Imperfect competition covers all situations where there is neither pure competition nor pure monopoly.

The situation in the real world lies between these two extremes. Imperfect competition may take several forms.

In fact, “there is no single case of imperfect competition, but a whole range or series of cases representing progressively more and more imperfect competition.”

In this elementary study, we shall take up two forms of imperfect competition:

ADVERTISEMENTS:

(a) Ordinary monopoly and

(b) Monopolistic competition.

Price-Output Determination under Monopoly:

Meaning of Monopoly:

ADVERTISEMENTS:

Monopoly may be defined as that market form in which a single produce controls the whole supply of a single commodity which has no close substitutes.

Thus, there are two essential conditions to constitute a monopoly:

(a) There must be a single producer or seller. He may be an individual or a firm of partners or f joint-stock company. This condition-is essential to eliminate competition;

(b) The commodity dealt in should have no closely competing substitutes. That is, there should be no other firm or firms producing similar products, otherwise there will be competition.

ADVERTISEMENTS:

These two conditions ensure that the monopolist can set the price of his commodity, i.e., he can pursue an independent price-output policy. Power to influence price is the essence of monopoly.

Price Determination under Monopoly:

Under monopoly conditions, too, there is bound to be interaction between the forces of demand and supply. But there is this difference that the-supply is not free to adjust itself to demand. It is under the control of the monopolist. A monopolist is the sole producer of his product which has no closely competing substitutes.

In other words, the cross-elasticity of demand between the product of the monopolist and the product of the closest rival must be very low, i.e., the product of a rival cannot take the place of the monopolized product. Monopolist is a sole producer of the commodity and he can easily influence the price by changing his supply.

Under perfect competition, because there is a large number of producers, the supply of each producer constitutes only a small proportion of the total supply Hence, under perfect competition, no one seller can influence the price by changing his own supply. On the other hand, the monopolist can influence the price.

In fact, he sets the price. There is another difference between monopoly and competition. When there is perfect competition, the demand for the product of an individual producer is perfectly elastic at the ruling price. He can sell any amount at the prevailing price. Such demand is represented by a horizontal straight line parallel to the X-axis. Also, marginal revenue (MR) = Price, i.e., average revenue (AR).

These two curves MR and AR coincide. This is not so in monopoly; the demand for the monopolized product is not perfectly elastic (there being practically no substitutes); hence demand price or curve AR falls to the right and MR curve is always below it.

Being in control of the supply, the monopolist can (a) either fix the price and offer to supply the quantity demanded at that price; or (b) he can fix the supply, and then let price be determined by demand in relation to the supply fixed by him. But he cannot fix both the price and also force the people to buy a pre-determined quantity at that price. He can only do one of these two things, i.e., either fix the price or fix the supply.

Equalising Marginal Revenue and Marginal Cost:

ADVERTISEMENTS:

The aim of the monopolist, like every other producer, is to maximize his total money profits. Therefore, he will produce to a point and charge a price which gives him the maximum money profits. In other words, he will be in equilibrium at the price-output level at which his profits are maximum. He will go on producing so long as additional units add more to revenue than to cost. He will stop at that point beyond which additional units of production add more to cost than to revenue.

In other words, the monopolist will be in equilibrium position at that level of output at which marginal revenue equals marginal cost. He will continue expanding output so long as marginal revenue exceeds marginal cost. He does so because profits will go on increasing as long as marginal revenue exceeds marginal cost. At the point where marginal revenue is equal to marginal cost, the profits will be maximized. If the production is carried beyond this point, the profits will start decreasing.

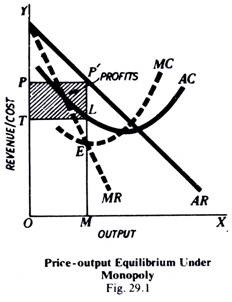

The price-output equilibrium of the monopolist can be easily understood with the help of Fig. 29.1 on the next page. AR is the demand curve or average revenue curve facing the monopolist. MR is the marginal revenue curve, which lies below the average revenue curve AR. AC is the average cost curve and MC is the marginal cost curve.

It can be seen from the diagram that until OM output, the marginal revenue is greater than marginal cost, but beyond OM the marginal revenue is less than marginal cost. Therefore, the monopolist will be in equilibrium at output OM, where marginal revenue is equal to marginal cost and profits are the maximum.

ADVERTISEMENTS:

The price at which output OM is sold in the market can be known from looking at demand curve or average revenue curve AR. It can be seen from Fig. 29.1 that corresponding to equilibrium output OM, the price or the demand or average revenue is MP’ ( = OP). Thus, it is clear that given the cost-revenue situation as presented in the diagram, a monopolistic firm will be in equilibrium at output OM and will be charging price equal to MP’ (= OP).

Now the question is: what amount of actual total profits—although maximum they would be in the given cost-revenue situation—will be earned by the monopolist in this equilibrium position? This can be found in the following way. At output OM, while MP’ is the average revenue, ML is the average cost. Therefore P’L is the profit per unit.

Now the total profits = Profits per unit x total output sold

ADVERTISEMENTS:

= P’L X OM

= P’ L X TL.

= P’LTP.

Thus, the total profits earned by the monopolist in the equilibrium position will be equal to the rectangle P’LTP. i.e., the shaded area in Fig. 29.1.

Monopoly Price Not Necessarily a High Price:

Monopoly price is not necessarily a high price. It may sometimes be even lower than ‘he price under competition, because the monopolist is spared the expenses of advertisement. Besides, he gains from the usual economies, resulting from large-scale production.

ADVERTISEMENTS:

It is also not necessary that the monopolist should always charge the highest possible price. He is afraid of public opinion, of Government interference and of substitutes being adopted for the commodity he produces. Thus the monopoly price is not necessarily a high price. But it generally is the monopolist cannot help exploiting his monopolistic position and charging a high price.

Discriminating Monopoly:

It is not to be assumed that a monopolist charges a uniform price. Rather, the usual practice is to charge different prices from different person, for different uses of the commodity and in different market areas. In this way, the monopolist is able to maximise his profit.

Such discrimination is made possible by certain conditions prevailing in the industry:

(a) Purchasers scattered over a wide area not in touch with one another,

(b) Legal barriers,

ADVERTISEMENTS:

(c) Ignorance about the prices being charged from others,

(d) Personal services, e.g. by doctors. The doctor is able to charge more from the rich than from the poor.

Price Determination under Competition and Monopoly Compared:

In a summary way, we can compare the competitive price-output equilibrium and monopoly price-output equilibrium. In both MR = MC; but there are important differences.

For instance:

(i) Under perfect competition (i) MR = AR (i.e., price) at every level of output. That is, the two curves MR and AR coincide in a horizontal straight line. Under monopoly, MR is less than AR (average revenue, i.e., price) at all levels of output.

ADVERTISEMENTS:

(ii) In perfect competition, MC = MR = AR (i.e., price); but under monopoly, the price charged is above the marginal cost. Both MR and MC are less than AR (i.e., price).

(iii) Under perfect competition, a firm reaches equilibrium at the lowest point of the average cost (AC); but under monopoly at the point of equilibrium (i.e.. where MR = MC), AC is still declining and has not reached the minimum.

(iv) Under perfect competition, a firm attains equilibrium only when MC curve is rising at or near the equilibrium output, but under monopoly, equilibrium is possible whether MC is rising, falling or constant. However, monopoly equilibrium is not possible when MC is falling but MR is falling more steeply than MC.

(v) A firm can earn supernormal profits under perfect competition only in the short run and not in the long run when they are competed away. But supernormal profits can persist under monopoly even in the long run.

(vi) A monopolist can restrict output and thus raise price. Hence monopoly price is generally higher than price under perfect competition.

Price Determination under Monopolistic Competition

ADVERTISEMENTS:

Characteristics of Monopolistic Competition:

In the real world, we find neither perfect competition nor monopoly. These extreme positions are rare. Actually, there is monopolistic competition which is one of the various forms that imperfect competition takes. Generally, neither the number of firms producing a product is very large (as in perfect competition) nor is it almost one (as in monopoly). There is a large number of firms—but not too large.

Further, the commodity produced by these firms is not ‘identical’, but is a bit ‘differentiated’. Take the case of sewing machines. There are a large number of firms each producing a machine of a different brand—Singer, Usha, Kamla, Shan, Rita, etc. All these are sewing machines, but are differentiated from one another by their respective labels. Similarly, we find tooth-pastes, fountain pens, inks, razor blades, face creams, face powders, etc., of various brands.

Due to these two characteristics of the present-day market, neither the conditions of perfect competition nor the conditions of monopoly are fulfilled. But still there is a keen competition among the producers of these differentiated products. Each one keeps an eye on the price-output policies followed by the others. This situation is called ‘monopolistic competition’ or ‘imperfect competition’.

It is ‘monopolistic’ because each brand is in itself a different product and is produced by a single firm; there is ‘competition’ in the sense that the other brands are so similar and that there is a keen rivalry among the producers; it is ‘imperfect’ in the sense that price can be influenced by individual actions. Advertisement or high-pressure salesmanship is a prominent feature of the market under monopolistic competition.

This results in a keen competition among the producers so that price determination under monopolistic competition should be more like perfect competition than like monopoly. Since competition is imperfect, one price does not rule throughout the market. On the other hand, the market is split up into segments in each of which the differentiated product rules supreme. In each segment the producer has a clientele of his own.

The consumers have an irrational preference for the product on account of its superiority, real or imaginary. In each segment, therefore, conditions are somewhat like monopoly, and the price is determined accordingly.

Since under monopolistic competition, different firms produce different varieties of products, therefore, different prices for them will be determined in the market depending upon their respective demand and cost conditions. Each firm will set price and output of its own product.

Price Determination under Monopolistic Competition:

Now the question arises at which price-output level the monopolistic competitive firm will be in equilibrium position? Here we have to remember that every seller, whether a monopolist or one working under perfectly or imperfectly competitive situations, wants to maximise his profits.

The seller will go on producing till the extra receipts to be had from additional production exceed the extra cost incurred in the production process. In other words, profits will be maximised when marginal revenue is equal to marginal cost. So long as marginal revenue is greater than marginal cost, the seller will find it profitable to expand his output, and if marginal revenue is less than marginal cost, obviously it is to his advantage to reduce his output to the point where marginal revenue is equal to marginal cost. In the short run, therefore, the firm will be in equilibrium when it is maximising its profits, i.e., when

Marginal Revenue = Marginal Cost

In the short run, a monopolistically competitive firm may either realise abnormal profits or be faced with losses. But, in the long run, such supernormal profits disappear. This is because we assume that entry is free and new firms will enter the industry if the existing firms are making supernormal profits.

As new firms enter and start production, the demand curve or average revenue curve faced by the firms will fall (shift to the left) and, therefore, the supernormal profits will be competed away, and the firms will be earning only normal profits.

Similarly, if in the short run firms are suffering losses, then in the long run some firms will leave the industry so that the remaining firms are able to earn normal profits. Another point which is to be noted in regard to the long-run equilibrium under monopolistic competition is that average revenue curve in the long run will be more elastic, since large number of substitutes will be available in the long run. Therefore, in the long run, equilibrium is restored when firms are earning only normal profits. Now, profits are normal only when

Average Revenue = Average Cost.

Therefore, equilibrium in the long run under imperfect competition holds when

Average Revenue = Average Cost.

Price under Oligopoly:

In an oligopoly, the number of sellers is small as against a sole seller under monopoly and many sellers under monopolistic completion.

Principal Characteristics of Oligopoly

The principal features of oligopoly are as under:

(i) Interdependence:

Owing to a small number of sellers, the price-output decisions of one firm are taken note of by other firms and affect their decisions too.

(ii) Indeterminate Demand Curve:

Since no firm is able to predict the reaction or behaviour of other firms consequent on price output decision of one firm, there is uncertainty, and no firm can be sure of the quantity of the commodity it can sell at a price. The demand curve is thus indeterminate.

(iii) High Pressure Salesmanship:

There being only a small number of firms in the field, there is a tendency for a firm in oligopoly to increase its selling costs and indulge in advertisement so that it may capture as much of the market as possible. There is a counter-campaign by the rivals.

(iv) Sticky Prices:

In order to avoid adverse reaction by the rivals, there is a tendency for the firms to avoid changing the price of their products. Hence comparative price stability rules in the oligopolistic market.

How is Price Determined under Oligopoly:

Since price-output decisions by one firm affect the decisions of other firms, nobody can be sure of their reaction. As pointed out above, the demand curve is indeterminate and no single price-output decision is possible.

Functions of Price Mechanism:

We have seen how price is determined under different market forms. We may now briefly refer to the role that price mechanism plays in the economic system. Price performs a very important function in the economic system. As a matter of fact, it is price which makes the working of the economic system so smooth. Under competitive capitalism, there is no central authority directing the economic forces. The price is the only directing force.

We may mention the following functions which price performs:

(i) Price controls consumption:

If the price goes up. It is a signal for the consumers to reduce consumption. The commodity will then be put only to more urgent uses.

(ii) Price directs production:

If the price is low, it warns the producers; and if it is high, it stimulates production.

(iii) It adjusts the existing supply to demand:

If a commodity is in short supply, the price will go up and reduce demand so that the demand is equated to supply. If stocks have been accumulated, the price will fall making demand to come up to the level of the supply. The supply is cleared.

(iv) Prices of factors indicate the most remunerative channels for them to flow into:

They thus find their most profitable employment.

Thus, price is a powerful regulator of all economic activity in a capitalist economy.