its popularity is due to the following reasons:

(a) Advantages:

Firstly, massive expansion in governmental activities has forced governments to mobilize resources from different sources. As a source of finance, tax-revenue is highly inelastic in the poor countries. Above all, governments in these countries are rather hesitant to impose newer taxes for the fear of losing popularity. Similarly, public borrowing is also insufficient to meet the expenses of the state.

As deficit financing does not impinge any trouble either to the taxpayers or to the lenders who lend their surplus money to the government, this technique is most popular to meet developmental expenditure. Deficit financing does not take away any money from anyone’s pocket and yet provides massive resources.

Secondly, in India, deficit financing is associated with the creation of additional money by borrowing from the Reserve Bank of India. Interest payments to the RBI against this borrowing come back to the Government of India in the form of profit. Thus, this borrowing or printing of new currency is virtually a cost-free method. On the other hand, borrowing involves payment of interest cost to the lenders.

Thirdly, financial resources (required for financing economic plans) that a government can mobilize through deficit financing are certain and known beforehand. The financial strength of the government is determinable if deficit financing is made. As a result, the government finds this measure handy.

Fourthly, deficit financing has certain multiplier effects on the economy. This method encourages the government to utilize unemployed and underemployed resources. This results in more incomes and employment in the economy.

Fifthly, deficit financing is an inflationary method of financing. However, the rise in prices must be a short run phenomenon. Above all, a mild dose of inflation is necessary for economic development. Thus, if inflation is kept within a reasonable level, deficit financing will promote economic development —thereby neutralizing the disadvantages of price rise.

Finally, during inflation, private investors go on investing more and more with the hope of earning additional profits. Seeing more profits, producers would be encouraged to reinvest their savings and accumulated profits. Such investment leads to an increase in income—thereby setting the process of economic development rolling.

(b) Disadvantages:

Disadvantages of deficit financing are equally important.

The evil effects of deficit financing are:

Firstly, it is a self-defeating method of financing as it always leads to inflationary rise in prices. Unless inflation is controlled, the benefits of deficit-induced inflation would not fructify. And, underdeveloped countries— being inflation-sensitive countries—get exposed to the dangers of inflation.

Secondly, deficit financing-led inflation helps producing classes and businessmen to flourish. But fixed-income earners suffer during inflation. This widens the distance between the two classes. In other words, income inequality increases.

Thirdly, another important drawback of deficit financing is that it distorts investment pattern. Higher profit motive induces investors to invest their resources in quick profit-yielding industries. Of course, investment in such industries is not desirable in the interest of a country’s economic development.

Fourthly, deficit financing may not yield good result in the creation of employment opportunities. Creation of additional employment is usually hampered in backward countries due to lack of raw materials and machineries even if adequate finance is available.

Fifthly, as purchasing power of money declines consequent upon inflationary price rise, a country experiences flight of capital abroad for safe return—thereby leading to a scarcity of capital.

Finally, this inflationary method of financing leads to a larger volume of deficit in a country’s balance of payments. Following inflationary rise in prices, export declines while import bill rises, and resources get transferred from export industries to import- competing industries.

Conclusion:

In spite of this, deficit financing is inevitable in LDCs. Much success of it depends on how anti-inflationary measures are employed to combat inflation. Most of the disadvantages of deficit financing can be minimized if inflation is kept within limit.

And to keep inflation within a reasonable and tolerable level, deficit financing must be kept within safe limit. Not only it is difficult to lay down any ‘safe limit’ but it is also difficult to avoid this technique of financing required for planned development. Still then, deficit financing is unavoidable.

It is an evil but a necessary one. Considering the needs of the economy, its use cannot be discouraged. But considering the effects of deficit financing on the economy, its use must be made limited. So, a compromise has to be made so that the benefits of deficit financing are reaped too.