In addition to the concept of national income it is useful to have some idea of certain other income concepts which are required for particular purposes.

Important amongst these are following:

(a) Personal Income:

Personal Income is the total of incomes received by all persons from all sources; it consists of wages and salaries, interest, rent and dividends received by individuals including the corporate bodies (like clubs and churches treated as collective persons).

It also includes mixed incomes of self- employed persons such as farmers, shop-keepers and barristers, and all transfers received from public authorities, by persons, such as pensions, unemployment benefit, family allowances etc.

ADVERTISEMENTS:

Personal income is, thus, equal to national income minus the undistributed profits of companies and public enterprises plus transfer payments received by persons. The difference between ‘national income’ and ‘personal income’ is that transfer payments while excluded from ‘national income’ are included in ‘personal income’. Personal income = national income – (Social insurance contributions + corporate profits tax liability + undistributed profits) + transfer payments:

YP = Yr – U + TR

(b) Disposable Income:

Personal income as defined above is not the income over which persons have complete command to spend, to save or to give away in any manner they like. Income-tax, national insurance contributions are obligatory payments which must be deducted to obtain what may be called Personal Disposable Income.

Even in this, incomes are included contributions like pensions, fixed commitments like the hire-purchase installments which further go to reduce the personal disposable income. When all possible deductions of this sort have been made, the remainder may be called ‘discretionary income’ (though the term is not officially used).

ADVERTISEMENTS:

Thus, it is that part of the personal income that remains in the hands of the individuals after payment of direct taxes. The major portion of disposable income is spent on consumption goods and a part is saved. Therefore, Disposable Income = Consumption Expenditure (c) plus Saving (S). Expenditure is also allocated between Consumption Expenditure plus Investment Expenditure. Since Income (Y) is always equal to Expenditure (E), therefore, C + S = C + I, therefore, S = I.

(c) Corporate Income:

In addition to personal and disposable incomes it is useful to have the concepts of corporate income, i.e., the profits and other income of companies and public corporations; when Income-tax and profits tax are deducted, this becomes corporate disposable income.

(d) Private Income:

This includes personal income before tax plus undistributed profits of companies before tax.

(e) Net Domestic Product at Factor Cost:

Net income produced within the national territory or frontiers of a country is called net domestic product at factor cost. When we deduct net income from abroad from the net national income at factor cost, we get the net domestic product at factor cost. It is clear that the concept of NNP is broader than the concept of domestic product.

ADVERTISEMENTS:

The latter focuses attention on the total output raised with the geographical limits of the economy. To get at the NNP from domestic product, we have to deduct from it the value of that part of domestic product which is due to activities of foreigners and add the value of the products produced by the nationals of the country outside the geographical limits of the economy, i.e., abroad;

NNP ≡ NDP + (X – M),

i.e., Net National Product ≡ Net Domestic Product + Export (X) – Imports (M).

(f) Per Capita Income:

Per capita income of a country usually refers to the average earning or income of an individual in a particular year in that country. It denotes the income received by an individual in a certain year in a country. Per capita income is expressed at current prices. In order to find out the per capita income of a certain year in a country, we divide the national income of that country by the population of the country in that year. Suppose we want to know the per capita income of India in 1988 we shall divide the national income of India in 1988 by the population of India in 1988

It is therefore, clear that a country having high national income and less population will have higher per capita income. In order to raise per capita income, it is necessary to check the growth of population, to increase national wealth and to provide for equal distribution of income. Per capita income enables us to know the standard of living of people and is an indication of economic development.

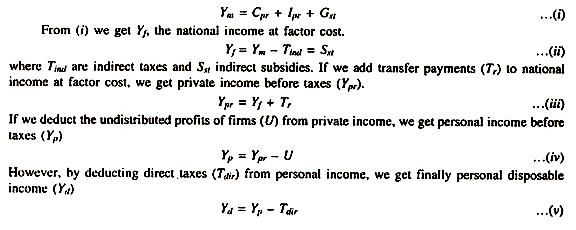

The following equations help us to understand these income concepts :

If we express private consumption during any period by Cpr private net investment lpr, and government purchase of goods and services by Gst, then the national income at market price Ym, is given by