Here we detail about the top five sector accounts of national income.

(A) Personal or Household Sector:

This sector includes the receipts and expenditures of all households (individual consumers and families), non-profit institutions.

The personal sector represents the single largest market for the products of business sector and the single largest recipient of the expenditures of business sector, in the form of wages, salaries and dividends.

Again, personal sector receives payments from the government of interest and social security benefits and pays taxes to the government.

ADVERTISEMENTS:

Broadly speaking, personal expenditures include: personal taxes, personal consumption expenditure made to business and foreign sectors and interest paid by consumers. If we deduct these expenditures from personal incomes we get personal savings. Transfer payments are not considered productive income and as such are not included in the GNP, even then, they represent an important source to the personal sector. An imaginary specimen of personal income and expenditure account is given below.

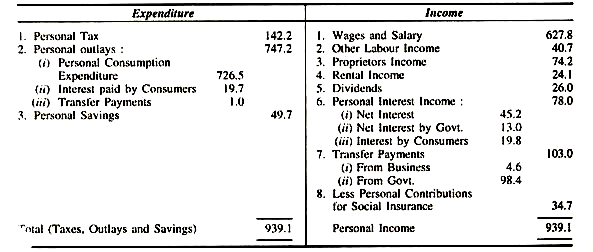

Personal Income and Expenditure Accounts, 1988-89 (Rs. in crores)

In the table, the sum of the right hand side constitutes personal income (Rs. 939.1 crore) which is spent on three general categories: consumption, savings and taxes, represented on the left hand side of the table. It also shows that the most important item on expenditure side is personal outlays on different items of consumption, which constitute about 77% of total expenditure. On the income side, most important source in this sector is wages, salaries etc.

(B) Business Sector:

ADVERTISEMENTS:

The business sector of an economy is composed of the corporate sector consisting of private and public limited companies and non-corporate sector consisting of proprietary and partnership firms. It also includes government enterprises, financial and insurance companies. In short, it covers all organisations producing goods and services at a price intended to cover the cost of production.

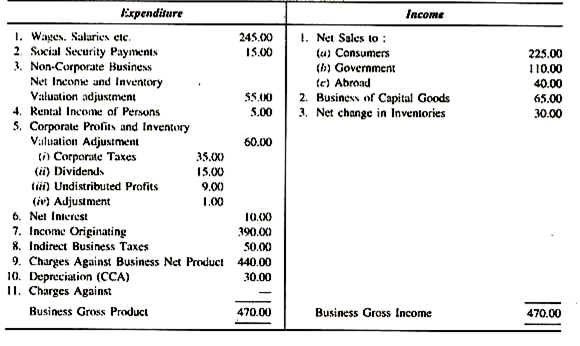

The accounts of this sector include the receipts and expenditures of all business and production units in a country. The business sector retains part of its funds as savings, though this is not an entry either in the business sector account or the GNP account, but it can be derived from other entries made therein. The capital consumption allowance (CCA), undistributed profits and inventory adjustments together form the bulk of gross business saving. A specimen of the same is given below.

Income and Expenditure Account, 1988-89 (Rs. in crores), Business Sector:

(C) Government Sector:

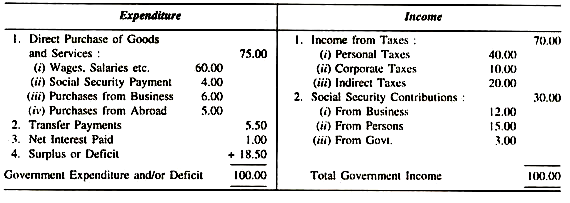

It shows the expenditure and income of the government. It is composed of all government bodies—central, state and local. The income of the government is largely derived from taxes, direct and indirect and social security contributions from business and personal sector.

The expenditure side includes purchases of direct services, purchase of goods and services from business sector and from abroad. It includes expenditure on transfer payments and interest payments to individual and institutional bond holders of the public debt.

The commercial and industrial units owned by the government also yield income to the government and it has to incur expenditure on account of these units for purchasing materials and services; but these units are not included in the government sector because they are already included in the business sector.

However, these are many transactions, such as repayments or borrowings of public debt which do not appear in the government sector account because these transactions neither measure production nor do they form a part of income. Similarly, previously built buildings, purchases of lands, equipment’s and other existing capital assets are also excluded from this account.

A hypothetical government sector account is given below for purposes of illustration:

Income-Expenditure Account, 1988-89 (Rs. in crores) Government Sector:

(D) Rest of the World (Foreign) Sector:

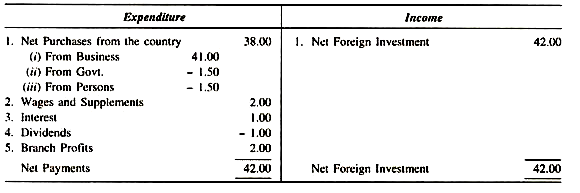

The sector in which exports and imports are introduced is called ‘the rest of the world sector’. It includes not only the net investment or disinvestment abroad through exports and imports but also includes borrowings not from the home country by the rest of the world but also net borrowing by the home country. The foreign transactions sector of the national income and product account should not be confused with the balance of payments account.

If an economy is a closed one, i.e., one having no trade relations with other economies, then the personal business and government sector accounts would have sufficed and there was no need to prepare the foreign sector account. But transactions are also international in nature and are being carried on with persons and institutions outside the national boundaries of a country; as such, these also form an important part or sector of national income accounts.

ADVERTISEMENTS:

All exports add to the flow of income and all imports necessitate payments to be made to foreigners and have to be see off against the income from exports. Transactions with foreign countries are a bit more complicated than the two activities of exports and imports. Such transactions cover not only visible goods and services such invisible items as insurance, shipping, banking, tourist, technical, diplomatic services, etc.

An imaginary income and expenditure account of the rest of the world sector is given below:

Income and Expenditure Account of the Rest of the World Sector, 1988-89:

(E) Saving and Investment Sector:

ADVERTISEMENTS:

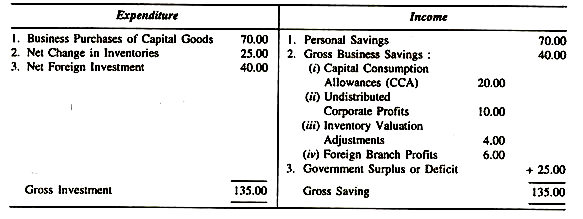

The fifth account called the saving and investment account shows how gross saving (or the income not consumed is equal to gross investment (or the product not consumed). It records the transactions of the whole economy. This account is of special importance. Each one of the four separatesector accounts mentioned above shows residual item representing the saving of the sector, The purpose of the gross saving and/investment account is to consolidate all these capital items into a single account for the economy as a whole.

The receipt or the gross saving side of this account includes the personal savings, business sector savings (held in form of capita! consumption allowance, undistributed corporate profits, inventory adjustments, branch profits etc.), government savings (which show the amount by which the revenues of the government exceed the expenditure). If the government revenues fall short of its expenditure, the government sector saving become a negative entry in the table or in the accounts.

An illustration of such accounts is given as follows:

Gross saving and Investment Account 1988-89 (Rs. in crores):

ADVERTISEMENTS:

Thus, we have seen that expenditure (GNP) equals consumption (C), plus gross private domestic investment (I), plus government purchases (G), plus exports minus imports (X – M). If, it is assumed that the economy is a closed economy (Keynes assumption), then, X – M – O and therefore, GNP = C + I + G. If we reduced depreciation (D), then, GNP or Y = GNP – D. We also know that the flow on the left hand side of the equation, i.e., income (Y) goes to individuals as disposable income, (Yd); to government as personal, corporate or indirect business taxes (T), and to business as undistributed profits—a form of business savings (Sp).

Since income is equal to expenditure, therefore:

Yd + T + Sb = C + I + G, (By Definition).

Further, disposable income (Yd) is either saved (Sp) or consumed (C), therefore, Yd = C + Sp, so that.

C + Sp + T + Sb = C + I + G.

ADVERTISEMENTS:

Consolidating private savings (Sp) and business savings (Sb), we may rewrite S = Sp + Sb, so that:

C + S + T = C + l + G (Sp + Sb = S)

or S + T = I + G

Finally, with no government sector (or one that never runs a surplus or deficit) the simplest equilibrium condition with G = T = O1 is:

S = I.

The various sector accountsare merely illustrative and attempt to provide maximum possible information about the transactions that take place in different sectors of the economy. This information is used for various purposes but the major objective of these sectoral accounts is to help in the preparation of national income and product accounts.

ADVERTISEMENTS:

This will require further consolidation of these sectoral accounts so that the complexities of each individual sector accounts are removed. After consolidation, inter-sectoral payments and receipt relationships become more explicit for purposes of analysis and investigation. These flows of receipts and expenditures, after consolidation, will give a product and income estimate just equal to the estimate of GNP computed through a unified account based on the aggregates of income, product and expenditure.