In any economy, its people are engaged in one productive activity or the other, whereby they earn income and spend their income on goods and services to satisfy their wants.

Evidently, the health and progress of an economy are to be judged from how much they are able to produce and spend, i.e., the country’s total output, income and expenditure.

These aggregates of the economy are but different aspects of its national income, and the study of Economics centres mainly round the concept of national income, i.e., what determines the level of national income, what causes fluctuations in it and what influences the rate of its growth.

The Circular Flow: The Wheel of Wealth:

But before taking up national income in detail, we may refer to a characteristic feature of all economies, viz., the circular flow between households and productive enterprises. Its clear understanding is very necessary to know how an economy broadly works. It will also make it easy to grasp the alternative interpretations of National Income.

ADVERTISEMENTS:

In every economy, there are households on the one hand and productive enterprises or firms on the other. The function of households is to consume goods and services for the satisfaction of their wants; and the function of productive enterprises is to produce goods and services for the satisfaction of the wants of households.

The household is the basic consuming unit in economic life. It is usually centred around the family unit. The firm or productive enterprise is the basic producing unit in economic life; it may be a grocer’s shop, a cotton textile mill or an agricultural farm. The chief characteristic of the firm is that it gets together resources or factors of production with a view to producing a particular good or goods.

Government Operations:

But the economy does not merely consist of households and firms. There is another sector, viz., the Government Sector, which occupies a position of strategic importance. Like households, government buys goods and services for the use of its various departments, and like firms, it is also a producing unit since it runs numerous public enterprises. The bulk of the government income is derived from taxes, fees, etc.

ADVERTISEMENTS:

Thus, households, firms and government are the main components of the entire economic organisation of a country which is known as an economy. Economy is the sum total of the operations of the households, firms and government. It is the decisions at the levels of households, firms and government which determine the shape of the economy of a country.

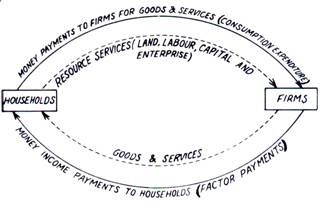

A very interesting fact of all economies is that there is always a circular flow or movement of resource services (the services of land, labour, capital, and enterprise) from the households to the firms, and the reverse movement of goods and services from the firms to the households.

As a matter of fact, the households, who consume goods and services, are themselves the suppliers of the resource services to the firms for the production of goods and services and get in return payments for their resource services in terms of goods and services produced by the firms.

This circular flow is illustrated by the inner circuit (in dotted loops) in the diagram given below:

The inner circuit shows the real flows as distinguished from the money flows. The real flows would take place only in a barter economy where goods/services are exchanged for goods/services and money is not used as a medium of exchange. But the modem economy is not a barter economy.

In the modern economy, money is used in the process of exchange, e.g., money acts as a medium of exchange. Households supply the resource services or factors to firms and receive in return payments in terms of money and then exchange that money for goods/services they want.

The firms sell goods/services for money and use the money so received to pay the households for their supply of resource services. Thus labour gets wages, capital gets interest, land gets rent and enterprise gets profits—all in terms of money. The money flow is shown in the above diagram by the outer circuit (in thick-lined loops)—factor payments from firms to households and consumption expenditure in the opposite direction from households to firms. These flows being in terms of money, this outer circuit is the monetary circuit.

It is thus clear that there are flows of money corresponding to the flows of resource services and the flows of goods and services. (But each money flow is in the opposite direction to the real flow). This circular flow also makes clear that process of production by firms generates incomes in the hands of households (or resource suppliers); this income enables households to spend on consumption and thus creates demand for production by firms. There is thus a circular flow of economic activity which demonstrates so effectively the intricate inter-dependence inside an economic system.

This circular flow of money, also known as Wheel of Wealth, is common to all modern economies. It exists whether resources are owned publicly or privately and whether the economies be free-enterprise economies or planned economies.

This circular flow of money continues indefinitely day by day, week by week and year by year. Indeed, this is how the economy functions. It may, however, be pointed out that this flow of money need not always continue at a steady level. In years of depression it will contract, i.e., it will become lesser in volume, and in years of prosperity, it will expand, i.e., it will become greater in volume. This is so because the flow of money is a measure of national income and will therefore change with change in national income.

It may be added that the above description of the circular flow is very much simplified. Several assumptions have been made to make its analysis easy to understand.

Firstly, we have assumed that neither do households save from their incomes, nor do firms save from their profits.

Secondly, we have assumed that the government does not play any part in the national economy—it neither receives any money from the people by way of taxes nor does the government spend any money on the goods and services produced by firms/resource services rendered by households.

ADVERTISEMENTS:

Thirdly, we have also assumed that the economy neither imports nor exports goods/services; i.e., we have not taken into account the role of foreign trade.

In short, we have explained the circular flow of a closed economy with no savings and no role of government. We can introduce these complications and see how the circular flow takes place in the working of the real-world economy. But that is hardly necessary since our simplified analysis serves satisfactorily the purpose of explaining the central issues involved.

Definition of National Income:

National income, in the words of Pigou, “is that part of the objective income of the community, including of course income derived from abroad, which can be measured in money.”

Mr. Colin Clark, a British authority on the subject, defines national income as follows:

ADVERTISEMENTS:

“The national income for any period consists of the money value of the goods and services becoming available for consumption during that period, reckoned at their current selling value, plus additions to capital reckoned at the prices actually paid for the new capital goods, minus depreciation and obsolescence of existing capital goods, and adding the net accretion of, or deducting the net drawings upon stocks, also reckoned at current prices. Services provided at non-profit-making basis by the State and local authorities (e.g., postal services and municipal tramway services) are included on the basis of charges made. Where taxation is levied upon particular commodities and services, such as the customs and excise duties on commodities or the entertainment tax, such taxes are not included in the selling value.”

According to Dr. V. K. R. V. Rao, an Indian authority on the subject, “national income may be defined as the money value of the flow of commodities and services, excluding imports becoming available for sale (or capable of being sold) within the period, the value being reckoned at current prices minus the sum of the following items:

(i) The money value of any diminution in stocks that may have taken place during the period;

(ii) The money value of the flow of goods and services used up in the course of production;

ADVERTISEMENTS:

(iii) The money value of the flow of goods and services used to maintain intact existing capital equipment (value being reckoned at current prices);

(iv) Receipts of the State from indirect taxation;

(v) Favourable balance of trade including transactions in treasure;

(vi) Net increase in the country’s foreign indebtedness or the decrease in the holdings of balances and securities abroad whether by individuals or the ‘Government of the country.”

In short, National Income is the aggregate factor income (i.e., earning of labour and property) which arises from the current production of goods and services by the nation’s economy. The nation’s economy refers to the factors of production, i.e., labour and property, supplied by the normal residents of the national territory.

Three Interpretations:

From the foregoing definitions, it will be seen that the concept of national income has three interpretations:

ADVERTISEMENTS:

(a) It represents a receipts total;

(b) It represents an expenditure total and

(c) It represents a total value of production.

This three-fold interpretation arises out of the fact that every expenditure is at the same time a receipt, and if goods or services bought are valued at their sales prices, we have a three-fold identity that the value received equals the value paid, equals the value of goods and services given in exchange.

To explain the above idea, let us take an economy where there are only two sectors: households and firms. Firms are required to produce goods. To produce them, they require services of factors of production. Thus incomes of these factors arise in the course of production.

The sales value of net production must equal the sum total of payments made by the firms to the factors of production in the form of wages, rents, interest and profits. These incomes in turn become the sources of expenditure. Thus, income flows from firms to households in exchange for productive services while products flow in return when expenditure by households takes place.

Concepts of National Income:

There are various concepts of national income which we study one by one.

Gross National Product (G.N.P.):

ADVERTISEMENTS:

This is the basic social accounting measure of the total output or aggregate supply of goods and services. Gross National Product is defined as the total market value of all final goods and services produced in a year. Two things must be noted in regard to gross national product. First, it measures the market value of the annual output. In other words, G.N.P. is a monetary measure.

There is no other way of adding up the different sorts of goods and services produced in a year except with their money prices. But in order to know accurately the changes in physical output, the figure for gross national product is adjusted for price changes.

Secondly, double counting has to be avoided. This means that for calculating gross national product accurately, all goods and services produced in any given year must be counted once, but not more than once. Most of the goods go through a series of production stages before reaching a market.

As a result, parts or components of many goods are bought and sold many times. Hence to avoid counting several times the parts of goods that are sold and resold, gross national product only includes the market value of final goods and ignores transactions involving intermediate goods.

What do we mean by final goods? Final goods are those goods which are being purchased for final use and not for resale or further processing. Intermediate goods, on the other hand, are those goods which are purchased for further processing or for resale.

ADVERTISEMENTS:

The sale of final goods is included in gross national product while the sale of intermediate goods is excluded from gross national product. Why? Because the value of final goods includes the value of all intermediate goods used in their production. The inclusion of intermediate goods would involve double counting and will, therefore, give an exaggerated estimate of gross national product.

An example will clarify this point. Suppose in our economy only two things are produced, raw cotton worth Rs. 100 and cotton cloth worth Rs. 200. Now what shall be the measure of gross national product? For finding it, if we add up the sales value of cloth and cotton, there is clearly an element of double counting in the sense that we have added the value of cotton twice—once as the sales value of cotton and secondly when we added to it the value of cloth. Actually, the value of cloth includes also the value of cotton, which having been accounted for already, should not be added a second time.

The “gross national product at market prices” may be obtained by adding up:

(a) What private persons spend on consumption or what is called personal consumption expenditure;

(b) What private business spends on replacement, renewal and new investment? This is called gross domestic private investment;

(c) what the rest of the world spends on the output of the national economy over and above what this economy spends on the output of the rest of the world, i.e., export surplus or net foreign investment; and

ADVERTISEMENTS:

(d) What the government spends on the purchase of goods and services, i.e., government purchases.

Net National Product (N.N.P.):

The second important concept of national income is that of net national product. In the production of gross national product of a year, we consume or use up some capital, i.e., equipment, machinery, etc. The capital goods, like machinery, wear out or fall in value as a result of their use in the production process.

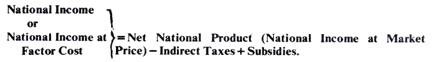

This consumption of fixed capital or fall in value of capital due to wear and tear is called depreciation. When charges for depreciation are deducted from the gross national product, we get the net national product. Clearly, it means the market value of all final goods and services after providing for depreciation. Therefore, it is also called ‘national income at market prices’. Therefore,

National Income at Factor Cost:

National Income at factor cost means the sum of all incomes earned by resource suppliers for their contribution of land, labour, capital and entrepreneurial ability which go into the year’s net production, or, in other words, national income (or national income at factor cost) shows how much it costs society in terms of economic resources, to produce that net output. It is really the national income at factor cost for which we use the term National Income.

The difference between national income (or national income at factor cost) and net national product (national income at market prices) arises from the fact that indirect taxes and subsidies cause market prices of output to be different from the factor incomes resulting from it. Suppose, for instance, a metre of mill cloth sold for Rs. 2 includes 25 P. on account of the excise and the sales tax.

In this case, while the market price of the cloth is Rs. 2 a metre, the factors engaged in its production and distribution would receive Rs. 1.75 P. a metre. The value of cloth at factor cost would thus be equal to its value at market price less the indirect taxes on it.

On the other hand, a subsidy causes the market price to be less than the factor cost. Suppose handloom cloth is subsidized at the rate of 19 P. a metre and it sells at 81 P. Then while the consumer pays 81 P. per metre, the factors engaged in the production and distribution of such cloth receives Re. 1 per metre. The value of handloom cloth at factor cost would thus be equal to its market price plus the subsidies paid on it. It follows, therefore, that the national income (or national income at factor cost) is equal to net national product minus indirect taxes plus subsidies.

Personal Income (P.I.):

Personal Income is the sum of all incomes actually received by all individuals or households during a given year. National income, that is, total income earned, and personal income, that is, income received, must be different for the simple reason that some income which is earned—social security contributions, corporate income taxes and undistributed corporate profits—is not actually received by households and, conversely, -some income which is received—transfer payments—is not currently earned. (Transfer Payments are old-age pensions, unemployment compensation, relief payments, interest payments on the public debt, etc.)

Obviously, in moving from national income as an indicator of income earned to personal income as an indicator of income actually received, we must subtract from national income those three types of incomes which are earned but not received and add in income received but not currently earned. Therefore

Personal Income =National Income —Social Security Contributions —Corporate Income Taxes—Undistributed Corporate Profits + Transfer Payments.

Disposal Income (D.I.):

After a good part of personal income is paid to government in the form of personal taxes like income tax and personal property taxes, what remains of personal income is called disposable income.

Disposable Income = Personal Income—Personal Taxes.

Disposable Income can either be consumed or saved. Therefore

Disposable Income = Consumption + Saving.